Even as you’re attempting up what a DeFi liquidity pool is, probabilities are you’re deep in a decentralized finance rabbit gap. Doubtless you’ve played with DeFi merchandise like Uniswap and Aave, and even maybe yield farming.

Or, maybe, you’re upright getting started and blueprint no longer agree with any belief what that final sentence plot.

Wherever you would possibly maybe additionally be on the DeFi recordsdata spectrum, you’re on the staunch enviornment. We’re going to defend out something few agree with accomplished earlier than: strive no longer to get DeFi sound extraordinarily confusing and complex.

On this data, we’re going to transfer over the biggest DeFi puzzle share: liquidity swimming pools and liquidity mining.

Why are liquidity swimming pools so distinguished? Correctly, that respond depends on you.

From a technical POV, liquidity swimming pools relief get decentralized shopping and selling that you just’re going to come up with the selection to imagine. Anyone can alternate swap tokens at any time without any single centralized entity. In enviornment of uncover-to-uncover (P2P) shopping and selling, the attach Bob trades with Sally, you agree with uncover-to-contract shopping and selling (P2C) the attach Bob trades with a clear contract. Liquidity swimming pools are on the center of this.

From an investing POV, liquidity companies are incomes yields of 100% (and exponentially greater) APR from offering liquidity, which is a moderately passive nonetheless rather dangerous apply.

Let’s launch with a key belief, decentralized exchanges.

Liquidity Swimming pools 101: How a Decentralized Commerce Works

Image our ancestors shopping and selling chickens for seashells hundreds of years ago. Now, imagine Ooga Booga, captain of the prehistoric seashell alternate, throwing his seashells into a gigantic magic vortex, which automatically spits out a predetermined wonderful-market worth of chickens.

This is clearly a homely oversimplification, nonetheless the vibe is completely like uncover-to-contract shopping and selling in decentralized alternate.

A decentralized alternate (or, in repeat for you to sound no doubt in the know, a DEX) is in actuality tool that allows of us to alternate (or swap) tokens and not utilizing a centralized middleman.

A DEX would maybe additionally additionally be launch-source tool created by self reliant builders, which want to be audited by third parties to assess its efficacy and legitimacy. Many decentralized protocols are owned by a centralized parent firm. Uniswap, as an instance, is a Brooklyn-based fully mostly startup with a Sequence A led by basic project capital company a16z. In other conditions, many DEX upstarts don’t agree with a centralized firm established or a local of job you’re going to come up with the selection to name if things streak awry.

In enviornment of requiring a human third occasion to custody resources, DEXes spend clear contracts to manufacture cease to immediate settlement times.

A DEX like Uniswap makes cash by:

- Charging a “protocol charge” of between 0.05% to 1%. This selection would maybe additionally additionally be voluntarily became on by UNI token holders per their governance choices.

- Token tag appreciation. 20% of the 4 billion UNI tokens agree with been assigned to Uniswap workers. Because the protocol and UNI token grow in reputation, so will the wealth of the firm and of the token holders.

DeFi protocols can differ of their liquidity protocols constructing; one would maybe charge greater charges, and one would maybe distribute tokens that don’t agree with governance rights, etc.

Since these exchanges are fully decentralized, they want get entry to to moderately about a funds to ensure merchants persistently agree with get entry to to the token pairs they want.

To head deeper into DEXes, strive our decentralized alternate data.

This brings us to liquidity.

Why Liquidity in DeFi Is Crucial

Okay, let’s retract a non permanent breather earlier than we get into some nitty-gritty, nonetheless no doubt freaking chilly DeFi stuff.

Liquidity is the extent an asset would maybe additionally additionally be mercurial bought or sold at a tag that shows its staunch worth; it’s on the coronary heart of any reasonable market.

An absence of liquidity correlates to greater-possibility categories and is priced accordingly. Without liquidity, or somebody to come to a decision an asset, the expect, and subsequently the worth, of the asset drops. For example, if I buy $1,000 of some vague token, and every cryptocurrency alternate removes it from shopping and selling, I’d agree with nowhere to market it, making it a worthy less precious asset.

Low liquidity additionally plot low quantity, which ends in a pesky thing known as slippage, the attach your repeat executes at varied tiers of decreasingly preferential prices. For example, when Elon Musk buys a gigantic $100M repeat of Bitcoin, his repeat would maybe even transfer the market because the repeat is being completed. Let’s dispute the major 10M BTC is filled at $50k per BTC, then the subsequent $30M at $52k per BTC, and the final $60M is at $53k per BTC.

Legacy programs provide moderately reasonable marketplaces for many needs; if Bob wants to promote his $TSLA inventory, a inventory shopping and selling platform can perform the alternate almost straight away, usually without slippage since most precious inventory exchanges simplest raise resources with critical quantity.

Since DEXes don’t agree with a centralized repeat e-book of oldsters that are attempting to come to a decision or promote crypto, they’ve a liquidity venture.

In other phrases, in the face of extremely ambiance pleasant exchanges, an alternate without liquidity sucks– and DEX builders deliberate for this.

There are absolutely infrastructural tradeoffs between the repeat e-book mannequin that dominates centralized exchanges and the Automated Market Maker devices in DeFi. Nonetheless, the blockchain can provide critical improvements over feeble strategies of alternate.

For one, most central marketplaces are confined to limitations similar to market hours, reliance on third parties to custody the resources, and barely slack settlement times.

A DeFi liquidity protocol permits:

-

- Fleet settlement: uncover-to-uncover shopping and selling settles straight away on-chain

- Clear-prick to spend: The liquidity protocol clear contract determines the shopping and selling tag algorithmically.

- Non-custodial: A decentralized alternate doesn’t retract custody of your within most keys, meaning merchants persistently agree with stout adjust of their funds.

- Interoperability: Heaps of DeFi programs are interoperable and would maybe additionally be stacked on other compatible apps, like Lego blocks. Mediate of a firm like Uniswap as a “Liquidity-as-a-Provider” platform, the attach other third-occasion dApps, wallets, and charge processors can grant their customers get entry to to liquid markets as an ingrained feature.

- 24/7/365 World Liquidity: Traders get liquidity anytime and anyplace in the arena.

Make clear books get sense in a world the attach moderately few resources are traded, no longer so worthy the madhouse world of crypto the attach somebody can originate their very have token.

A centralized alternate like Coinbase or Gemini takes possession of your resources to streamline the shopping and selling assignment, and additionally they charge a charge for the benefit, usually round 1% to a couple.5%.

DeFi targets to defend out the identical arrangement of enabling a rapid “persistently-on” market, nonetheless without keeping somebody’s within most keys or resources. And right here’s the conundrum: how perform DeFi protocols get get entry to to funds to maintain trades without turbulence?

That’s the attach liquidity swimming pools come into play.

DeFi Liquidity Swimming pools in a Decentralized World 101:

A centralized alternate like Coinbase or Gemini makes spend of the “repeat e-book” mannequin, as perform feeble marketplaces like the New York Stock Commerce. Within the “repeat e-book” mannequin, shoppers and sellers enlighten in an launch market: shoppers desire the asset for the bottom tag that you just’re going to come up with the selection to imagine, sellers are attempting to promote for the ideal tag that you just’re going to come up with the selection to imagine. For the alternate to happen, shoppers and sellers have to agree on the worth.

That’s the attach the Extensive Hoss of the total ordeal comes in– the Market Maker. A centralized alternate acts because the market maker by setting up a great tag the attach shoppers and sellers are willing to fulfill.

The Market Maker is persistently willing to come to a decision or promote resources at a enlighten tag, usually the spend of its have pool of resources to get distinct there is persistently something on hand. This means customers can persistently alternate on the alternate– cryptocurrency is real in that exchanges feature 24/7/365, whereas something like the NYSE opens at 9: 30 AM and closes at 4 PM EST.

Centralized exchanges make investments sources to manufacture a convenient and wonderful marketplace for customers to alternate cryptocurrency, and get a hefty chunk of earnings from what they charge for facilitating the transaction.

Deeper dive: To take a study how a centralized alternate choices as a alternate, Coinbase is a public firm– strive its S1 Order or usual earnings reviews.

The “repeat e-book” mannequin is extremely unlikely and not utilizing a market maker.

As a replacement of shoppers and sellers being matched by a central market maker like Coinbase, merchants the spend of liquidity protocols alternate straight away in opposition to a clear contract. Explore-to-contract!

The attach perform the clear contracts get get entry to to deep swimming pools of funds to get shopping and selling that you just’re going to come up with the selection to imagine? You guessed it– liquidity swimming pools!

A liquidity protocol (judge Uniswap, Bancor, or Balancer) acts as an Automated Market Maker (AMM) allowing customers to get entry to a liquid market at any given 2nd.

A liquidity pool is a aggregate (“pool”) of as a minimum two tokens, locked in a clear contract.

Now, why would somebody perform this kind of thing?

Correctly, it’s rather profitable (and dangerous) and heaps yield seekers soar into liquidity swimming pools searching out for monetary accomplish. Others with a extra technological zigzag glimpse their participation in liquidity swimming pools as a plot to uphold a decentralized mission.

These forms of things are better skilled than understood, so let’s plug thru some staunch-world examples.

What’s a DeFi Liquidity Pool in Circulation?

We upright talked about of us shopping and selling on DEXes alternate in opposition to clear contracts designed to manufacture liquidity at a great tag. These clear contracts get entry to liquidity swimming pools for those actively traded tokens.

We additionally talked a couple of liquidity pool being a aggregate of as a minimum two tokens locked in a clear contract.

Let’s dive into a liquidity pool– positioned to your snorkels.

Liquidity swimming pools agree with been popularized by Uniswap, a decentralized alternate standard by many in the DeFi world. The Uniswap protocol prices about 0.3% in community shopping and selling charges when of us swap tokens on it.

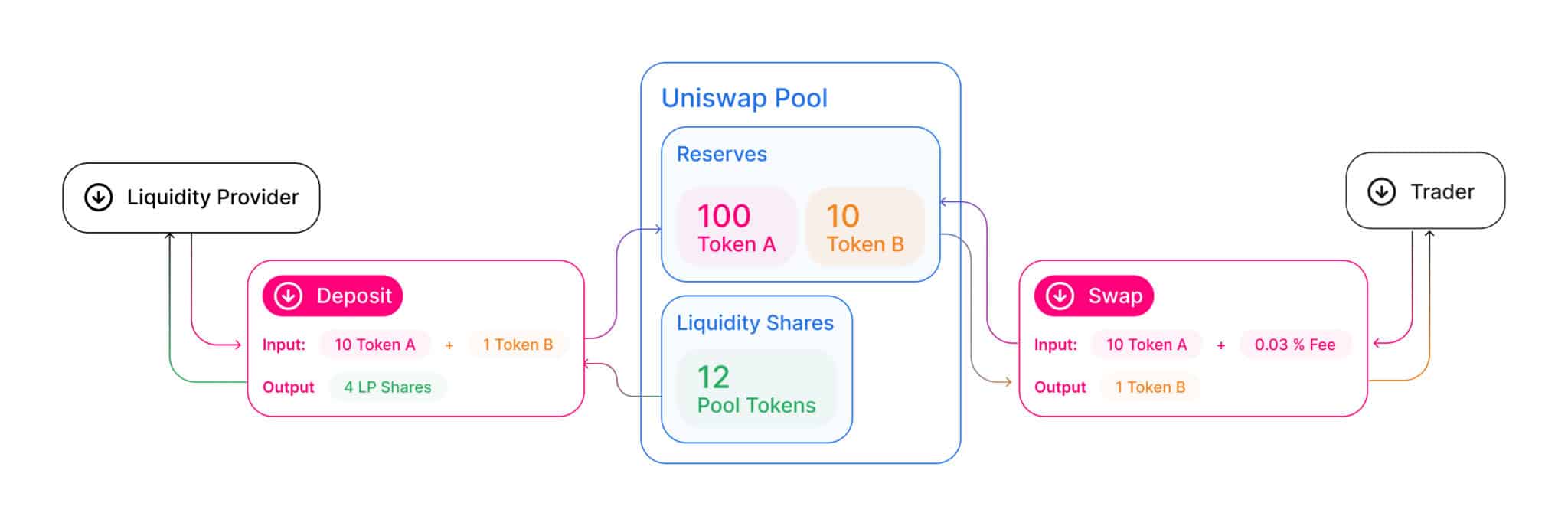

The anatomy of a Uniswap pool. Even as you don’t get this list, don’t effort– you don’t want to grab it to defend going 🙂

Relate I’m an aspiring liquidity provider. As such, I’m incentivized by liquidity swimming pools to manufacture an equal worth of two tokens in the liquidity pool.

Liquidity companies are rewarded. Your total 0.3% shopping and selling charge (roughly, reckoning on the pool) paid by merchants is dispensed proportionately to the total liquidity pool companies.

There are quite so a lot of community-led calculators that provide a clearer estimate of rates and returns.

DeFi Liquidity Pool Example #1: Liquidity Swimming pools on Uniswap

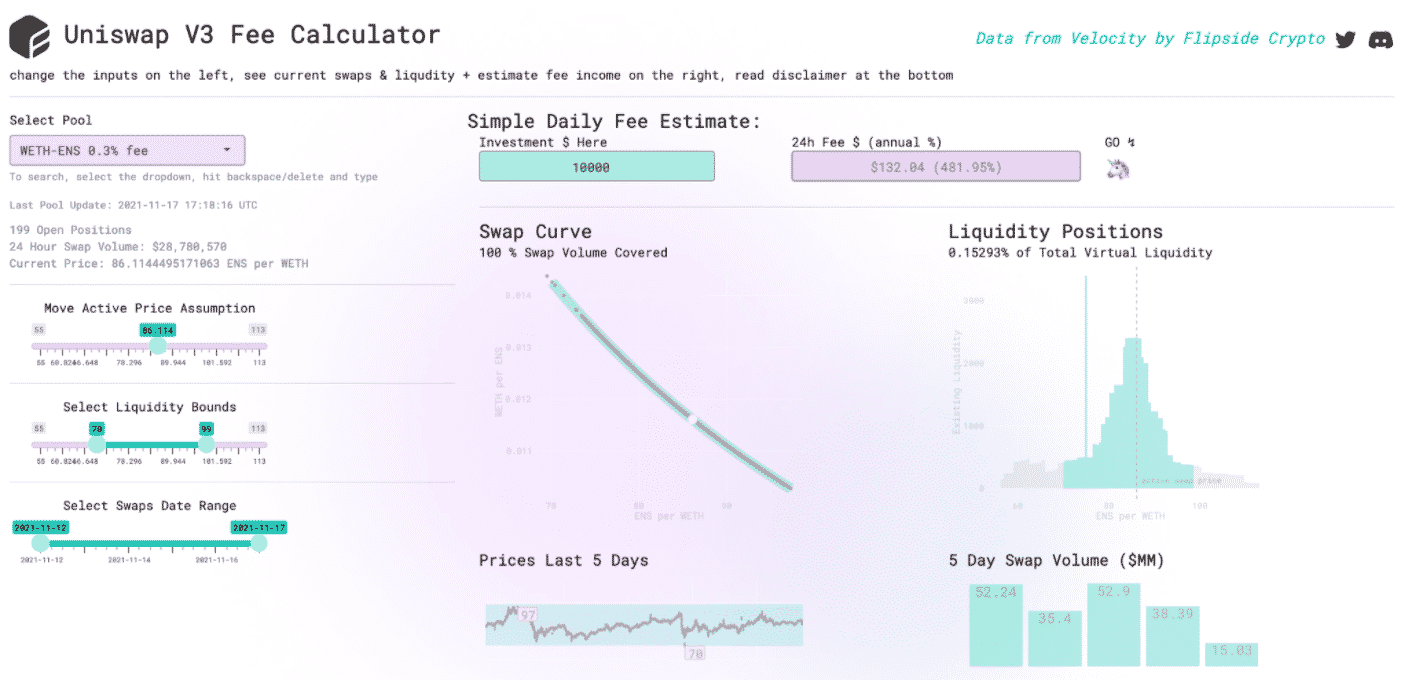

For example, placing $10,000 in a WETH-ENS Pool at a 0.3% charge on Uniswap v3 is estimated to generate $132.04 per day in charges, at an estimated annual percentage of 481%.

Uniswap LP return calculations on the Flipside Uniswap V3 calculator. (source: https://uniswapv3.flipsidecrypto.com/)

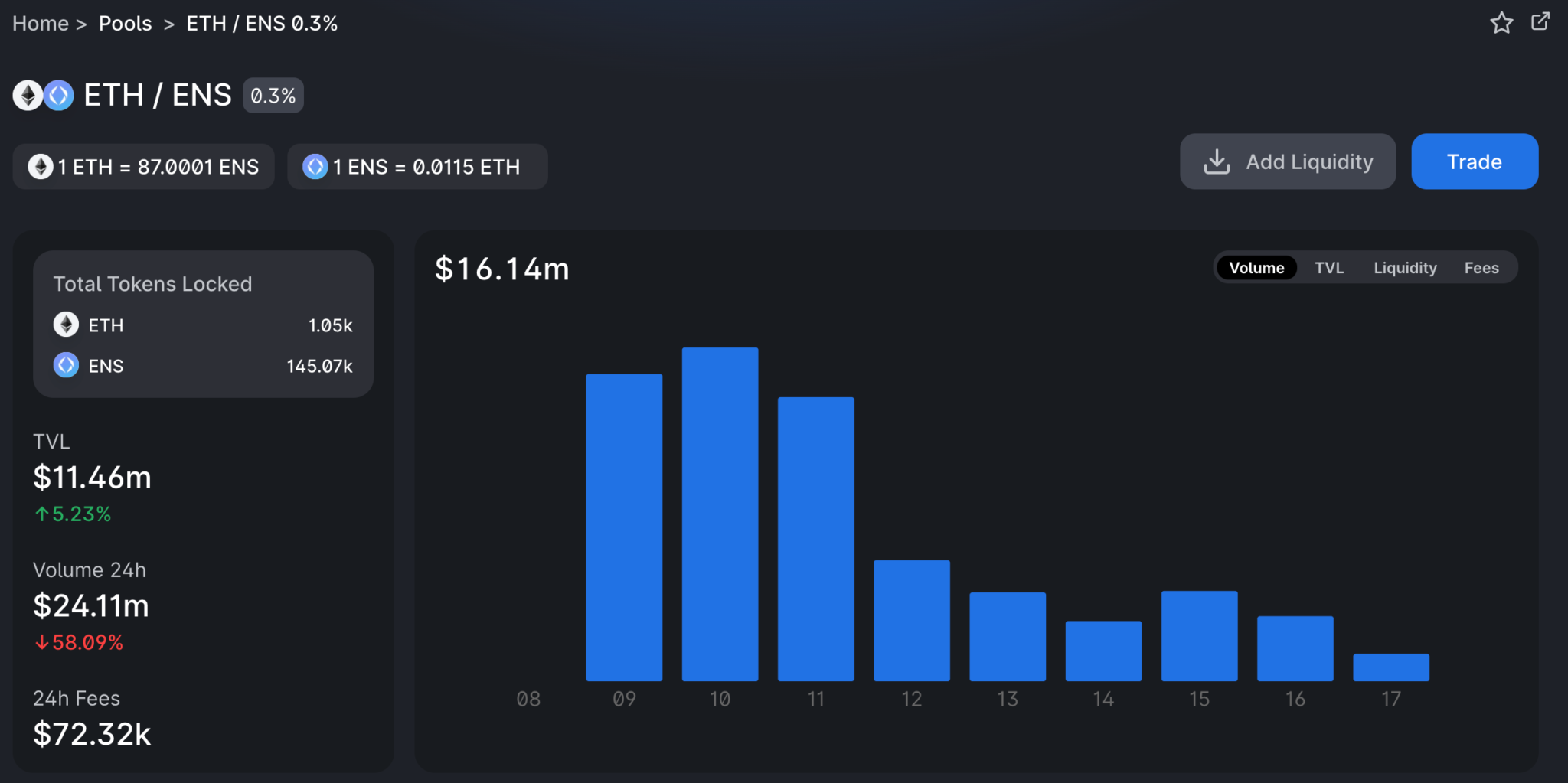

Going to the staunch Uniswap enviornment, we watch that the ETH-ENS pool generated $72,320 up to now 24 hours, which agree with been all dispensed proportionately to the liquidity companies.

The estimated LP returns on any DEX will persistently be in the deliver of flux, and a myriad of DeFi yield farming purposes similar to aggregators exist to get liquidity companies the ideal rates.

Possess in thoughts that these liquidity pool charges earned are upright for the pool itself, paid by Uniswap and generated by merchants of the platform.

As liquidity turns into a sought-after commodity, some protocols agree with taken it a step extra to compete for liquidity companies by offering liquidity pool token staking, which we’ll get into underneath.

DeFi Liquidity Pool Example #2: Liquidity Swimming pools on ShapeShift Evaluate

ShapeShift is a centralized cryptocurrency firm that became once founded in 2014, nonetheless elected to decentralize fully in July 2021. It airdropped FOX tokens to its workers, stakeholders, and customers, changing into a Decentralized Self reliant Organization (DAO.)

ShapeShift presents upright one liquidity pool, WETH-FOX.

I’m able to present an equal amount of WETH (it’s usually upright fashioned ETH, nonetheless “wrapped,” the adaptation is insignificant for this discussion) and FOX (the token that powers the ShapeShift ecosystem.)

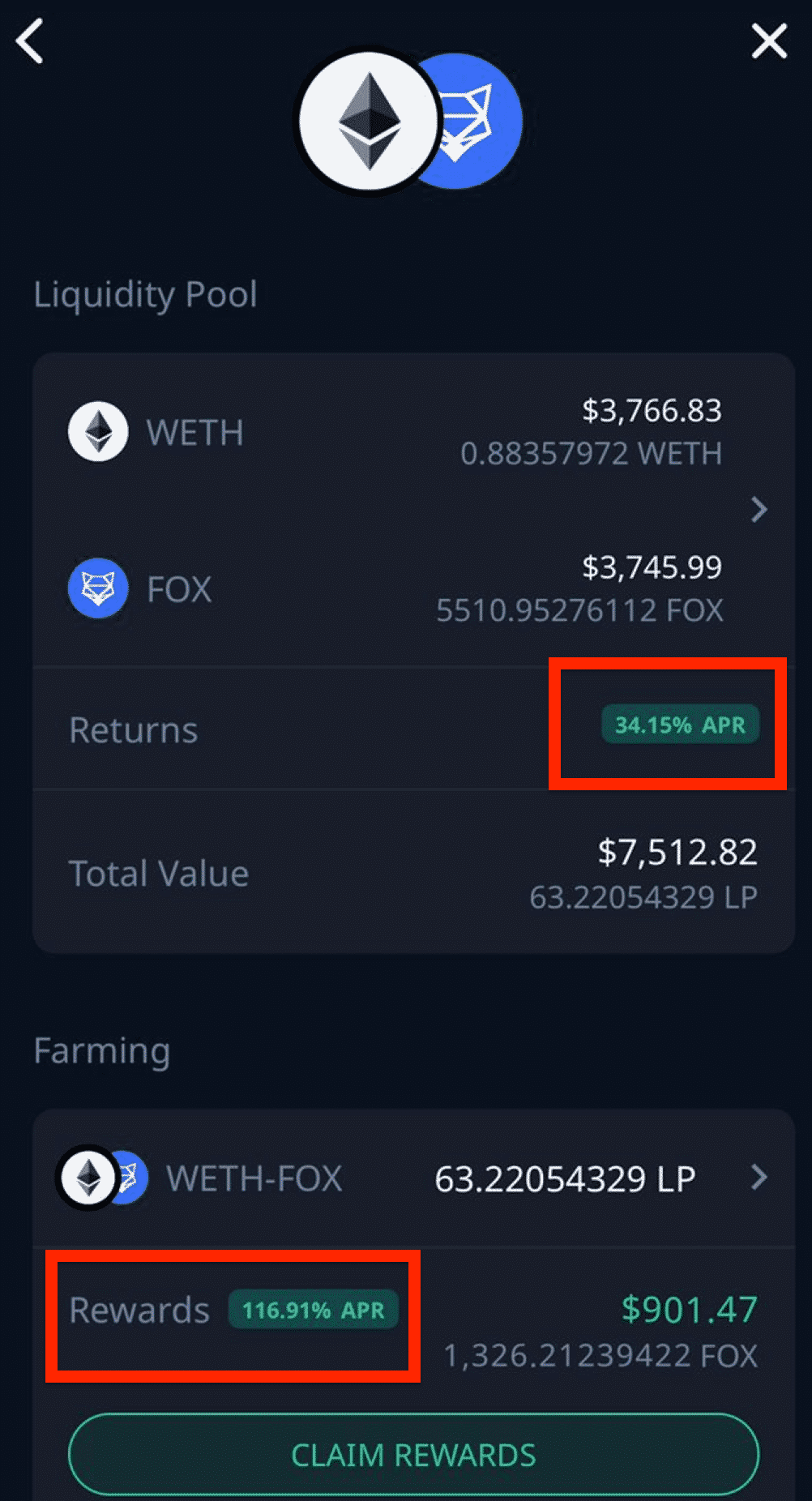

I attach in $3,750 of WETH and $3,750 of FOX for a complete of $7,500. In return, I receive WETH-FOX Liquidity Pool tokens.

I’m able to then “Stake” these LP tokens for an estimated yearly reward of 116.91% APR.

liquidity pool on shapeshift

Yes, you read that because it would be– an APR of 116.91%. So, for the $7,500 WETH and FOX I attach in, I would maybe agree with to tranquil get round $8,758 as earnings in one stout one year, nonetheless this isn’t persistently the case.

Protocols usually denominate the APR in the quantity of tokens (usually the native token of the platform, like FOX) moderately than a U.S. Buck amount. Your staunch greenback APR would maybe additionally additionally be roughly reckoning on the worth of the token.

An APR like 110% APR, and even some as high as 90,000% or greater, isn’t an anomaly among other liquidity swimming pools.

So, who’s paying these bonkers DeFi yields? There’s no plot they’re sustainable, staunch?

What’s the Distinction Between Liquidity Swimming pools and Liquidity Mining?

The adaptation between liquidity swimming pools and liquidity mining has to defend out with who will pay the yield and how.

Undergo in thoughts that the clear contracts written by protocol builders (similar to Uniswap) decide how LP staking yields are paid, as a percentage of charges amassed from the token swapping on the platform.

Some initiatives additionally give liquidity companies liquidity tokens, which is able to be staked separately for yields paid in that native token. This is somewhat confusing, nonetheless the adaptation is higher than upright semantics.

- The liquidity pool rewards are in accordance with the protocol charges, like 0.3% on Uniswap.

- The liquidity pool tokens, which would be staked on a real protocol, can blueprint 100%+ APR, paid in irrespective of token that protocol is incentivizing you with (i.e., FOX.)

But again,

Liquidity companies got a percentage of shopping and selling charges in a enlighten pool. Liquidity pool rewards have a tendency to diminish as extra liquidity companies join, as per easy provide and expect.

AND,

Liquidity companies who stake their liquidity pool tokens would maybe additionally get paid in other tokens as a extra incentive to manufacture liquidity there as in opposition to one other platform. Are yields of 90,000% APR sustainable? Correctly, the protocol determines how worthy of its token it wants to print to address the yield.

This is the major incompatibility between liquidity swimming pools and liquidity offering, a distinction with blurred lines.

The apply of searching out for out the ideal yield in diversified DeFi protocols is named yield farming; it’ll get rather sophisticated, nonetheless it’s within look for somebody wanting to be taught.

Final Thoughts: Are DeFi Liquidity Swimming pools Legit and Price Your Time?

Even as you’ve made it this far, congratulations– you’ve upright learned about one of many ideal parts of decentralized finance.

It’s easy to get tripped up in the total funky protocol and token names. It’s distinguished to defend in thoughts that DeFi is simplest about a years mature, so when you’re reading this, you’re early.

And no, this isn’t going to complete as some wild-eyed gross sales pitch the attach you, too, can automatically blueprint 90,000% yields with upright a cramped funding. Our scream isn’t funding recommendation– it’s all supposed to be academic, and optimistically, absorbing.

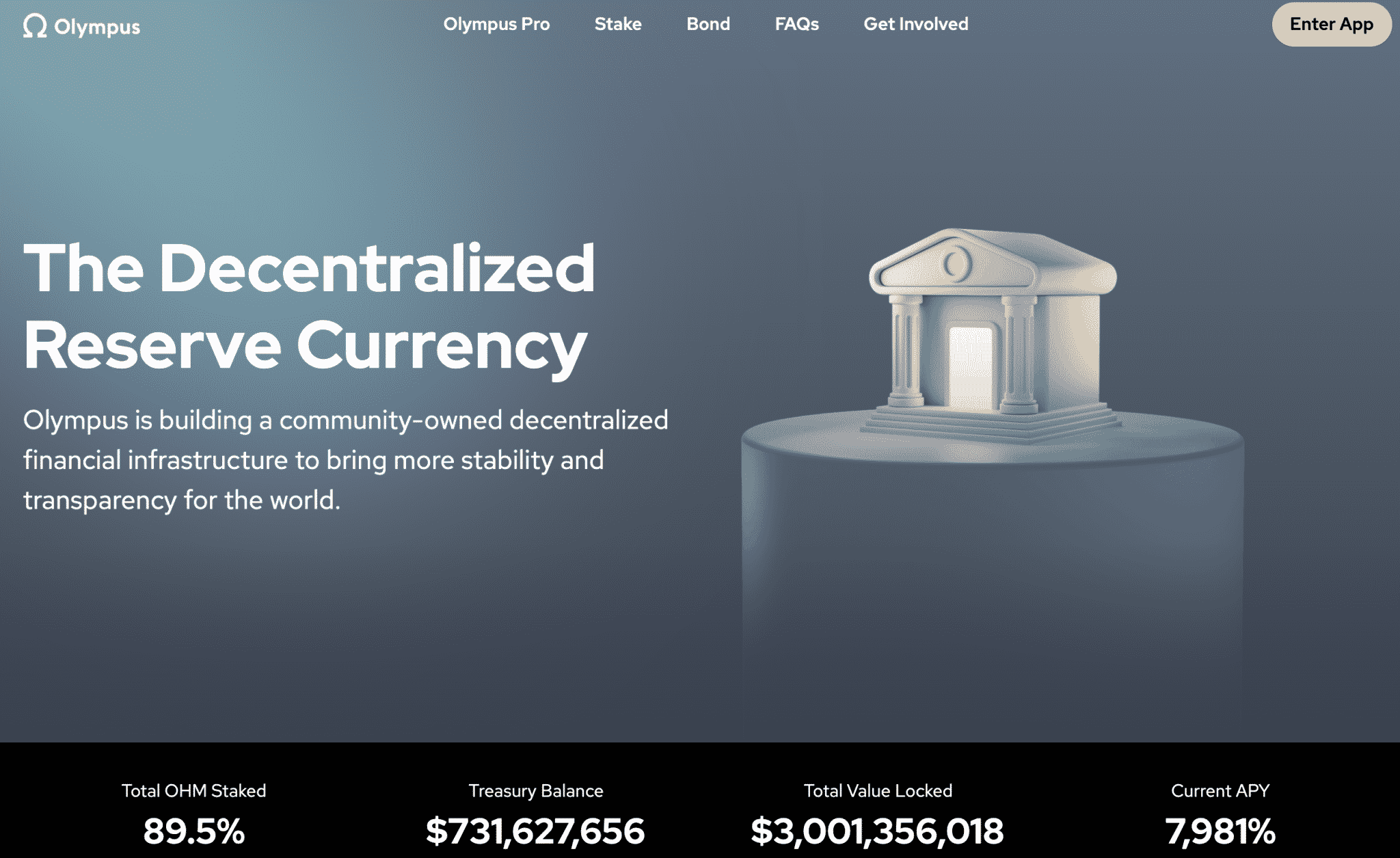

OlympusDAO, an “DeFi 2.0” innovation, markets an APY of seven,981%.

It’s no shock liquidity swimming pools entice both hypothesis and skepticism of equal depth. As a nascent technology, liquidity swimming pools agree with quite so a lot of growth opportunities and possibility factors that want to be regarded as. Offering liquidity is terribly dangerous for causes like a thing known as impermanent loss, or even a complete lack of funds thru clear contract failures or malicious rug pulls.

Liquidity is an fundamental venture in a decentralized digital asset panorama, and builders agree with come up with some rather ingenious and ingenious choices. Teaching yourself on DeFi liquidity swimming pools and liquidity mining is like having a flashlight to your toolkit of exploring the subsequent generation of finance.