- What is a bitcoin transaction?

- How does a Bitcoin transaction work?

- How prolonged construct Bitcoin transactions seize?

- Transaction funds

- Closing Tips: What Else to Know About Bitcoin

The brief answer: Nonetheless prolonged it takes to switch Bitcoin between wallets varies from transaction to transaction.

In case you construct a Bitcoin transaction, it wants to be accredited by the community before it will even be carried out. The Bitcoin group has location a broken-down of 6 confirmations that a switch wants before you would possibly presumably presumably also preserve in mind it entire.

What determines the Bitcoin transaction cases?

The 2 predominant factors influencing the transaction time are:

- The amount of community exercise

- Transaction funds

The more transactions that the community wants to course of, the longer every transaction takes. Right here’s because there are good a finite selection of miners to course of every block and there are a finite selection of transactions that can even be incorporated in a block.

Miners on the Bitcoin community prioritize transactions by the rate that they receive for confirming them. Attributable to this fact, must you pay a better rate, a miner is more doubtless to course of your switch which decreases the transaction time.

How prolonged does it seize to verify a Bitcoin transaction?

As mentioned earlier, a Bitcoin transaction in total wants 6 confirmations from miners before it’s processed. The frequent time it takes to mine a block is 10 minutes, so you would possibly presumably request a transaction to seize spherical an hour on life like.

Nonetheless, the gentle reputation enhance of Bitcoin has brought on congestion on the community.

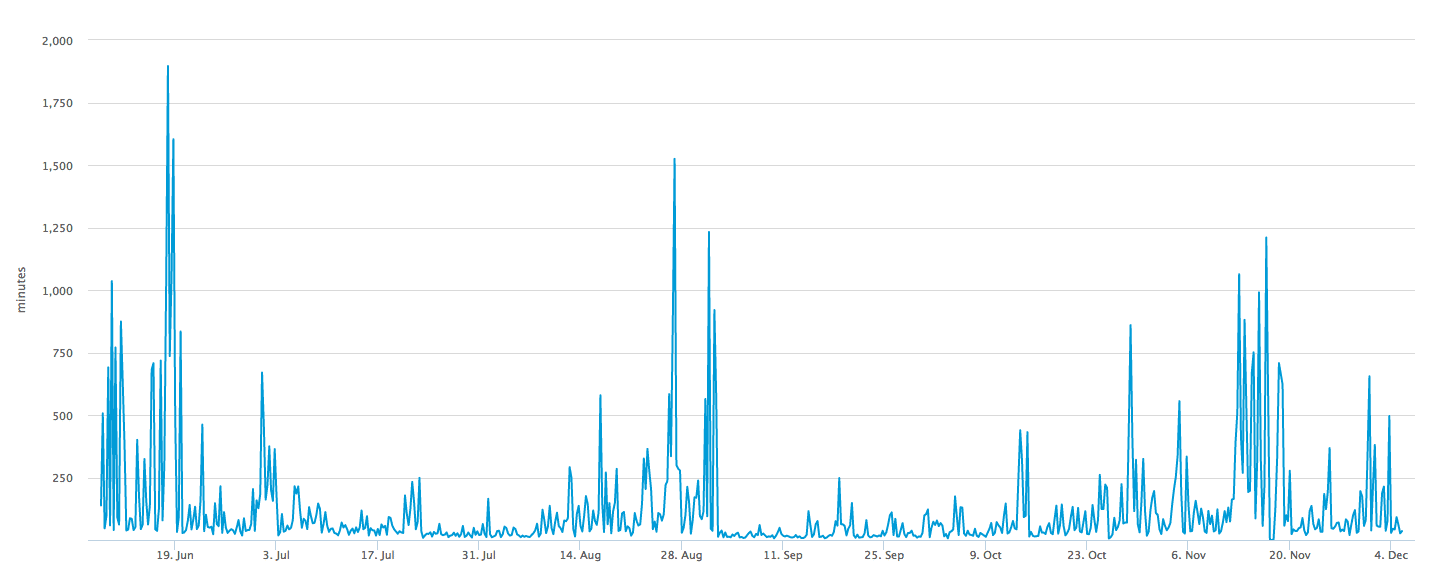

The life like time for one Bitcoin affirmation has now not too prolonged within the past ranged wherever from 30 minutes to over 16 hours in grievous cases.

Traditionally, there has been a divide within the Bitcoin group on how one can good address these scaling considerations. Some participants (particularly those in prefer of Bitcoin Earnings 2018) deem that the resolution is a elevated block size that’s in a position to holding more transactions per block.

Other group participants debate that enhancements equivalent to Segregated Witness (SegWit) and the Lightning Community will lope up the community with out having to enlarge the block sizes.

Most attention-grabbing time will repeat which resolution proves to be the correct.

What is a bitcoin transaction?

First, let’s be conscious that bitcoins don’t physically exist. There’s no stable coin to possess on your hand, nor a token or trail of paper to indicate the worth of your bitcoin. As an different, bitcoins exist within the virtual realm as a series of transactions which were verified—in essence, legitimized—on the hyper-obtain, public ledger veritably known as the “blockchain.” In other phrases: bitcoins are a historic past of signatures, secured with cryptography.

So, must you “like” bitcoin, what you with out a doubt possess is details: the historic past of your bitcoins, and a pair of “keys” allowing you to make utilize of them—the final public key and the non-public key.

Think about your bitcoin as a collection of knowledge tokens saved in a tumbler box. The final public key is the designate of your box—each person knows this is your box and the intention noteworthy bitcoin your box incorporates. Like a checking tale routing number, your public key is shared so as that folk can ship you money.

By distinction, your non-public key is safely guarded; it’s a long way the technique to launch your glass box of bitcoin. Having entry to the non-public key is equivalent to having adjust of the checking tale, which is why other folk seize wide anguish to forestall non-public keys from falling into the irascible fingers.

In sum, bitcoins are summaries of transaction details. Public keys aid you possess that details. Non-public keys authorize you to ship that worth to one more public key.

How does a Bitcoin transaction work?

Swear that you would possibly per chance give your friend Dave a generous birthday reward of 5 bitcoin (5 BTC). To construct so, you would possibly per chance make utilize of your non-public key to ship a message to the final public blockchain asserting this transaction. This transaction message incorporates three parts:

- Input: the source transaction of the bitcoins you’re sending to Dave. This code explains the historic past of how the bitcoins got here to your public key.

- Amount: the selection of bitcoins—on this case, five—that you intend to ship to Dave.

- Output: Dave’s public key, or the address to which you would possibly presumably presumably be sending the bitcoins.

This three-section transaction message is disbursed to the blockchain; in actuality, transaction contain plenty, for an wide breakdown, verify out this Bitcoin transaction viewer. As soon as the blockchain receives it, details-crunchers veritably known as “miners” work to verify the transaction. There’s a elaborate, very technical background to miners and the work of bitcoin mining, but for the sake of figuring out here, we’ll preserve it straightforward. Briefly, miners resolve advanced math considerations that construct gentle signatures—an up to this point transaction historic past—for the transacted bitcoin.

On your case, the miners will verify that you like five bitcoin to ship to Dave, then change those bitcoins’ checklist of past transactions to point to that you would possibly presumably presumably be sending five bitcoins to Dave’s public address.

Unfortunately for Dave, this course of would not occur instantaneously. Truly, bitcoin transactions are arena to delays ranging from a brief while to some days. Right here’s because bitcoin requires miners to verify transactions. Transactions are on the total lumped into “blocks,” to be verified and added to the final public blockchain; in step with fashioned bitcoin protocol, it takes about ten minutes to mine one block.

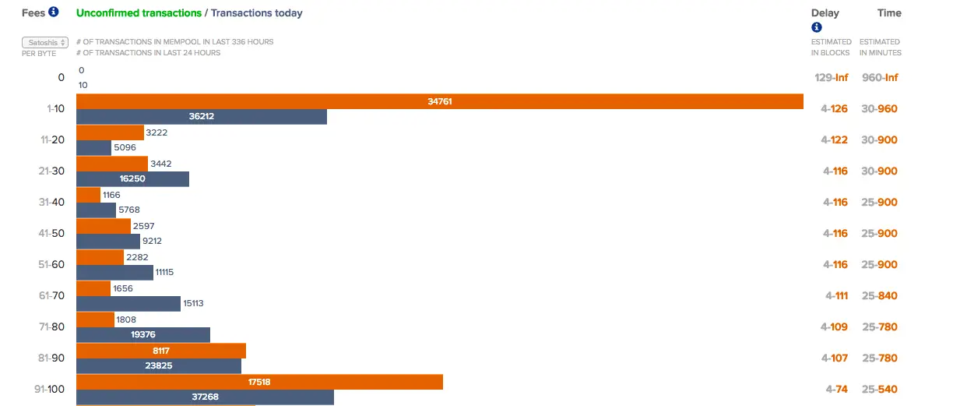

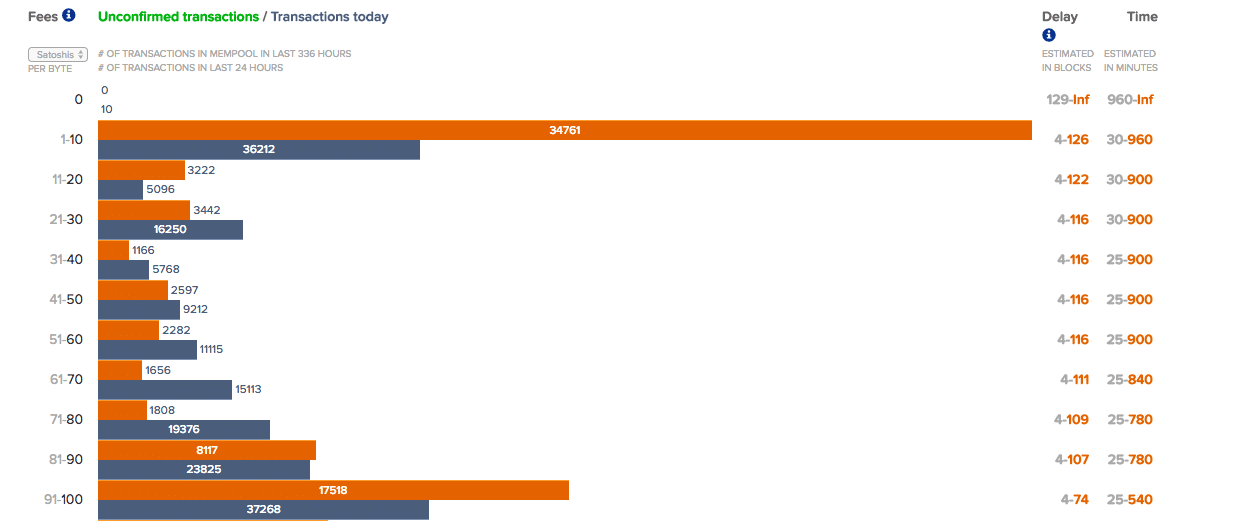

Nonetheless, because of its rising reputation, the bitcoin community is over and over backlogged with transactions ready to be lumped into a block. Block sizes are restricted, and contributors which construct now not construct it into one are lumped into a enormous queue veritably known as the “bitcoin mempool.” The mempool fluctuates in size, with wait cases furthermore dependent on transaction precedence and funds, which we are in a position to disguise quickly. For a thought of the backlog, verify out the most up-to-date Bitcoin Mempool.

Transaction funds

Mining requires well-known effort and skills, so bitcoin transactions are an increasing selection of arena to extra funds. Transaction funds aid to prioritize the queue—the better you’re prepared to pay miners to verify your transaction, the quicker it’s doubtless to be processed. Bitcoin transaction funds are on the total expressed in “satoshis per byte”. A Satoshi is one hundred millionth of a bitcoin, per byte size of the transaction, which is on the total over 200 bytes.

Bitcoin funds aren’t mandatory, though they construct incentivize miners to course of your transaction faster. Transaction funds are on the total location by the person creating the block of transaction details to be mined. These rates and their dependent wait cases vary as traffic ebbs and flows.

To illustrate, you would possibly presumably presumably also pay 200 satoshis per byte (which is 0.000002 BTC or 0.01 USD per byte) for your reward to Dave to be positioned within the bitcoin queue of the subsequent 1-3 blocks. Your transaction will thus seize about 10-30 minutes to be verified.

Alternatively, you would possibly presumably presumably also pay a better rate—direct, 300 satoshis per byte—to like your transaction positioned within the quick queue or the subsequent block to be mined. Your transaction is on the total carried out within the subsequent 10 minutes.

Bitcoin is a individual-essentially based, sight-to-sight plot, thus making the plot inclined to volatility and experimentation. As of this writing, Bitcoin transactions had change into alarmingly costly—at one point, for instance, transferring 0.01BTC ($42) tag $4 in transaction funds. As bitcoin continues to acquire as a platform, the roller coaster of rates, funds, and wait cases will doubtless stabilize.

Closing Tips: What Else to Know About Bitcoin

Despite Bitcoin’s rising reputation, the staunch course of of the utilize of cryptocurrency remains murky to many folk. Transactions—public, yet obtain, as they’re reliant on bitcoin’s underlying blockchain skills—are the predominant to the currency’s future success. They furthermore conceal some of Bitcoin’s most quick challenges: wait cases, plot overloads, and transaction funds wanted to pay “miners” to course of the decentralized currency.

Time will repeat if the persevered utilize of bitcoin will subtle out the over and over uneven transaction course of

This educationally-centered technical article used to be proudly sponsored by BitScript.app, a Bitcoin academic platform & pattern atmosphere.

By no manner Dash away out One other Opportunity! Gain hand chosen news & details from our Crypto Experts so you would possibly presumably presumably also construct skilled, told choices that straight like an affect on your crypto earnings. Subscribe to CoinCentral free e-newsletter now.