The inspiring usaand downs in label conventional for Bitcoin might perchance frighten freshmen to the crypto industry. On the replacement hand, any person who has been following BTC for a lovely prolonged duration of time has grown acquainted with these fluctuations– you might perchance presumably also presumably be unlikely to be alarmed of a fall from $60,000 to $30,000 thousand whilst you gain beforehand seen a fall from $20,000 to $3,000 thousand and the next prolonged rise to $60,000.

Fluctuations with such high volatility are great much less frequent in venerable financial markets. Every so continually, however, the price of industrial devices drops sharply, and the financial method enters a express of crisis.

About a past crises come to thoughts– the crisis of 2007-2008 or the dot-com bubble. These phenomenons gain similarities, and cryptocurrency investors gain many insights to possess from the financial crises of the past.

Let’s stare what we can learn from prior moments of tumultuous financial history.

The following article is a guest post by Bert Kozma, a author, and Editor-in-Chief at Cryptogeek.records. He has covered cryptocurrency and financial markets for the closing decade as an author and borrows from his journey as a sales and marketing educated. He holds a Bachelor’s Stage in Global Commercial from Saimaa University of Applied Sciences.

Editor’s showcase: The following article is rarely any longer investment advice and is supposed fully for the reason of leisure and education. Cryptocurrency is an incredibly unstable industry and at all times talk with a certified financial manual earlier than taking on any investments.

Lesson 1: Observe the Crowd at Your Distress.

The group tends to be a awful manual by the utilize of financial decisions; it panics with out bother, and its actions are on the total contrary to logic and aged sense.

In 2005, 3 years earlier than the onset of the world financial crisis, several of us managed to predict the rising bubble within the usa housing market.

Those participants were ready to profitably invest and produce cash from the next financial crisis. Described within the book “The Massive Quick” by Michael Lewis and its eponymous film, loads of the “consultants” on the time didn’t mediate that there became as soon as a market bubble, and the outliers suggesting in every other case were loopy.

Scion Capital hedge fund manager Michael Burry campaigned to convince his investors that he’s using their property accurately, playing in opposition to the market. About a of them even sued him. No topic the force, he became as soon as sooner or later dazzling. After the mortgage market crashed, Scion Capital’s income became as soon as 489 percent – bigger than $ 2.69 billion.

A sober and crowd-autonomous judgment is a principal asset in unstable markets.

Lesson 2: There’ll at all times be cycles in a market. Be ready.

Bull markets don’t closing and not using a sign of ending.

This seemingly evident and simple rule is forgotten by a truly neat preference of investors, particularly at some level of prolonged sessions of steep label appreciation.

Outdated to the 2007 US Valid Property Disaster, which induced the world financial crisis, valid property prices rose for a prolonged time. It bought to the level that other folks took out loans and bought valid property that they in every other case couldn’t earlier than in hopes that the price of their property would rise so great that the loan would pay itself off.

Whether or no longer it’s about dot-com shares, the housing market, or Dogecoin — within the waste, any boost shall be adopted by a decline, which might perchance or might perchance no longer be catastrophic.

Aid this likelihood in thoughts and don’t salvage lost within the euphoria of optimism.

Lesson 3 – Don’t Give Up on Promising Sources after a Impress Tumble

When the noxious dot-com bubble burst on March 10, 2000, an complete bunch of Cyber web corporations went bankrupt, were liquidated, or supplied.

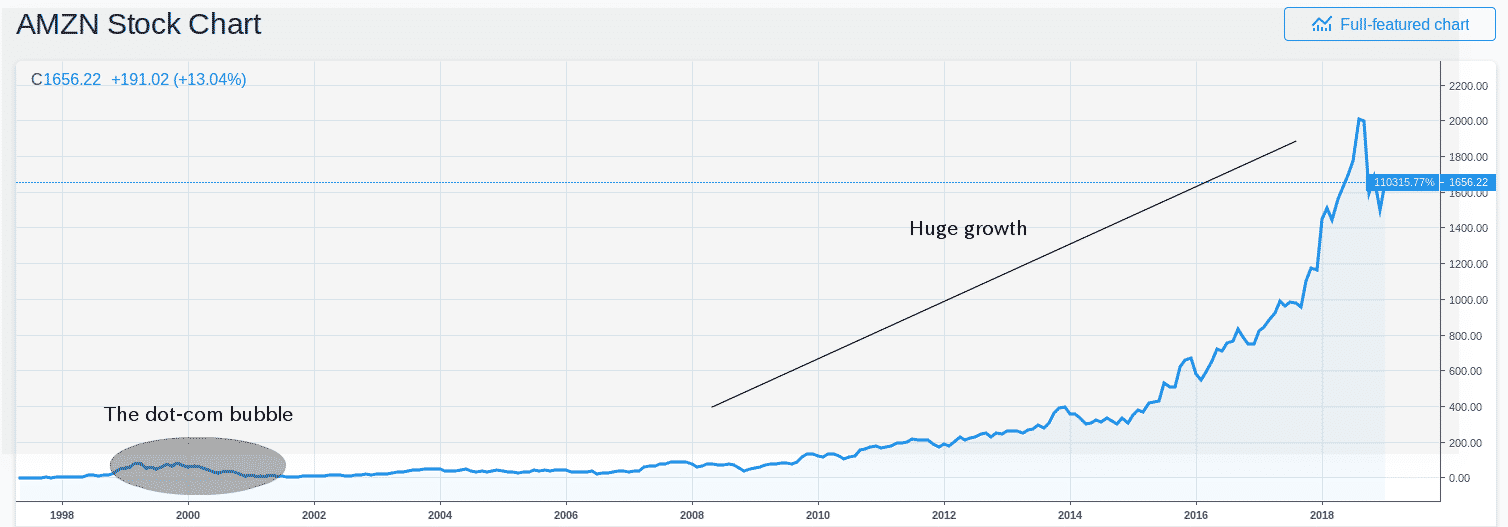

Amazon’s stock label for the reason that dot com break. Source: Miro on Medium

Cyber web shares within the leisurely 90s soared inadequately due to the total hype spherical the emergence of the Cyber web and its doable utilize for commercial. The high stock prices of these corporations were justified by loads of commentators and economists. The corporations themselves, as a change of growing their like commercial units, spent cash on promoting and marketing.

After the events of the crisis, for several years the note “dot-com” began to consult with any immature, in awful health-notion to be commercial method. Belief in tech corporations eroded and investors were unhurried to invest in Cyber web-linked shares.

This day, few of us attach in thoughts bankrupt corporations equivalent to NorthPoint Communications or World Crossing– however loads of the scrappy startups of the dot-com bubble carry severely extra weight lately: Amazon, eBay, and Google are some of basically the most treasured corporations on this planet.

When the label of bitcoin dropped to $3,000 in 2018, down unbiased about 90% from its then-ATH, many adamant investors held on. When BTC’s label rose to $64,000 in 2021, they were rewarded for his or her valid palms and prolonged-term perception within the asset.

Lift into consideration the prolonged-term potentialities of an asset, despite basically the latest hype.

Lesson 4 – Diversify

Investing your complete funds in a single asset might perchance furthermore be very unsafe.

Whenever you happen to’re actively investing in cryptocurrencies, it’s price diversifying into different financial autos love shares, fiat currencies, valid property, gold, and extra– no longer no longer up to to diminish the potential likelihood of losing your complete eggs in one basket.

Lesson 5 – Be Wary of Sources that Occupy No Obvious Price

An asset that is rarely backed by valid label with valid-world utilize is at all times seen as a doubtful investment target; yet, many speculators jump on the chance to roam the wave.

At some level of the dot-com bubble, these property became out to be Cyber web company stock.

At some level of the 2008 crisis, the so-known as synthetic CDOs represented inappropriate debt that became as soon as great riskier than anticipated.

After we glance for at basically the most speculative cryptocurrency property with prices that pump for dazzling a tweet or seemingly at random, we glance for at current property love Dogecoin and Safemoon.

Dogecoin, for instance, became as soon as created as a meme and no longer the universally identified automobile of label love Bitcoin and Ethereum. It has however experienced fundamental boost in 2021, thanks in neat segment to the vocal Doge proponent, Elon Musk.

Granted, some might perchance exclaim that Bitcoin is furthermore an asset that has no valid-world label. On the replacement hand, because the oldest and simplest-known cryptocurrency, bitcoin has already change into a longtime source of label and medium of change. Most altcoins can no longer boast of the comparable, so there is a few credibility to the Bitcoin investor ethos.

While some altcoins attain provide label by the utilize of having greater expertise, many coins on the market might perchance be dazzling silly investments.

Realize investing in memes in traits might perchance furthermore be unsafe.

Lesson 6 – Bitcoin Patrons Might perhaps well aloof Occupy a Backup Opinion

A neat-scale crisis can at as soon as affect the viability of industrial institutions.

In the aforementioned movie “The Massive Quick”, Michael Burry made a huge gamble in opposition to the housing market using a credit ranking default swap mechanism.

In the tournament of a fall in securities prices, banks were obligated to pay him neat sums of cash. On the replacement hand, on the comparable time, he predicted the crisis might perchance be so serious that many of these banks might perchance be compelled to terminate and be unable to pay their debts to him.

He foresaw this scenario and chose to deal simplest with banks that weren’t so carefully connected with the housing market and that might perchance presumably remain afloat within the tournament of a crisis.

Something comparable might perchance happen within the cryptocurrency market. Imagine that you just gain invested in a coin that is listed on a restricted preference of cryptocurrency exchanges. Now imagine that these exchanges are closed due to a huge drop in prices within the cryptocurrency market, and now you gain nowhere to promote your property.

Poof, dazzling love that, your liquidity for that coin dwindles.

You gain to gain a backup method.

Perchance extra seemingly is the restriction of the work of exchanges within the territory of definite countries within the tournament of a crisis. Now, it’s conventional that cryptocurrency exchanges acquired’t be readily accessible to utilize in definite countries (for instance, Hitbtc is rarely any longer readily accessible within the usa). In the tournament of a crisis, these restrictions can change into extra extreme.

What might perchance happen to your digital property on exchanges if the country that regulates these exchanges forbids them from conducting commercial?

Occupy in thoughts which country these exchanges are positioned in and how the cryptocurrency policy of that country might perchance commerce.