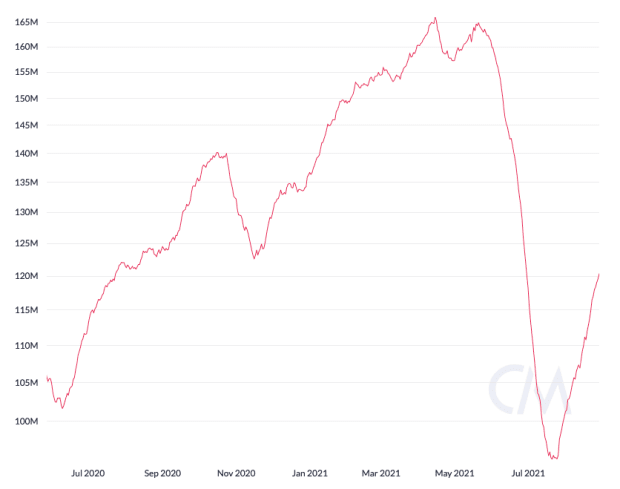

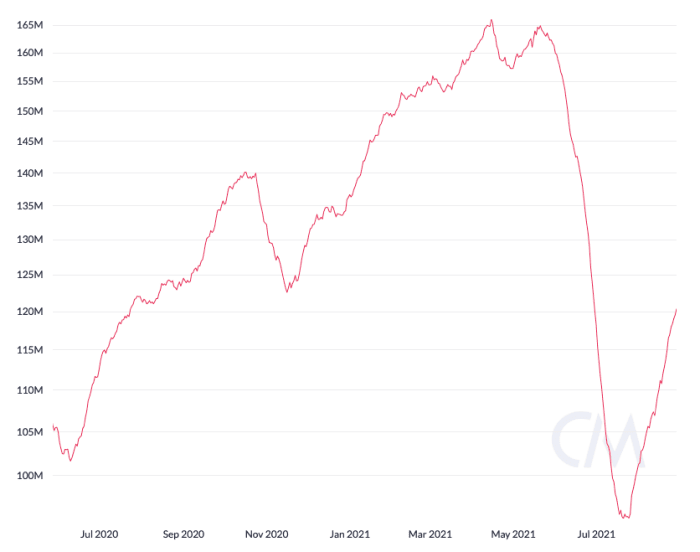

The Bitcoin community’s one-month implied hashrate seen practically four months of staunch increases since the origin of 2021, topping at 166 exahashes per 2nd (EH/s) in April. For the period of that month and the next, it lateralized but started dropping sharply as June started. By July 1, the Bitcoin community hashrate had fallen by practically 30%, bottoming later that month at spherical 95 EH/s. Nonetheless since then, hashrate has been convalescing quick, rising by over 30% in about 30 days and setting a V-shape restoration in motion.

The thriving computing energy employed on the Bitcoin community started hovering down as China started tightening bitcoin mining rules in Also can. In below two months, provincial governments had already issued a spread of shutdown orders and inspection notices to native miners, who seen no other option than to flee the country for merely. Nonetheless since the huge ASIC exodus ensued, some farms started being redeployed in a foreign country, bringing all these banned miners again online and triggering a stable hashrate restoration.

August has been a wanted month for the Bitcoin community hashrate, with the 30-day transferring average of the mean hashrate for the time being at 120 EH/s, in accordance with CoinMetrics data. The “one-month implied hashrate is a better suited metric to observe mid-to-lengthy-time period adjustments in Bitcoin’s hashrate due to it filters out all of the noise,” explained Lucas Nuzzi in his article for BitcoinMagazine. As immense on every day foundation swings in hashrate are phased out, the 30-day implied hashrate provides a clear peep for which direction hashrate is heading as a total. For the time being, it desires to amplify easiest by spherical 38% to reach its all-time high. The 7-day transferring average, one more current hashrate metric, is for the time being at 130 EH/s — the very ultimate it has been since June.

In a upright “V-shape” restoration, the Bitcoin community hashrate has been successfully passing a extreme stress check, showing it will recover from a ban by truly apt one of many enviornment’s ultimate economies. Dominated purely by free-market rules, Bitcoin is certainly antifragile and now not doable to be banned. Which capability fact, the upright winners shall be these countries that elevate to adopt and welcome Bitcoin and its ecosystem as adverse to strive in opposition to it — and the sooner, the easier.