Voyager Make investments is a crypto hobby yarn and broker, in all chance most critical its commission-free procuring and selling and its skill for users to obtain hobby on their holdings. The app excels in its simplicity and has the typical cryptocurrency trade facets: a wallet accessible by mobile app, a frequent trade interface, and a newsroom. The next Voyager Make investments review will explore the Voyager Make investments product, company, and in-depth knowledge on its mechanics.

Frigid Perk #1 Commission-Free Procuring and selling: So, how does Voyager offer price-free procuring and selling? It routes its clients’ crypto transactions to quite loads of exchanges, helping to search out the finest rates.

Frigid Perk #2 Cryptocurrency Ardour Story: Funds you defend in Voyager mechanically obtain hobby unless you opt-out within the app settings. Its rates are aggressive with most cryptocurrency hobby yarn alternate choices.

Voyager Make investments Fast Summary

Voyager Digital Ltd. traces its origins to 2017, and the Voyager app went dwell in 2019. This day, it is miles considered a true entry level for users of all ride levels, allowing them to arrange their portfolios with out working various accounts with diversified exchanges.

- Voyager helps users design terminate cryptocurrencies from over a dozen exchanges within its app.

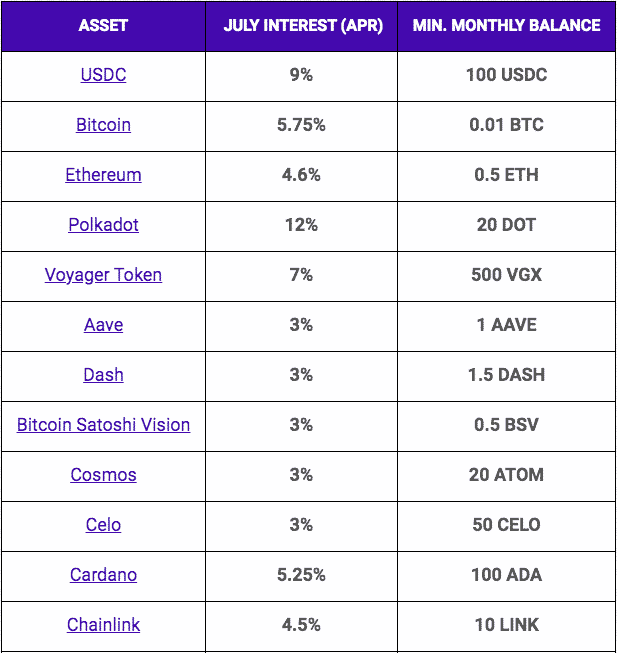

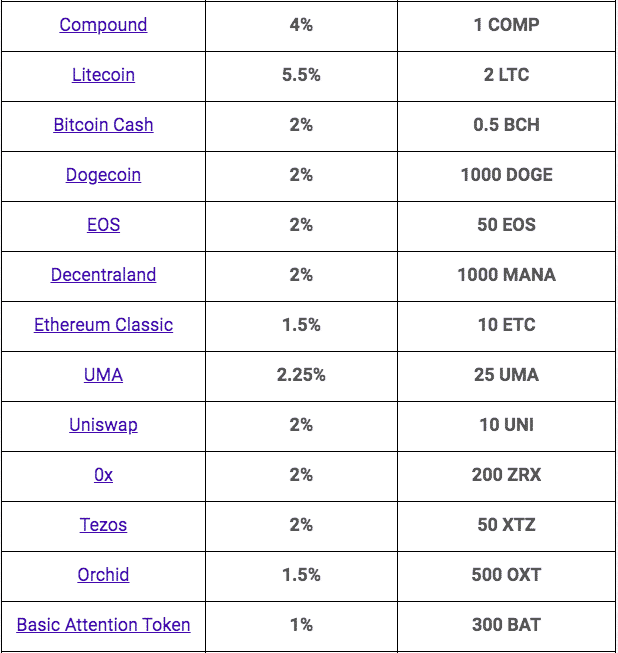

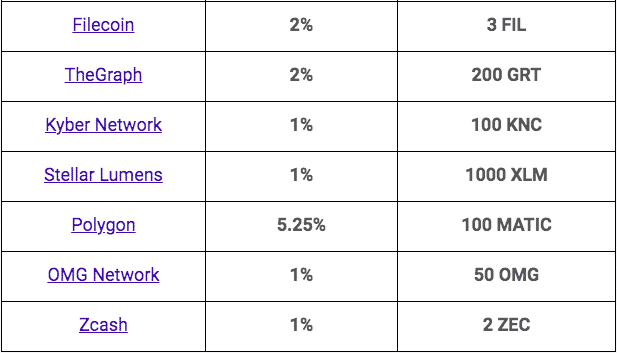

- It enables users to obtain as a lot as 10% APY on 50+ cryptocurrencies, including BTC, ETH, USDC, LTC, DAI, DODGE, and BCH. Users must defend a minimum steadiness to qualify for crypto hobby.

- Voyager is obtainable in all states within the US, apart from Original York. It is no longer yet obtainable internationally.

- Voyager is “100% price-free” and simplest accepts charges when it saves you money while brokering.

- It has a remarkably easy signup course of and enables users to originate procuring and selling as soon as their transfers certain.

Most up-to-date Signal-Up Bonus: Bag $25 when procuring and selling $100 on Voyager Make investments.

Voyager Make investments is uncommon in that it is miles a publically traded company, listed on the Canadian Stock Alternate (CSE) below the emblem VYGR.CN. It is some distance moreover a FinCen registered Money Companies Trade, and it trades in US OTC markets below the emblem VYGVF.

Voyager Make investments is a US-regulated public company primarily based in Jersey City, Original Jersey.

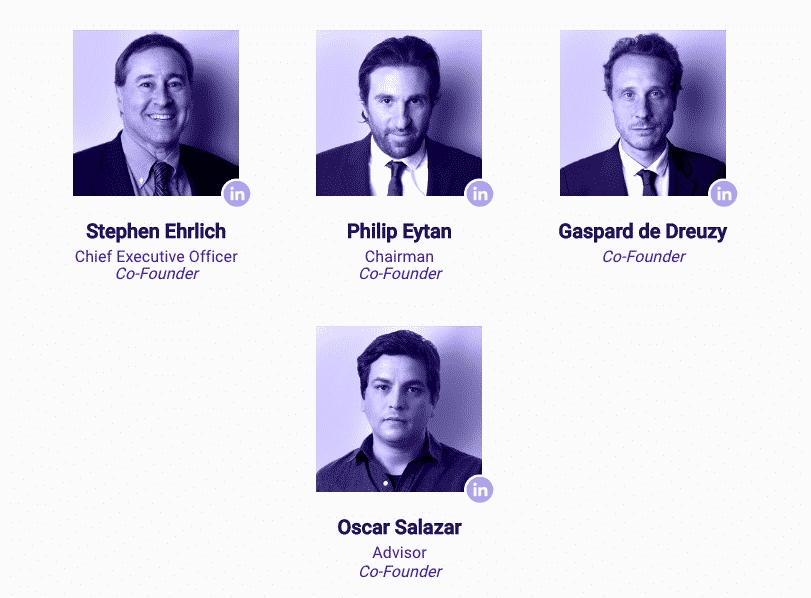

Voyager’s founding crew has decades of ride in brokerage, funding, and market building.

Its Founder and CEO is Stephen Ehlrich, who moreover based broker-dealer Lightspeed Monetary.

The relaxation of the C-suite contains Phillip Eytan, Gaspard de Dreuzy, and Oscar Salazar, the trio who co-based Pager: a digital healthcare solution.

CEO Stephen Ehlrich has worked in executive roles within the finance industry for decades. He spent seven years as the CEO of E*TRADE First price Procuring and selling, a brokerage platform, Morgan Stanley subsidiary, and over six years as the CEO of Lightspeed Monetary, an digital procuring and selling company.

Chairman Phillip Eytan worked with Morgan Stanly as a Telecom M&A Analyst. He moreover served as a director and founding investor with Socure, digital identity and fraud verifying carrier, and Pager.

President Gaspard de Dreuzy is a co-founder and the president of Pager and became the co-founder and CEO of Kapitall, a internet stockbroker with video sport-fancy procuring and selling tools, and free recount accounts for amateur traders.

More popularly identified as the Founding CTO and co-founding father of Uber, Oscar Salazar brings his ride building client-pushed experiences to declare the Voyager crew. He is moreover a co-founder and the CTO of Pager.

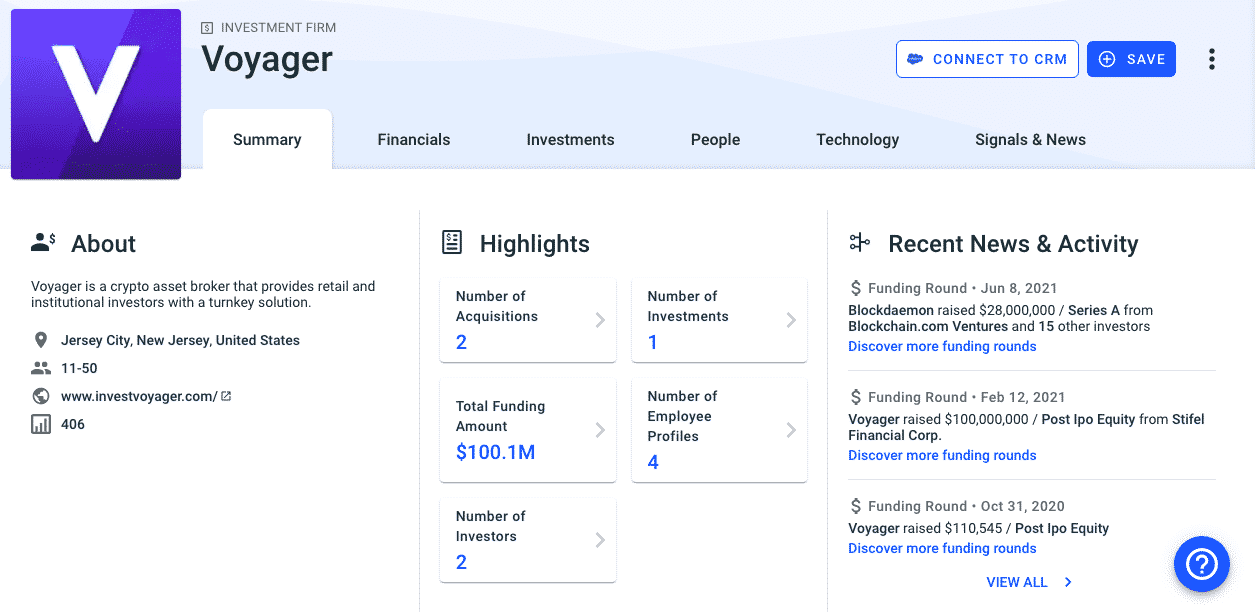

Voyager Make investments Funding: How unparalleled Has it Raised?

Voyager has raised over $100.1M in four funding rounds, comprising $110.5K all the draw in which thru its Series C in October 2020 and 100M in a Series D in February 2021.

Voyager is a publicly-traded company registered below the tag CNSX: VYGR. Their stock opened with $0.95 in its Feb 11, 2019, IPO, and its early traders consist of Streamlined Capital and Stifel Monetary Corp.

Voyager Make investments review company bio on Crunchbase

Voyager Make investments Review and Ardour Charges

One distinct advantage Voyager has over various broker alternate choices is that it costs no price. Whether users are taking a look to design terminate or sell their cryptocurrency, they’ll simplest pay the price quoted for that transaction.

Nevertheless, if Voyager manages to broker a deal better than the quoted tag, they’ll retain a dinky percentage of the saved amount and send the remaining to you.

Voyager uses a technique coined “Natty Reveal Routing” to grab ultimate thing about pricing disparities between its 12+ partnered exchanges, getting you the finest price to your trade.

Bag $25 when signing up and procuring and selling $100 on Voyager Make investments.

The Voyager broker supports over 50 cryptocurrencies.

If you happen to switch funds into your Voyager wallet, you mechanically originate incomes hobby on those funds. Voyager offers as a lot as 10% APY on 20+ tokens, a chunk no longer as a lot as standard hobby offerings fancy Celsius and a chunk greater than BlockFi.

To motivate the exhaust of its in-house token VGX, Voyager offers higher APY rates to users who decide to fetch their hobby in VGX. This characteristic is no longer obtainable within the US.

Now not like many crypto hobby yarn suppliers, Voyager requires users to maintain a minimum month-to-month steadiness of every token held of their wallets to obtain hobby. These rates differ and are modified most continuously.

In most cases, you must presumably also obtain as a lot as 9% APY on stablecoins, as a lot as 6.25% on BTC with a minimum steadiness of 0.01BTC, and as a lot as five.25% APY on ETH and not utilizing a lower than 0.05%.

Rtes as of seven/15/2021. We can carry out our finest to retain this Voyager Make investments Review updated as rates trade.

Methods to Signal Up for Voyager Make investments + Promotions

Voyager simplified its yarn creation and verification considerably when put next to most various cryptocurrency brokers, who require a flowery signup and verification course of sooner than connecting users to the market.

The full course of can grab simplest a jiffy. Once you test in and post some frequent knowledge, you must presumably also link a payment manner, fund your yarn, and originate procuring and selling as soon as your switch goes thru.

The signal-up course of (Source: Voyager Make investments)

Voyager’s app has an in-built, continuously refreshing crypto news feed, and a profit-and-loss calculator. Users maintain entry to up-to-date knowledge on the cryptocurrency market actions and portfolio balances, profits, and losses over time. This characteristic is price it whenever you maintain gotten many resources, as the profit and loss instrument can enable you to determine which tokens are doing effectively and which aren’t.

Overall, Voyager’s mobile app is a effectively-belief-out product. Nevertheless, whenever you defend managing your investments from your computer computer, you’re out of ultimate fortune– Voyager has yet to beginning a desktop version. Its carrier is obtainable simplest on mobile on the time of this writing, which remains to be pretty precious for procuring and selling on the journey. Nevertheless, Voyager is simplest obtainable within the US and operates in all US states but in Original York.

One other thing to repeat is that Voyager doesn’t strengthen procuring and selling between cryptocurrencies today. You’ll want to even simplest purchase crypto with fiat, and likewise you must presumably also simplest convert your crypto to fiat, no longer a definite coin.

So, whenever you’d defend to sell some of your LTC for ETH, you’d prefer to noticeably change the LTC to USD, then send in a design terminate seek data from for ETH. Nevertheless, Voyager does mean you must presumably also switch your crypto to external wallets.

How Does Voyager Make investments Bag Money?

Admire most crypto hobby yarn services and products, Voyager makes cash by taking loans at a instruct price (the hobby it will give you) and then the exhaust of it as capital to make loans at higher rates to company borrowers.

Secondly, Voyager makes cash on trades initiated by its users. If Voyager can rep a bigger trade price for a given transaction that it has proven its client within the distinctive tag quote, it makes a percentage of the savings on that repeat. The relaxation of the funds is despatched to the patron.

Is Your Crypto Stable With Voyager Make investments?

You’re presumably rather in guaranteeing any resources you must presumably defend in Voyager are protected. It’s price noting that as crypto can no longer be FDIC insured, your funds are never solely possibility-free. Nevertheless, listed below are some steps Voyager takes to abet mitigate that possibility.

Platform Security

Voyager uses 2FA and industry-traditional encryption and various security guidelines to make certain users of its platform are protected. Nevertheless, Voyager’s domain establish system server became hacked in December 2020. When it observed the breach, the corporate forcefully took the system offline to stable its clients. In accordance to Voyager, no funds or client knowledge were compromised all the draw in which thru the assault.

How are your resources protected?

No Voyager Make investments Review could presumably be full with out noting that simplest USD is insured by FDIC, no longer your crypto – concept accordingly!

Voyager’s partner bank insures all USD in its custody as a lot as $250,000. Despite this, your crypto is no longer FDIC or SDIC insured. Voyager is an licensed and controlled public company within the US and undergoes traditional audits.

Voyager uses a form of custodians to provide protection to its client’s resources, including Fireblocks and Ledger Vault. These custodians combine security finest practices, insurance protection to retailer crypto in hardware and sizzling wallets.

In April 2021, Voyager exceeded $3.3 billion price of resources below its management.

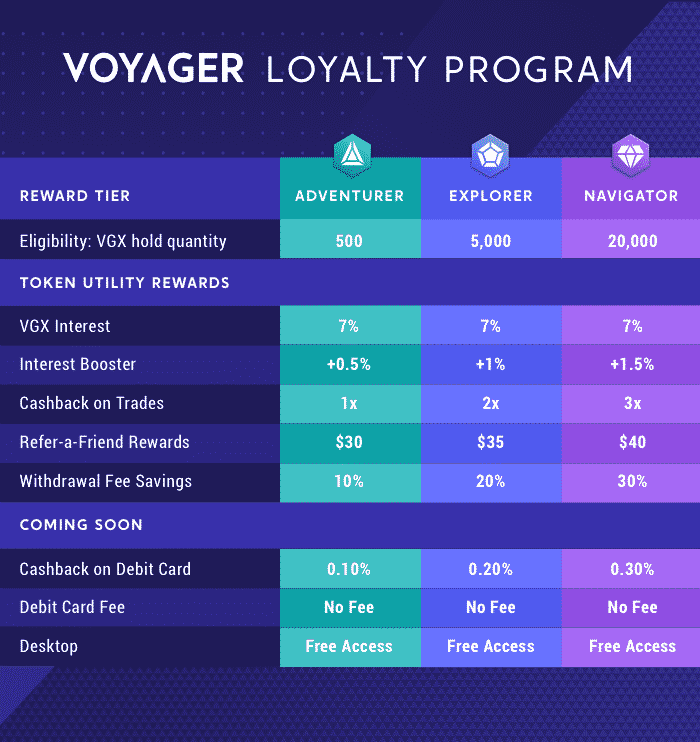

VGX and the Voyager Loyalty Program

VGX is the native, proprietary token of the Voyager platform. Voyager uses it to reward its users. These rewards can consist of incomes higher hobby rates (on VGX and tokens), cashback rewards, and more.

- VGX Ardour: All VGX Tokens you defend on Voyager will mechanically obtain 7% APY for the predominant yr. After that, holders fabricate the skill to vote on future yield rates.

- Cashback Rewards: When Voyager’s clear repeat router can build a tag enchancment, users fetch 2x or 3x the price enchancment normally given to clients, reckoning on their loyalty tier. This reward is paid out in VGX.

- Refer-a-Pal Rewards: Voyager has a signal-up and referral bonus of $25 for the referrer and the unique client when the unique client makes a trade of $100 or more. Relying to your loyalty tier, you must presumably also fetch as a lot as $40 for every particular person you consult with the Voyager app. The referrer will fetch rewards in VGX, while the unique client will fetch their reward in BTC.

The Voyager Make investments loyalty program varies by tier.

Voyager has many more perks for users of its VGX token:

Customer carrier

The effectively-maintained Voyager FAQ part is obtainable thru its app and online page online. The platform would no longer offer dwell phone strengthen. To contact Voyager, create a strengthen tag within the “Support” part of the app.

Final Thoughts: Is Voyager Make investments Legit?

Voyager offers an beautiful combine of services and products. Its cryptocurrency hobby yarn rates are aggressive to Celsius and BlockFi, but the product has just a few more hoops to leap thru, equivalent to the keeping of a certain quantity of the VGX token.

The clear repeat router helps rep mountainous deals for trades, which beats many exchanges at their very maintain sport.

Even supposing its platform and custodian are slightly protected, Voyager offers loans the exhaust of your resources, which is no longer possibility-free.

In the future, Voyager intends to beginning a crypto debit card that could enable users to invent purchases the exhaust of their holdings. It moreover wants to beginning a desktop-accessible version of its platform.

The fruits of facets and tokens is similar to the Crypto.com form platform, but with a much less complex and more subtle client ride.

From our evaluation, Voyager doesn’t appear inherently riskier than any various crypto hobby yarn provider.

Its brokering characteristic is a precious bit for users who defend now to no longer arrange more than one accounts with exchanges. We esteem its in-built profit-and-loss and news facets, and Voyager appears to be on an upward pattern as its platform good points notability and its valuation grows.

Voyager is moreover working on getting a Bitlicense, which is in a space to enable it to operate within Original York and internationally.

Voyager Make investments Choices: Other Crypto Ardour and Alternate Platforms

BlockFi is a great need for you whenever you’re outdoor the US. It’s obtainable internationally and in all US states but Original York. BlockFi offers a crypto trade, hobby yarn, and crypto-backed loans (meaning you must presumably also exhaust your holdings as collateral for a loan). BlockGi’s platform supports over 15 tokens and uses industry-main security practices. Be taught our BlockFi Review.

Robinhood is a true need whenever you must defend to trade crypto alongside various shares. Its portfolio platform is terribly newbie-friendly and enables you to trade BTC, ETH, and five various cryptocurrencies alongside your stock, price-free.

Accomplish Up to 9% APY

Assets to your Voyager Make investments yarn can obtain hobby on 30+ coins whenever you meet the minimum steadiness for every. Charges fluctuate, but Voyager claims users can obtain as a lot as 9% APY on stablecoins fancy USDC, 5.75% on Bitcoin, 4.6% on ETH, 3% on AAVE, and 4.5% on LINK.

Ardour compounds month-to-month and accrues day-to-day. The average month-to-month steadiness for instruct coins in a position to incomes hobby must meet a minimum to obtain the hobby for that month. You’ll obtain hobby on any qualified resources to your yarn, whether you purchased them on the Voyager platform or deposited them from an external wallet.

What Might maybe maybe perchance presumably be Improved

You’ll want to even’t habits coin-to-coin trades: Users can simplest trade coins to fiat. Voyager Make investments claims it’s working on crypto to crypto procuring and selling.

Bag $25 when signing up and procuring and selling $100 on Voyager Make investments.