Key Takeaways

- Zilliqa’s Metaverse as a Service platform Metapolis is teaming up with Agora.

- Investors appear to enjoy welcomed the partnership, helping ZIL rally.

- Additional procuring for stress would per chance scrutinize the token surge to $0.17 or even $0.26.

Zilliqa’s ZIL token has outperformed the remainder of the market within the past 24 hours after the blockchain startup printed a brand new partnership with the world skills awards app Agora.

Zilliqa Partners with Agora

Zilliqa is soaring, defying a months-lengthy tear across the broader cryptocurrency market.

The sharding pioneer’s ZIL token has more than doubled within the past 24 hours after scoring a key partnership for its upcoming Metaverse as a Service (MaaS) platform, Metapolis.

Slated to initiate in April, the new platform has been touted as an immersive, gamified XR Metaverse skills. Per a Zilliqa blog publish, it will enable “conceptually-rich and customised-designed domes as phase of cities” to host producers, artists, ideas, games, e-retail outlets, genuine property or different digital experiences.

Metapolis has composed $2 million in pre-initiate earnings and lately partnered with the world skills awards app Agora.

In a Friday press initiate, Sandra Helou, Head of Metaverse and NFTs at Zilliqa, acknowledged that the partnership would “bring no longer finest creativity to lifestyles for the length of the Metaverse but furthermore originate without boundary lines rep admission to for creatives worldwide to join within the digital world.” She added that the partnership between each and each firms would explain them at the “forefront of Web3 innovation.”

For the explanation that announcement, customers enjoy proven optimism relating to the utility that Metapolis will bring to Zilliqa. ZIL’s market price skyrocketed by 116% quickly after the partnership became once introduced. It’s a minute bit cooled off since, shopping and selling at honest below $0.12. That places the venture’s market cap at about $1.6 billion.

Overcoming Resistance

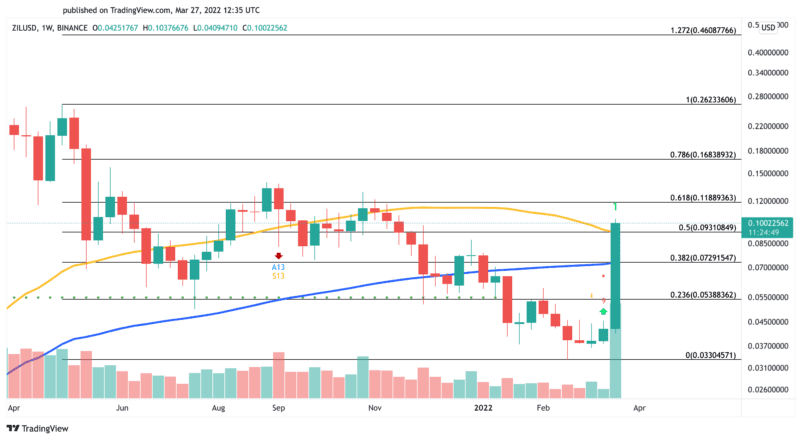

From a technical standpoint, it appears to be like that the Tom DeMark Sequential indicator anticipated the sudden upward designate motion. The technical index introduced a preserve signal on ZIL’s weekly chart, which is now getting validated. With finest a few hours earlier than the weekly shut, the token would per chance shut above the 50-week keen reasonable, doubtlessly signaling extra gains on the horizon.

Overcoming this significant hurdle would per chance aid sidelined customers to re-enter the market. One other spije in procuring for stress would per chance enable ZIL to breach the $0.12 resistance stage and target $0.17 or even $0.26.

Restful, a spike in profit-taking would per chance push ZIL decrease earlier than it continues surging. Failing to shut the above 50-week keen reasonable would per chance end result in a brief pullback to the 100-week keen reasonable at $0.072 or the $0.053 enhance stage.

Disclosure: At the time of writing, the creator of this portion owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and rep weekly updates from our lead bitcoin analyst Nathan Batchelor.

The guidelines on or accessed through this internet situation is obtained from unbiased sources we mediate to be staunch and official, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any files on or accessed through this internet situation. Decentral Media, Inc. is no longer an investment handbook. We attain no longer give personalized investment advice or different financial advice. The guidelines on this internet situation is subject to alternate without scrutinize. Some or all of the records on this internet situation would per chance simply grow outdated-long-established, or it will seemingly be or change into incomplete or mistaken. We would per chance simply, but are no longer obligated to, update any outdated-long-established, incomplete, or mistaken files.

You’ll want to below no conditions beget an investment decision on an ICO, IEO, or different investment based fully on the records on this internet situation, and it is best to below no conditions interpret or otherwise rely on any of the records on this internet situation as investment advice. We strongly counsel that you seek the advice of a licensed investment handbook or different qualified financial professional once you happen to would per chance successfully be searching for investment advice on an ICO, IEO, or different investment. We attain no longer accept compensation in any compose for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

Inspect beefy terms and cases.

European Parliament Might simply Vote to Ban Anonymity in Crypto

European Parliament participants are reportedly planning a vote next week that, if winning, would per chance bar anonymity in crypto payments, together with crypto transactions to unhosted wallets. The experiences furthermore counsel EU…

How Centralized Crypto Lenders Originate Excessive Yields for Customers

How is it doable that centralized crypto lenders offer double-digit APYs for depositing stablecoins, whereas (inflation eroded) bucks are yielding pennies sitting in a primitive financial institution savings fable? Crypto Products…

Coinbase to Video display Canadian Transactions Above 1,000 CAD

Coinbase customers in Canada will rapidly be required to memoir the significant aspects of recipients who rep mountainous transactions, per a scrutinize despatched to customers. Coinbase Complies “Starting on April…