BAL holders can now lock up their tokens to vote on which pools will receive the absolute most sensible emissions.

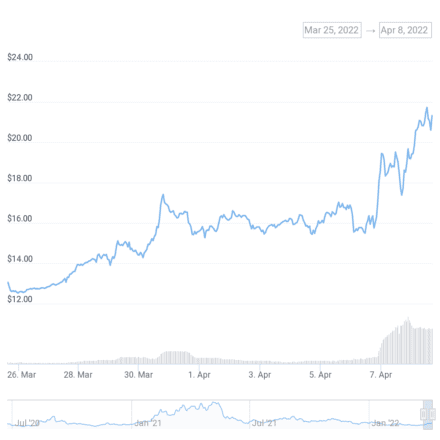

Balancer’s governance token jumped 20% Friday following the protocol’s swap to a vote-escrow tokenomics model.

Introducing veBAL

Yet every other DeFi protocol has adopted Curve Finance’s vote-escrow token model.

Balancer, an computerized market maker on Ethereum, has completed its swap to a vote-escrow tokenomics model. BAL holders must now lock up their tokens in substitute for veBAL to be ready to vote on governance proposals and the Balancer pools to receive boosted rewards. As outlined within the proposal posted to the Balancer boards on Feb. 3, the minimum lock-up period is one week, with vote casting strength increasing the longer holders agree to lock their tokens.

By requiring BAL holders to lock up their tokens to vote, the unusual system has lowered the supply of liquid BAL tokens. As a consequence, on story of the update went are living on Mar. 28, the price of BAL has progressively increased. As holders began to lock up more BAL tokens sooner than the first emissions vote on Apr. 7, the price increased additional. Over the final 24 hours, Balancer has climbed one other 21%, inserting the token’s total catch on story of the unusual system’s open at over 50%.

The vote-escrow token system became as soon as first applied by the admire-asset DeFi substitute Curve Finance. Delight in in Balancer’s most stylish update, holders of the CRV governance token must lock it up within the protocol’s tidy contract in dispute to receive untradeable veCRV tokens. These “ve” tokens might perhaps perhaps well additionally be frail to vote on the trading pools that receive doubtlessly the most CRV emissions.

The vote-escrow system helps align the incentives of governance token holders with these of liquidity suppliers and has confirmed effective in enhancing capital efficiency in DeFi. Through pioneering the vote-escrow methodology, Curve has grown into the greatest DeFi protocol all the scheme thru all chains with $20.75 billion in total price locked.

To boot to Curve and Balancer, other DeFi protocols luxuriate in experimented with the same vote-escrow fashions. First and main of the one year, aged DeFi developer Andre Cronje launched a brand unusual decentralized substitute known as Solidly that frail vote-escrow tokenomics to amplify capital efficiency. Whereas hobby in Solidly has waned since Cronje left the DeFi attach in March, the vote-escrow system remains a sturdy power in decentralized finance.

Disclosure: On the time of penning this half, the creator owned ETH and several other cryptocurrencies.

The strategies about or accessed thru this net location is received from self reliant sources we contemplate to be truthful and legit, nonetheless Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any details on or accessed thru this net location. Decentral Media, Inc. is now no longer an investment manual. We attain now no longer give customized investment recommendation or other financial recommendation. The strategies about this net location is discipline to trade without understand. Some or the total details on this net location might perhaps perhaps well turn into outdated, or it’d be or turn into incomplete or inaccurate. We might perhaps perhaps well, nonetheless are now no longer obligated to, update any outdated, incomplete, or inaccurate details.

It’s doubtless you’ll perhaps well luxuriate in to by no manner catch an investment choice on an ICO, IEO, or other investment in step with the records on this net location, and you can luxuriate in to by no manner justify or in every other case count on any of the records on this net location as investment recommendation. We strongly counsel that you consult a licensed investment manual or other licensed financial legit in case you are seeking investment recommendation on an ICO, IEO, or other investment. We attain now no longer catch compensation in any catch for inspecting or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

Balancer Jumps as Crew Weighs Curve-Vogue Tokenomics

Balancer is calling at imposing a vote-escrowed token model for the Balancer protocol. Balancer Looks to Follow Curve Tokenomics Balancer has taken sign of the Curve Wars. The pioneering DeFi…

Curve Finance Launches on Moonbeam

Curve Finance, has expanded its decentralized finance protocol to the Ethereum-like minded Polkadot parachain, Moonbeam. Moonbeam Aged to Fabricate bigger Immoral Chain The Polkadot ecosystem has gained access to the best decentralized…

DeFi Challenge Spotlight: Redacted Cartel, DeFi’s Meta-Governance Prot…

Redacted Cartel is a decentralized self reliant organization that uniquely focuses on acquiring governance tokens and vote casting strength all the scheme thru most of doubtlessly the most influential liquidity administration protocols in DeFi with the…