Bitcoin has a prolonged design to pass on this bull market, and the remainder of the year appears sparkling.

Despite bitcoin’s meteoric upward push of over 550% this year, on-chain prognosis paints an image of it unruffled being early within the sport. Why? Three phrases: Coin Days Destroyed (CDD).

Nowhere Advance The High This Year

By assessing CDD, we are succesful of visualize the boldness amongst prolonged-term bitcoin holders relative to essentially the most up-to-date trace of bitcoin.

To compile how CDD works, let’s inaugurate up with coin days.

What Is A Coin Day?

Coin days are the sequence of days since a bitcoin became once moved over from one pockets to 1 other. The logic on the help of them is to set the next worth to an indolent coin. Why? On yarn of prolonged-term bitcoin holders compile greater files of market cycle volatility and thus are more proficient at identifying the one cases to spend or promote.

So when prolonged-term holders promote their bitcoin, the Coin Days Destroyed will surge greater. When solid fingers make a selection, CDD traits lower which implies their self assurance in a fresh bull market.

What Are Coin Days Destroyed?

Coin Days Destroyed is a term for when bitcoin that’s been sitting in a pockets—accruing coin days—is all of a surprising equipped, causing these coin days to be “destroyed.” Importantly, bitcoin is no longer genuinely destroyed. CDD is merely terminology that calculates the time erased.

Right here’s an instance: Have in mind an investor purchases 1 bitcoin and holds it in their pockets for 90 days, then sees a mountainous magnify within the worth and decides to promote. He would compile “destroyed” 90 bitcoin days.

When investors are amassing (and few feeble coins are spent), Coin Days Destroyed will constructing downwards. All the design thru late-stage bull markets, feeble coins generally are more and more spent and can lead to a spike in Coin Days Destroyed.

The implausible thing about this draw: It weighs less on the job of non eternal traders. Since these traders don’t make a selection bitcoin for prolonged, their impact on Coin Days Destroyed will likely be minimal as in comparison to the activities of prolonged-term traders.

However, when prolonged-term holders are beginning to promote their bitcoin, it’s worth being attentive to.

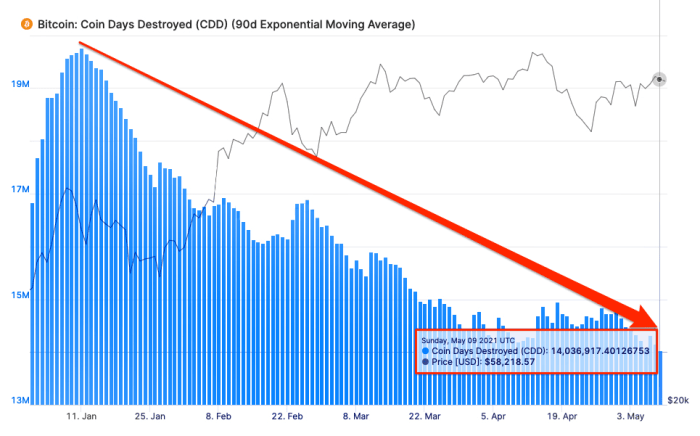

When we watch at these primary metrics, it appears that bitcoin is nowhere shut to its excessive this year. Bitcoin is now over $40,000 nonetheless the 90-day transferring average for Coin Days Destroyed is shut to its lowest stages. See the chart below:

The decline in Coin Days Destroyed reveals that feeble fingers are stronger than ever amid the worth magnify.

How Is CDD calculated?

Coin Days Destroyed is calculated by:

- The sequence of bitcoin in a transaction

- Multiplied by the sequence of days since these coins had been final spent.

The “destroyed” allotment comes into make when it’s removed on receipt. Over again, it design the coins held for prolonged classes of time will lift more weight in CDD.

This on-chain metric reveals the burden of the solid fingers versus the non eternal speculators.

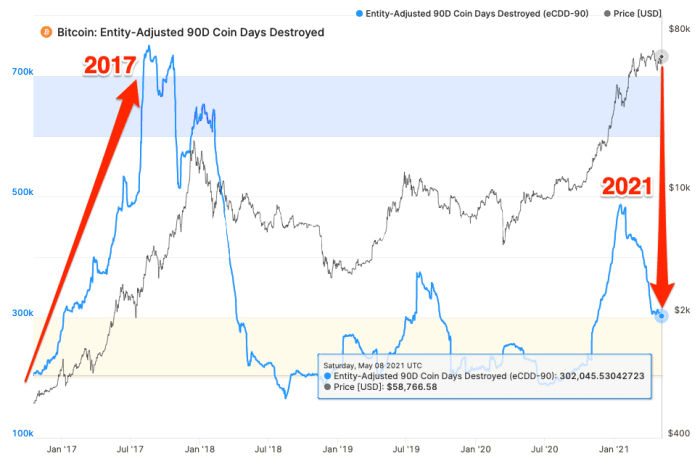

Per chance the most up-to-date sequence of Coin Days Destroyed is design lower than the 2017 trace top. So, for that reason fewer extinct fingers are promoting than within the previous bull cycles.

Inquisitive relating to the Bitcoin network is now 12 years feeble and essentially the most up-to-date BTC offer has already appreciated, it’s telling that solid fingers are no longer promoting their holdings. This implies that the market top is nowhere shut to our most up-to-date trace.

What’s more, the upper quiz from institutional investors would per chance maybe be the major power on the help of this most up-to-date surge in prolonged-term self assurance from extinct holders.

In April, Constancy Investments, with $10.3 trillion in property below management, launched an analytics platform succesful of on-chain Bitcoin files visualization for its institutional purchasers called “Sherlock.” Wells Fargo is furthermore making ready to embrace bitcoin investing, because it proclaims this is succesful of also offer an actively managed cryptocurrency product.

These strikes by excessive-profile asset management firms underscore the upward push of institutional investors who’re banking on the prolonged skedaddle impart in Bitcoin.