The below is from a contemporary edition of the Deep Dive, Bitcoin Journal’s top payment markets publication. To be among the many first to score these insights and a quantity of on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

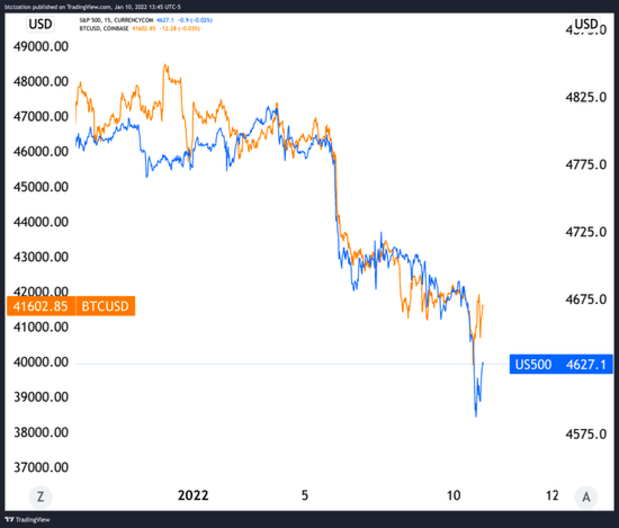

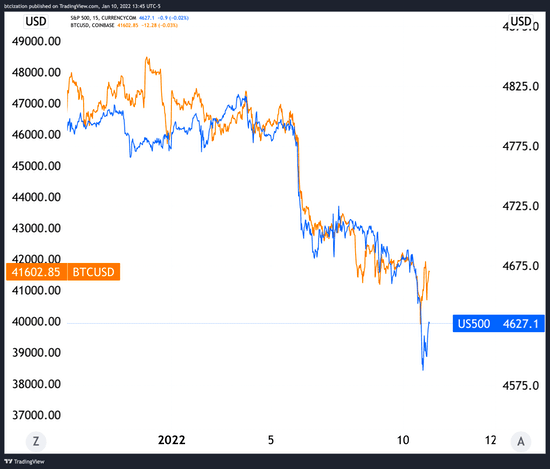

The 2 sources devour been shopping and selling in a extraordinarily correlated vogue for the explanation that commence of the original twelve months. With the stock market start this morning, every sources sold off in tandem, with bitcoin bouncing first with equities following, which serves as a strong mark for bitcoin investors.

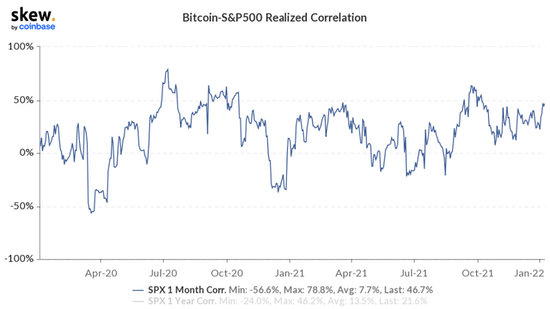

Currently the rolling one-month correlation between the 2 sources is +46.7%.

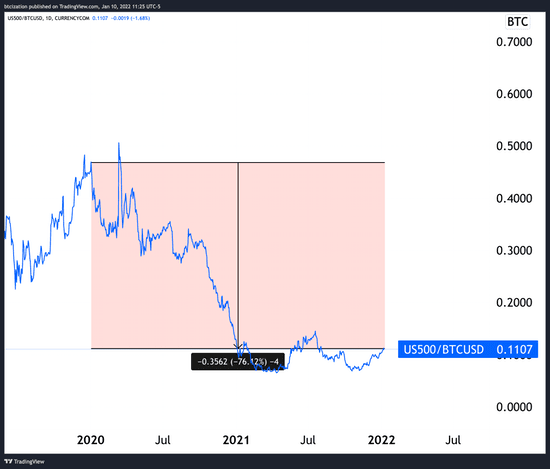

No topic the mostly determined correlation between the 2 sources over the last 24 months, the S&P 500 is down by 76% in BTC phrases for the explanation that commence of 2020.

Merchants across the equity and crypto markets are conserving a stop test on the upcoming CPI print this coming Wednesday, with the original prediction quantity at 7.1% twelve months over twelve months. The consensus is that the market’s selloff off in inflation is accessible in stronger than the predicted resolve, with better relative inflation which procedure elevated rigidity for the Fed to hike charges in 2022.