The underneath is an excerpt from a most up-to-date edition of Bitcoin Journal Legitimate, Bitcoin Journal’s top payment markets e-newsletter. To be amongst the first to glean these insights and quite quite lots of on-chain bitcoin market analysis straight to your inbox, subscribe now.

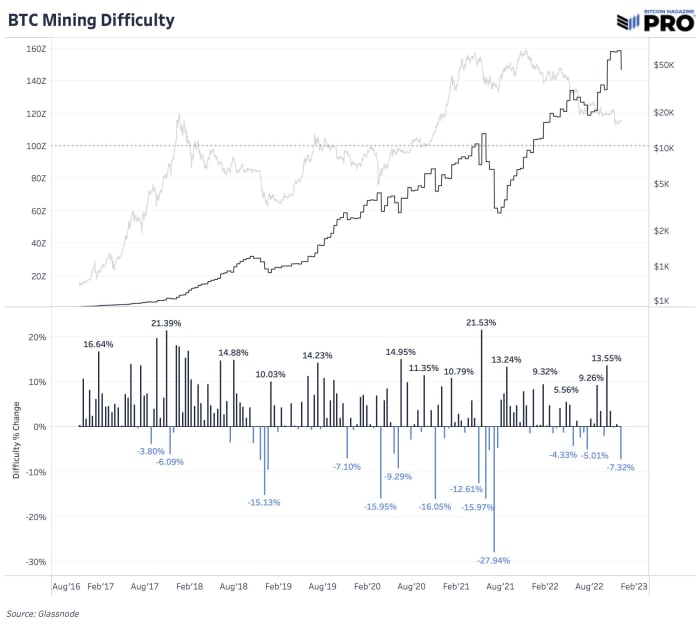

File Downward Way Adjustment

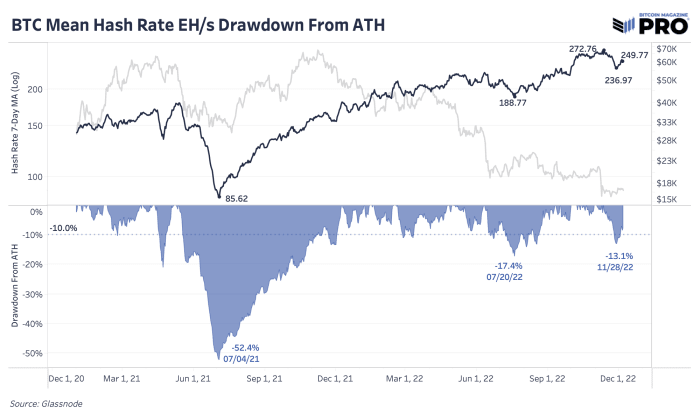

The mining trade continues to desire a beating as rising vitality inflation, debt burdens and unhappy bitcoin costs desire their toll. At the end of November, we saw a 13.1% decline in hash payment from all-time highs. Alternatively, of the critical hash payment declines since 2016, that’s unexcited fairly diminutive when in contrast with the handful of down sessions over 15% during that time.

Presumably the most up-to-date 7.32% downward predicament adjustment is a straight away response to all of that hash payment going offline. As we stand today, the hash payment is correct round 250 EH/s and down 7.84% from its all-time excessive of roughly 273 EH/s. This is the finest downward predicament adjustment we’ve seen since July 2021, when we saw a collection of downward predicament adjustments following the Chinese mining ban. This must elevate some temporary reduction to present miners, nonetheless or no longer it is too early to reveal if this pattern in declining hash payment has already concluded.

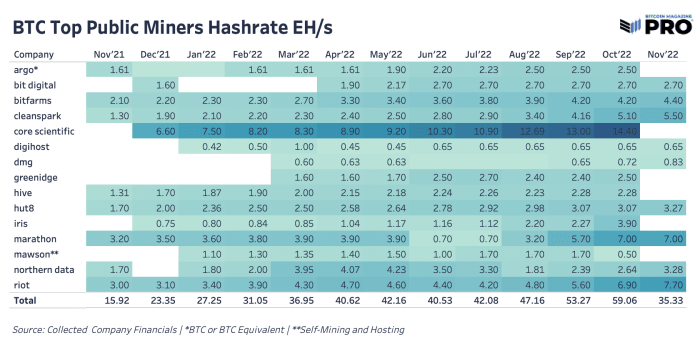

Even with basically the most up-to-date drawdown in hash payment, we’re no longer seeing announcements approach from critical public miners. Most public miners’ hash payment is both flat or is rising during the last month.

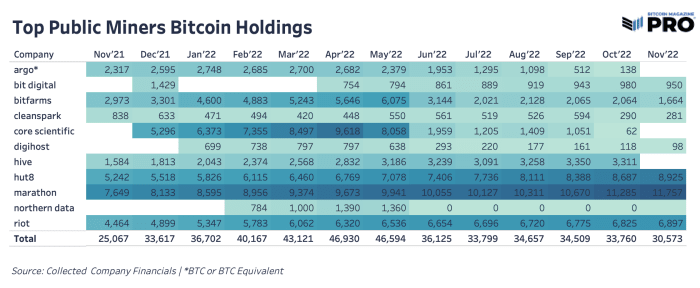

From of us who be pleased equipped month-to-month production updates so far, bitcoin holdings are largely rising from the greatest three treasuries across Riot, Marathon and Hut 8 accounting for 27,579 bitcoin. Bitfarms sold a meaningful amount from their treasury which is likely connected to paying down their present debt amenities.

In bitcoin phrases, miners’ stock performance continues to tumble this year when year-to-date returns versus bitcoin performance. The hash imprint undergo market is alive and successfully, which has been a core thesis for us when evaluating the present possibilities of investing in public miners versus bitcoin. Any miner outperformance in bitcoin short-timeframe has proven to be a possibility available in the market to reprice the equity decrease.

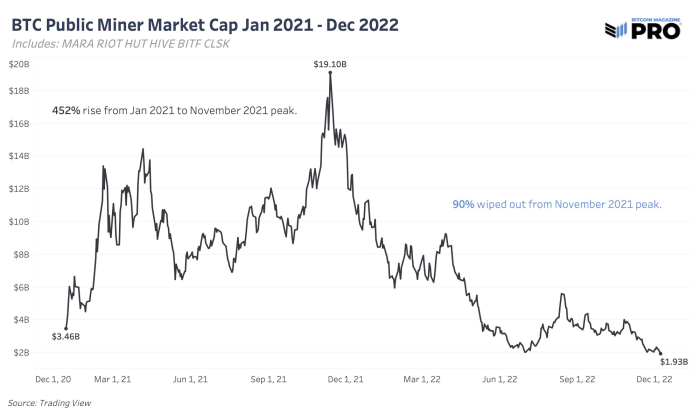

Having a peek on the market caps of a proxy basket of six public bitcoin miners reveals apt how worthy imprint has been wiped out from 2021. After a 452% upward thrust in imprint to its November 2021 top of $19.1 billion, the market wiped out 90% of imprint in lower than a year.

While the worst of the drawdown of public miner market capitalizations and hash imprint (miner revenue per tera hash) has already taken build, we pronounce that the advanced circumstances can last for a sustained duration of time, squeezing many market participants alongside the model. Presumably the most up-to-date downward predicament adjustment precipitated some reduction, nonetheless it is far barely sufficient for many miners who purchased the bulk of their machines in 2021, searching at for $30,000 as their “worst-case predicament.”

Throw in an atmosphere the place worldwide vitality costs and interest charges be pleased skyrocketed and plenty of operations are facing immensely advanced circumstances — namely web web hosting amenities the place companies befriend as intermediaries for purchasers searching to reap the benefits of mining bitcoin. The elephant in the room for the declare of the mining trade is the actuality that a couple of of the trade’s greatest web web hosting amenities are both already bankrupt, teetering on the perimeter of financial pain or are fully out of deployable hash payment for indolent ASICs.

We are succesful of be intently searching at hash payment and the declare of the mining trade going forward. Though the trade has been bludgeoned over the direction of 2022, we suspect it isn’t out of the woods rather but.

The unheard of thing about bitcoin and capitalism is that entirely the solid will reside on. Regardless, blocks will continue to be mined each and every roughly 10 minutes.