This text will stumble on:

a) How we also can discern the worth of MicroStrategy (MSTR), an organization in a rather uncommon situation within the space, moreover to the basics of how designate investors operate.

b) Whether or no longer or no longer, on condition that MSTR is so closely invested in bitcoin, the main opportunity designate of investing in MSTR is proudly owning an similar quantity of bitcoin. Subsequently, why it now makes more sense to designate it in bitcoin than in dollars. The reason is adopted by some rough makes an are trying to achieve excellent that!

c) Why the strategy of pricing in bitcoin also can change into increasingly linked within the future.

As is smartly identified, MSTR is an organization which now has necessary skin within the Bitcoin game. In August 2020 it used to be introduced that they were adopting Bitcoin as their main treasury reserve asset. They transformed their entire company treasury into bitcoin and possess continued to convert free cashflows into bitcoin since. There possess been also two convertible debt disorders to monitor, the proceeds of which were also fully transformed to bitcoin. Most lately in June 2021, there used to be extra non convertible debt issued, using the proceeds to resolve yet more bitcoin.

Some numbers for context. As of the time of this writing (August 5, 2021):

MicroStrategy HODLs 105,085 BTC worth a total of approx $4.1B (bought at a median designate of $26,080 per coin). The MSTR fragment designate is at the 2d $666, with a total company designate of approx $6.5B. Their situation is unparalleled amongst other firms in phrases of both:

- their bitcoin holdings as a share of their company designate or market cap

- the final measurement of the company.

In other phrases, other good firms (reminiscent of Tesla) preserve noteworthy smaller percentages of bitcoin relative to company measurement, whereas other high share holders are simply some distance smaller in measurement.

These numbers also can also be viewed at the next chart of bitcoin treasuries in publicly traded and non-public firms.

Starting up around August of 2020, we began to see bitcoin being added to the balance sheets of public firms. One such company is MSTR. Right here’s why you frequently hear MSTR described as a proxy Bitcoin ETF. Nonetheless, it’s a more dynamic situation than that resulting from their seemingly ongoing BTC buys within the future. Subsequently why I’m taking a glance at how a historic designate investor also can designate them.

Mature Dollar-Based Valuation

First, the vogue the market will mainly be valuing MSTR is in buck phrases. Despite every little thing, the fragment designate is priced in dollars and profits are made in dollars.

For these peculiar, I’m going to masks how this form of valuation shall be fashioned shrimp by shrimp.

MSTR makes rather stable profits and possess no longer grown deal in most original years.. Essentially the most historic manner of valuing an organization love right here’s to sum up the account for designate of all of estimated future profits, after which to be able to add in every other linked property with the exception of this, love bitcoin.

What attain we indicate by account for designate? $100 bought in 10 years time is no longer as precious as $100 excellent now , so we deserve to bargain future profits by an hobby rate to earn the worth now.

Shall we embrace, we also can designate $100 in 10 years as: $100 / 1.0122 ^ 10 = $88.60

The hobby rate historic right here is the 10-year return on U.S. treasuries, viewed because the “threat-free” rate of return on U.S. dollars. Treasuries are conception to be reach innocuous because if it ever got right here to it, the Fed also can manufacture more dollars to pay the duty.

In other phrases, if we need $100 in 10 years, we are able to invest $88.60 now to reach attend it. Conversely we are able to claim that the chance of being paid $100 in 10 years is “worth” $88.60 to us now. We are able to then repeat this calculation yearly to “bargain” all anticipated future profits and sum them all up. This implies of valuation is especially analogous to valuing firms paying dividends, since these profits internet paid out to shareholders as cash jog alongside with the circulate streams. It’s fine identical to the strategy of valuing a bond too.

As it happens, historically MicroStrategy did no longer pay out profits as dividends, but constructed up a pleasant cash pile on their balance sheet, which is what led Michael Saylor to be aware of bitcoin within the main win 22 situation. Whether or no longer dividends are in actual fact paid out, place on the balance sheet, or reinvested within the enterprise, it’s the underlying skill to generate revenue which underpins the basis of designate investing.

Genuinely, analysts exhaust a noteworthy elevated hobby rate in their calculation for valuing shares than the innocuous rate. The overall hobby rate historic also can replicate the innocuous treasury rate for the period in query plus a further “equity threat top class”. The latter displays the indisputable reality that future profits are noteworthy much less certain to be realised than nominal returns in U.S. treasuries, that are viewed as innocuous. This top class is highly subjective but additionally can simply sit at about 5–6% each and every year. for US Equities on common. .

All told, the contemporary MSTR market cap of $6.5B displays contemporary bitcoin holdings worth $4.1B, plus the account for designate positioned on the discounted sum of all future profits, alongside with other components. These also can encompass any certain or unfavorable top class positioned on MSTR by the market, and also an adjustment for the convertible debt issued, as as to whether or no longer these are inclined to be transformed to equity at future dates.

In June 2021 there used to be a extra bond enviornment introduced, and one more illustration of MSTR being in a dynamic situation and buying more bitcoin when the opportunity offers. This most original bond enviornment is no longer convertible. It has been historic to resolve more bitcoin now, but will lower their capability to convert future profits to bitcoin as they’ll deserve to pay these bond coupon payments as a priority. As an example this, the enviornment is $500m at an annual hobby rate of 6.125%, so the company will deserve to pay around $30.6m yearly to provider the hobby payments.

Bitcoin Based Valuation

I possess there might possibly be now a slight enviornment with the historic manner of valuing MSTR in buck phrases. It relates to the “opportunity designate” of buying MicroStrategy shares.

On every occasion we invest in an asset, we forgo using that cash in assorted places — right here’s known as the opportunity designate. But where else also can we preserve that cash? There’s no longer any longer any such thing as a manner any individual is investing in MSTR now with out being a believer within the mountainous bitcoin held by them as a protracted-term investment. Arguably, by investing in MicroStrategy one is especially foregoing a “innocuous” investment in bitcoin itself that they’ll also simply in every other case preserve. The logical result is to buy a glance at and designate MSTR in BTC as a substitute! And in doing so, be aware of whether or no longer the MSTR investment is “worth” the bitcoin invested, versus the hazards.

It’s worth noting that there are stakeholders out there for whom the entirely exposure to bitcoin accredited them is buying shares in an organization reminiscent of MSTR. While this would perchance well also be necessary for some, let’s buy in every other case for now.

So how attain we designate MSTR in bitcoin? The set to originate is easy: MicroStrategy holds 105,085 bitcoin excellent now.

We then must add on a account for designate of the complete bitcoin they’re going to also simply procure within the future. Right here’s clearly the tricky fragment, as profits are in buck phrases, so we deserve to estimate how the bitcoin designate in dollars also can circulate over time. We also deserve to estimate the future profits of the company (similar as earlier than).

This text is focused more on the thought than the observe. I’m undoubtedly no longer going to mannequin both with any precision! Nonetheless, I’ve made up some some distance-out cases to illustrate. In regard to profits transformed to bitcoin, others are some distance better licensed to dig thru the accounts, but for the capabilities of this illustration let’s buy MSTR converts $50M worth of profits to bitcoin each and every quarter and that this continues for 15 years. All highly subjective.

How would we bargain these profits? Preserving BTC doesn’t offer a threat-free return, so we don’t deserve to exhaust a treasury rate as above — we in attain exhaust 0%.

Nonetheless, the equity threat top class fragment referred to above ought to silent silent stand. This again displays the uncertainty of making an equity investment, in this case, versus simply preserving the underlying threat-free bitcoin. Undergo in mind, it’s termed “innocuous” in BTC phrases.

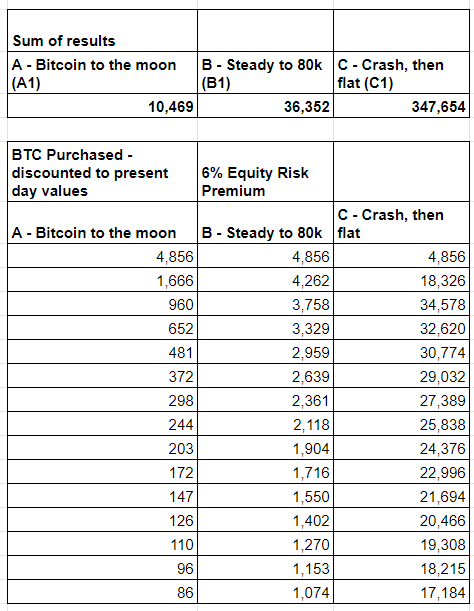

Lastly, we need costs of conversion to BTC. I’d understand any stochastic prognosis as simply no longer skill to internet excellent! To preserve issues easy, let’s deterministically observe three cases for the next 15 years for an illustration:

a) “To the moon” — bitcoin hitting $1M per bitcoin in 15 years time.

b) “Slack and genuine” — achieving enhance of below 5% each and every year to hit $80,000 per bitcoin in 15 years.

c) “Wrong crack of break of day” — a swift retreat accurate down to $5,000 per bitcoin after this year and closing at this level, supported entirely by hardcore HODLers from then on.

These are intentionally differing cases. The screenshot below displays — in notion — how noteworthy BTC shall be purchased in yearly for each and every scenario.

Enact no longer buy these numbers severely!

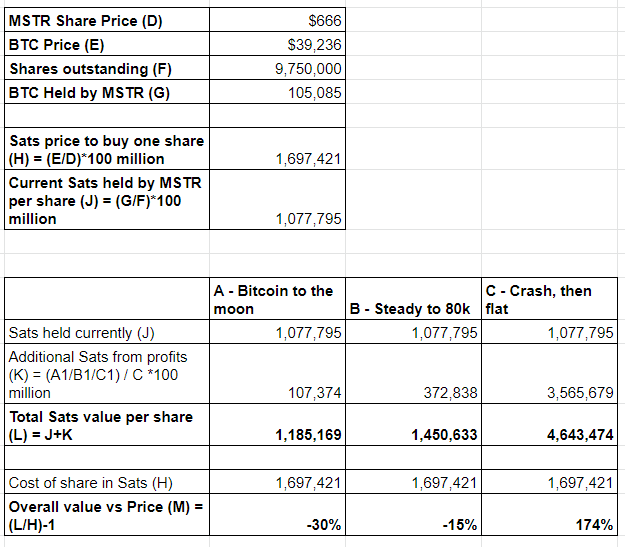

So how would we be aware of an investment of bitcoin into MSTR nowadays?

To preserve the illustration easy, let’s be aware of one fragment of MSTR and strive to designate this single fragment in bitcoin,in phrases of the bitcoin MSTR holds now, plus future profits transformed to bitcoin.

We then must bargain the extra future BTC buys from the table above, and add the sum of these to this too. So:

- We transformed the assumed annual USD profits at the plentiful brush rates in each and every scenario (see table above);

- bargain using the equity threat top class entirely to ruin the account for values of future bitcoin purchases (see table below); and

- add the present bitcoin that MSTR preserve.

Summing these then provides an estimate of future bitcoin MSTR purchases below each and every scenario.

The query:“if we invest one bitcoin into MSTR shares, will we internet a brilliant return on that after we designate these shares in bitcoin?”

As confirmed above, after we compare the final designate of sats that one fragment of MSTR also can generate to the contemporary designate in SATs, we see the next returns –

a) -30%

b) -15%

c) +174%

Based on scenario A, it’ll be a no longer easy promote to invest your bitcoin into MSTR. Project B is shut to par, and scenario C in actual fact appears to be like to be to be like love a correct payoff in BTC phrases.

Essentially the most placing thing about these outcomes becomes glaring as soon as you happen to imagine about it. The worse bitcoin performs over the 15-year period, the easier an investment MSTR appears to be like to be to be like when valued in BTC! Right here’s as MSTR will invent more BTC at a lower bitcoin designate for the buck profits it makes.

Many thanks for early feedback on this article from @YATReviews on Twitter, who has pointed out this is in accordance to viewing MSTR as a “bitcoin dividend safety”. For normal dividend stocks valued in dollars, their dividends (if consistent) can in actual fact account for more valuable at compounding wealth when the fragment designate is low, since these dividends exhaust more shares.

The other account for account for is that if BTC does very smartly within the upcoming years, at the account for measurement of the enterprise MSTR also can simply no longer circulate the dial that noteworthy in phrases of adding to their holdings (see scenario A, where entirely around 10% more bitcoin is added to contemporary holdings from future profilts).).

Some good disclaimers: as already mentioned, no allowance is at the 2d fabricated from the convertible bonds issued which shall be transformed to equity. My thought is that the main offer had a conversion rate of $398 for 1.6M shares; a easy capability is to encompass these on the selection of shares within the valuation, if no longer incorporated already. The 2d offering is at $1,432, so right here’s more advanced to designate. I would prefer any feedback on easy ways to encompass them. Also, there might possibly be possibly the most most original “straight up” bond enviornment from June 2021which is no longer convertible. While we possess assumed slightly lower profits transformed to bitcoin resulting from the $30m annual coupon payments, we ought to silent also allow for the compensation of the $500m main at expiration.

Closing Thoughts

Why also can this commerce of valuation capability to designate in bitcoin account for linked?

Preston Pysh has beforehand commented on this. Take into consideration we were to circulate to an increasingly bitcoin denominated world in which bitcoin continues to esteem and increasingly firms preserve bitcoin on their balance sheets.

Folk with bitcoin would silent internet investments, but entirely if the aptitude of these investments outweigh the opportunity designate of fine preserving bitcoin as a substitute. This also can lead attend to “designate” equities performing smartly again, as entities generating profits can add more bitcoin to their balance sheets. Conversely, firms no longer generating free cashflows can’t, and hence their valuations when priced in bitcoin shall be lower..

It will possibly perchance well be acknowledged that the contemporary pattern to invest in enhance equities outcomes from all people having a fine high time need — and hence no longer valuing future dividends as noteworthy. Bitcoin reduces time need and hence also can commerce this. For the thought to in actual fact resonate, future profits might possibly well well be realized (or as a minimum with out considerations valued) in bitcoin. For now, it is entirely in actual fact bitcoin miners for whom this form of calculation also can also be made, (Adam Support has commented on this too) but even they’ve fiat denominated bills.

I would prefer any tips or feedback on this article — especially tips on the valuation ideas discussed. Please account for all of right here’s painted with an incredibly plentiful brush — the numbers no longer supposed to be correct — and right here’s more of a conception experiment than no longer easy quantitative prognosis

Disclaimer — the writer owns both bitcoin and shares in MSTR. This text ought to silent no longer be taken as an endorsement to resolve both.

Exploring the world of Bitcoin on Twitter @bitcoinactuary.