Hear To This Episode:

In this episode of Bitcoin Journal’s “Fed Gape: podcast, CK and I continued our monthly assortment with Dylan LeClair, creator of the Deep Dive document. We had the choice to scamper over the metrics in the bitcoin market that he is looking at and is an skilled in. They collect got a free model of the document that comes out every day, and an queer paid model monthly and yearly. Adjust to alongside with his trot deck here.

“Fed Gape” is a podcast for folks drawn to central monetary institution fresh events. Bitcoin will consume central banks in some unspecified time in the future, working out and documenting how that is going on is what we are about here at “Fed Gape.”

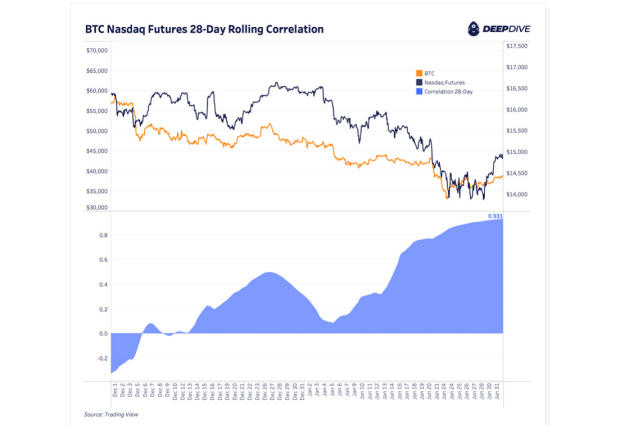

Bitcoin’s Correlation To Stocks And VIX

The most predominant topic we covered in this episode and the foremost topic from the January difficulty of the Deep Dive is bitcoin’s correlation to shares and the volatility measure, the VIX. LeClair described why this correlation has seemed over the last one year and what it will expose us relating to the health of the bitcoin market.

Grayscale GBTC And Bitcoin Designate

One of the essential better issues we talked about with LeClair used to be Grayscale and the raze this market behemoth has on the bitcoin imprint.

As that it is doubtless you’ll even investigate cross-sign in the chart above, GBTC inflows stopped in January 2021, one one year earlier than this document, and curiously, very near the price of bitcoin on the time of this writing of $42,000.

LeClair walked us via this product and its raze in the marketplace. We talked about foremost institutions, aka market makers, that will were caught on the vulgar side of this replace, as the ample imprint top price that used to be facilitating “innocuous” arbitrage all true now changed to a reduction.

Bitcoin On-Chain Analysis Of Liquid Circulating Provide

Because the name suggests, the Deep Dive is an in-depth document that goes into very mutter metrics relating to the Bitcoin network. A vogue of is what I elaborate as the liquidity of circulating provide and its correlation to price. As that it is doubtless you’ll even investigate cross-sign in the chart above, the formed areas symbolize coins that collect moved interior a three-month length. It is connected to velocity, however the assign velocity is occupied with the amount of transactions, liquidity of circulating provide is a p.c of the total provide that has moved on the very least once.

The proportion of provide that turns into liquid begins to ramp up as the price approaches peaks, and resets decrease as imprint consolidates. The pattern is rising of decrease top-stage circulating provide and decrease lows. That makes sense if we deem by system of buying energy on the tops and bottoms. In varied phrases, every peak is a decrease amount of satoshis but a increased stage of buying energy, for the reason that imprint is greatly increased. And vice versa, the lows are a decrease amount of satoshis but a increased stage of buying energy.

If bitcoin is going to continue appreciating in price, we would anticipate that true pattern to continue. As original entrants near into the market they’ll gather fewer satoshis to bewitch, even in cases of FOMO.

Stablecoins As Collateral And Holders Of Sovereign Debt

The next segment of our discussion blew me away. LeClair discussed the upward push of stablecoins relish Tether which will most certainly be rising in use as collateral for leveraged trades in bitcoin. Within the past, folk tended to utilize their bitcoin as collateral, which acted to intensify imprint strikes. With stablecoins taking extra of that characteristic, it may maybe also merely quiet result in a lot much less volatility in the bitcoin imprint.

LeClair additionally talked about the fact that Tether and varied stablecoins provide small, a lot noticeable bewitch strain for U.S. government securities. They collect got these very ample reserves of bucks that they prefer to position into stable assets. What’s better for this than U.S. treasuries?

I make a connection that the original-or-garden listing of international holders of U.S. government debt needs to be expanded to embody, no longer true international central banks, but maybe in the raze, firms relish Tether. How crazy would or no longer it is to gaze Tether with true as many U.S. treasuries as countries relish Germany, China or Japan? This would right this moment make Tether and varied stablecoins massive geopolitical gamers.

Federal Reserve And Rate Hikes

On the day of recording this dwell hasten, March 1, 2022, bond markets had been swinging wildly. So, we examined true what used to be going on and gave our listeners some expectations for the relaxation of the one year.

The chart below displays the chances of a 50 basis point (bps) hike this month are without a doubt zero, and the chances of any hike continue to drop. The amount of implied price hikes by the raze of the one year has fallen from nearly seven to now decrease than five. I suspect that this is in a position to continue to drop over the following few months to at most three price hikes in 2022.

SWIFT Choices, Gold And Russia

We ended the episode with some focus on relating to the gap in Russia and Ukraine, nearly relating to the sanctions of the SWIFT network. The top doubtless viable alternative on the horizon is Bitcoin. The a lot discussed Russia/China alternative is in its infancy and quiet makes use of banks as nodes which is inclined to be inclined to sanctions. Gold isn’t any longer an probability for immediate worldwide settlement, and can doubtless suffer imprint declines in this space on chronicle of Russia needs to access bucks, and can promote gold to originate that.

The Russia/China interbank alternative isn’t any longer an alternative banking or monetary gadget, it is true a messaging protocol. It is in the the same boat as a central monetary institution digital forex (CBDC), it’s original but no longer progressive. It quiet has all of the points of failure relish injurious institutions and rails of the past. Bitcoin, on the assorted hand, is basically a brand original gadget, with a brand original monetary unit. It is the top doubtless ingredient at this time that suits the invoice as a replace to SWIFT and the decrepit fiat gadget.

Here’s a customer post by Ansel Lindner. Opinions expressed are entirely their very beget and originate no longer necessarily mediate those of BTC Inc or Bitcoin Journal.