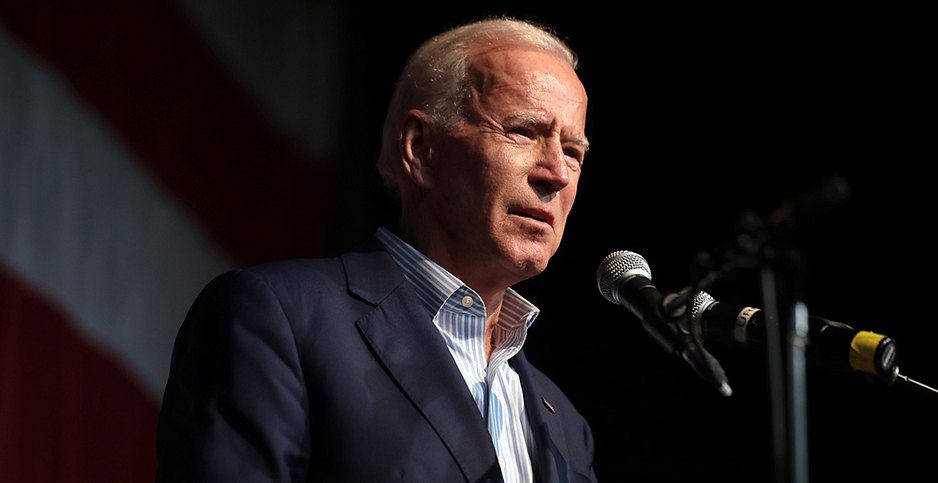

On Wednesday the White Residence defended President Joe Biden’s trillion-dollar spending proposals despite the criticism relating to rising inflation and low-passion rates. Inflation has risen at unprecedented ranges in the U.S. and the frequent American’s shopping energy is rising less extremely effective. Now critics fancy JPMorgan Shuffle CEO Jamie Dimon and American economist Larry Summers salvage blasted the Biden administration because they quiz inflation to grow “significantly increased.”

Individuals See Buying Vitality Sink Whereas Analysts Suspect Even More Inflation on the Horizon

Inflation has been a distress for American electorate ever since the U.S. executive and Federal Reserve made up our minds to enhance the M1 monetary present fancy by no blueprint sooner than in historical past. Truly, inflation is the upward thrust in label for goods and services and products, and the nation’s forex finally ends up shopping fewer goods and services and products.

Experiences display cowl that just about every thing is rising in fee, and the U.S. dollar can snatch far lower than it will most likely sooner than. Vehicle prices are anticipated to battle by the roof this year, food prices salvage grown enormous and pork prices touched a seven-year excessive. The USDA expects the fee of food to upward push from 2.5% to 3.5% for the year. It’s pretty blatant that the central bank and politician’s on the general quoted “2% inflation fee” is a delusion, as 2021 statistics display cowl prices of goods and services and products in the U.S. salvage surged.

Morningstar.com increased its 2021 inflation forecast for the Interior most Consumption Expenditures Label Index on Wednesday. “We quiz 2021 core inflation of two.5%,” the prediction notes.

“For 2022-25, our forecast is surely unchanged; we quiz realistic core inflation averaging 2.3%, beautiful above the Federal Reserve’s 2% long-proceed target,” the Morningstar.com inflation document adds. Meanwhile, on Would possibly per chance well also 26, monetary executives and economists salvage criticized the Biden administration for searching for even more money from the Federal Reserve.

“You’re speaking about unprecedented persisted fiscal and monetary protection, more or less on autopilot,” JPMorgan Shuffle CEO Jamie Dimon explained at Wednesday’s Senate listening to. “[There is] nothing spoiled with 1.6%,” Dimon added. “I’d quiz it to dawdle significantly increased than that. Optimistically, it acquired’t be out of whack and the Federal Reserve would possibly perchance well be ready to tamp it down. However we continuously map for things worse than that.”

“You’re speaking about unprecedented persisted fiscal and monetary protection, more or less on autopilot,” JPMorgan Shuffle CEO Jamie Dimon explained at Wednesday’s Senate listening to. “[There is] nothing spoiled with 1.6%,” Dimon added. “I’d quiz it to dawdle significantly increased than that. Optimistically, it acquired’t be out of whack and the Federal Reserve would possibly perchance well be ready to tamp it down. However we continuously map for things worse than that.”JPMorgan Shuffle CEO Jamie Dimon spoke about inflation when he testified sooner than the Senate Banking Committee held on Would possibly per chance well also 25. Whereas a spacious decision of monetary establishments and Wall Side twin carriageway CEOs argued against “woke capitalism” and “native weather swap” that day, Dimon spoke about inflation.

The JPMorgan Shuffle CEO, who manages the ideally suited monetary institution by resources held, said the chief’s stimulus would possibly perchance gain carried away. “If that money is wasted, it is no longer productively spent, we are able to salvage more inflation, less productivity, slower divulge and the American democracy you would possibly perchance salvage misplaced even more credibility [in the] eyes of the arena,” Dimon Pressured.

Despite Jamie Dimon’s commentary, the White Residence most most essential deputy press secretary, Karine Jean-Pierre, emphasised to the clicking that the “President’s plans are working.”

“That is a president who understands about making obvious that we’re no longer wasteful,” she added. “He made obvious there turned into no corruption and no damage. And so he understands how this all works.”

Larry Summers: ‘Fed’s Will Most effective Prefer the Punchbowl After It Sees Some Of us Staggering Spherical Drunk’

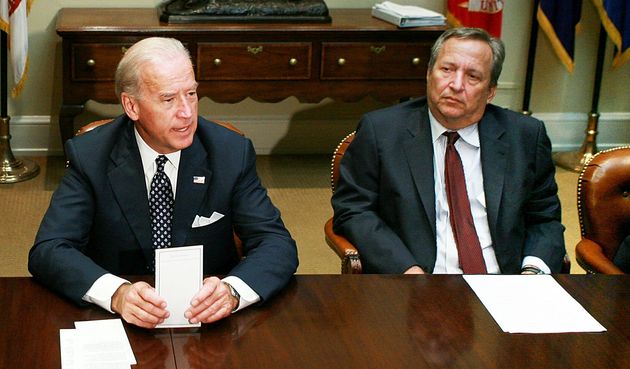

Now not all individuals is of the same opinion with Karine Jean-Pierre and the Biden administration. At the Coindesk 2021 Consensus conference the faded Clinton and Obama legit, Larry Summers mentioned runaway inflation and monetary easing insurance policies as well.

“I advise [the] protection is pretty overdoing it,” Summers said on Wednesday. “The sense of serenity and complacency being projected by the industrial policymakers, that that is all something that can without problem be managed, is misplaced.”

The faded Vice President of Pattern Economics and Chief Economist of the World Financial institution, faded Clinton administration Treasury Division legit, faded director of the Nationwide Economic Council for the Obama administration, Larry Summers, has warned the Biden team of workers of rising inflation. As far as the inflation forecast, Summers said there would possibly perchance be “big uncertainty” at the Consensus conference this week.

The faded Vice President of Pattern Economics and Chief Economist of the World Financial institution, faded Clinton administration Treasury Division legit, faded director of the Nationwide Economic Council for the Obama administration, Larry Summers, has warned the Biden team of workers of rising inflation. As far as the inflation forecast, Summers said there would possibly perchance be “big uncertainty” at the Consensus conference this week.“Joe Biden has a historical opportunity to be a spacious president,” Summers further remarked. “However I advise they would possibly perchance well restful learn the lesson of the Johnson administration’s errors that elected Richard Nixon and the Carter administration’s errors that elected Ronald Reagan.”

Summers statements concluded when he said:

The Fed’s thought inclined to be that it removed the punchbowl sooner than the occasion acquired honest. Now, the Fed’s doctrine is that this would possibly perchance perchance also only fetch the punchbowl after it sees some individuals staggering around beneath the impact of alcohol. We’re printing money, we are rising executive bonds, we are borrowing on unprecedented scales. Those are things that completely have more of a possibility of a provocative dollar decline than we had sooner than. And provocative dollar declines are more liable to translate themselves into inflation than they were historically.

Despite Obvious Data and Criticism, White Residence Disagrees The US Will Gawk ‘Long-Time duration Inflation’ and It’s the Fed’s Job ‘First and Vital’

In most up-to-date cases as inflation has gripped the American economy, the U.S. dollar index (DXY) plummeted beneath 90 all over again rising weaker. Seven days previously the U.S. dollar dropped to a 3-year low and economists assume the dollar would possibly perchance dip 10% lower. Despite the incontrovertible truth that there is hundreds info and statistics showing the dollar is weaker and inflation is dislocating the economy, the White Residence wholeheartedly disagrees.

Per Larry Summers’ most up-to-date critique of Biden economics, a White Residence legit spoke back and urged CNN it does “no longer witness signs of continual dislocation or long-time duration inflation.”

The legit noted that it does video display the inflation rates however it’s more in the fingers of the U.S. central bank. “Our team of workers intently displays inflationary pressures however inflation is at the starting up beneath the purview of the Federal Reserve,” the White Residence legit concluded.