BTC, ETH, and XTZ salvage all rebounded above excessive make stronger levels, but live at possibility of downward stress

Ethereum’s ETH has correlated highly with BTC in 2021, and the latter’s uptick on Thursday furthermore saw ETH/USD surge to interrupt above $2,000.

Standard crypto trader Michael van de Poppe suggests Bitcoin’s reclaiming of make stronger at $31,000 may maybe presumably wait on it surge to $40k. Meanwhile, the uptick in BTC’s fortunes may maybe presumably see altcoins soar 80%+ in the conclude to term.

If we glance at the price circulation of #Bitcoin, we can clearly see and deliver that we’re preserving above $31Okay.

If that sustains, and the market grants a better low, I deliver now we salvage learned a non eternal bottom & we will take a look at $40Okay.

This would lead #altcoins to tear 80-150% from right here. pic.twitter.com/Zrpq8zOJvJ

— Michaël van de Poppe (@CryptoMichNL) July 22, 2021

But while the crypto market looks to recoup losses suffered these previous few weeks, some industry players imply BTC is yet to bottom, and promoting stress may maybe presumably peaceful push Bitcoin and alts lower.

With that in thoughts, right here’s a transient outlook for Bitcoin, Ethereum, and Tezos heading into the weekend.

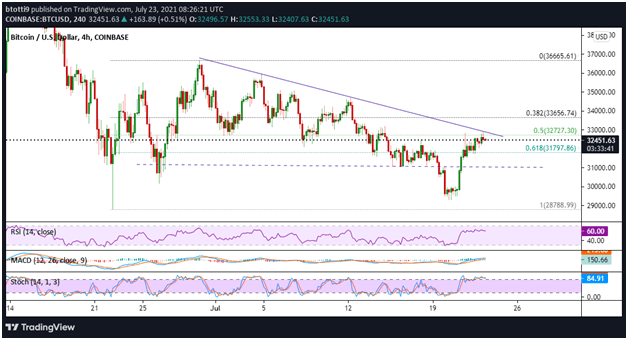

BTC label

Bitcoin (BTC) has recovered above a excessive horizontal zone and in the intervening time eyes a breakout in direction of $33,000.

Technical indicators imply that bulls salvage the upper hand because the 4-hour MACD has fashioned a bullish crossover as it looks to interrupt above 0; the RSI in the identical timeframe is furthermore above 50.

Nonetheless, the RSI has in general flattened and suggests a skill flip, equal to the stochastic oscillator that continues to be in the bullish zone, but with a skill bearish depraved.

Key label levels to search on the upside are $32,500, $34,800, and then the major resistance at $36,650. If the upside fizzles out, needed make stronger levels are likely at the 61.8% Fib level ($31797) and recent lows of $29,300.

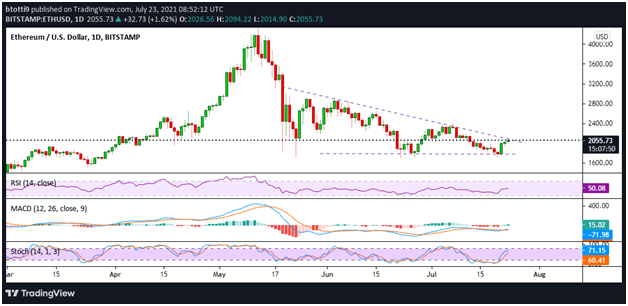

ETH label

ETH looks bullish on the day-to-day chart, with the RSI, MACD, and stochastic all showing bullish indicators. On this scenario, Ethereum’s label may maybe presumably damage above a descending trendline to take a look at resistance levels conclude to $2,150 and $2,325.

In accordance with van de Poppe, popping off a weird horizontal line may maybe presumably catapult ETH/USD to $2,400 and then $2,900. On the downside, bulls deserve to defend the crucial make stronger level at $2,000 to prevent a retest of weekly lows of $1,720.

XTZ label

Tezos label has obtained 6% in the previous 24 hours and in the intervening time trades conclude to $2.57. Bulls strive and consolidate above $2.35.

The RSI is rising and may maybe presumably upward thrust above 50 to hand consumers the advantage. If the upward stress holds, XTZ/USD may maybe presumably take a look at resistance at $3.00 and look new make stronger spherical $3.38. In case the bullish scenario performs out, the following targets would be at $4.10 and $5.73.

Traders, nonetheless, face a quantity of stress conclude to the 20-day EMA and 50 SMA at $2.59 and $2.89 respectively. A breakdown would thus establish Tezos’ label at possibility of declining to $2.16 and $1.79.