This article specializes in setting up a timeline of present mining-associated events, the economics of mining at home for the frequent U.S. resident, some speculation on the economical future limits and some steps you may perhaps take to initiate mining non-KYC bitcoin at home.

While you’re acquainted with my other work, you realize that I enact no longer write about bitcoin brand motion, on the different hand, brand motion is expounded in this case as a consequence of electrical energy payments are paid in fiat. Decoupling the economics of bitcoin mining from fiat conversion abstracts the topic too noteworthy to be functional for a wide viewers, in my brand. I strive to elevate it cramped to handiest the associated events and chart comparisons to direct my point.

A Fresh Bitcoin Mining Event Timeline

This has been a attention-grabbing year for Bitcoin with many basic events equivalent to Whirlpool unspent skill reaching an all-time-excessive, Taproot activation, El Salvador adoption, Craig Wright suing Bitcoin.org and the deaths of Mircea Popescu and John McAfee. Additionally, the network hash rate and procuring and selling brand both hit all-time-highs followed by more than 50% pull backs. As turbulent as prerequisites were at instances, this year has additionally been stout of different must you were prepared.

On the outside, 2021 may perhaps presumably also no longer seem as a beautiful time to initiate mining Bitcoin, nonetheless I may sigh why I believe right here’s a beautiful time to initiate a little, modest Bitcoin mining operation at home with the intent of buck-brand averaging (DCAing) non-KYC bitcoin thru your electrical energy bill. Excluding for the events talked about above, appropriate zooming in on the mining sector is a rabbit hole all its comprise.

Here is a timeline of some important mining-associated events that I believe contributed vastly to the bullish case for mining bitcoin at home:

April 14: The BTC brand peaked at a fresh all-time-excessive appropriate beneath $65,000 per bitcoin. This modified into as soon as a short-lived top and charge momentum took a flip for the bearish by Could also 19 with the procuring and selling brand experiencing a roughly 50% fall. This modified into as soon as critical to mining in that many miners may perhaps presumably also pay for his or her operations with handiest a little share of the bitcoin they were mining. With electrical energy rates halt to $0.03 per kilowatt hour (kWh), some operations may perhaps presumably also invent 1 bitcoin at a brand of $3,700, leaving with regards to $61,000 in headroom.

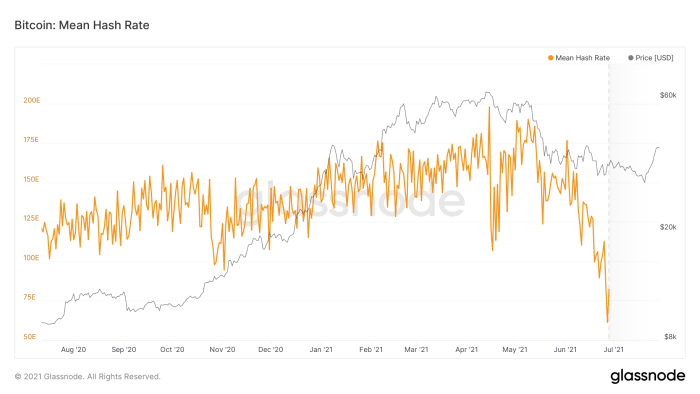

April 15: The imply Bitcoin network hash rate peaked at 197 exahashes per 2d (Eh/s), then dropped to 106 Eh/s two days later. Clearly one thing came about to about 46% of the network hash rate that all shared some total denominator. Appropriate round this time, there had been reviews of an incident associated to a coal mine accident in Xinjiang, China which supposedly had a 30% drawdown possess on the total Bitcoin network hash rate. Handiest about a weeks from this point, China would again be on the center of consideration because it pertains to Bitcoin mining.

Could also 6: The U.S. mining firm Marathon mined the principle OFAC-compliant block on the Bitcoin network. This modified into as soon as the principle instance of a critical censorship initiative that I’m responsive to and I thought about it an attack on Bitcoin. Marathon has since reversed its situation on censoring transactions, on the different hand, handiest time will sigh if their intentions are beautiful to the censorship-resistant attributes of Bitcoin. I believe this modified into as soon as a critical match in that I anticipated this level of attack coming from a nation handle China, nonetheless 2021 has been stout of surprises.

Could also 11: While you happen to apply Bitcoin dispositions fair a cramped more closely, there is speculation that a assembly between Federal Reserve Chairman Jerome Powell and Coinbase CEO Brian Armstrong may perhaps presumably also possess fueled market manipulation that had a detrimental possess on the upward brand momentum. The timing of this assembly modified into as soon as coincidentally apt earlier than a gigantic brand drawdown. Here’s critical in mining phrases as a consequence of of the possess on working margins and doubtlessly dark regulatory initiatives being talked about within the support of closed doors at one in all the worlds excellent Bitcoin exchanges.

Could also 12: The charge broke $50,000 enhance phases and commenced falling with more velocity; probably attributable in share to worry, uncertainty and doubt (FUD) being circulated by Elon Musk associated to Tesla losing enhance for Bitcoin payments. The CEO cited concerns over the Bitcoin network’s energy consumption. Musk touted enhance for Dogecoin, fueling the misunderstanding that somehow a Bitcoin transaction requires a static quantity of energy and that the network is inefficient.

Could also 21: With the value in clear decline, markets were shaken even extra with news of a Chinese language Bitcoin mining ban. The Chinese language govt declared that all Bitcoin mining operations need to quit, desist and filter out within two months following the announcement. This modified into as soon as no longer the principle announcement of its form from the Chinese language govt, nonetheless there modified into as soon as proof within the network hash rate disruptions that perceived to enhance the speculation that this time modified into as soon as various.

Per the Cambridge Bitcoin Electrical energy Consumption Index (CBECI), China had dominated the Bitcoin mining alternate, accumulating 65% to 75% of the network hash rate. In my brand, these percentages are inflated as a consequence of I imagine there is about a conflation between Bitcoin mining hardware bodily situated within the direction of the borders of China and world Bitcoin mining operations simply owned by Chinese language corporations. In both case, by March 2021 the CBECI indicated that roughly 46% of the entire Bitcoin network hash rate modified into as soon as within the direction of the borders of China. The Cambridge Centre for Change Finance (CCAF) took a more in-depth explore, spanning from September 2019 to April 2021, on the mining exodus from China, concluding that the percentage had dropped from 75% to 46% at some point of that point.

Despite the 46% fall in hash rate from the 197 Eh all-time excessive on April 15, it is some distance attention-grabbing to cover that the network imply hash rate climbed from 106 Eh support as a lot as 189 Eh on Could also 2, handiest 15 days later. Then it ceaselessly declined again to basically the most present low of 61 Eh on June 27. I will handiest speculate that presumably there modified into as soon as a mountainous preliminary horror that precipitated most Chinese language miners to shut off round April 15, probably the coal mine accident, with many mining operators scrambling to resume operations within the times that followed; handiest to permanently shut operations down after the Chinese language govt’s announcement of the mining ban. Supposing that ASICs were being relocated initiate air of China’s borders and powered support on following the China ban, total Bitcoin network hash rate began to crash a restoration. In any match, I’m no longer certain we will ever know precisely what came about, nonetheless I enact think there is loads more to this fable than I’m understanding at this point.

Could also 24: Michael Saylor threw his enhance within the support of Marathon, whereas it modified into as soon as calm actively attacking the Bitcoin network by censoring transactions. Together, Saylor and Marathon teamed up and announced the Bitcoin Mining Council (BMC). Clearly, to me anyway, this modified into as soon as a knee-jerk reaction to the different of losing Musk’s enhance for Bitcoin. The Bitcoin Mining Council modified into as soon as nothing more than a Hail Mary strive from an armchair quarterback to strive to stable his baggage. What has transpired since has been some gold-medal-great psychological gymnastics.

This council modified into as soon as convened in worry within the direction of the postulate that the public at tall may perhaps presumably also possess a detrimental thought of Bitcoin as a result of unsubstantiated environmental concerns. Which is able to be extrapolated as: If institutions think Bitcoin is no longer environmentally pleasant, then they may perhaps perhaps no longer invest in it; and if institutions assemble no longer invest in Bitcoin, then the value is no longer going to lag up; and if the value doesn’t lag up, then Bitcoin is pointless. This number-lag-up (NGU) mentality undercuts the permissionless, censorship-resistant, neutral, without boundary traces and initiate attributes of Bitcoin, changing them with this thought that Bitcoin is merely a conduit to way more fiat. In any match, the BMC is opening the door to ESG initiatives, carbon credits and regulatory dangers that crash me imagine right here’s an attack on Bitcoin.

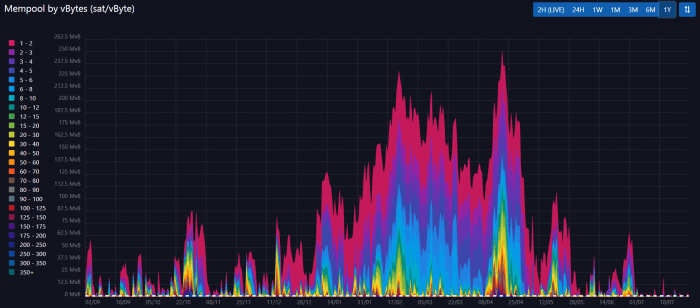

June 3: The mempool cleared for the principle time since December 14, 2020. Here’s critical for about a causes because it pertains to mining. Transaction charge revenue on the entire is a tall share of mining revenue. In actuality, because the block subsidies continue to halve every 210,000 blocks, finally the transaction charges shall be basically the most convenient factor incentivizing miners. There are a full bunch years earlier than that will become a reality, nonetheless there are no longer as a lot as three years left earlier than the block subsidy turns into 3.125 bitcoin per block.

The fall in transaction charges at this explicit time in Bitcoin events indicates to me that Chinese language miners had been working some roughly plan that artificially boosted the transaction charges. With the absence of mining operations in China, there modified into as soon as no more incentive to continue these schemes. The further charges would possess boosted mining earnings. A field for bigger miners which shall be in opponents with every other, nonetheless noteworthy much less of a field for little miners making an are attempting to DCA thru their electrical energy bill by mining at home.

When the associated charge rates started hiking in January, the yarn on the time modified into as soon as that the rainy season in China modified into as soon as affecting the network hash rate so noteworthy that charges were spiking. This had a call of ripple outcomes, handle Bisq floating the thought to invent their platform on top of Liquid rather than Layer 1 Bitcoin. The notify I even possess with this yarn in hindsight is that the hash rate modified into as soon as 50% greater in January 2021 than it is some distance now, but charges were 300-instances greater.

Why Opportunity Knocks Now For Dwelling Bitcoin Mining

The outlook for Bitcoin modified into as soon as grim by the quit of June. One would will possess to be crazy to think that investing in bitcoin, no longer to claim mining equipment, modified into as soon as a beautiful resolution. Ironically, right here’s the save aside the bullish case for mining non-KYC bitcoin at home starts…

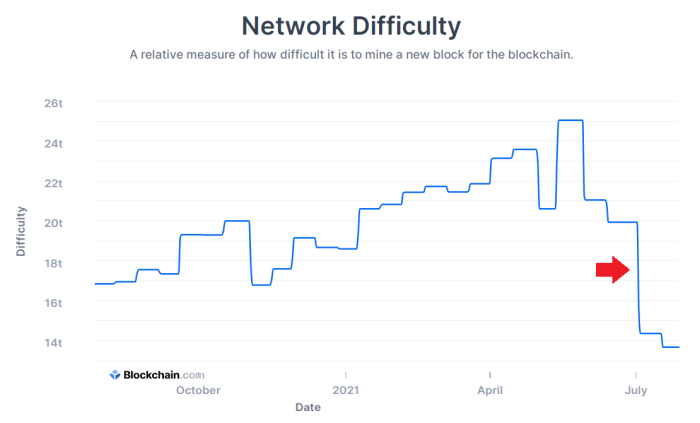

There may be a mechanism constructed into the Bitcoin protocol called the challenge adjustment. Here’s how the network attempts to elevate a fixed 10-minute interval between blocks. Every 2,016 blocks, the challenge in finding a block is adjusted reckoning on how noteworthy hash energy has been online. The more hash energy that comes online, the faster blocks are mined. If blocks are being mined too fleet, then the refined adjustment will enhance to strive to safe the interval support to 10 minutes. Alternatively, when blocks are being mined too leisurely, the challenge adjustment decreases to strive to safe the interval support to 10 minutes.

On July 3, 2021, the Bitcoin network experienced the excellent decrease in mining challenge up to now, following the fall in total network hash energy. Main as a lot as this adjustment, blocks were being mined slower than the 10-minute target on common. This adjustment in challenge attempted to safe that interval support heading within the correct route.

When blocks are much less refined to mine, it capacity that operational miners possess a more perfect time mining blocks. Or, in other phrases, more blocks will most probably be mined for the quantity of equipped hash energy as a consequence of the hash rate is staying static whereas the rate of block finds will enhance, in this case. Though with regards to 50% of the hash rate had long previous offline, the miners that remained online at some point of the challenge adjustment liked a with regards to 30% amplify in mining rewards. The challenge adjustment made it in mutter that the quantity of bitcoin earned in mining rewards for a given quantity of hash energy elevated by with regards to 30%.

This profitability amplify is no longer handiest liked by tall mining operations, it is no longer an economies-of-scale revenue. It is miles linearly disbursed to all miners according to the quantity of hash energy they are offering. For instance, by becoming a member of a mining pool, even home miners can way rather fixed mining rewards. I bustle a single 80 terahash (Th) ASIC at home; earlier than the challenge adjustment, my ASIC modified into as soon as yielding approximately 0.00055 BTC day after day. After the challenge adjustment, my day after day mining rewards elevated in an inversely proportional capacity to the challenge decrease to approximately 0.00070 BTC.

In this June 24, 2021 Twitter thread, Slush Pool outlined the challenge adjustment phenomenon and even though it may perhaps presumably also seem counterintuitive at the birth, the decrease in challenge equipped a uncommon different for operational miners of all sizes. These outlandish network and market prerequisites additionally equipped a critical gamble for those on the sidelines to jump into the mining sport.

In total, the value of ASIC hardware is closely tethered to the BTC brand. As the value of bitcoin fell, mining hardware prices additionally fell, in relative fiat phrases. Additionally, mining hardware modified into as soon as turning into more readily accessible as, supposedly, the ASICs leaving China critical fresh properties. This flood of hardware additionally helped support strains on the secondary ASIC markets that had been tormented by world microchip shortages. While you happen to identified the window of different, this can even probably lag down in history as one in all the excellent instances to initiate a house mining operation.

The save aside There Is Dwelling Mining Threat, There Is Reward

As more folks turned aware of what modified into as soon as going down within the Bitcoin situation, I started getting more DMs and emails asking if it modified into as soon as greater to appropriate prefer bitcoin or to initiate mining at home. The total misconceptions had long been discouraging for little-scale home miners. Some total narratives that you just may perhaps presumably also possess probably heard in present years are:

- Mining is handiest for tall operations

- Residential electrical energy is too costly to mine

- You would be greater off spending your money at an alternate shopping for BTC rather than losing it on electrical energy

- Atmosphere up a mining operation is complex and complex

- You will never crash your a reimbursement

Many of the false narratives were shattered in Diverter’s groundbreaking files on home mining, or as he likes to call it, “garage band mining.” To peek for your self the save aside the narratives went to die, learn “Mining For The Streets.” This files modified into as soon as published appropriate after the Could also 2020 Halving and it wasn’t except October 2020 when I learn the article that I seen what modified into as soon as going down and the different that I modified into as soon as lacking out on, the different that many folks were lacking out on as a consequence of they assumed the narratives were beautiful. I situation out to explore for myself, you realize, assemble no longer belief, study? I detailed every step of the direction of in my January 2021 “Dwelling Mining For Non-KYC Bitcoin” files. I wished a capacity to amplify my bitcoin holdings without the usage of KYC, I knew DCA modified into as soon as the excellent capacity nonetheless the auto-DCA products and services require KYC. Diverter’s files showed me the resolution I modified into as soon as procuring for.

But, coming support to the questions at hand: “Am I greater off dollar-brand averaging or mining?” I critical one thing more to direct folks what roughly likelihood they were taking by jumping into mining at home. A sturdy approach for home mining is to initiate little and invent your files, expertise and dedication slowly. There are so many variables, handle electrical energy rate, hardware brand, outlandish home ambiance, network hash rate and BTC brand. There isn’t the kind of thing as a capacity I will sigh any one right here’s a viable resolution for them, nor can I say it is no longer. The excellent factor I will enact is present the info one wishes to permit them to crash an instructed resolution for themselves and sigh that their resolution relies on what they think the halt to future holds for the BTC brand and the Bitcoin hash rate and one of the critical top ways ingenious they are able to safe in solving warmth or noise concerns.

On July 13, 2021, I posted this Twitter thread presenting about a charts I had set up collectively by compiling 12 months value of BTC brand, network hash rate and day after day mining rewards data. Some possess said that I’m cherry picking the info, which is bullshit. I presented 12-months value of files, I did not take away any tainted data from the location. I even posted my spreadsheet and accompanying recordsdata on GitHub in a repository readily accessible for anybody to fork and regulate on the different hand they wish. I already set up the principle 12 months of historical data collectively and I would encourage anybody to avoid losing aside the work in to amplify that data situation within the event that they are making an are attempting to.

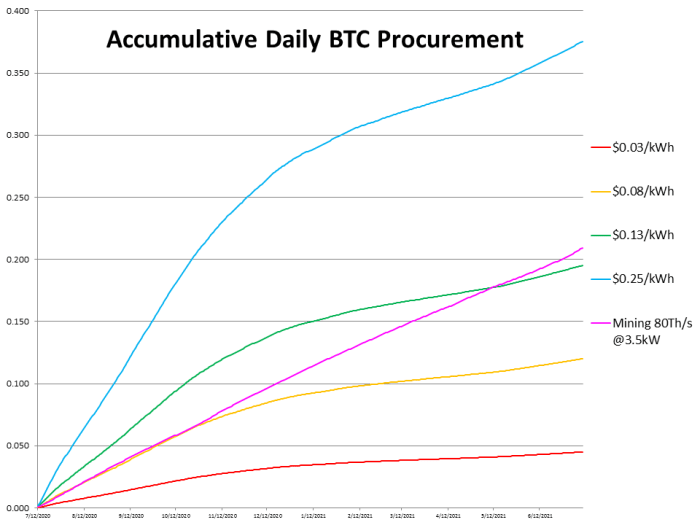

Per chance the excellent factor in making the resolution to mine at home is going to be your electrical energy rate. In my data situation, I set up four various rates collectively representing a vary of customers. The frequent rate for electrical energy within the US is $0.13 per kWh, in mutter that’s what I’m going to be specializing in basically the most. I dilapidated the specs of my comprise hardware for some baseline ASIC variables: 80 Th/s at 3,500 watts consumption. Here’s a modest setup that one may perhaps presumably also safe for roughly $5,000 or 0.125 BTC in these market prerequisites.

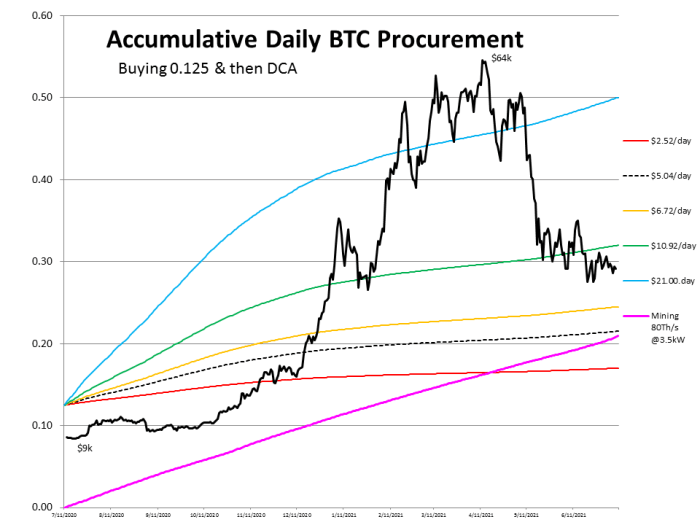

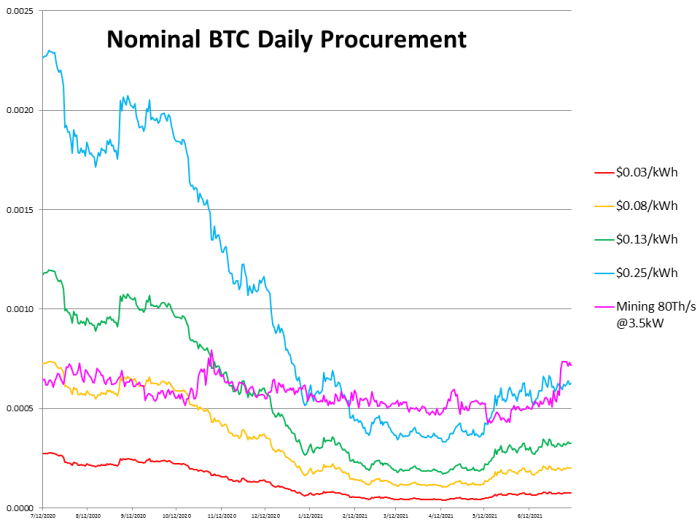

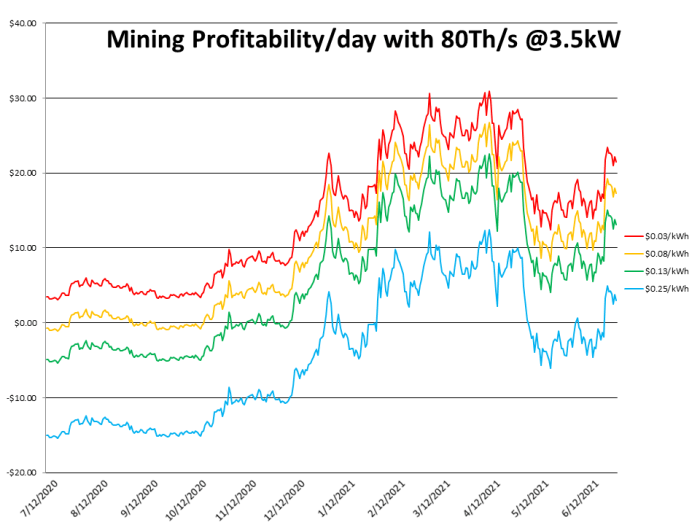

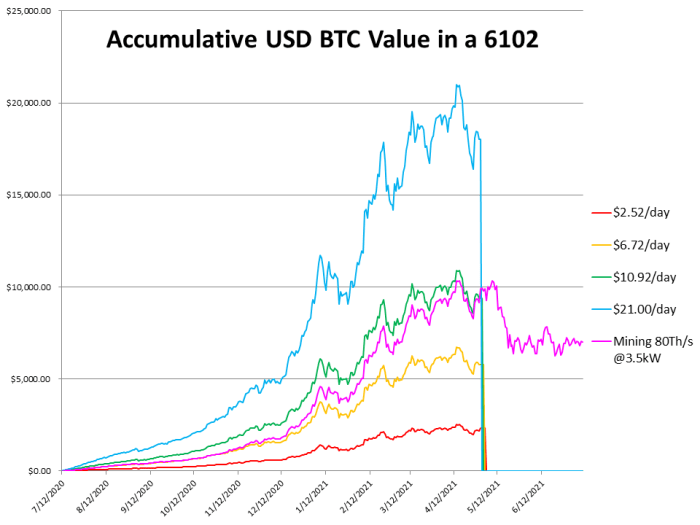

I may allotment with you four charts that I made the usage of the above data. I thought that these four charts illustrated the info critical to produce insight into basically the most pressing questions. Handiest the 2d chart accounts for the preliminary hardware brand (0.125 BTC or $5,000) my reasoning is that:

- I are making an are attempting to house the impression dollar-brand averaging has between an alternate and an electrical energy bill.

- In my brand, the upfront brand is a wash since you’re going to probably both prefer a lump sum of bitcoin with the money or use that money to take an ASIC, in both case what happens by dollar-brand averaging after the reality is what I wished to house. While you sold a lump sum of bitcoin, this can doubtlessly appropriate take a seat in cool storage anyways so I assemble no longer peek why you wouldn’t deploy that capital in mining equipment and set up your money to work. Nonetheless, for due diligence my fourth chart takes the upfront brand into fable.

The first chart displays the cumulative quantity of bitcoin you would possess stashed away must you had dollar-brand averaged the quantity paid in electrical energy versus mining straight. You would also peek that apt round 10 months into mining, you would possess surpassed the quantity of bitcoin collected in entire at $0.13 per kWh.

Had you been spending $21 per day dollar-brand averaging (the identical of paying $0.25 per kWh), then you definately would possess gotten off to a critical head birth on the origin of the year. But for the frequent U.S. home miner, playing the long sport would possess paid off.

Bitcoin is presupposed to support a individual possess a low time need, and I believe that a success miners brand this thought successfully. This chart reveals you roughly how long it would take to safe your return on investment (ROI) must you deploy some quantity of bitcoin to bag an ASIC. For instance, must you had spent 0.125 BTC to take your ASIC, then after about seven months you would possess earned your bitcoin support. After that point, you’re working an ASIC that’s paid for and accumulating more bitcoin than you would possess had within the principle situation must you had appropriate sold a lump sum and then stopped accumulating.

The crucial takeaway for me from this chart is the postulate that, more probably than no longer, you’re appropriate going to be retaining your bitcoin in cool storage for the foreseeable future anyway. Why no longer set up some of that capital to work in a capacity that will return the investment in roughly one year, plus offer you the hardware critical to then amplify your holdings? Many S9 Antminers are calm working profitably to this hide day, five years after being deployed. It is miles an cheap assumption that this day’s fresh technology of ASICs will additionally be working profitably successfully into the following subsidy epoch.

The 2d chart takes the principle chart into fable and additionally displays the upfront hardware brand. Special as a consequence of of @6102bitcoin for encouraging me to crash this explicit chart, I believe right here’s the more plan capacity. The assumption right here is that must you had a lump sum of cash, roughly $5,000, you’re going to both prefer 0.125 BTC with it or you’re going to prefer an ASIC. This chart reveals the outcomes over the closing year must you had started with 0.125 BTC and then besides dollar-brand averaged an identical quantity you would had been paying in electrical energy to bustle the ASIC. You would also peek the trend line for mining starts at zero since you would possess spent your money on the ASIC rather than bitcoin, whereas the different trend traces birth at 0.125 BTC.

First and main study, over the closing 12 months, if your electrical energy rate modified into as soon as bigger than $0.06 per kWh, then you definately would had been greater off shopping for 0.125 value of bitcoin and then dollar-brand averaging an identical quantity that you just would had been spending on electrical energy.

Nonetheless, I believe it is some distance great that the mining trend line is closer to being linear as mining accumulates a more fixed quantity of bitcoin. In comparison with the DCA trend traces, they are more vertical whereas the value of bitcoin is lower since you safe more for your money, nonetheless they birth to flatten out because the value of bitcoin will enhance as a consequence of you safe much less for your money. Again, this all comes all the manner down to what you imagine lies ahead for the value of bitcoin and the network hash rate. Finally, I imagine the trend line for mining will intersect and surpass the total DCA trend traces. But must you pay more than $0.06 per kWh, that will perhaps presumably also take more than a year according to the closing 12 months of files.

One other crucial consideration to imagine whereas having a explore at this chart is that the ASIC hardware brand is closely tethered to the value of BTC. For instance, a Whatsminer M31S+ bought in December 2020 quadrupled in charge by April 2021. If the value of BTC goes up, then your asset appreciates in charge and if the value of BTC goes down, then your day after day mining rewards tend to lag up as other mining operators lag offline and hash rate decreases.

The third chart reveals the quantity of bitcoin you would possess collected day after day had you been spending your money dollar-brand averaging versus paying the electrical energy to bustle an ASIC. For instance, what would safe you basically the most bitcoin, DCA with $10.92 per day or pay $10.92 per day in electrical energy? You would also peek that for roughly the principle quarter of the year, you would had been stacking more BTC by appropriate shopping for at an alternate.

But that modified round mid-November 2020 when mining at $0.13 per kWh would had been breaking even with the DCA capacity. What came about mid-November 2020? The brand of BTC broke $16,000 and the network hash rate modified into as soon as round 125 Eh/s. By mid-December, when BTC broke $20,000 and the network hash rate modified into as soon as calm round 125 Eh/s to 130Eh/s, mining at $0.13 per kWh began to become more a success than breakeven. Which implies that by dollar-brand averaging with an alternate, you would had been getting much less bitcoin for your money.

Nonetheless, by the usage of that same quantity of cash to pay for the electrical energy, you would be getting more bitcoin.

One process of getting a explore at right here’s: At $0.13 per kWh, you’re going to atomize even mining as long as BTC stays above $15,000 and the network hash rate stays beneath 135 Eh. Name me bullish, nonetheless I assemble no longer think BTC is going support to $15,000, nonetheless I enact think the hash rate will surpass 135 Eh/s. So, even though the hash rate spiked from there to 250 Eh/s, then as long because the BTC brand held $28,000, you would calm be breaking even by mining.

Beget you if truth be told think that if Bitcoin shattered or no longer it is all-time-excessive hashrate of 197 Eh/s by one other 21% that the value of BTC would be beneath $28,000? I believe that’s a stable margin of error and I’m placing my bets that the value doesn’t fall beneath $15,000 or that the hash rate spikes above 250 Eh at some point of the the leisure of this 6.25 BTC subsidy epoch.

The fourth chart displays the USD charge profitability of mining according to kWh rate. You would also peek that from February thru Could also, when BTC modified into as soon as procuring and selling above $35,000, even paying $0.25 per kWh modified into as soon as a success. On the head you would had been paying $21.00 per day in electrical energy nonetheless earning about $33 in bitcoin. There were parts within the closing year whilst you would had been earning $3 in BTC for every $1 you spent on electrical energy at $0.13 per kWh. Take into fable that: On the U.S. common electrical rate you would had been accumulating bitcoin at 66% beneath market brand.

To recap my important parts accomplish that share according to a modest single 80 terahash (Th) ASIC and paying the U.S. common $0.13 per kWh:

- Network hash rate may perhaps presumably also climb to 250 Eh and you would calm be a success mining as long as BTC held $28,000. Or if BTC fell to $15,000, then as long because the network hash rate stayed beneath 135 Eh, then you definately would calm be breaking even.

- I’m placing my bets on the network hash rate no longer breaking 250 Eh and the value no longer losing beneath $15,000.

- Why no longer set up some of your capital to work must you’re appropriate going to elevate it in cool storage anyway? Fetch an ASIC, safe your ROI after about a year and then possess that nominal number increasing.

- No one can pronounce that DCA is the excellent accumulation capacity. But by doing it thru your electrical bill, you may perhaps safe bitcoin for a tall percentage beneath market brand whereas avoiding KYC.

- While you are taking upfront hardware prices into fable, you may perhaps be greater off appropriate shopping for bitcoin must you pay more than $0.06 per kWh within the halt to term. Nonetheless, I believe mining is a protracted sport and must you’re by it, then it is some distance greater than auto-DCA for a call of causes previous appropriate the buildup of discounted bitcoin, such because the dearth of KYC possibility, enhanced privacy and the fact that mining is permissionless.

One other crucial consideration: There isn’t the kind of thing as a KYC keen with mining at home. Here is an instance of the accumulative USD charge of custodial BTC in a 6102-style match:

Auto-DCA products and services use KYC and possess custody of your bitcoin except you withdraw to your comprise pockets. You would also be censored from gaining access to your bitcoin overnight in that divulge of affairs. Even must you withdraw your bitcoin to your comprise custody, it is some distance calm associated to your identification as a consequence of of the KYC. In a adverse, 6102-style match, you would possess a target in your support if taking self custody.

There are products and services that offer automatic withdrawals to your comprise Bitcoin pockets, which is a beautiful birth for self-custody. The notify is that these products and services require KYC which irrevocably attaches your identification to a bitcoin take. Simply having custody of your bitcoin will no longer stable guard you from a adverse 6102-style match. Mining at home is impervious to this possess as there is no KYC keen.

How To Fetch Started Mining Bitcoin From Dwelling

While you’re drawn to studying more about mining non-KYC bitcoin at home, you may perhaps presumably also uncover the total data you wish by reading Diverter’s files: “Mining For The Streets” or my files “Dwelling Mining For Non-KYC Bitcoin.”

Sourcing: Initiate by procuring for classified ads within the Telegram channel “Hardware Market Verified Listings.” The sellers who put up right here possess given their identification to the channel admin. Here’s no longer a silver bullet in opposition to scammers, nonetheless it surely is a beautiful birth. While you may perhaps presumably also possess any hesitations, attain out to someone handle myself or Diverter or RoninMiner for recommendation.

While you uncover an ad for one thing you wish to possess, assemble no longer hesitate as a consequence of there is a minimum sigh quantity (MOQ). Contact the vendor and safe on their radar. Many sellers will consolidate little orders to achieve their MOQ. While you strike a deal, be affected person, this can probably take a month or longer from the time you submit your charge except your hardware arrives.

Air lag along with the accelerate: ASIC’s invent various warmth and you’re going to need to enact one thing with it, otherwise you’re going to warmth up the location that the ASIC is in and it may perhaps presumably no longer bustle if it overheats. It is main to take into fable the capacity you’re going to present sufficient ventilation.

Some folks strive to take this warmth to use in warming their properties and there is no shortage of ingenious solutions that shall be aware right here. For myself, I made up my mind to drag frigid air in from initiate air and appropriate vent the hot air support out thru a detailed by window. I additionally installed an inline duct fan to support possess the air attractive.

Noise: ASIC’s are loud — very, very loud. The ASIC I’ve been the usage of for an instance listed right here will most probably be round 95 decibels (dB). For reference, that’s roughly as loud as having a lawn mower working in your living room.

So, you wish to crash careful considerations referring to the capacity you’re going to cope with these noise phases… these 24/7 fixed noise phases. While you may perhaps presumably also possess a family, their sanity is at stake, so realizing fastidiously. While you may perhaps safe even a 10 dB attenuation, this can crash the total incompatibility on this planet. Here’s more uncomplicated to enact than you may perhaps presumably also think, it will most probably be accomplished by building an easy enclosure that also permits for sufficient ventilation or by installing your ASIC in a basement or garage. For my setup, I constructed an enclosure out of plywood and medium-density fibreboard (MDF). Take into fable the usage of fire-rated provides as an alternative must you are taking to lag this route.

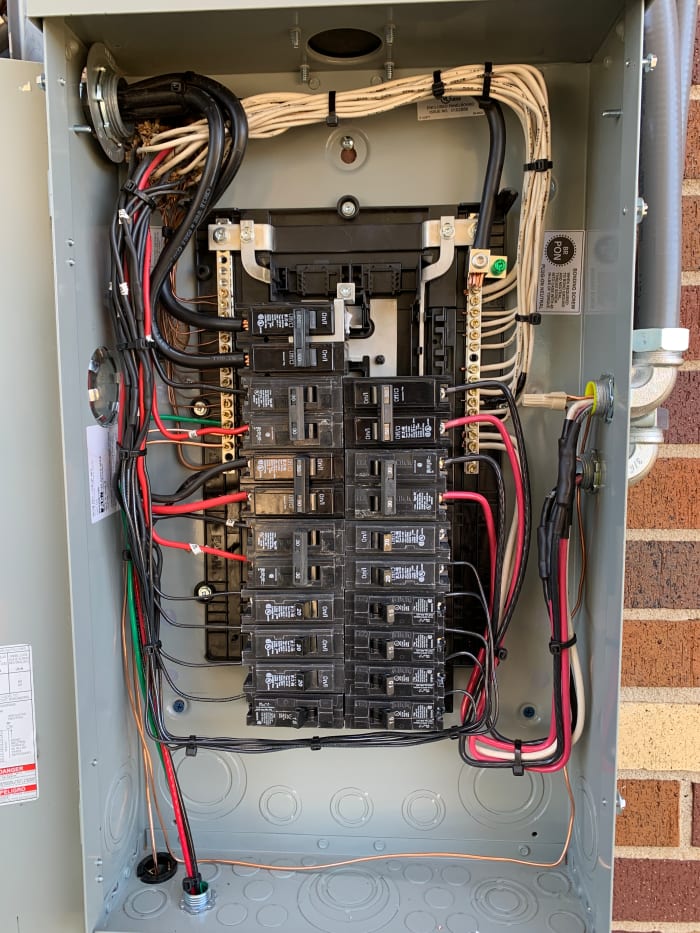

Electrical: Make sure you may perhaps presumably also possess the appropriate electrical infrastructure ready to lag for your fresh hardware. These ASICs need 240 volt energy sources and one ASIC will pull roughly 15 amps. For instance, must you wish to need to bustle two 80 Th ASIC’s at 3,500 watts every, guarantee that that you just may perhaps presumably also possess no longer no longer as a lot as a 30 amp dedicated circuit bustle in 8 American wire gauge (AWG) terminated to two outlets, on the entire with NEMA 6-20 receptacles.

Now, must you assemble no longer possess any thought what I appropriate said, that is probably to be a critical indicator that or no longer it is time to call a licensed electrician. They assemble no longer appear to be as costly as you may perhaps presumably also think and no quantity of bitcoin is value the safety of you and your loved ones.

Pool: By connecting to a mining pool, you’re going to be combining your hash energy with that of many other miners and collectively, the full lot of the pool’s hash energy is dilapidated to work in a coordinated effort in solving for a block.

You technically can bustle a solo miner along with your comprise node or with CK Pool. The downside is that must you enact no longer uncover a block, then you definately enact no longer safe any rewards. But must you doubtlessly did uncover a block then you definately would safe 98% of the block subsidy (6.25 BTC) plus the transaction charges mining with CK Pool. For instance, on June 3, 2020, a single 50 Th S17 mined a block solo. In my thought, I joined Slush Pool and consistently stack mining rewards day after day because the pool finds blocks.

Connecting to a pool is the very best share about all of this. You toddle your ASIC into energy, join it to the gain with an Ethernet cable, then initiate a web browser in your local network and log into your ASIC with the IP handle, roughly handle the capacity you log into your own home router. Once logged in, simply replica/paste the pool URL in your miner’s configuration online page and that’s the reason it, you’re accomplished.

Then you may perhaps log into your pool’s dashboard to monitor your miner’s save aside and input the Bitcoin handle you wish to possess your funds deposited to. I suggest updating your Bitcoin deposit handle normally and no longer reusing it. Slush Pool, as an example, doesn’t require any identifying data as antagonistic to an electronic mail handle to situation up an fable. Be responsive to this looming possibility posed by creeping KYC regulations, Slush Pool provides its detailed standpoint on present events in this Twitter thread.

Conclusion

I’m bullish on mining non-KYC bitcoin at home. Or no longer it is no longer equivalent to you’re making an are attempting to compete with institutional mining operations. You is probably to be appropriate making an are attempting to DCA thru your electrical bill.

I believe that nearly all of parents can mine bitcoin at home profitably. There may be a wide vary of margin the save aside mining will continue to be a success, even for home miners on residential electrical rates. Mining at home is safer and more non-public than the usage of a KYC provider to derive bitcoin.

I’m hoping that this article has given you some insight into basic Bitcoin events this year as they picture to mining and one of the critical top ways this has affected the landscape. I cannot sigh you if mining is apt for you or no longer, that is probably to be a resolution you should attain at in your comprise. I even possess tried to avoid losing aside collectively as noteworthy data as I will and offer my standpoint on it in mutter that you just may perhaps crash a more instructed resolution for your self.