Considered most certainly the most commonest objections I nonetheless hear to preserving any bitcoin is, “I exact don’t understand what it’s miles or how it if truth be told works.” You, reading this factual now, would possibly perchance well perchance even if truth be told feel this form.

I’m going to bewitch a wager and notify no, you are no longer certain how any of this works. You don’t understand it in any respect, but while you inquire in Screen veil Time on your iPhone, you’ll search for some staggering usage of a tool and system you most definitely can no longer birth to point out.

But you don’t get to hang how these programs work because you gape fee in them. And that’s sufficient.

Let’s inquire at an even extra summary system: cash and investments. You potentially form cash each and each month and withhold it in a checking tale, pay on your existence with a bank card and cash tests once in a while.

- Enact you know the fashion your bank clears and settles transactions?

- Enact you know the fashion Robinhood retains the accounting on your stock portfolio and executes trades on your behalf?

- Enact you know the fashion the Federal Reserve “conducts the nation’s monetary coverage”?

Even while you’re employed in the monetary system, I’ll bewitch a wager that you simply carry out no longer get a paunchy retract on how these programs work. In many situations, the operators of these programs get no longer get any reason to attend you understand — they most often take good thing about obscuring how they work to the surface world.

Even while you don’t know the fashion these programs work, you have interaction with them each and daily because you understand the fee of every and each on your individual existence.

Working out Rate

Working out what something is or how it if truth be told works is no longer a prerequisite to discovering fee in it. Bitcoin is not very any totally different. You must perhaps well internet fee in it with out feeling akin to you get a deep figuring out of how it if truth be told works or what it’s miles. Plus, the sooner you change into enthusiastic with Bitcoin and acknowledge that it must also get fee for you, the extra you stand to kill as others reach to just like the fee Bitcoin can lift to their lives.

The moment Bitcoin “clicks” would possibly be the moment you inquire at its properties in context of what you most definitely can like. Potentially the most uncomplicated, one sentence description of Bitcoin is mostly sufficient to retract out this:

Bitcoin is an asset with a fastened, predictable supply that will be transported anyplace on this planet in seconds and securely kept on your possess mind.

I’m no longer going to point out how any of that works, because frankly, you don’t get to hang. You finest need reasonable assurances that all of that is loyal, exact akin to you get reasonable assurances that your paycheck will reach by or that the electronic mail you exact sent to your boss will internet it to their inbox. I’ll get into those assurances later.

So, what carry out you most definitely can like that Bitcoin will be ready to attend you with? Maybe you most definitely can like…

- To prefer sources that produce profits, so you most definitely can scoot the 9-to-5 rat flee.

- To retract savings against inflation till you retire.

- To scoot tyranny by transferring your savings out of a broken monetary system or oppressive authorities’s reach.

Procuring Assets

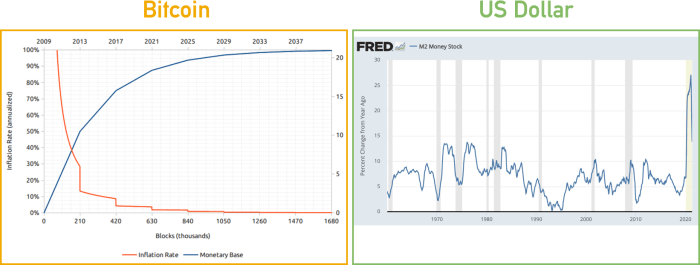

You get to prefer a crop of a enterprise that pays you each and each month, so you most definitely can at last stay off of that profits in field of working 9-to-5 (or longer). Why are corporations this present day insanely overrated when in contrast to their revenues? Why would patrons continue to prefer the stock of corporations at such insane valuations?

Now we get to inquire at how central banks habits their monetary coverage, which no longer too long ago formula mashing one button: PRINT. The U.S. Federal Reserve increased the greenback’s supply by 24% last year alone. That makes cash a tainted store of fee and pushes patrons into other sources.

In field of sitting on cash, patrons are shopping for stocks and investing in any enterprise with even a flimsy pitch deck, making it exhausting for you and I, earning salaries or working queer jobs, to prefer an asset that produces profits for a cheap designate.

Investors are no longer even shopping for corporations for the profits they produce anymore; they are exact shopping for them hoping they’ll sell them later for a increased designate. Investors are finally scrambling to prefer scarce sources. Investable corporations are a miniature bit extra scarce and difficult to kill than fiat currencies operated by governments — particularly when those governments present you their willingness to print limitless currency.

Some patrons are initiating to like that a much extra scarce asset now exists and so that they are piling into it in waves. It is a long way queer amongst sources in that it has a fastened, predictable supply. That asset is known as bitcoin.

Conserving Financial savings

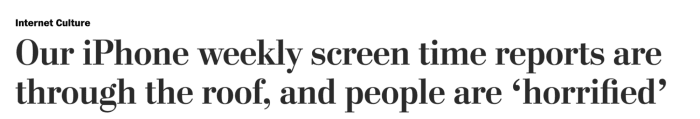

You get to grow your savings so you most definitely can retire comfortably, but inflation is always creeping up and eating away your nest egg and the fee of your wage or salary. Why carry out we search for steadily rising costs over the last century? It has nothing to retract out with financial divulge and the entirety to retract out with the incontrovertible fact that our currencies carry out no longer get a fastened, predictable supply. The currencies we affirm this present day are constantly manufactured — you most definitely would possibly perchance well call it counterfeited — by central banks. This debases the fee of all devices of that currency in circulation.

At the same time as you happen to would favor to guard your savings against the rising designate of goods and companies and products on your field country’s currency, you most definitely can like cash that will perhaps well no longer be debased. You need cash that doesn’t lift a detrimental exact curiosity price, love fair about all fiat currencies this present day. You need bitcoin.

Escaping Tyranny

You must perhaps well perchance perchance also get it even worse: you aren’t exact attempting to scoot the rat flee or set aside up, but you are threatened by a hostile or nasty monetary system or authorities that will perhaps well snap up your savings overnight. Earnings a checking tale is modest to freeze or take. a part of property will be taxed or taken by power. A internet of bijou will be seized on the border. What you most definitely can like is an asset that’s highly portable and straightforward to steady: bitcoin.

What while you exact want to rent the entirety and work till you descend dreary?

If that is you, perhaps you don’t need bitcoin. The World Economic Discussion board predicts that by 2030 “You’ll possess nothing” — and rent the entirety. You don’t get to stress about asset costs outpacing profits divulge because you’re gay to be sitting on your cubicle at 70, ensuring you pays rent on your shoebox this month and continue to rent your attire.

At the same time as you happen to would bewitch rather extra independence and self-resolution on your existence, perhaps bitcoin is something you’d take good thing about.

How will you trust this straightforward definition of bitcoin?

I mentioned needing reasonable assurances that the properties of bitcoin which internet it this form of highly effective tool for saving cash and gaining independence retract exact.

How does bitcoin provide reasonable assurances that it in truth is a fastened supply, highly portable, steady asset and unit of tale?

Cheap Assurances

In field of reading each and each line of Bitcoin’s code and reasoning about how it all works in practice, we get to bewitch a step encourage and inquire at historic past. We rely on this form of reasonable assurance exact to get by our day-to-day lives.

You carry out no longer read the entire operation handbook of your automobile ahead of you trust it alongside with your existence at 70 miles per hour on the freeway. You is at risk of be reasonably confident you’ll be splendid, given the emblem of the auto and the incontrovertible fact that most of your of us didn’t get to read the handbook to make affirm of their autos safely.

You carry out no longer chemical take a look at each and each meal because you’re pretty certain the greens at your native grocery store aren’t going to poison you (even supposing infrequently, they carry out).

We affirm historic past and the skills of others to gauge the entirety in our lives. Let’s word that to Bitcoin.

To get a technique for whether Bitcoin fulfills its guarantees of being fastened in supply, in an instant portable and steady to store, we get to seek recordsdata from ourselves:

- Has Bitcoin operated in a predictable formula over its historic past?

- Enact we affirm it to transfer fee globally, and mercurial?

- Is it steady to store and affirm?

Predictable Present And Operation

Bitcoin is grand extra predictable in its supply (“inflation price”) than fiat currencies, that are field to the whims of a number of highly effective other folks.

Bitcoin also sports lower downtime than other fee networks — even day to day ones love Visa or settlement programs love FedWire.

Provided that the asset has never considered a supply shock and has flawlessly caught to its pre-ordained inflation price over 12-plus years whereas experiencing like a flash divulge and securing a form of of billions of bucks in fee, we would possibly perchance well perchance be pretty certain this would possibly perchance well perchance be predictable going forward.

Undoubtedly extra predictable than the greenback and no longer devalued systematically!

Rapidly, World Rate Transfer

Strive sending cash to someone in one other country, and let me know while you’re ready to retract out so in no longer up to a number of days with out paying a hefty price. That’s our present banking system: clunky and dear.

Bitcoin would not care what a part of land you came about to be born on or the size of the transaction you’re attempting to internet. As long as you get an recordsdata superhighway connection and the bitcoin address of your recipient, you most definitely can broadcast a transaction and get it settled in minutes.

Of us carry out this each and daily with Bitcoin, transferring billions of bucks, experiencing zero factors. For the last 12 months, someplace around 150,000 bitcoin get moved on the Bitcoin blockchain each and daily. You must perhaps well be reasonably certain your transactions will wade by as correctly.

Precise Storage

No other asset suits the safety and portability of bitcoin. Set some on a hardware pockets or on an app on your phone and search for for yourself. At the same time as you happen to set aside your seed phrase and any passphrase you position up, you most definitely can break your pockets to bits and nonetheless get your bitcoin encourage with exact the seed words you wrote down. Memorize them and you may perchance well perchance perchance bewitch them anyplace. Strive walking out of a hostile country with gold bars on your mind.

An increasing form of different folks trust the Bitcoin network with their savings each and daily since its inception. You don’t get to inquire a long way to search for the fee locked in bitcoin and the choice of addresses and wallets rising.

The protocol itself has never been hacked — no person has lost a single satoshi (one-hundred-millionth of a bitcoin) to a protocol error. That’s beyond a cheap assurance of safety.

But… It’s Volatile!

Importantly, it’s miles a mistake to inquire on the bitcoin designate as evidence of the properties of bitcoin because a market designate consists of no longer one asset but two: a sinful and a quote asset. As soon as we inquire on the value of bitcoin, we’re having a inquire at its designate in U.S. bucks, or in Euros or in another fiat currency which would not get a fastened, predictable supply.

The supply of fiat currencies — and perceptions about how that supply would possibly perchance well perchance replace ensuing from central bank insurance policies — has a wide internet on asset costs. Honest correct inquire on the S&P 500 dips around Fed coverage adjustments and announcements. Bitcoin, when priced in bucks or one other fiat currency, is field to this volatility. The volatility is additional accentuated by the vagaries of quiz for a extraordinarily fresh and misunderstood asset, plus the doggedly predictable supply of bitcoin. At the same time as you happen to’re gripping to wait three or four years, your prefer of bitcoin most often goes up in fiat terms regardless of volatility in the intervening time.

No topic designate swings, the Bitcoin network continues to operate. Its standard properties live exact.

What Is Bitcoin To You?

This is the ask you get to seek recordsdata from yourself to “understand” Bitcoin: no longer what it’s miles but what it does for you, on your loved ones contributors, for our societies.

To me, it’s an even bigger make of cash and the finest formula to set aside. Money is a technological system exact love the fetch or your automobile, but with a much longer historic past and extra significance to society’s aloof functioning and construction. Getting cash “factual” can mean peace or conflict, existence or death for societies and other folks.

In field of attempting to like Bitcoin, you most definitely would possibly perchance well get regarded as attempting to birth by attempting to like what Bitcoin is changing: our present international monetary system. Here’s one field to birth.