Photo: Greg Kahn. Shutterstock characterize by DCStockPhotography

Key Takeaways

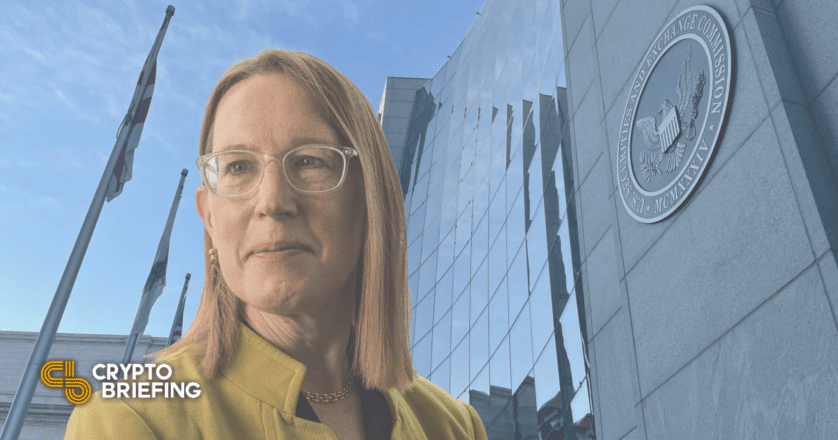

- The educated-crypto SEC Commissioner Hester Pierce issued a public commentary Wednesday slamming the agency’s new regulatory agenda.

- Commissioner Pierce dubbed the SEC’s regulatory methodology as “fallacious” and unhealthy for the nation’s capital markets.

- She also criticized the SEC’s strive to withhold an eye on decentralized finance without first addressing the crypto industry’s main desires.

Hester Pierce has issued a public commentary criticizing the U.S. Securities and Alternate Fee’s new regulatory agenda. She described the agency’s methodology as “fallacious” and unhealthy for the nation’s capital markets.

Commissioner Pierce Blasts SEC’s Agenda

Commissioner Hester Pierce has spoken out against the SEC’s new crypto regulatory agenda.

The fervently educated-crypto member of the SEC’s 5-particular person board of commissioners issued a public commentary Wednesday bashing the regulatory agency’s new “Regulatory Flexibility Agenda.” Printed the identical day, the agenda involves 53 legislative documents that outline the short and lengthy-term regulatory actions that the administrative agency plans to employ.

In holding with the SEC’s Chairman Gary Gensler, the agenda is pushed by two public policy targets: persevering with to drive effectivity in U.S.’s capital markets and modernizing the guidelines for on the brand new time’s financial system and applied sciences. “Doing so will relieve us to produce our three-share mission: maintaining investors, striking forward dazzling, clear, and efficient markets, and facilitating capital formation,” Gensler mentioned in announcing the agenda in a press originate.

Commissioner Pierce, on the opposite hand, disagrees with Chair Gensler’s methodology to regulating capital markets, noting in her most up-to-date commentary that his notion “sets forth fallacious targets and a fallacious system for reaching them.” She wrote:

“The agenda, if enacted, dangers surroundings off the regulatory model of a rip fresh—like a flash-transferring currents flowing far off from shore that can even be fatal to swimmers. Pleasing as constructive wave and wind prerequisites can invent unhealthy rip currents, the ride and persona of the rulemakings on this agenda invent for unhealthy prerequisites in our capital markets.”

Commissioner Pierce then proceeded to blast the SEC’s notion, announcing that it shunned considerations on the core of the agency’s mission in favor of “shimmering objects” exterior its jurisdiction. “We once sought to present protection to retail investors; we now breeze to the abet of educated investors,” she mentioned, adding that she believes the SEC in its fresh make does less to relieve little and rising corporations and as an different increases their charges and shrink their investor nefarious.

Amongst her criticism, Commissioner Pierce also addressed the agency’s sneaky strive to withhold an eye on crypto protocols—namely decentralized cryptocurrency exchanges and liquidity suppliers—without first dealing with the industry’s main desires and repeated requires for regulatory readability.

“Even supposing the Agenda involves guidelines that can withhold an eye on crypto protocols or platforms by design of an unmarked backdoor, it does now not appear to encompass any guidelines essentially supposed to grapple with the indispensable regulatory questions which bear arisen round these resources,” she wrote, relating to the SEC’s proposed rule to amend the definition of “change” in the Securities Alternate Act of 1934.

The mentioned rule, outlined in a 591-web page file printed in January, fails to invent any relate references to crypto resources or decentralized finance protocols. As a substitute, it proposed including all “communication protocols” and systems that facilitate investors and sellers of securities within the Alternate Act’s definition of an “change.”

Many industry specialists bear argued that the proposed rule represents an effort on the SEC’s share to lift decentralized exchanges and cash market protocols below its regulatory purview. More importantly, the definition’s excessively astronomical phrasing dangers redefining all “communications protocols” as doable securities exchanges. As a end result, many important crypto industry stakeholders, including Coinbase, Delphi Digital, Coin Center, FTX, and the Blockchain Association, bear submitted comments to the agency opposing the proposal.

Commissioner Pierce, guilty for SEC’s Token Safe Harbor proposal, mentioned that once the agency hurriedly writes and implements a myriad of guidelines it creates prerequisites that can roil the markets. “We can withhold far off from rising regulatory rip currents by recalibrating our agenda to focal point on considerations core to the protection of investors and operation of our markets and by slowing down the ride to invent obvious that we and the public can take into myth what we’re doing,” she summarized.

Disclosure: At the time of writing, the author of this piece owned ETH and plenty of other completely different cryptocurrencies.

The records on or accessed by design of this web location is bought from self sufficient sources we reflect to be correct and official, but Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any records on or accessed by design of this web location. Decentral Media, Inc. is now not an investment advisor. We produce now not give personalized investment advice or completely different financial advice. The records on this web location is subject to commerce without scrutinize. Some or all of the records on this web location would possibly maybe maybe change into out of date, or it will seemingly be or change into incomplete or wrong. Shall we, but usually are now not obligated to, substitute any out of date, incomplete, or wrong records.

You ought to light never invent an investment resolution on an ICO, IEO, or completely different investment per the records on this web location, and you ought to light never clarify or otherwise depend on any of the records on this web location as investment advice. We strongly indicate that you just consult a licensed investment advisor or completely different licensed financial educated if you strive for investment advice on an ICO, IEO, or completely different investment. We produce now not accept compensation in any make for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

SEC Commissioner Hester Peirce Opposes Crypto Bailouts

SEC Commissioner Hester Peirce has instructed in an interview with Forbes that she would oppose bailouts for crypto projects, even though she remains pleasant towards the house. Peirce Condemns Crypto Bailouts…

After Bitcoin, SEC Commissioner Hester Peirce Backs DeFi

Hester Peirce, a commissioner on the U.S. Securities and Alternate Fee (SEC), known that DeFi is “a impulsively rising nook of the crypto world with vital cash.” She added that…

Official-Bitcoin SEC Commissioner Hester Peirce Elected to Relieve 5 More …

Commissioner Hester Peirce has been re-elected to the Securities and Alternate Fee (SEC), allowing her to abet with the regulatory body for one other term. Peirce has an exact fame within…

SEC Chair Gensler Reiterates DeFi Regulatory Risks

In a Wednesday Financial Instances interview, SEC Chairman Gary Gensler repeated his question for crypto procuring and selling platforms to register with the SEC, claiming they risk regulatory worry by working exterior…