Within the duration in-between, nonetheless, I will relate: Working out Bitcoin begins with belief money. And that begins with realizing that that it’s possible you’ll per chance possible moreover no longer yet sign money from a first solutions basis.

For the reason that starting up of the technology which our civilization collectively refers to as “money,” doubtlessly the most smartly-liked charge change medium of all ages has continuously been naturally emergent and collectively agreed upon by a free market of alternate because of the particular attributes of that medium. Early examples encompass seashells, bones, beads, stones, and treasured metals.

Except the suppose of the nation-impart, money had never been a portion of paper whose stammer is mandated by force and whose sole charge proposition comes from being backed by “the stout faith and credit score” of an organization which, as Murry Rothbard wrote in “Anatomy of the Hiss,” achieves its ends by maintaining a “self-enforced monopoly on the usage of force and violence, [and ultimate power of legislation] in a given territorial online page.” Though because the territorial online page of a authorities turns into more localized, vote casting essentially turns into more transparent and simpler to confirm and resolve.There are more wise and actionable exams and balances, as successfully as more manageable oversight. There is moreover a bag human ingredient (social consensus layer), as people of any native authorities physique have a tendency to know many of their constituents on a neighborly level.

Smooth, predatory authorities feigns to serve its electorate, however, as Rothbard notes, essentially it’s “doubtlessly the most simple organization in society that obtains its income no longer by voluntary contribution or charge for services rendered, however by coercion.” The monopoly on correct coercion is maintained by draw of violence, social conditioning and indoctrination, extortion, gatekeeping, exploitation and financial debasement. At this level, many participants will defend their governments, citing the services a authorities does present: public safety, education, roads, social applications, safety nets, and a variety of others. I contend that such issues are better managed and financed by public and deepest free industries working within a free market of change under a sound money standard. In a scenario equivalent to this, where prosperity itself is greatly more tall, the assortment of ladies and men who require social assistance will be vastly diminished. These that enjoy require this will be helped as they continuously occupy — by draw of the beneficent generosity of oldsters that occupy the draw in which to give assistance. It’s mandatory to expose right here that the lawful requirements of a sound money society are continuously on the upward thrust and after a variety of succeeding generations of such, this will change into an increasing number of determined that we live in a reality of abundance, every spiritually and materially.

As the criteria and quality of existence within a society flourish, so does that society’s industry, lawful caliber and intellectual development. This most steadily leads to emergent choices to major concerns. Fetch education as an illustration: Effect for a number of specialized occupations in clinical and study fields, unique society has collectively crafted a plan that has all however changed centralized elevated tutorial institutions. Of us occupy begun to admire they don’t must stammer $100,000 to extinguish four years on busy work correct to derive a portion of paper asserting they had the privilege. Vastly superior and arguably more related educations on any given arena will be attained in half the time by a sufficiently outlandish mind and an files superhighway connection, which puts at our fingertips the total thing of the collective human files wrong in video, graphical, audio and text codecs, as successfully as offers the draw in which to bid in true-time 24/7 with billions of others for serve. It’s foremost to expose that neither the infrastructure nor upkeep of the files superhighway requires the existence of a federal authorities.

For doubtlessly the most segment, the truly helpful services a impart does present neither accurately mirror the tag of taxes paid nor does it account for the correct charge of our enslavement as we enable a governmental monopoly on money to persist. The hijacking of free-market money and the unhurried transition to monopoly-mandated fiat currencies spans over a variety of centuries and changed into done in the U.S. in 1971. The fiat financial machine is an inherently imperfect machine designed to expand wealth inequality while moreover enriching those easiest up in the machine (search: “Cantillon live”).

Furthermore, fiat money is debt. It finest comes into existence by draw of a loan, which future generations of taxpayers will be required to pay serve, plus curiosity. Fiat money inexorably requires ever-increasing ranges of more fiat money to prevent a complete give draw. It’s the very definition of a Ponzi plot. (behold: The Finest Rip-off in the Ancient past of Mankind.)

Attributable to Bitcoin, we’ve a non-violent opportunity, a “sly roundabout plan that governments can’t stop” to come serve to a free-market-sound-money standard. The hyphenated words are to expose apart between the total belief of a “free market financial system” versus one in which society has the freedom to make your mind up its financial asset.

What you’ll be witnessing over the subsequent 10 years is the realm market naturally converging on doubtlessly the most developed financial technology to ever exist, which is absorbing to an increasing number of change into the arena’s most smartly-liked plan of exchanging charge. I enjoy it’s foremost to emphasize that I am no longer advocating for complete removal of authorities, however barely a straightforward separation of cash and impart, in which case the mandatory purview of authorities could per chance be vastly diminished.

Society wants an enforcer of ethics and requirements for suppliers and companies of the general public. In “The Conception of Sound Money,” Ludwig von Mises asks, “However how to grab under modify the males entrusted with the coping with of the authorities equipment, lest they stammer their situation to injury those whom they had been elected to serve? Straightforward the draw in which to prevent the rulers from the stammer of their situation to change into despots and enslaving the citizenry?” Governments occupy monopoly modify over the introduction and issuance of a financial machine and constitutional authority to dictate all legislation and regulation pertaining to the stammer and prerequisites of that machine, which ends in a debt-slave rat flee that retains the majority of oldsters unaware, overworked, underpaid, extorted, and metabolically unhealthy.

Fetch faraway from the hands of the impart the monopolistic vitality it wields over money — the very plan that humanity uses to form and forge civilization itself — and stumble on the impart change into a servant of “We the Of us” over as soon as more.

It’s a cramped-understood indisputable reality that money is doubtlessly one amongst doubtlessly the most essentially foremost technologies that’s ever emerged from our species. It is a plan developed by mankind for the reason of conserving, channeling, exchanging, focusing and directing human time and energy. That stored time and energy is the very driver that catalyzes the construction of our species’ civilization.

Money’s role in our species’ potential to aspire to such incredible heights because the unique age is as foremost because the suppose of the advanced communication machine every person is conscious of as language, one more emergent phenomenon of our species.

True as language enables us to bid smartly-liked files, financial technology enables us to bid charge. Money will be regarded as as a huge charge evaluation and allocation community that communicates what we collectively charge and the draw in which powerful we charge it. Finally, it signals to the arena where our energy as a civilization is incentivized to continue focusing.

To govern, subjugate and manipulate a society’s charge evaluation and allocation community is to manipulate and reveal the participants within that society in the direction of optimistic behaviors and ends. By distorting natural incentives to place, develop, build and make a contribution, a financial standard that is rooted in debt, debasement and inflation encourages unchecked consumerism, reckless company suppose, laxing lawful requirements and instant-sighted resolution-making that most steadily goes in opposition to doubtlessly the most simple curiosity of future generations for the sake of instant time duration profits.

Now not like the communication we alter by draw of language — where dishonesty is total and repercussions will be ambiguous — unfettered charge communication created by markets exchanging a free-market-financial-asset is incentivized to be fair. This is because any dishonesty would instant and accurately be revealed by changes mirrored in corresponding markets, and it’s never in the very lengthy time duration curiosity of a participant to lose money or injury recognition in this kind of plan that could per chance build them out of industry.

In a centrally-deliberate financial machine, dishonesty is no longer allowed to be mirrored in market fluctuations because all tag-signaling indicators are dampened and controlled. Issues be pleased manipulating curiosity rates, mass introduction of unique financial units, bailing out reckless or malicious entities and regulations imposed by the central planners seize free-market tag signals suppressed and unable to bid concerns within the machine.

Within the occasion you intervene with and manipulate the natural tag-signaling mechanisms of a society’s financial community as central banks enjoy, you introduce friction, inefficiencies and errors into the machine. If done lengthy ample, the markets within that machine change into entirely disconnected from reality. We are witnessing this scenario play out in economies across the globe. Happily a superior financial technology now exists to win the location of authorities-mandated fiat.

Folk occupy been experimenting with and improving the usual of their financial technology all the draw by draw of historical past. From bones and beads to salt and stones. As an increasing number of atmosphere pleasant alternate and commerce developed the evolution and enlargement of human civilization, we in the end learned to mine, soften and refine treasured metals. For a variety of millennia, gold changed into the customary of sound financial technology and it powered complete civilizations. As doubtlessly the most bag steel of your complete system, gold doesn’t rust, corrode or tarnish. It’s extremely malleable and intrinsically alluring. Most likely most importantly, it’s barely scarce.

However, gold has a number of mountainous concerns. These concerns change into elevated and elevated impediments to its potential to be an ample financial technology as civilization continues to reach.

1. Gold is inconvenient to pass mountainous amounts and to divide into dinky or unique units of charge, limiting its ease of stammer and comfort. This leads, naturally, to gold-backed paper notes. A portion of paper that acts as an IOU to your gold in a bag, centralized vault. Different notes can symbolize diverse amounts of gold and every person can alternate the stammer of these notes, shining that they’ll be redeemed for gold at any time.

This sounds be pleased a excellent resolution till you keep in mind that it requires trusting the vault keeper to no longer distribute more notes than there’s gold to redeem. What’s worse, imagine the vault keeper does this and then begins handing out paper expose curiosity-bearing loans to the unassuming public. The vault keeper will get filthy rich, along with his household and guests. In the end, the charade can’t continue, the vault keeper is compelled to swear he has no gold yet every person decides it’s absolute most realistic to correct seize the stammer of the paper notes, leaving the vault keeper free to continue making as many notes as he desires. That’s literally a TLDR for what has took situation in the US over the closing century.

2. Verifying the authenticity of gold is costly and no longer easy. With out developed scientific instruments or melting the gold, it’s far foremost to trust that the availability of the gold is being lawful about its purity. Rulers of societies can, and all the draw by draw of historical past occupy, secretly debased the purity of treasured steel money in expose to invent extra money. Historically that is followed by a give draw of the governing physique engaged in the debasement.

3. Real change of gold requires events to be in stop bodily proximity to every diverse.

Bitcoin is extremely divisible. It’s trivial to grab sovereign modify over your bitcoin. It’s verifiably scarce. It is also moved at stop to the velocity of gentle over communication channels on a huge world decentralized digital community, and there is a complete, mathematically verifiable, publicly transparent audit done in your complete ledger of the Bitcoin protocol every 10 minutes.

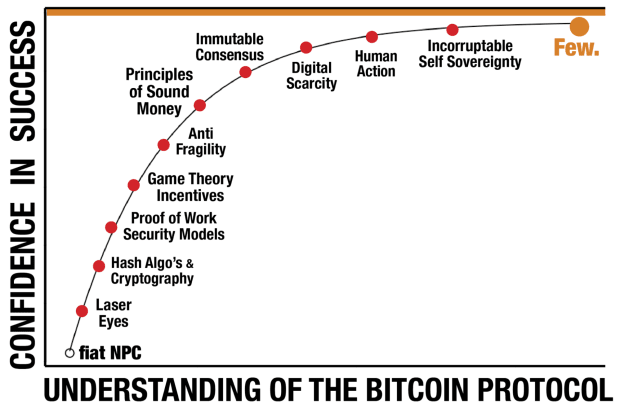

Within the occasion you fully steal the above aspects and tranquil face a persistent hesitation and doubt regarding Bitcoin’s final triumph, it goes to occupy to seemingly be concluded that it’s far foremost to no longer yet enjoy a technical belief of how the Bitcoin protocol is absorbing to meet the role of sound money and luxuriate in this world standard with out project of governmental disapproval, malicious assaults, hacks or dismay of creeping corruption within the Bitcoin machine itself.

If that is the case, inserting in the work to admire the technical properties of the protocol is de facto mandatory. Enact no longer trust me, take a look at it to your self.

PS: Bitcoin doesn’t resolve wealth inequality.

I enjoy inequality to be an emergent phenomenon particular to inherent imperfections in our shared human nature which hasn’t yet collectively done enlightenment. The collective character flaws that enjoy us all oh-so-human are per chance why humanity requires sound money in the foremost situation. An incorruptible charge machine is designed to grab every person lawful, accountable and productive.

Bitcoin does build away with dependency on a machine that is designed particularly to exacerbate and intensify wealth inequality. That legacy machine distorts the very tag sign mechanisms that a financial community would stammer to facilitate a natural and right rebalancing of that inequality.

In that sense, Bitcoin is no longer designed to facilitate redistribution of wealth. It’s designed to be a superior financial different, to give a chance for fogeys to voluntarily opt-out of an existing homely machine and into one thing that is more vivid. Redistribution of wealth is a second-expose live, a resultant that is optimistic by a person’s timeliness in recognizing and opting into the superior emerging machine.