For potentially about two years now, it has been on the entire current within the cryptocurrency community that “BTC is an fair asset class,” which demonstrates that the first cryptocurrency performs properly as an investment instrument that hardly correlates with the industrial cycle and isn’t even connected with assorted asset lessons. On August 18, 2020, CoinShares even launched a entire file on this, which mainly talked about the inability of correlation between bitcoin and commodities and ragged shares.

But what about the correlation with the U.S. Buck Currency Index (DXY)? Max Keiser became once one amongst the first to blueprint our attention to bitcoin’s negative correlation with the U.S. dollar. In assorted phrases, when the U.S. dollar rises, then, as a rule, BTC tends to tumble. I’ll also add that there might be hardly a positive correlation between BTC and the U.S. dollar.

Restful, if there might be a positive correlation, it carries medium- and prolonged-term risks for a procure upward pattern in bitcoin.

Examples Of Hostile Correlation Between BTC And DXY

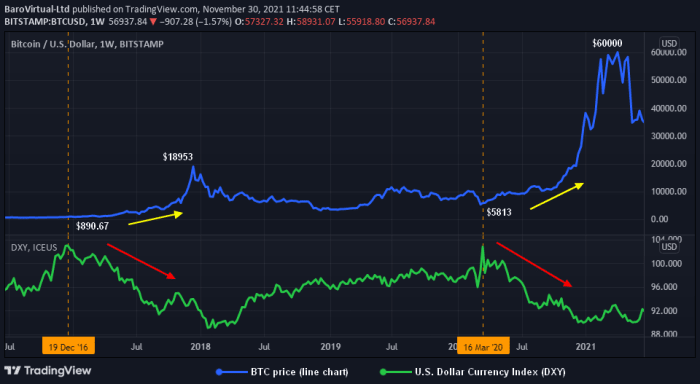

In the chart above, we are in a position to take into chronicle that the downtrend within the U.S. dollar, which began on December 19, 2016, at $103.10, led to a pointy upward push within the mark of BTC from $890 to $18,953, while the U.S. dollar fell to $89 by January 22, 2018. A an analogous divulge became once noticed on March 16, 2020, when the U.S. dollar entered a brutal downtrend due to the the U.S. monetary executive institutions’ not-entirely-rational monetary coverage.

These two examples completely veil the traditional inverse correlation arrangement between bitcoin and the U.S. dollar. These need to not the correct examples of this assertion; that you might well simply ranking assorted earlier examples thru a buying and selling charts provider.

Examples Of Certain Correlation Between BTC And DXY

As that you might well take into chronicle from the chart above, a positive correlation results in on the least uncertainty and at most wild turbulence, including well-known bearish corrections.

In the extinguish, the perceptible strengthening of the U.S. dollar between January 22, 2018, and March 16, 2020, had a extraordinarily negative impact on the express of bitcoin. In actuality, it sounds as if the lessons marked on the chart had been potentially a pair of of the worst milestones in bitcoin history, such as the first “crypto chilly weather” of 2013 to 2015, as retail patrons suffered gargantuan losses within the first build, compatible admire assorted groups of traders.

Now, working out from historical examples that the correlation between bitcoin and DXY exists, it is definite that this correlation if truth be told desires to be significantly monitored. Let’s switch on to the components within the abet of the original strengthening of the U.S. dollar, which carries medium- and prolonged-term risks to the outlook of bitcoin’s mark cycle.

The Present Speak Of Bitcoin And DXY

First, let’s explore on the technical image of the correlation of the conception of as property and select what maintain of correlation is noticed compatible now.

The chart above reveals the 2nd positive correlation between the U.S. dollar and bitcoin this year, which carries many risks for bitcoin.

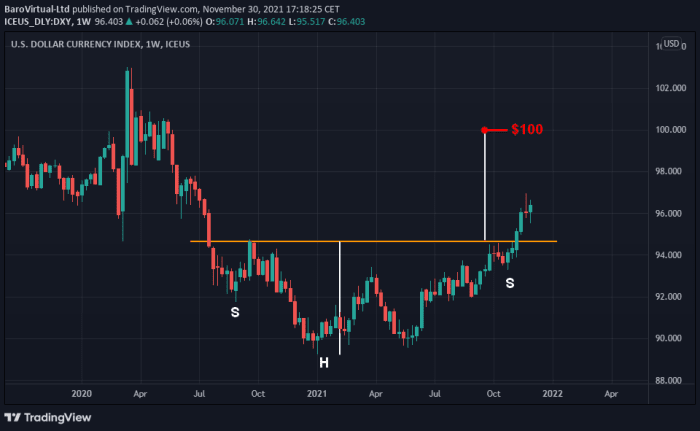

From Might maybe perchance seemingly 25 of this year, the U.S. dollar began an everyday upward pattern all the arrangement thru the framework of a roughly gathered consolidation from November 6, 2020, to September 3, 2021. At some stage within the framework of this consolidation, there became once also the first native positive correlation, which led to the collapse of bitcoin to the general negative indicators of an impending correction on April 14, 2021. Additionally, the U.S. dollar has successfully overcome the resistance at $94.895 and has successfully consolidated above it, i.e., the DXY is unruffled bullish.

Three key components toughen the bullishness of the U.S. dollar, nonetheless with the functionality to hurt bitcoin for the foreseeable future:

1. Bullish formation on the DXY weekly chart:

The a success implementation of this pattern can bring very incorrect surprises to bitcoin, as skilled patrons will weaken their positions in all unstable property, obviously, which might well be BTC. A a success breakout of the $100 tag will lead to a extra severe reduction in prolonged positions in bitcoin and its derivatives, including ragged shares tools on BTC.

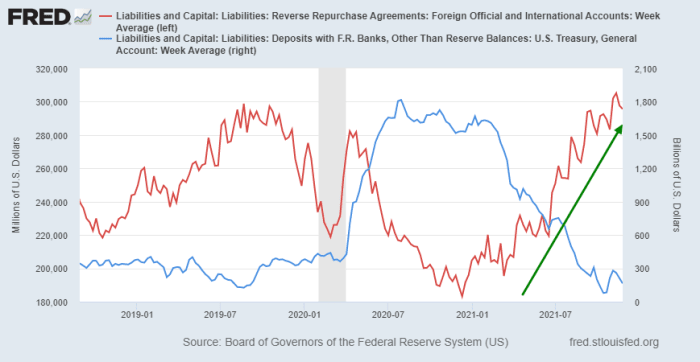

2. The need of transactions of international people with the U.S. dollar:

Day after day repurchase agreements (REPOs) for non-residents (brown line) has an upward pattern, suggesting that the U.S. dollar is unruffled demanded. I maintain that right here’s the major component supporting the bullish sentiment of the U.S. dollar compatible now.

3. The express of dollar liquidity within the worldwide market:

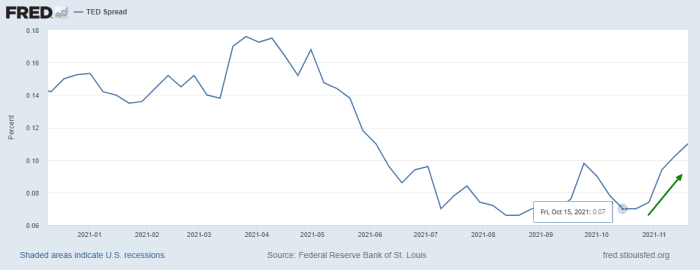

The TED spread shows the demand for dollar liquidity within the worldwide market in London, U.K. (LIBOR).

As that you might well take into chronicle within the native size, starting from October 15, 2021, this indicator is increasing, which signifies an everyday demand for the dollar from international avid gamers, who’re now profitable in declaring the strengthening of the U.S. dollar. This temper prevails among international people, including for the reason that Federal Reserve, following a gathering on November 3, 2021, diminished the quantitative easing (QE) program, which, among assorted issues, harms bitcoin within the medium- and prolonged-term point of view.

I’d also raise to blueprint your attention to the truth that a recent stress of COVID-19 might well maybe moreover disrupt the Fed’s plans to gradual down the “printing press.” Since a selected fragment of the expansion of the U.S. dollar became once basically based, among assorted issues, on the expectations that the Fed will lag the tempo of the stimulus program winding down, such negative info might well maybe moreover reason particular uncertainty to maintain.

To summarize, it desires to be acknowledged that I wouldn’t desire you to safe the affect that the arrangement we reviewed works 100% and with out failures. I need to lift to the community that the historical info of a particular asset and the suggestions for comparing them is unruffled of wide price. In this regard, now we absorb to watch the correlation between bitcoin and the U.S. dollar, since this enables us to form a roughly defensive response design to present protection to our investment (buying and selling) positions.