Zero-rate crypto trading most ceaselessly refers to “zero-commission” trading, the put the alternate entity doesn’t out of the blue price you, the user, for the transaction.

This original worth proposition is altering the cryptocurrency alternate trade mannequin, as original alternate upstarts aim to unthrone their commission-charging opponents from their thrones.

Legacy platforms like Coinbase, Binance, and Gemini may perchance perchance perchance even have captured the bulk of entry-level cryptocurrency traders, but a shift began spherical slack-2020.

Contemporary platforms began attempting to subvert the incumbent exchanges with the guarantees of “zero-rate” trading– a trade mannequin the put exchanges don’t price traders a commission rate, but reasonably gape to construct their money but another skill.

There’s no such thing as a free lunch, so what does zero-rate trading entail?

The next article explores zero rate cryptocurrency trading and what it map for traders, entrepreneurs, and the industry at mammoth.

Is Zero Price Crypto Shopping and selling Legit?

So, what’s the rob?

The cryptocurrency alternate mannequin may perchance perchance perchance also additionally be remarkably profitable at scale– shrimp charges on every trade can add as much as billions. For instance, the high-earning cryptocurrency alternate in 2018 became once Binance, and it became once making about $3.48 million per day. Throughout the same 365 days, the high twenty exchanges averaged about $1 million per day in earnings.

Exchanges most ceaselessly construct money in about a ways:

- Deposit charges.

- Withdrawal charges.

- The repeat/quiz spread. Exchanges can profit by exploiting the diversities within the costs buyers and sellers question to pay through market making.

- Shopping and selling commissions. Here’s the commonest monetization skill for exchanges, crypto and stock alike. Assume a trading commission as a service rate for brokering the trade between a buyer and a vendor.

- List charges. Charges paid by coins to be listed on the alternate.

For these irregular in regards to the mechanics of cryptocurrency exchanges, take a look at out Coinbase’s 2020 S1 Disclose. Coinbase, now a publicly-traded company, had to narrate its essential earnings-generating actions.

The zero-rate invasion is a two-pronged threat to this mannequin.

First, DeFi. Customers may perchance perchance perchance also preserve custody of their non-public keys and alternate resources the use of a similar blockchains. Essentially the most efficient charges paid are in general network charges, which have been nothing to scoff at whereas you’ve been the use of the Ethereum DeFi ecosystem.

2d, zero-rate CeFi. The alternate takes custody of your non-public keys and executes the trade, an identical to Coinbase, but it absolutely makes its bread but another skill. Voyager, StormGain, and Robinhood are two corporations that have adopted this mannequin on the forefront of their worth proposition.

The StormGain trading mechanics are also billed as zero-rate. There isn’t a commission on the trade, but reasonably, a profit part of 10% is taken most efficient from profitable trades.

For instance, capture you offered BTC at $30k on StormGain. It’s now $50k, and also you ought to must always trade it for USDC. Your profit would be $20k, and StormGain would take a 10% ($2,000) minimize of this trade.

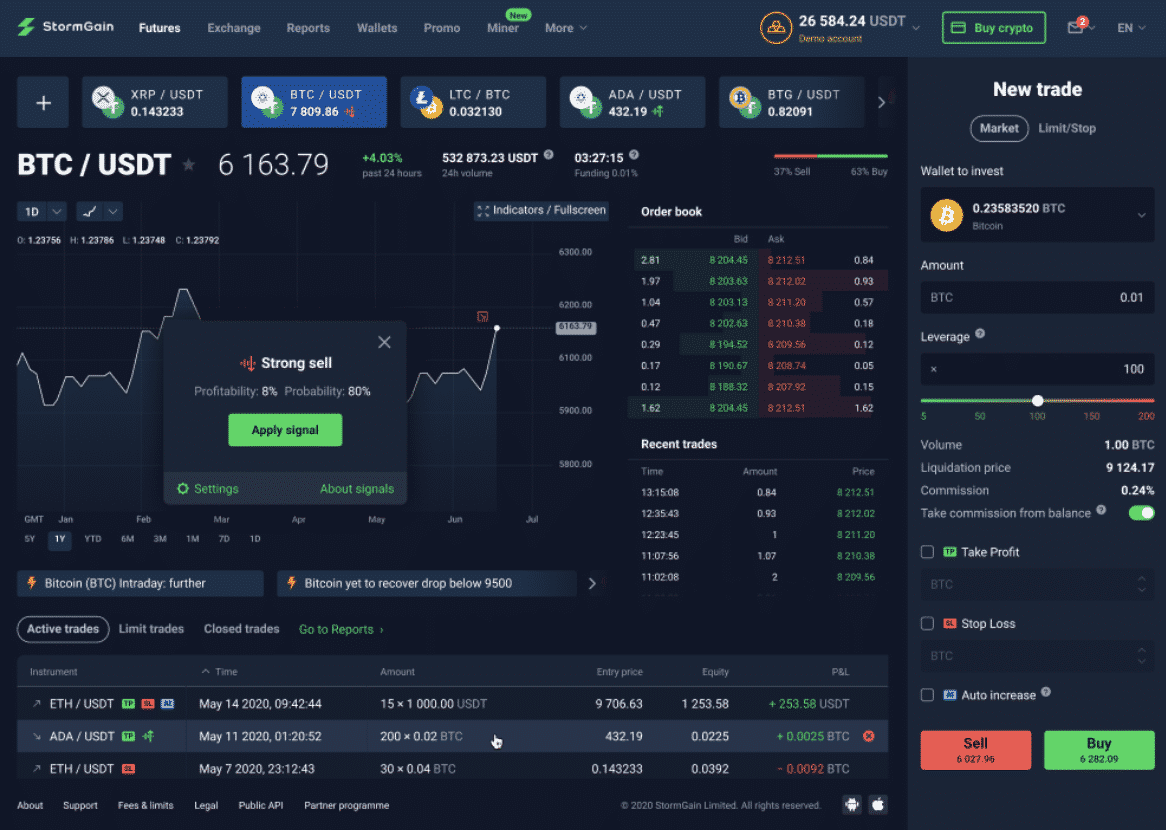

A snapshot of the stormgain platform

Alternatively, if BTC fell to any amount underneath $29.99k after you offered it at $30k and determined to cash out for USDC, StormGain would fulfill the trade for gratis.

This form of mannequin is intriguing for any individual trading on a loss, but can catch wildly costly when a significant profit margin is taken into fable.

Voyager claims to route its possibilities’ crypto transactions to varied exchanges in narrate to safe the final word that it’s doubtless you’ll perchance perchance also imagine rate; it advertises that it most efficient makes money for your trade if it saves you money. Per Voyager, you acquired’t pay the relaxation above the quoted mark of a trade; if Voyager finds you the next alternate trade mark, it takes a minimize of the variation of the worth below its quote, and also you reduction the the relaxation.

Nonetheless, Voyager is the event that sets the within the muse quoted rate. Disgruntled customers have claimed that this word doesn’t necessarily construct Voyager “zero rate” as its commission is disguised as an artificial repeat-quiz spread.

Robinhood’s crypto service is comparable– it doesn’t price a commission, but it absolutely makes money on the repeat-quiz spread.

Closing Solutions: Is Zero-Price Crypto Shopping and selling Buddy or Foe?

The cryptocurrency ethos at mammoth is enamored with the disintermediating advantages of decentralized forex. For about a of the extra hardcore cryptocurrency advocates, centralized exchanges charging commission or making a single dollar for your trades may perchance perchance perchance also as nicely be the Sith.

There isn’t the relaxation inherently unfair about an alternate charging a rate to use the infrastructure it has potentially invested hundreds and hundreds or billions to develop.

The zero-rate trading mannequin, albeit basically utilized by centralized exchanges, is one step closer to aligning vendor and alternate pursuits. The “we most efficient construct money whereas you quit” has an appeal, especially for these higher-frequency traders that declare hundreds of greenbacks per 365 days placing easy trades.

To assist these pursuits aligned, the zero rate crypto trading platforms may perchance perchance perchance also unruffled be fully clear in how their profit is generated.

Deliberately quoting a vendor a higher mark so that it’s doubtless you’ll perchance perchance also construct money on a higher repeat-quiz spread is similar to browsing mall retail outlets elevating their costs ahead of working a steep “low cost” to entice possibilities.

Better-frequency traders would be luminous to intimately explore how an alternate charges its charges, and the map in which it performs against a bunch of competitor exchanges. DeFi platforms like Uniswap or Aave have a tendency to living an attractive lawful baseline for the precise rate of a trade.