HODL Waves maintain been around for a pair of years but are peaceful fairly contemporary. They were first launched in an article by Dhruv Bansal at Unchained Capital, a bitcoin-native monetary products and companies firm. The difficult share about having a transparent blockchain is you’ll need faith in all forms of insights inner the guidelines. In explicit, ticket is true one granularity of bitcoin, i.e., what the free market pays for the asset thru patrons and sellers. By mixing details science with a transparent blockchain, you can see extraordinary more from the market and peep below the hood. Here is no longer possible with the worn markets that claim to be free and commence. In explicit, the Federal Reserve Board has never been in point of fact audited in a transparent ability, which leaves extraordinary to be desired.

Bitcoin used to be made transparent with an unspent transaction output (UTXO) accounting building and is audited every ten minutes by each contributor within the community (nodes). Here is what makes it possible to quiz on-chain details and insights. Here is what makes bitcoin this kind of highly efficient rotten layer.

HODL waves are constructed off of UTXO details. In very straightforward terms, there is a proceed of breadcrumbs or “mud” that’s left at the inspire of with each transaction. These mud UTXO particles maintain a date and timestamp on them that enables us to quiz into the ancient past of Bitcoin’s blockchain. Unchained Capital went more into detail on UTXOs here in their blog publish. On the present time I will true level of curiosity on three plenty of groups that screech up in HODL waves.

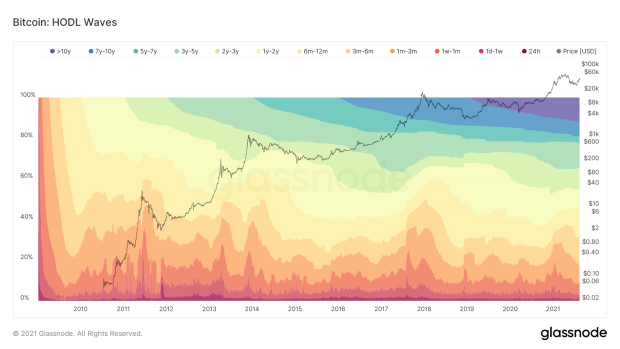

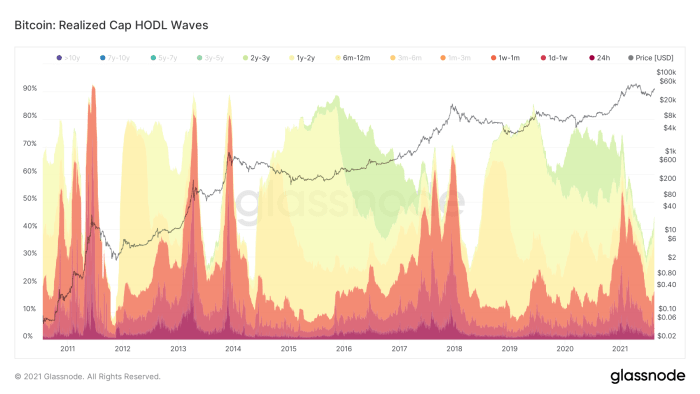

Above, you’ll need faith in that there are plenty of colors. Every coloration shows the age of the UTXO groups, from 10 years to 24 hours. It’s possible you’ll perchance perchance well furthermore practically have faith in the waves forming ought to you peep at the dwell of every cycle. Apply those up and to the gleaming, and there you would possibly possibly perchance well furthermore neutral maintain the distinctive HODL Wave.

Misplaced Cash

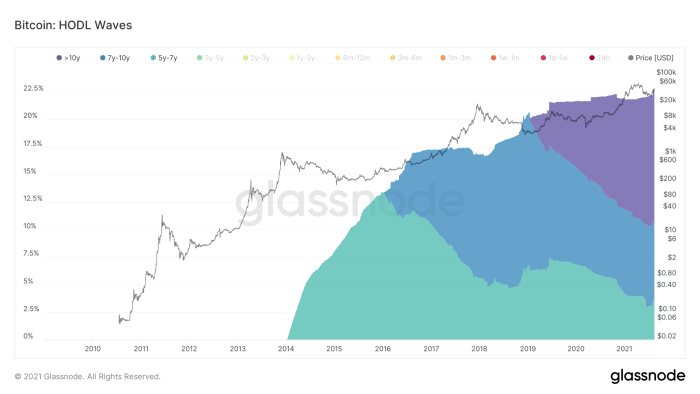

The first HODL wave community we can peep at is the “misplaced coins”. These are coins which maintain been visibly sluggish for five-10 years. There maintain been a collection of plenty of analyses performed which maintain attain to an respond on misplaced coins, continually estimating that between 3 million to 4 million mined coins are misplaced. For context, Satoshi had an estimate of about 1 million bitcoin, all of which maintain never been moved, and are regarded as “misplaced.”

Each Unchained Capital and Chainalysis maintain performed more true measurements on the misplaced coins and maintain attain out with at most 3.8 million coins misplaced. These estimates were performed in 2018 and 2017 respectively, and maintain held up totally. Over time, we can get there will be fewer and fewer coins being misplaced. As wallets and security enhance and the skills matures, bitcoin will change into significantly tougher to lose.

Having a peep at the misplaced coins community above we can have faith in that with about 18.5 million coins mined, 22% of them are between the age of 5 and 10 years. There are few changes domestically, but for basically the most share, they’re untouched. That diagram for the time being, out of all coins mined about are 22% misplaced, presumably endlessly. Here is amazingly critical to gift, on legend of no longer easiest is Bitcoin’s cap 21 million, but this number is furthermore immutable. If anyone loses their coins, they’re long gone endlessly. There are no bailouts or attain-overs. Here is furthermore true with gold. If you happen to were to lose your complete gold in a boating accident (oh no!) that’s long gone endlessly. This makes bitcoin even more scarce, and in flip more precious.

Luckily, the benefit of exhaust for bitcoin is rising day-after-day, and we’re seeing more actual and actual systems to defend your keys. Between multi-sig, contemporary wallets, estate solutions, and encrypted backups, bitcoin has change into tougher to lose. Now to no longer mention the importance and greenback price is exponentially better than it used to be within the early days, so obviously most of us are taking better efforts to defend their bitcoin lengthy time duration, than within the early days. It’s no longer true magic net money anymore.

Long-time duration Holders

The 2d community is the “lengthy-time duration holders.” It is categorized by grouping UTXOs between six months and three years. This continually manifests between bull markets or snappy rises in ticket on the decrease-cease time body. This wave tends to screech up after the bull market is over. These UTXOs seem to compile drained as the bull market intensifies.

Despite the indisputable reality that no longer excellent, you would possibly possibly perchance well exhaust this as a tool to quiz the attach we’re within the bull scuttle. When it comes to 2015-2017, there used to be one definite upward push in lengthy-time duration holders that peaked firstly of the bull scuttle. Once the price started rising, lengthy-time duration holders started selling. The low level used to be at the true high of the 2017 bubble.

Within the 2012-2014 bull scuttle, there used to be a transient-time duration accumulation share shown within the spike at the cease of 2013. These waves need to no longer predictors, but appear to be laggards and true a ancient past guide of what came about all over the share.

Temporary Holders

The third community is the “brief-time duration holders.” They are grouped between the ages of 1 day and one month. These peep to high at sizable ticket surges in bitcoins ancient past. If you happen to peep carefully you’ll need faith in three broad ticket surges for every bull scuttle. Right this moment, we’re easiest on the first ticket surge. It seems to be savor this would possibly possibly be retail coming in, and brief-time duration speculators.

In 2012 we seen the first mammoth ticket surge, which grew to alter into into consolidation, then a scuttle-up. This repeated in 2016 but used to be a actual ticket surge that used to be more tender landing in a single blow-off high in preference to a double bubble. This brief-time duration HODL wave will be difficult to quiz within the arriving months.

Visualizing Bull And Undergo Markets

Placing them aspect by aspect you will advise a pair of transparent distinction between after we were in a bull market and after we were in a endure market. The lengthy-time duration holders give ability to the brief-time duration as ticket rises, at closing ending the bull market when there is no one left to settle. Since an amplify in ticket is merely more patrons than sellers, this makes sense. I gained’t compile any ticket predictions here, but curiously UTXOs and HODL waves are evolving or maturing. As pockets/security skills improves, and Layer 2 solutions outdated vogue, these UTXOs will commence up to peep plenty of. Bitcoin is evolving at a expeditiously tempo, so this would possibly possibly be the closing 365 days we predict a pair of few of these signatures within the blockchain.

Realized HODL Ratio

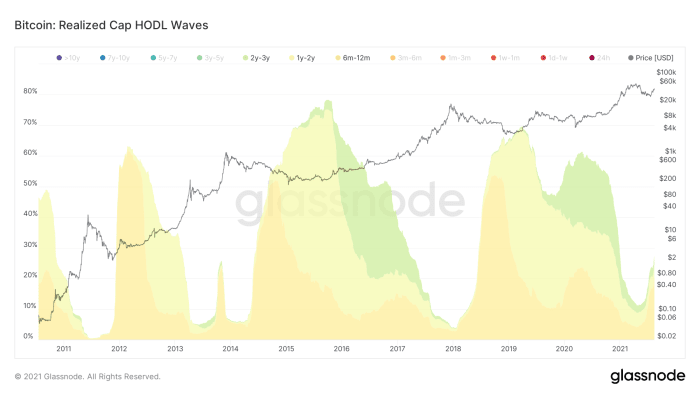

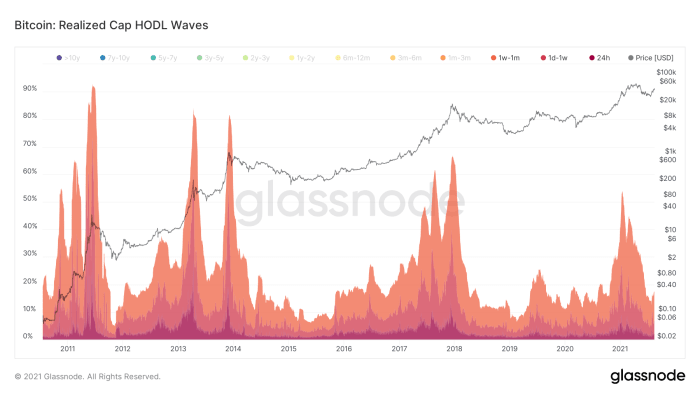

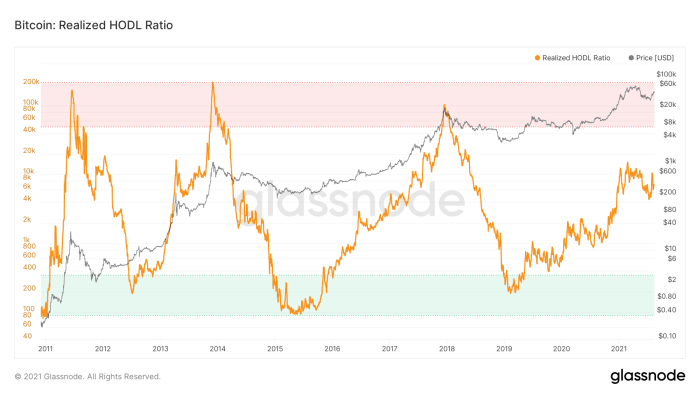

In the end, having a peep at the distinction between lengthy-time duration and brief-time duration holders, you will attain up with a ratio. Glassnode has made this visible and it seems to tune the tell and bust cycles of the past elegant extraordinary.

“The Realized HODL Ratio is a market indicator that uses a ratio of the Realized Cap HODL Waves. In explicit, the RHODL Ratio takes the ratio between the 1 week and the 1-2 years RCap HODL bands. As well, it accounts for increased offer by weighting the ratio by the total market age. A high ratio is a demonstration of an overheated market and would be extinct to time cycle tops. This metric used to be created by Philip Swift.” – Glassnode

By this metric, the bull market is diagram from over and seems to be performing more similarly to the 2014 bull market. Despite the indisputable reality that that is no longer a predictor of future success, we can infer one thing from this details.

On-chain details is peaceful fairly contemporary but it absolutely has given us many insights and can neutral continue to screech contemporary and provocative things all over the Bitcoin blockchain. Here is all possible as a result of the UTXO building within the Bitcoin community and the transparent nature of its transactions. In some diagram Bitcoin will continue to adapt and outdated vogue, leaving plenty of metrics at the inspire of as layers are constructed on high and transacting migrates from one layer to a different. There’s rarely always any ability to define what the lengthy scuttle holds, but being in a local to quiz the hump thru details is more provocative than ever.