Motive to belief

Strict editorial protection that specializes in accuracy, relevance, and impartiality

Created by industry consultants and meticulously reviewed

The ideal requirements in reporting and publishing

How Our News is Made

Strict editorial protection that specializes in accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

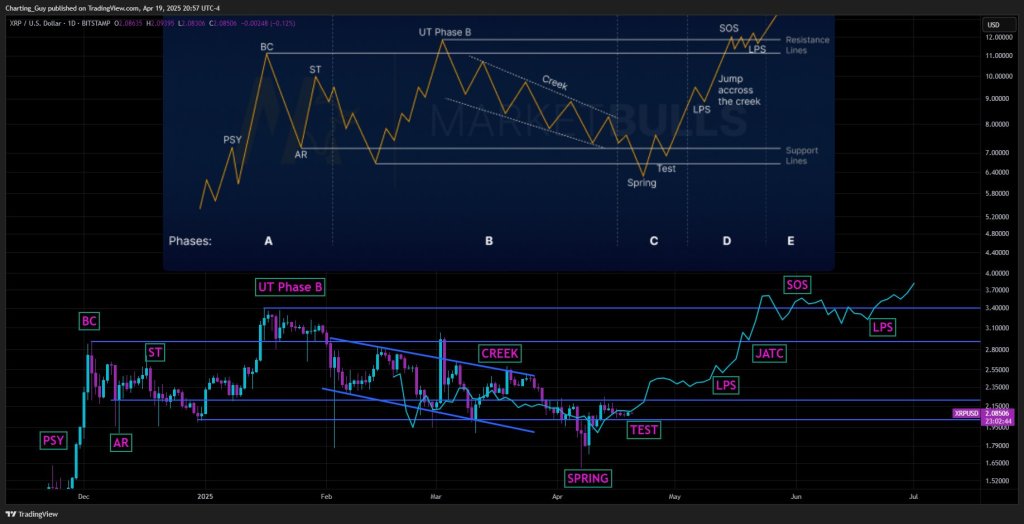

Crypto analyst Charting Man (@ChartingGuy), posting to X on April 20, has mapped the day-to-day XRP/US Greenback chart on Bitstamp onto a textbook Wyckoff re‑accumulation schematic and argues that the sample is now a long way ample evolved to indicate a summer season markup in the direction of— and potentially beyond— the $3.70 space.

“Wyckoff Pattern Ignites XRP Bull Case

The chart spans the 5‑month rotten that started with preliminary offer (PSY) in tiresome November. A vertical surge carried designate staunch into a $2.68 Buying Climax (BC) in early December, at once followed by an Computerized Reaction (AR) that washed support to roughly $1.90, anchoring the decrease boundary of what would develop into the Portion A procuring and selling vary. A Secondary Take a look at (ST) in mid‑December revisited the $2.72 zone, finishing Wyckoff’s preliminary “quit‑motion” sequence.

Portion B unfolded through January: question rebuilt, producing an Up‑Thrust (UT) in Portion B that temporarily pierced $3.40 in mid January earlier than offer re‑asserted itself. From that prime XRP traced a descending, low‑perspective channel—labelled the “Creek”—with gradually decrease highs and lows into early April. One day of this descent, Charting Man’s overlay shows the familiar noticed‑tooth of Wyckoff’s inner trying out, suggesting frail‑hand distribution as a substitute of correct distributional topping.

On April 7 the market below‑nick vary toughen, knifing to about $1.61, and at once snapped support: the everyday Spring of Portion C. A shallow Take a look at of the spring followed shut to $2.00, fulfilling Wyckoff’s requirement for bullish affirmation. From that time the analyst’s projected direction turns better.

Portion D begins with what Wyckoff called Final Level of Increase (LPS) between $2.35 and $2.55 in early Might perhaps, followed by a steeper attain that drives throughout the February crest. Here’s followed by a Soar Across The Creek (JATC)—a decisive thrust throughout the descending channel prime and horizontal resistance at roughly $2.70.

The model then shows a designate breakout above the mid-January excessive at $3.40 would constitute the Signal of Energy (SOS) spherical $3.40 in tiresome Might perhaps, finishing the transition into Portion E. Afterwards, Charting Man expects a 2nd backing up staunch into a most major Final Level of Increase (LPS) between $3.10 and $3.30 in mid-June, followed by an even steeper attain.

In Portion E the schematic quickens, taking XRP into the $3.70 space by early July—an honest that sits one tick above the $3.40 resistance band on the analyst’s designate axis. With the position rate at $2.12 at publication time, the roadmap implies a capacity upside of shut to 74% over the subsequent two and a half of months.

Nonetheless, Charting Man cautions that “this doesn’t indicate up‑solely now—timing also can very successfully be rather off,” underscoring Wyckoff’s probabilistic nature. Nonetheless, the meticulous alignment of staunch‑world designate motion with the classical re‑accumulation phases—total with labelled PSY, BC, AR, ST, UT, Spring, Take a look at, LPS, JATC and SOS—adds weight to the bullish case. If the market respects these technical milestones, XRP would perchance likely rapidly be working with prices no longer viewed since the ideal cycle’s peaks.

At press time, XRP traded at $2.11.

Featured image created with DALL.E, chart from TradingView.com

Disclaimer: The records found on NewsBTC is for academic purposes

solely. It does no longer signify the opinions of NewsBTC on whether to aquire, promote or maintain any

investments and naturally investing carries dangers. You must likely be told to conduct your have

research earlier than making any investment choices. Exercise recordsdata equipped on this online page

entirely at your have risk.