Mimesis Capital: Internal The Occasion Horizon, File #17

Why Hash Ribbons Predict Local Bitcoin Bottoms So Accurately

Belief: When the bitcoin heed hits a high-tail stage, promoting rigidity begins to exponentially travel.

Bitcoin mining is a ruthless industry. Over the future handiest the best mining companies will live to relate the tale.

The tendency for the mining industry to attract tremendous quantities of rivals mixed with simplicity and sweetness of the Bitcoin protocol could perhaps well perchance give us a technique to predict native “heed ground” for bitcoin.

Halvings

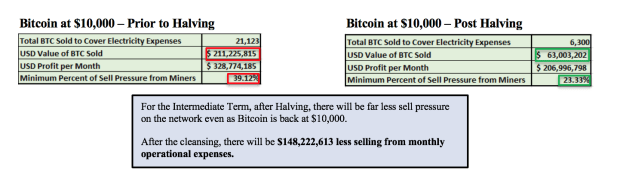

Blockware Solutions, a bitcoin mining firm, released an in-depth record closing three hundred and sixty five days on how halvings without lengthen absorb an influence on miners and how mighty promote rigidity is eliminated from the market put up-halving.

Make a selection a absorb a study your entire record to catch a right suggestion of how they reached their issue conclusions, but they estimated that USD-denominated compelled miner promoting would tumble 70% after the halving with no alternate in heed.

This became as soon as possible a serious catalyst for the unusual bull trail.

How Does This Work?

Sell rigidity drops attributable to miner capitulation.

Straight away after a halving miner capitulation occurs because the block subsidy is lower in half of, but the working expenses of mining companies enact no longer alternate.

Income being sliced nearly in half of, whereas expenses dwell unchanged, is clearly disruptive for any industry.

This challenge purges the most inefficient miners from the network. As a consequence, challenge falls and the best miners in actuality change into more successful. This free market direction of gets rid of the miners who are compelled to promote the most bitcoin to quilt their expenses and rewards the best miners by giving them more bitcoin.

The miner capitulation direction of occurs except promote rigidity has lowered greatly. As heed falls, promote rigidity exponentially disappears attributable to the most inefficient (excessive compelled sellers) miners being eliminated from the network.

When Can Miner Capitulation Happen?

The most rational own of miner capitulation is put up-halvings. A 70% cut price in promote rigidity, as estimated by Blockware Solutions, clearly had a extensive enact in the marketplace heed of bitcoin.

Nonetheless, this inefficient miner purge occurs naturally over time and particularly round heed drops.

Contemporary efficient miners are repeatedly being introduced online (better ASICs, lower electricity rates, fully financed publicly-traded mining companies, etc.). The most inefficient miners catch purged when challenge increases, electricity rates magnify or heed drops.

Simplified Miner Capitulation Bottom Examples

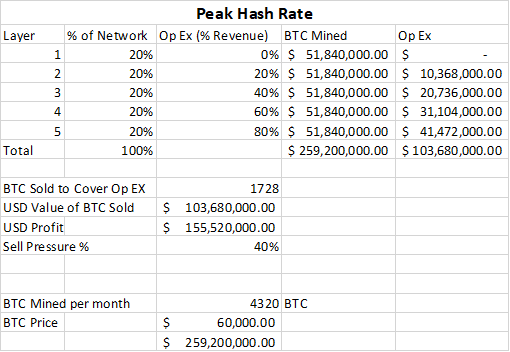

The first model is assuming peak hash price and a bitcoin heed of $60,000.

The first layer is the best and is roughly 20% of the entire network. This possible would consist of publicly-traded companies enjoy $RIOT, $MARA and $HUTMF which absorb catch entry to to unlimited quantities of capital readily in the market in public markets and that enact no longer want to promote any bitcoin.

The fifth layer is the most inefficient and is additionally roughly 20% of the entire network. At the unusual bitcoin heed, their working expenses are roughly 80% of their revenue (mined bitcoin). This draw their margins are very quiet to drops in the worth of bitcoin, electricity heed increases, rent increases and network challenge increases.

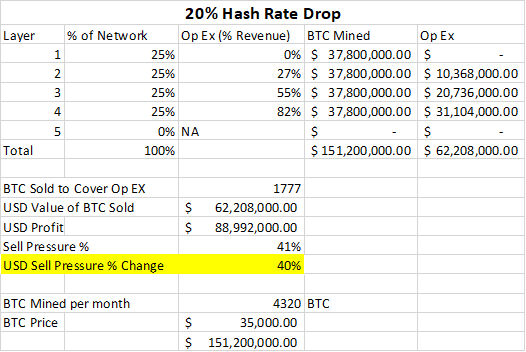

Now let’s peek at the 2d model. In this model, the worth has dropped from $60,000 to $35,000 and the hash price has additionally fallen 20%.

The gripping thought here is that USD-denominated promote rigidity lowered by 40%.

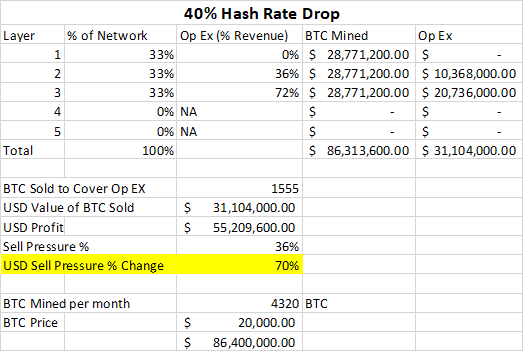

Final, let’s peek at the third model. In this model the worth has dropped from $60,000 to $20,000 and the hash price has additionally fallen 40%.

The gripping thought here is that USD denominated promote rigidity lowered by 70%.

Hash Ribbons

Hash ribbons are an indicator to support measure miner capitulation.

Whereas the hash ribbon indicator is never any longer ideal, it’ll illustrate aspects in bitcoin’s history the place promoting rigidity begins to exponentially travel.

The indicator releases a expend signal when miner capitulation has ended and worth has cooled off. Charles Edwards from Capriole Investments explains hash ribbons in element.

When promote rigidity begins to exponentially travel attributable to the dynamics of hash price falling, we are able to even be more assured bitcoin has bottomed.

One other gripping element to level out is that the indicator by no draw goes off shut to tops (2011, 2013, 2017). Because the worth begins to tumble after every native top, hash price continues to rise. Since hash price is serene rising as the worth falls, promote rigidity is possible rising all by the network except miner capitulation occurs and indicators the bottom all the blueprint by a absorb market.

This is how deep absorb markets happen. Ticket gets blueprint overheated for what the network, users and miners can sustainably take care of. When heed momentum shifts, miners are serene being deployed because it is a ways serene highly successful to mine bitcoin. Then you definately catch a length the place harmful heed scoot scares away unique customers, but more sellers (capitulating miners) serene seem attributable to more miners getting deployed and rising network challenge.

Since bitcoin is the ideal monetary accurate ever created and we’re watching the arena delivery to monetize it, it be possible an improbable thought to stack more sats when it begins to catch exponentially more scarce, as indicated by hash ribbon bottoms. This is set to happen yet again for the twelfth time in history.

TLDR: Use hash ribbons to time bitcoin buys when heed has dropped and promote rigidity is possible exponentially losing too.