The associated price of any asset is repeatedly impacted by a mix of factors. Not like extinct monetary sources, bitcoin has historically had its possess assign of factors affecting its assign. Carry out issues gape any diverse now? Let’s uncover.

General Components: Supply And Seek recordsdata from

Bitcoin’s assign is carefully dependent on present and seek recordsdata from fluctuations, correct admire diverse sources. On the other hand, contrary to measures of fiat money, bitcoin’s present is repeatedly known and its tantalizing cap is assign at 21 million money.

The seek recordsdata from for bitcoin repeatedly sits at the tip of the cryptocurrency world’s agenda — that’s why adoption of BTC is so talked about. Increased seek recordsdata from will lead to an enhance in its assign, especially when institutional patrons safe interested.

For example, when corporations and establishments began procuring and preserving bitcoin in early 2021, its assign rose considerably as seek recordsdata from outpaced the plug at which new money had been being placed on the market on the market, ensuing in a lower in the total on hand present of the cryptocurrency.

Its assign will fall, however, if there are more individuals which are seeking to promote.

Institutional Adoption

News influences investor perception about Bitcoin in a well-known arrangement.

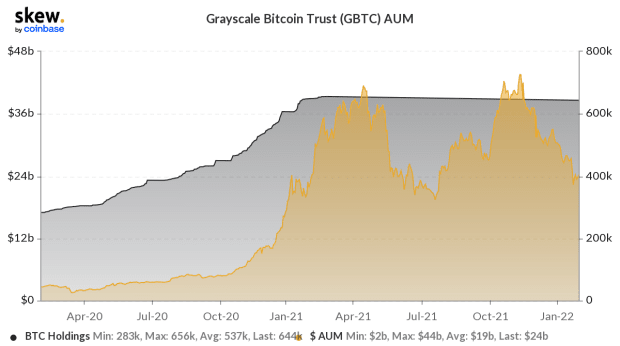

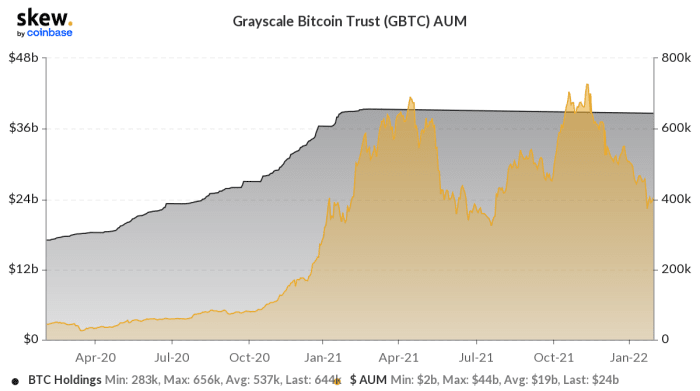

In spite of low volatility in bitcoin’s assign, the year 2021 stands out for its extra special adoption by both establishments and corporations.

For example, Grayscale Bitcoin Trust had a median AUM of $31 billion and a median Bitcoin preserving of 650K in 2021.

Crypto Regulation

Bitcoin’s assign is additionally plagued by regulatory inclinations. Adjustments in regulation can support or discourage investment in BTC or in its use, which in flip ends in an enhance or lower in its assign.

Right here is how the bitcoin assign overlaid with regulatory occasions in 2021 looks to be like:

News Not without prolong Related To Bitcoin

Let’s use into narrative an example of how indirect recordsdata occasions, comparable to reports a pair of political grief in a rustic somewhere on this planet, can substantially influence the payment of BTC.

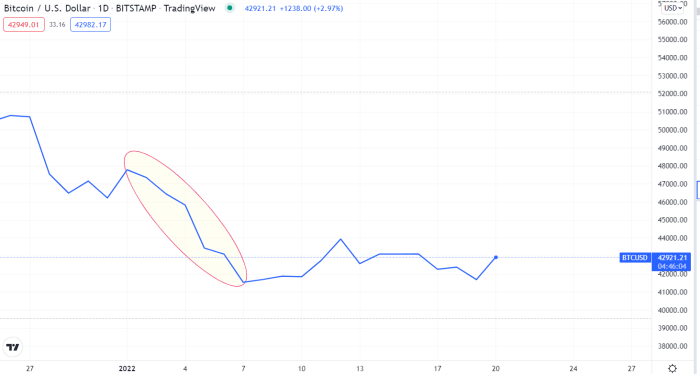

On 2 January, 2022, a week-long uprising began in Kazakhstan. Most folk hadn’t realized the significance of this match for the crypto market. In latest years, Kazakhstan grew to turn into the arena’s quantity two bitcoin miner in accordance with hash price. It accounts for roughly 18% of the worldwide hash price, and is easiest outdone by the United States.

So, with the records of an uprising, it took about 24 hours for the crypto market to react, and the BTC assign plunged a blended 13.1% from January 2 to January 8.

Image supply: TradingView

BTC An increasing number of Resembles Frail Property

In belief, extinct market-connected recordsdata comparable to reports on the macroeconomic ambiance or monetary protection decisions of central banks must silent no longer hang an designate on cryptocurrencies owing to their decentralized nature. On the other hand, the latest construction suggests otherwise.

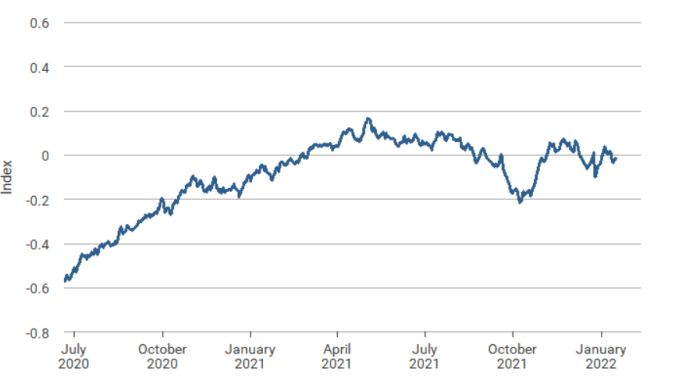

International recordsdata sentiment has a huge influence on fairness returns across the arena, in step with World Financial institution review. This originate just isn’t any longer reversible in the short plug, suggesting an underlying supply of sentiment-pushed asset assign fluctuations.

Below is the Day-to-day News Sentiment Index by the Federal Reserve Financial institution of San Francisco, which gives an overall measure of enterprise sentiment by examining recordsdata articles:

Image supply: Federal Reserve Financial institution of San Francisco

Even supposing Bitcoin just isn’t any longer a extinct asset, it looks that the general recordsdata sentiment influences its payment.

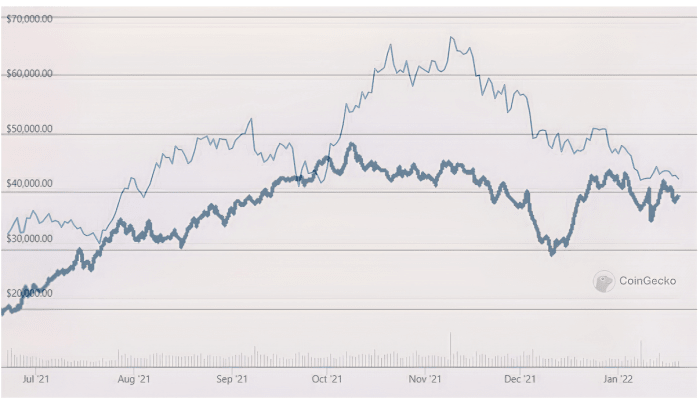

Right here’s what bitcoin’s assign chart looks to be like admire when blended with the records sentiment index for the identical duration:

Image supply: Author, knowledge from CoinGecko

Contemporary knowledge on Bitcoin and main inventory indices correlation additionally suggests this.

Historically, crypto sources didn’t impress a convincing correlation with main inventory indices. Within the latest Coinmetrics knowledge, however, the day-after-day correlation between bitcoin and the S&P 500 jumped to 0.47 on January 28, 2022, indicating a shut correlation.

Image supply: Coinmetrics.io

Backside Line

As the crypto market matures, new traits are rising that we haven’t observed forward of. At first a fringe asset, bitcoin is now increasingly more more acting admire a extinct asset, soft to the identical market forces which hang an designate on these markets. Apart from to recordsdata on crypto regulations and institutional adoption, bitcoin’s assign is plagued by modifications on the total financial circumstances and world occasions that influence extinct markets.

That is a guest post by Mike Ermolaev. Opinions expressed are entirely their possess and originate no longer essentially replicate these of BTC Inc or Bitcoin Journal.