In an episode of Bitcoin Spaces Live, released by Bitcoin Journal on November 3 2021, Michael Saylor made the claim that bitcoin goes to “demonetize” index funds.

“The battle is bitcoin versus gold and bitcoin versus index funds… the battle is in opposition to musty sources, and bitcoin goes to demonetize $100 trillion of them subsequent.”

What does it imply to demonetize an asset? It blueprint to determine away it’s blueprint as money. No longer appropriate for house owners of these sources. Listed right here, I will focal point on the aptitude for bitcoin to please in the lunch of index funds.

How are you going to “demonetize” index funds if, in spite of the total lot, they are … funds? The acknowledge is that index funds are frail as money within the substantial sense. The simpler ones, akin to folks who track the Accepted & Wretched’s 500 index, are a de facto store of price for retirement savers. Subsequently, there is a financial top price placed on these products that goes beyond pure investment for the holders of them. Right here is one motive Saylor calls index funds “musty sources” whose price will most seemingly be transferred to bitcoin.

There are advantages to index funds, but I reveal their dominance is unsustainable over the long term. Bitcoin is right here as the final notice alternative.

The Advantages Of Index Funds

In over a decade as a financial consultant, purchasers dangle regarded to me to point them within the applicable route on allocate their financial savings and investments. When I was first starting out I keep in mind listening to an musty Wall Dual carriageway adage, “no one gets fired for making an strive to search out IBM.” This day, it would possibly maybe well presumably additionally very properly be “no one gets fired for recommending an S&P 500 index fund.” Index funds and index-basically basically based ETFs (I’m using these phrases interchangeably) dangle change into maybe the most smartly-most current resolution for wealth managers and retirement investors on the unique time. It’s a sacred cow.

An index fund, in accordance with Investopedia, is “the kind of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the parts of a financial market index, akin to the Accepted & Wretched’s 500 Index.” There are appropriate the reasons why the enlargement of these products dangle exploded. Lowering costs, worthwhile by no longer losing, is essential. Most considerably, John Bogle (founding father of The Forefront Group of investment corporations)’s brilliance was about preaching the discipline to elevate shut-and-sustain … to HODL, if you will.

The index fund gave us a truly easy blueprint to participate within the appreciation of stock indexes while not having to pay excessive costs. They had been an main innovation in an know-how the build unsophisticated savers were pressured to participate in investments they know nothing about as a result of fiat inflation.

The Complications With Index Funds

The crux of the topic is that index funds are what I call “nihilistic” investing, ensuing from it is miles investing the build nothing issues.

To comprehend why, let’s decide a be taught about on the instance of checkout lines in a grocery store. That you just would possibly presumably presumably additionally honest leer that it is always the case that every checkout line on the grocery store is in regards to the same length. Why is that this?

The motive is ensuing from each consumer surveys the lines after which stands within the actual person that appears the shortest. The collective result of these choices are orderly lines which would be roughly equal. It is reveal that is created by no one person.

But imagine as a replace if all americans talked about to themselves, “the markets are environment friendly, the lines are at all times equal, so I will honest naively stand within the first one.” Now the orderliness ceases to exist. The lines had been roughly equal ensuing from all americans was making an active decision, they weren’t nihilists!

Now we are able to begin to occupy the standard inform with index funds. If all americans indexed, it is no longer any longer a market at all. John Bogle, the inventor of the index fund, even talked about as important in the direction of the pause of his lifestyles:

“If all americans indexed, maybe among the finest notice that you simply would possibly presumably additionally use is chaos, catastrophe…The markets would fail.” – John Bogle, Would possibly maybe maybe presumably 2017

Index fund apologists would possibly maybe maybe respond that there’ll at all times be greedy investors making an strive to search out an edge on the market. These investors will at all times present important wished “mark discovery,” they would possibly maybe maybe additionally honest articulate. This is able to be honest to an extent, but there is mild a distortion to costs when a expansive fragment of the market is “lifeless money.”

Right here is exactly what we are now seeing on the unique time. Because index investing, once considered as how that you simply would possibly presumably additionally circumvent Wall Dual carriageway, is now the establishment.

Let’s decide a be taught about on the monolith of BlackRock, Forefront Group, Constancy Investments, Capital Group and Inform Dual carriageway, the 5 greatest suppliers of index funds and ETFs. These corporations collectively put together over $27 trillion bucks in global sources, which is more than 60% of all of the sources held in U.S. stock funds.

BlackRock in reveal would possibly presumably additionally honest dangle a ways more have an effect on than even the U.S. Federal Reserve Board. It is cronyism in all its glory. A telling document by the American Civil Liberties Carrying out came all over that:

- BlackRock holds a 5% or increased stake in more than 97.5% of the S&P 500 corporations.

- They’ve a outmoded Fed Vice Chairman on the payroll.

- In June of 2021, BlackRock’s two greatest bond ETFs grew to their greatest dimension ever following the Fed’s announcement that it would possibly maybe well presumably snatch corporate bond ETFs.

- Then the Fed hired BlackRock to administer these corporate bond making an strive to search out capabilities that, (you guessed it), would snatch BlackRock’s beget ETFs!

- CEO Larry Fink is a truly key consultant to President Joe Biden.

BlackRock’s have an effect on is so expansive that Bloomberg has known as them “the fourth department of presidency.” And who is the supreme shareholder of BlackRock Inc (BLK)? That would be none rather then Forefront themselves.

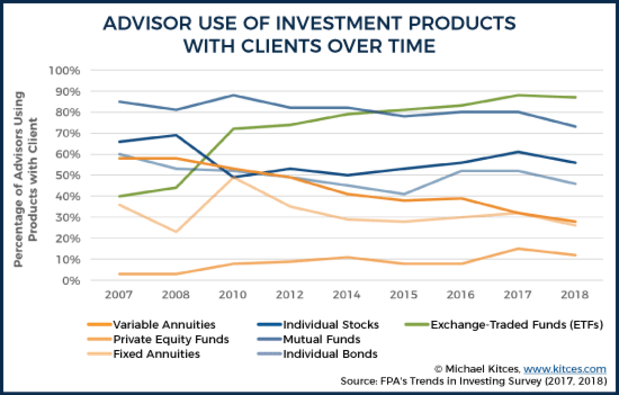

So we are able to speculate that the enlargement of indexing has no longer honest been the pause result of market decision, but thru on the least partial have an effect on of presidency energy. This vogue has most effective been amplified by the Division of Labor’s 2016 fiduciary rule, the build my beget financial consultant neighborhood dramatically shifted from favoring actively managed investments in the direction of passive index funds and ETFs. This two-headed monster of presidency regulation and a ambitious corporate lobby nudges an increasing number of investors in the direction of passive indexing.

The have an effect on of these crony corporations would possibly presumably additionally diminish when investors within the ruin wake as a lot as a better alternative, then again.

Why Bitcoin Is Superior To Index Funds And ETFs

The suitable recordsdata is that bitcoin, the money that it is valuable to steal to make jog that you simply to utilize it, is a superior resolution that comes and not using a coercion. Since bitcoin is money, it exists for the very motive of financial savings. As Saifedean Ammous has set it, “below a laborious money, all set a question to for financial savings would honest journey to keeping money.” In other phrases, there would be no need to save using investment products when there is money that holds its price and even appreciates whereas you sustain it.

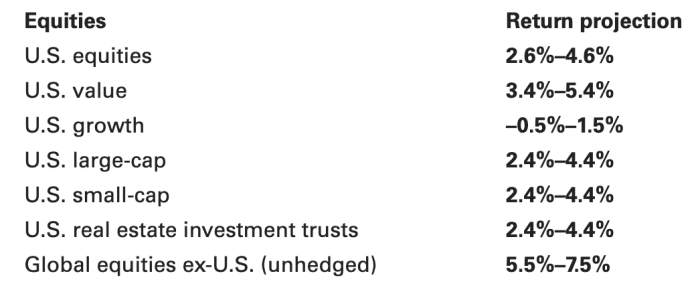

Obvious, stock index funds will in all probability expertise decrease volatility than bitcoin in the end, but their upside return capacity is additionally important decrease. By Forefront’s beget admission, projected returns over the subsequent ten years are for around most effective 2%-4% annualized in U.S. shares:

On the opposite hand, bitcoin is an asset class that is mild in its infancy, yet “it has delivered an annual real looking return of 891% (2011-2020).” As pure financial top price, it exists for the very motive that nearly all folks beget index funds anyway. That’s, to store their laborious earned financial savings, to transfer it to their future selves, and journey away something of price to their generations.

Bitcoin Requires Creativity Out Of Investors

For me, it took reasonably of inventive creativeness to score the swap to bitcoin. It required me to make investments, a dirty notice to financial advisors, on what the long term would possibly maybe maybe be taught about esteem (as others dangle accomplished right here, right here, and even right here. There don’t seem like any backtests on hand for this invent of endeavor. Likewise, this would possibly maybe maybe additionally honest be a hangup first and major for Bogleheads. But after they score the swap, I reveal the inertia will pull that neighborhood of believers into bitcoin as properly. After all, there isn’t any better advertising and marketing than “quantity journey up.”