Over the closing 40 years, financial coverage has prompted interest charges to teach no from a high of around 20% all the manner down to the zero sure. For the length of the an identical duration, the U.S. greenback (USD) cash provide has expanded at a charge by no scheme earlier than seen in neatly-liked historical past and asset prices in greenback terms exploded to the upside, all while the U.S. moderate hourly wage has lagged on an unparalleled scale.

Ironically, the rising wealth gap, prompted by lagging wages and rising asset prices, has happened while the Federal Reserve (Fed) has been focusing on a 2% inflation charge and pushing the fable that inflation is factual for the economic system, factual for economic improve and, most of all, factual for the moderate Joe. This makes us surprise why the Federal Reserve, via financial coverage, is adjusting interest charges and atmosphere inflation targets and whether this intervention is of direction benefiting the economic system.

To commence, let’s focal point on the inquire of: Why are we seeing this intervention from the Fed? The United States has a complete debt to Putrid Domestic Product (GDP) ratio of 257%.¹ This fragile debt dwelling of cards, which the Federal Reserve has created, has prompted them to danger deflation and its effects on the economic system. The Federal Reserve is then of direction forced to intervene so as that they are no longer perceived because the ones permitting the economic system to crumple. They attain this basically via the lowering of interest charges and via inflation, or in other phrases, a debasement of the currency via a selection of the cash provide. This intervention ends in an amplify in consumption, asset purchases and malinvestment, which, in turn, ends in an ever-rising debt burden and an ever-increased deflationary headwind on the economic system. The cycle then repeats itself with the Fed having to intervene time and time all all over again. The Federal Reserve is caught in a negative feedback loop which they themselves have created.

What Are The Aspect Results Of Inflation?

First, let’s search files from at the consequences of inflation from the buyer point of view. Let’s have faith for a 2d that the government with out be conscious doubled the overall provide of bucks in the diagram. In principle, all the pieces would double in designate because the associated charge of the currency might perchance per chance be halved. Now, the producers of a product or carrier of direction have three alternate choices:²

- They would well double the worth of their product or carrier to retain their most up-to-date margins. The facet stop of doing so is that they’re going to seemingly force away customers.

- They would well retain the most modern designate. The facet stop of doing so is that they’re going to settle on a success on their margins and their backside line.

- They would well retain the most modern designate nonetheless decrease the quality of the inputs which produce up their product or carrier. The facet stop of doing so might perchance per chance be that they might perchance perchance provide their customers with a decrease quality product or carrier nonetheless retain their margins.

What tends to happen is that the producer chooses either option one or three in uncover to settle on the direction of least resistance and decrease a possible hit to their backside line. We, as a result of this reality, have this byproduct of inflation whereby the producer now has to either raise the worth of the product or carrier or deceive the buyer by lowering the quality of their product or carrier. Both of which ends in the customers losing out.

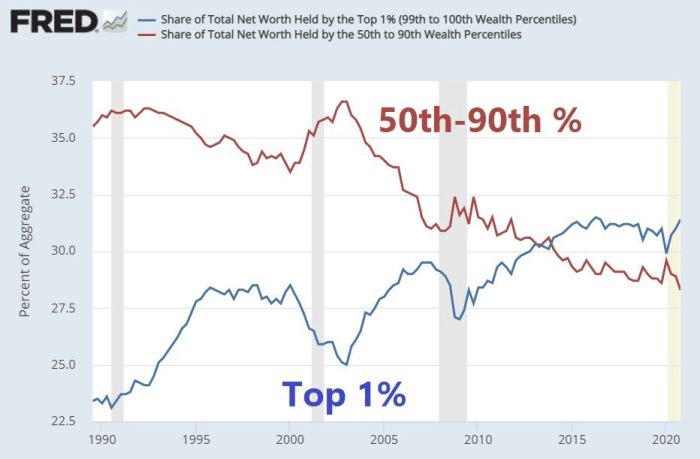

2nd, let’s search files from at the consequences of inflation from an asset point of view. As inflation devalues the currency’s buying vitality, it causes both the worth and demand of resources to amplify, which in turn artificially increases scarcity. This creates knock-on effects in the bear of warfare and social unrest, as disputes come up over ownership of resources. Monopolization then tends to ensue in uncover for these in vitality to retain withhold an eye on as a result of the rising scarcity and designate of resources. We then have the larger dispute, whereby gargantuan wealth inequality between the holders of these resources and the holders of the currency begins to seem because the currency loses buying vitality. This is able to well be seen in the lagging moderate hourly wage in the case of resources in the chart beneath.

To play satan’s point out, when inflation became originally carried out, the central banks had factual intentions. Inflation in the bear of economic expansion, or charge of interest adjustment, is a capability for the Federal Reserve to try to dampen non permanent volatility by stimulating the economic system in times of stress. On the opposite hand, the difficulty is that volatility is good vitality, which as we know from the first law of thermodynamics, can’t be destroyed. As an different, it is good transmuted, and so by looking out to forestall/dampen non permanent pain in the economic system, this as a replacement delays the pain and amplifies its future effects. That’s the reason the initial bump in debt, in the bear of economic and fiscal stimulus in times of stress, evolves into this beast of constant debt expansion in uncover to forestall economic crumple.

The Federal Reserve might perchance perchance well argue in any other case, nonetheless the asserting, “there might perchance be not any such thing as a free lunch,” aloof applies to financial and fiscal stimulus. By stimulating the economic system, what they are of direction asserting is “I clutch to shift cash toward one dispute of the economic system and faraway from one other dispute.” This other dispute of the economic system ends up getting the rapid stop of the stick, which is nearly regularly the decrease class. Irrespective of how the Fed portrays it, stimulus in the bear of inflation, helicopter cash or the adjustment of interest charges will regularly have negative facet effects.

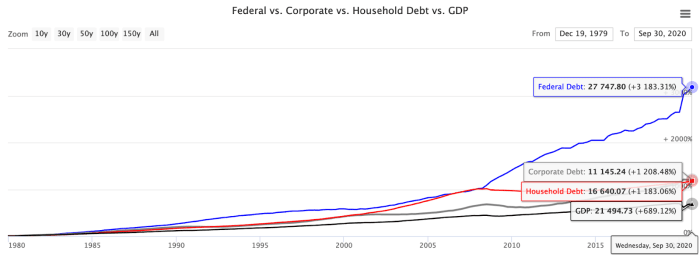

So why can’t we honest appropriate stop this financial intervention in uncover to end the wealth gap? Earlier, we mentioned the deflationary headwind. In uncover to ticket this, we now have got to study out the most modern dispute of the U.S. debt dispute. Combined, federal, company and household debt add up to $55.26 trillion in opposition to a GDP of $21.49 trillion (as proven beneath). This offers us a complete debt to GDP of 257%.⁹ Merely build, for every $1 of GDP, there might perchance be $2.57 in debt. Let’s make a selection, conservatively, that the moderate interest on this debt is 3%. This would mean that, in uncover for the United States to carrier honest appropriate the interest cost on its debt by myself, it would deserve to grow by 7.71% 12 months over 12 months earlier than we uncover about any accurate improve in GDP.

We then scheme to the conclusion that the central financial institution is caught between a rock and a laborious build of abode. They would well let the United States hump into a deflationary debt spiral, which might perchance perchance well effectively motive the economic system to crumple. Alternatively, they might perchance perchance well retain low interest charges and consistently develop the financial nefarious via inflation, hoping and praying that this intervention will lead to meaningful, productive improve in the economic system, permitting the United States to commence paying down its debt burden. Up to now, it looks like the central financial institution is selecting the latter option of relying on hope. This implies it is extremely no longer going we are able to uncover about this debasement of the greenback stop anytime soon.

This then makes us inquire of that if inflation is largely happening, then: Why are we no longer seeing the USD crumple in opposition to other currencies? This is no longer honest appropriate a dispute in the United States nonetheless a global dispute. Whenever you happen to judge the U.S. debt to GDP is a dispute at 257%, globally we’re sitting at 356%.¹¹ You’ve doubtlessly heard the asserting “a rising tide lifts all boats.” This quote hits the nail on the top and is the explanation we’re no longer seeing the greenback lose cost in opposition to other currencies. Each other important fiat currency is in the true same dispute. They’re all printing away, looking out to outrun their very bear debt burden and are, as a result of this reality, all being debased at a equivalent charge.

It is possible you’ll well then surprise, how can this be the case for all countries? In straightforward terms, we now have got one other negative feedback loop. Let’s dispute you’ve got countries A, B and C. If A and B make a resolution to debase their currency via inflation, then C’s currency strengthens in opposition to A and B’s. A and B are of direction struggling to alternate with C thanks to the strength of its currency they in most cases make a resolution to decrease alternate with C, basically trading between themselves. C is then forced to debase its currency in uncover to retain its alternate relationships so as that this bargain in alternate doesn’t persist and affect its economic system. This cycle then repeats as every nation continues to debase in uncover to support with one one other. Each nation is of direction in a rat fling to the backside, where, in the stop, all fiat currencies will seemingly be worthless.

Why are we no longer seeing interest charges upward push as a result of the inflationary effects of economic expansion? The central banks around the enviornment cannot let interest charges upward push. From the calculations above, the U.S. GDP has to grow by 7.71% honest appropriate to carrier the interest on its debt, assuming a 3% charge of interest. If interest charges had been to switch up to 5%, then the United States would deserve to grow by 12.85% to carrier the interest on its debt. That’s the reason we’re seeing countries equivalent to Japan and Australia capping interest charges via yield curve withhold an eye on in uncover to forestall charges from rising too high. Any meaningful upward push in charges will seemingly be catastrophic to the economic system.

It turns into evident that as a result of the manipulation intervention from the central banks globally, we cannot exhaust our oldschool metrics for tracking inflation equivalent to interest charges and currency alternate charges. Additionally, when it’s possible you’ll well be looking out to get ahead by investing in resources, the Consumer Label Index (CPI) isn’t going to attend either since it is good the moderate designate of a basket of consumer items and services. It doesn’t consist of resources equivalent to stocks, accurate estate and bonds. Central financial institution intervention is clouding designate and inflation signals on both micro and macro ranges and, as a result of this reality, impacting economic resolution-making. We have now fully a few metrics this demonstrate day to depend on which are no longer manipulated.

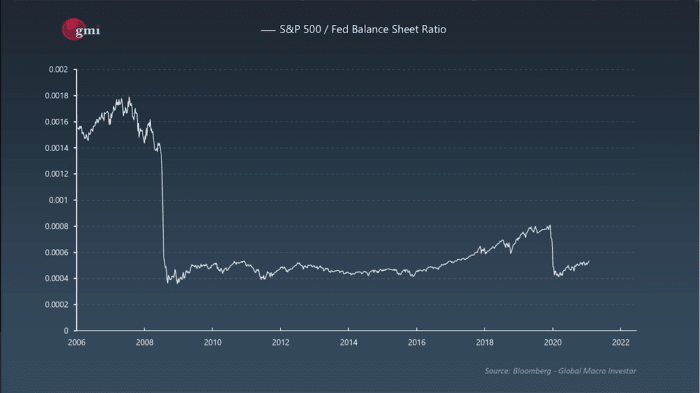

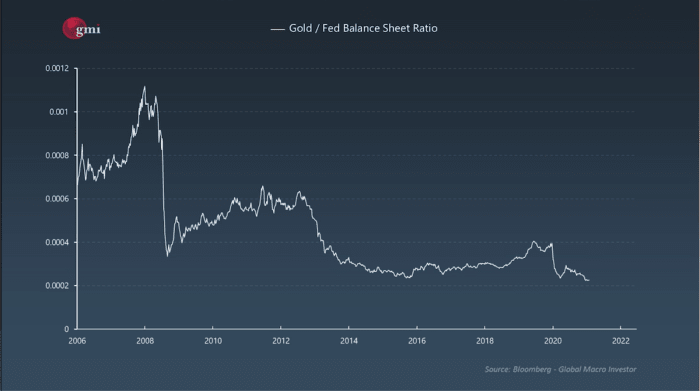

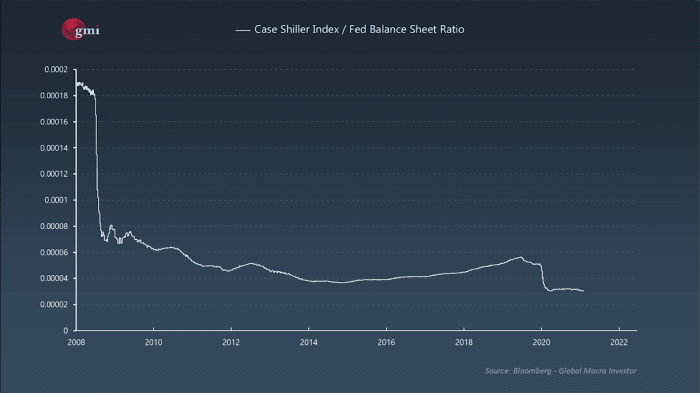

By now which that chances are you’ll also have reached the conclusion that as soon as you honest appropriate invest in accurate estate, stocks and a minute allocation of gold, you needs to be outrunning this debasement of the greenback. I need it became that uncomplicated. After we substitute the lens via which we explore these resources, a particular image emerges. As an different of the exhaust of the USD because the denominator, let’s uncover about what occurs if we exhaust the Federal Reserve stability sheet.

What begins to emerge is that these resources aren’t of direction seeing the gargantuan designate appreciation that we’ve been led to judge. As an different, these resources are struggling to support with the debasement of the USD, all while the moderate worker, preserving bucks, is greatly losing buying vitality (Table 1). It then turns into optimistic that this financial expansion is the rationalization for the ever-rising wealth inequality. Unless we uncover a few bargain in financial intervention, or a new different sound currency, asset holders, and more particularly equity holders, are going to continue to dominate, while the center and decrease class will get overwhelmed. What’s worse is that in the again of this facade of rising asset prices, everybody, along side the investors, is getting screwed. Except you invest correctly, you are going to fight to outrun the debasement of the USD.

This then begs the inquire of, how noteworthy expansion is happening below the hood of the Federal Reserve stability sheet? If we hump to the Federal Reserve internet site,¹³ we are able to uncover about that the Fed’s stability sheet has increased from $870 billion in July 2007 to $7.793 trillion in April 2021. That’s an annualized improve of 17.33%. This is the hurdle that we now have got to beat honest appropriate to protect earlier than the debasement of the USD. With this expansion, there might perchance be regularly a danger of uncontrollable inflation and costs right via the board running faraway from us. We have now seen this happen in greenback terms, particularly in asset prices over the closing decade. On the opposite hand, after we exhaust the Fed’s stability sheet because the denominator, though there are classes of transitory improve where particular resources outperform, general, we uncover about underperformance.

To construct the 17.33% hurdle into point of view, listed below are the 15-12 months annualized returns of a big collection of asset classes:¹⁴

- Orderly Cap Shares — S&P 500 Index: 9.88%

- Petite Cap Shares — Russell 2000 Index: 8.91%

- Global Developed Shares — MSCI EAFE Index: 4.97%

- Rising Market Shares — MSCI Rising Markets Index: 6.95%

- REITs — FTSE NAREIT All Equity Index: 7.15%

- Excessive Grade Bonds — Bloomberg Barclays U.S. Agg Bond Index: 4.4%

- Excessive Yield Bonds — ICE BofA U.S. Excessive Yield Index: 7.44%

- S&P U.S. Treasury Bill 0–3 Mth Index: 1.11%

- Gold: 7.08%

- Accurate Property: 2.28%

No longer a single asset class in that list outperformed the 17.33% hurdle charge. In other phrases, when you had invested in any of the above asset classes, with a straightforward exercise and settle on technique, that chances are you’ll have lost buying vitality over the closing 15 years. Except it’s possible you’ll well be outrunning the 17.33% charge of economic expansion via clear investing, it’s possible you’ll well be losing buying vitality. It is as straightforward as that.

Except the premise of our financial coverage modifications (i.e., we shift toward an Austrian economic approach¹⁵), I doubt we are able to uncover about any true, long-time duration, meaningful improve in resources and in the economic system. Moderately, the more seemingly scenario is that the Fed will continuously debase the currency and inflate the debt burden. The greenback will continue to lose buying vitality, expanding the ever-rising wealth gap, and the Fed will withhold pushing the fable that all the pieces is hunky dory and stable in the economic system.

We have now to produce some enormous modifications to the manner we operate. We should substitute how we scheme financial coverage and produce sure that that the oldsters in vitality settle on accountability and withhold its inhabitants’s handiest pursuits in the foreground. On the opposite hand, these issues had been talked about ad nauseum and so I desired to carry up a few others:

Banking Arrangement

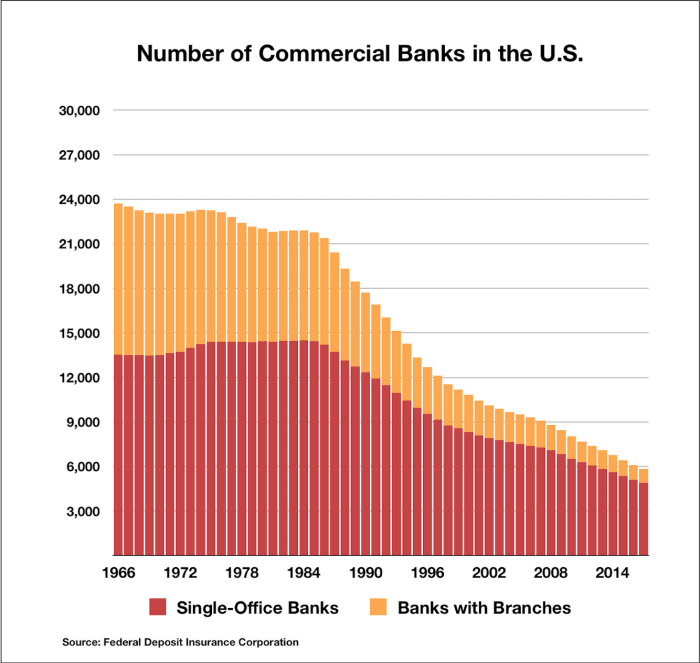

Petite banks facilitate and lend to minute companies, while enormous banks facilitate and lend to enormous companies. What’s provoking is that, since the 1960s, we now have got seen a decline from around 24,000 banks in the United States to beneath 6,000 banks nowadays (chart beneath). This is as a result of the implementation of rules which inspires expansion and mergers, while also making it very complex for minute banks to dwell to tell the story as a result of the hoops they must bounce via. In the most modern banking ambiance, a care for few banks dominate the alternate.

Why does this topic? It matters because over 90% of the enterprise inhabitants in the United States is represented by minute- and medium-sized companies. Petite companies are a important driver for economic improve and innovation. These same companies need the minute banks in uncover to dwell to tell the story. They need the flexibility to borrow in uncover to innovate and grow by the exhaust of these funds to attend amplify productiveness, enhance effectivity and undertake new abilities to support with opponents. If minute companies are unable to borrow, this has important implications on economic productiveness and improve.¹⁷

In uncover to promote minute enterprise improve — which as we know provides jobs, fuels innovation, and increases group productiveness — we now have got to substitute our most up-to-date scheme to banking. As an different of lobbying for rules which inspires consolidation and mergers right via the banking sector, we now have got to decrease the requirements for minute banks in uncover to promote the proliferation of minute branches right via communities.

Countries equivalent to China¹⁸ have identified this need for minute banks in uncover to spur on productiveness, innovation and improve. In return, China is with out doubt some of the splendid export countries as a proportion of GDP. They’ve also seen a large produce on their ranges of poverty. China’s proportion of residents living beneath the poverty line has dropped from 98.3% in 1990 to 24% in 2016. For the length of this same duration, the United States’ decrease class has slowly increased in measurement,¹⁹ while their inventory market and housing prices have concurrently persisted to climb increased and became farther out of attain for the moderate particular person.

College Of Laborious Knocks

Realistically, we’re doubtlessly too late to place into effect the faculty of laborious knocks scheme as a result of the scale of the debt burden and the systemic issues right via the economic system. Regardless, we now have got to stop kicking the can and backstopping the big corporations and big banks at any time after we hit a tempo bump in the economic system.

For the length of the mid-1900s, Yellowstone Nationwide Park launched a protocol to extinguish any minute wooded space fire.²⁰ They believed that they had been detrimental to the native natural world and had been an eyesore for vacationers. What they did not ticket is that wooded space fires are a pure allotment of the wooded space’s lifestyles cycle and happen in uncover to optimistic kindle and brush accumulation, while promoting natural improve and fluctuate. In 1988, after years of preventing the smallest of fires, sufficient brush and kindling had gathered that the park had a hearth which worn out 36% of the wooded space.

We are in the meantime seeing this play out in our economic system. By propping up the economic system at any time after we hit a tempo bump, we’re

a) Encouraging malinvestment: As folks originate to get overly fully pleased that the central financial institution or govt will intervene right via times of stress, we uncover a few upward push in extra speculative leverage in uncover to maximise returns. This in consequence ends in unsustainable improve and thus amplifies the fragility of our economic system.

b) Magnifying the wealth gap: With this overhanging debt burden, the central banks have minute option nonetheless to debase the currency and retain low interest charges in uncover to forestall a systemic crumple. This financial expansion causes a upward push in asset prices, all while the greenback’s buying vitality continues to diminish. As we know, the effectively off settle on resources while the decrease class holds cash, thus developing an ever-expanding wealth gap.

c) Constricting innovation: A zombie company is one which is unable to financially beef up itself. This is an illustration that the product or carrier the enterprise offers either doesn’t have sufficient demand, or that the enterprise has been irresponsible with its budget and is unable to carrier its debt. This enterprise might perchance perchance well aloof, as a result of this reality, restructure or dissolve. We might perchance perchance well aloof permit the pure lifestyles cycle of a enterprise to play out moderately than prop up unsustainable companies. When a new enterprise has to compete with an ever-rising collection of zombie companies, this makes it your total more stressful for that enterprise to succeed and prosper. It is because moderately than specializing in innovation, the enterprise must exhaust a fraction of its resources to compete. As of July 2020, 19% of listed companies in the United States are zombie companies and this number is rising.²¹

Recessions are a pure allotment of the commercial lifestyles cycle as they motive introspection which ends in innovation and substitute. They wipe out putrid actors who have taken on too noteworthy leverage and invested poorly. Overall, recessions have a particular stop on the economic system and it is shortsighted to intervene and try to govern the stop result.

Education

The millennial era might perchance per chance be the first to be poorer than its oldsters,²² and that is no longer a theme we settle on to study for generations to return. In uncover to interrupt this cycle, we now have got to alter the curriculum we educate in schools and add:

- Monetary literacy: It is mandatory to educate the foundation of clear investing by introducing children to the a big collection of asset classes and terminology right via the financial diagram. This also can promote a shift toward better cash management, which can, in turn, produce a bargain in pointless consumption as a result of a greater conception of the preservation and improve of wealth via investing.

- Education on how our financial diagram works: This also can give children a greater conception of how our financial diagram is structured. In turn, this can permit them to better ticket the financial coverage and motives in the again of the oldsters they vote into vitality.

Introducing financial training into the curriculum permits people to feel more empowered to settle on withhold an eye on of their budget. With out a substitute in our tutorial diagram, we cannot inquire of an amplify in financial literacy.

Debt

Globally, we needs to be more acutely conscious in how we scheme debt. Debt can even be separated into three important classes:

- Consumption debt: Debt mature for consumption applications (i.e., vehicles, clothing and abilities). This debt tends to be via bank cards and traces of credit rating.

- Asset debt: Debt mature for the clutch of resources (i.e., dwelling equity line of credit rating, mortgage and investment margin). This debt tends to be via banking institutions and brokerages.

- Productive debt: Debt mature for productive enterprise applications in uncover to facilitate improve or for the clutch of product and tools which abet in productiveness, abilities and innovation.

Financial prosperity and improve is living by how effectively abilities interacts with the three drivers of production: land, labor and capital.²³ On the opposite hand, in uncover to amplify economic productiveness and produce sustainable improve, we now have got to produce sure that we’re evenly distributing our efforts between all three drivers. If we build of abode more weight into the kind of drivers, economic improve will originally upward push. On the opposite hand, if we continue on this trajectory, economic improve will flatten, and by some means this overuse will act as a headwind, main to reduced economic improve.

In the most modern economic native climate, there has been an overuse of capital in uncover to consistently stimulate the economic system. We are of direction at the point where this overuse has prompted an amazing amplify in consumption and asset debt in uncover to bear perceived economic improve. Genuinely, we’re no longer seeing any meaningful improve. As an different, we’re merely developing a headwind in the bear of an ever-expanding debt burden. We should focal point our vitality on the exhaust of debt in more productive ways by reducing this abuse of consumption and asset debt and promoting productive debt exhaust. This shift in the manner we produce basically the most of debt will abet the opposite two drivers of production, land and labor, and, in turn, produce meaningful economic improve.

This leaves us with the inquire of: What can I attain in the rapid time duration as an particular particular person? We want to construct our cash to work and deserve to make a resolution on which asset(s) to invest in. On the opposite hand, no longer all resources are created equal. If everybody became given $1,000,000, then you definately’d make a selection the ones who hadn’t already done so, would exit and clutch a dwelling and we’d all are living happily ever after. Defend into consideration that a minute fragment of the inhabitants already owns the bulk of property. On the origin, the early birds would commence buying property. On the opposite hand, as a result of the amount of cash coming into the property market, the provision/demand imbalance would motive dwelling prices to rocket and the laggards might perchance per chance be priced out as soon as all all over again thus declaring the most modern wealth inequality. We have now to salvage resources which are ready to outpace the popular asset classes (accurate estate, equities and gold) and ideally outpace the debasement of the USD in uncover to meaningfully produce wealth and slowly end the wealth gap.

Enter bitcoin. Bitcoin might perchance perchance well no longer handiest be financially priceless over the rapid to very long time duration as a capability to produce wealth, nonetheless it might perchance per chance well be a possible acknowledge to the social issues we’re in the meantime dealing with in societies around the enviornment. Due to this, I’ve to scheme bitcoin from both a financial and a social point of view.

How Can Investing In Bitcoin Aid Us From A Monetary Perspective?

First, with the most modern manipulation of the financial diagram, it will not be laborious to study that we attain no longer have pure, free market interest charges. This poses a important systemic dispute whereby all equity, accurate estate and mounted-earnings valuation calculations are per interest charges because the important enter. If your important enter to a calculation is grossly off, then how will you have faith the output of that calculation? We might perchance perchance well have basically the most fragile, hyped up financial diagram in historical past, and if charges are to upward push honest appropriate a few proportion aspects, we are able to also uncover about this dwelling of cards fall. Bitcoin might perchance perchance well doubtlessly be an limitless hedge to a crumple of the financial diagram as a result of its decentralized, immutable nature with out counterparty exposure.

2nd, bitcoin is with out doubt some of the few resources which has managed to outrun the debasement of the USD. Since its inception in 2009 till April 2021, it has finished a compound annual improve charge of 256.87%. It is possible you’ll well hear folks dispute that bitcoin is a bubble and I am no longer going to switch into your total rebuttals to the a big collection of arguments (there might perchance be loads of files online relating to any questions which that chances are you’ll also have). On the opposite hand, it is mandatory to demonstrate that bitcoin has a build provide of 21 million coins versus the ever-expanding USD. This scarcity is with out doubt some of the important drivers which offers bitcoin its cost, and the longer this financial expansion experiment goes on, the increased the demand for bitcoin will became as folks search files from a lifestyles raft to interrupt out the sinking fiat diagram.

How Can Investing In Bitcoin Aid Us From A Social Perspective?

Before all the pieces, I judge that the government does have a build of abode in society. Its reason is to construct justice and home tranquility, provide well-liked protection, promote well-liked welfare and retain liberty for its inhabitants. On the opposite hand, the government’s important interest needs to be its folks, no longer itself, and positively no longer a minute fragment of its inhabitants. We have now to produce sure that that the government is held responsible and retains our pursuits at heart. If it turns into too overbearing, then we now have got to face up and form substitute. When true governance is in build of abode, we are able to also aloof uncover about improve in welfare, productiveness and innovation, all while giving everybody equal different to grow as people.

One in all the important flaws in our most up-to-date diagram is that we attain no longer have a sound currency. As an different, we now have got placed the vitality of the financial diagram into the fingers of the central financial institution, which the government has a important affect over. It is inevitable that the government will exhaust its authority to manipulate the financial provide in uncover to retain and grow its vitality. We, as a result of this reality, have a warfare of interest. Folk would like to be capitalistic, while the government alternatively is inherently anti-capitalistic and wishes to retain withhold an eye on. Bitcoin has the flexibility to substitute this flaw in the diagram.

If bitcoin turns into increasingly more more prevalent, we are able to uncover relating to the sure facet effects of getting a true sound currency. Taking away the government’s capacity to manipulate the currency, which in turn puts the vitality again into the fingers of the people, causes the government to be more fiscally acutely conscious while also ensuring that it is performing in the handiest interest of its inhabitants.

Why would bitcoin switch vitality to the actual particular person? Bitcoin is the first asset which is largely portable, immutable and decentralized. Additionally, it will not be the financial institution, institutions or govt which grant people entry to their bitcoin, nonetheless moderately the people themselves who have sovereignty over their bitcoin. Therefore, if the government turns into too onerous, then the actual particular person can pack up and hump away. Expertise is breaking down land constraints which traditionally gave governments allotment of their vitality.

This, nonetheless, is no longer the case with oldschool resources. Any meaningful sum of cash or gold tends to be saved in a financial institution, which the financial institution can restrict entry to. Property is immovable and, as a result of this reality, can even be seized and financial resources held in brokerage accounts can even be frozen. This offers vitality to the governing physique or third occasions, which have custody over our resources. This implies that, in a centralized currency, the vitality is in the fingers of the issuer, whereas in a decentralized currency the vitality is in the fingers of the holder.

Whenever you happen to is also living in a developed nation and judge that the government has your handiest pursuits at heart, then it’ll also seem to be decentralized currencies are attempting to repair a non-dispute. On the opposite hand, as we now have got seen right via historical past, the connection between the oldsters in vitality and the popular inhabitants can turn very rapid and we now have got to produce sure that that the government continues to act in the handiest pursuits of its inhabitants. Furthermore, that is no longer the case for loads of americans around the enviornment who attain no longer have consolation and stability within their nation. For instance, when Greece went into recession in 2016,²⁴ in uncover for the government to fund its liabilities it iced up financial institution accounts and confiscated folks’s cash holdings. What’s worse, is that in many increasing countries girls are unable to commence financial institution accounts with out a male signatory.²⁵ Therefore, they are unable to construct and enhance their instances. In both scenarios, bitcoin has the flexibility to give the actual particular person again their freedom.

As with anything else, it is mandatory to be life like. Therefore, we now have got to accept that in a capitalistic society, if bitcoin turns into a important asset in the financial diagram, we are able to most positively uncover about some bear of wealth inequality. This is inevitable. On the opposite hand, equity and equal different are of extreme significance, and a sound decentralized currency equivalent to bitcoin offers the handiest likelihood of attaining this. What’s particular about bitcoin is that, as a result of its lack of manipulation, we are able to handiest produce/invent bitcoin via labor or the sacrifice of resources. This permits bitcoin to act as a vote casting mechanism which channels reality and innovation by permitting tips that offer cost to upward push to the cease. This is no longer the case for the USD. The central financial institution and the government are up to tempo of how the USD is distributed. This grants them withhold an eye on over who can and can’t exhaust the currency, which in turn offers them the vitality to make a resolution who succeeds and who fails.

In its rapid 12-12 months lifespan, bitcoin is effectively on its manner to developing global social substitute and for the first time ever permitting folks true withhold an eye on over their deepest wealth. Over the following few many years, I judge bitcoin will seemingly be a power to be reckoned with.

At closing, I judge that investing is no longer honest appropriate about financial produce. It is mandatory to invest consciously, to invest with a long-time duration time horizon, and to invest in resources which have both a particular social and economic affect. Even supposing no person of direction is conscious of what an global with a cryptocurrency at the core of its financial diagram would search files from like, it is mandatory that we commence discussing possible possible choices to our most up-to-date fiat diagram. From all the pieces we now know, our most up-to-date manner of working is merely no longer working, and the further we continue on this trajectory, the increased the capability consequences will seemingly be.