The bitcoin mark rallied last week, nevertheless the transfer did now now not come all of the sudden. While some of us attributed the spike in mark to the unsuitable news about Amazon planning to settle for bitcoin, the charts had been signaling a transfer turned into coming, impending a decisive level for weeks.

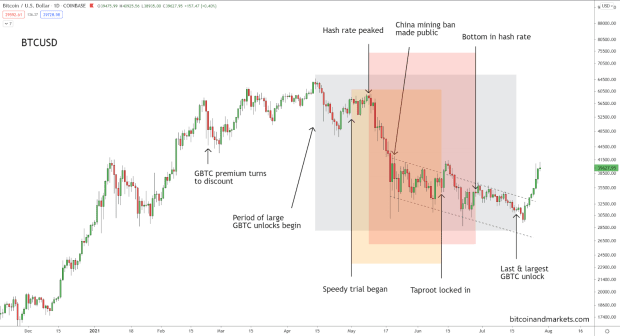

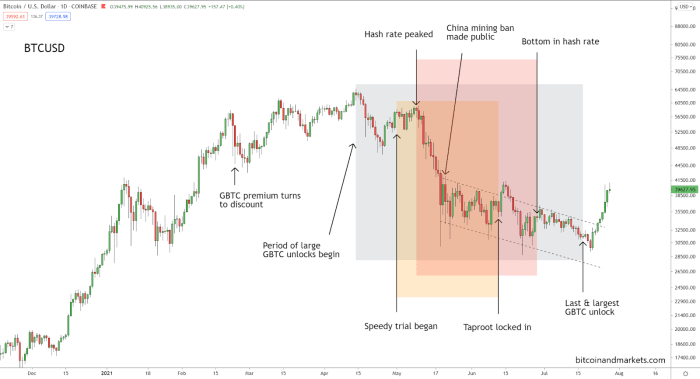

I attribute this mid-cycle correction to three dominant and simultaneous narratives that, before resolved, caused principal uncertainty and mark declines. These events affected sentiment in all segments of the bitcoin market — miners and retail, builders and high-derive-charge americans. Any single the sort of narratives on their very maintain could well well additionally beget caused a dip, nevertheless all three together mixed to trigger a principal traipse on mark.

A New Chinese Ban On Mining

The plunge in mining hash charge due to the the Chinese mining ban (highlighted in red above) grew to change into the mining industry the incorrect plot up. Miners had been dramatically affected, already dealing with a world chip shortage, after which this news turned into added to their plate. Retail holders and traders had been also plagued by this fashion, being bombarded with negative headlines for weeks.

Hash charge (the cumulative computer lag at which miners watch the subsequent block) peaked honest right old to the ban, on May maybe maybe well 9. I believe that right here is when miners in China began hearing rumors of what turned into to return. The legit public assertion from the Chinese Communist Event banning mining came on May maybe maybe well 21. Over the subsequent four weeks, hash charge kept falling, in entire crashing from 190 exahashes per 2d (Eh/s) to 58 Eh/s on the underside.

This turned into without a doubt an immense verbalize for many casual traders. Would the network be ready to take care of this sort of fundamental blow? Those deeply into the weeds in Bitcoin, nevertheless, had been much much less worried about this discipline. Bitcoin is adaptable. Blocks had been found a slight bit slower, nevertheless continued to tick away. Anguish adjusted down about a times as designed, and the network itself suffered no lasting damage. The hash charge plunge in a roundabout plot bounced on June 27 and as of this writing, is up 98% off the lows.

The restoration will be leisurely nevertheless regular as Chinese mining tools is moved or supplied, ending up in additional friendly and dispensed jurisdictions and resulting in a extra fundamental mining industry. Investor uncertainty decreased impulsively as the hash charge bounce continued into July. This day, the network is stable and solid.

Grayscale Belief’s List Unlocks

The 2d principal plot on the abet of uncertainty in this duration turned into the Grayscale Bitcoin Belief (GBTC) launch agenda (highlighted in grey above). This tale affected the sentiment of high-derive-charge traders and skilled purchasing and selling outfits in the dwelling. There turned into a reasonably strongly-held belief among whales that their peers would be leveraging into arbitrage trades presently after liberate classes.

A immediate 101 on the GBTC: GBTC is a closed-quit belief, where traders can salvage exposure to the belief’s underlying asset, bitcoin, without in my design conserving the bitcoin, honest like one more-traded fund (ETF). Licensed traders can have interaction contemporary shares without extend from Grayscale on the cost of derive asset charge (NAV) (the divulge mark identical), increasing the provision of renowned shares, then after a six-month lock-up duration, can promote the shares on the secondary market to traders of all forms. Shopping contemporary shares from Grayscale requires Grayscale to transfer out into the market and have interaction bitcoin, causing a upward push in mark.

There can even be a strategies loop facet. As mark rises in bitcoin, it drives extra secondary market question of and the next premium, then extra question of for contemporary GBTC shares and additional divulge purchasing for by Grayscale. It pays neatly as lengthy as the premium in the secondary market lasts. As an illustration, if the premium is 20%, traders can have interaction a half of GBTC at NAV then, six months later, advertise at a 20% salvage. (It’s a slight bit extra annoying than that, nevertheless that’s the fundamental knowing.)

For GBTC’s immediate lifespan, it had continuously enjoyed a premium, nevertheless in the week of February 23, mark on the secondary market slid into a decrease mark, meaning that the cost in the secondary market went under NAV. It successfully decrease off the strategies loop, and question of by authorized traders to have interaction contemporary shares impulsively stopped, due to the this reality Grayscale purchasing for bitcoin stopped as neatly.

Long legend immediate, market contributors had been monitoring the six-month lockup classes for blocks of shares. Some analysts had been gazing for a mammoth mark plunge coinciding with the last and splendid liberate on July 17. It turned into now now not peculiar to listen to mark predictions in the mid-to-low $20,000s. When the dip did now not materialize, the uncertainty spherical GBTC disappeared.

The GBTC decrease mark has recovered from 15% to merely 6% nowadays, and is snappily impending parity.

Bitcoin’s Taproot Upgrade

The third tale for bitcoin turned into the Taproot upgrade (highlighted in orange above). This tale affected builders and lengthy time duration HODLers. They’re neatly aware about the scorching history of Bitcoin upgrades turning dirty, and had been understandably enthusiastic this upgrade could well well additionally lead to identical division. Afterall, Taproot is the principal soft fork for Bitcoin since the hotly-contested SegWit upgrade in 2017. In standard, there turned into much much less drama spherical this upgrade from the initiating, of us had been serene unsure honest right the plot in which it would play out.

Bitcoin upgrades are leisurely and meticulous things, due to it takes years to work thru the scheme in a decentralized and trustless plot. No person individual nor one community is to blame to record of us to upgrade. The hardest ingredient is merely getting everyone to agree.

The nature of the Bitcoin upgrades as soft forks makes this process a slight bit bit more straightforward. A soft fork is a substitute that is backwards neatly suited with old versions, it does now now not allow contemporary habits that would break outmoded, non-upgraded nodes. (There could be rather an extraordinarily good deal of nuance lacking from that assertion, nevertheless that’s the customary knowing.) Coordination tactics mild by extra centralized altcoins are now now not likely in Bitcoin, so it becomes a lengthy, unsure strategy of launch and public debate.

Despite all this, a loose compromise turned into reached and on May maybe maybe well 1, two activation mechanisms had been initiated, one called Fast Trial, the utterly different an easy date for activation in the slay. If Fast Trial turned into a hit in reaching a principal degree of toughen by August 11, the 2 mechanisms would merge into one. If now now not, the major Bitcoin utility would beget to return to the planning stage, and it would additionally discontinuance in a network break up.

The community didn’t beget to wait lengthy, Fast Trial turned into a good success, locking in activation very snappily on June 12. The final process grew to change into out to be somewhat painless and clear, nonetheless it turned into the of years of prior discussion, planning and compromise. Taproot will fully suggested in November.

This upgrade flew severely below the radar this summer, nevertheless when it turned into locked in, many of the hardcore Bitcoiners, of us deeply enthusiastic in the dwelling, breathed an infinite explain of relief. There would be no community break up adore in 2017.

The Leisure Of 2021

These three principal narratives are mostly wrapped up, nevertheless there are serene some minor lingering disorders. A pair of somewhat insignificant GBTC unlocks are scheduled for the the rest of July and into August. Miners beget now now not carried out their restoration, nevertheless are neatly on their plot. I request, by the quit of the year, hashrate to be abet to fleshy strength and breaking all-time-highs in computational lag. Taproot is locked in nevertheless now now not activated. That doesn’t come except November. A pair of neatly respected cypherpunks in the dwelling are serene enthusiastic, nevertheless they’re nuanced arguments now now not shared by everyone.

The inviting ingredient is what occurs now. If and when the GBTC mark turns abet into a premium, it would present a solid incentive for traders to have interaction contemporary GBTC from Grayscale, forcing Grayscale to have interaction bitcoin on the launch market. Therefore, the fabricate of GBTC on mark for the the rest of the year is always sure.

Miners will be much less beholden to a fickle authoritarian divulge adore China. Per chance that ends in charge financial savings if in a friendlier jurisdiction that has much less corruption, resulting in additional hoarding or increasing of hash charge.

Ultimately, Taproot enables many contemporary high-powered aspects in the Bitcoin protocol. This could well launch up many unseen alternatives for monetary products and providers and businesses of all forms.