Environmentalists narrate Bitcoin makes use of too principal energy. The area can’t rating the money for it. It’s not worth it. That’s what they narrate. So, it must be accurate. Or must it? Within the event you’re reading this, you’re doubtlessly conscious of the smartly-liked anti-Bitcoin “energy per transaction” account. You’ve considered it in a few fundamental media publications. It goes one thing treasure this:

“In step with Digiconomist, a single bitcoin transaction makes use of the an analogous quantity of energy that the sensible American family consumes in a month — which equals roughly a million instances extra in carbon emissions than a single bank card transaction. And globally, the carbon footprint of bitcoin mining is greater than that of the United Arab Emirates and falls lawful underneath the Netherlands.”

–”Environmentalists Sound Fear At US Politicians’ Embody Of Cryptocurrency,” The Guardian

The Bitcoin community does indeed use a few energy to supply permissionless security and, in narrate to relief minority user rights, that energy is highly atmosphere pleasant. Alternatively Digiconomist’s “energy per transaction” metric, which compares Bitcoin to retail fee suppliers and is in total mature in the media, is an invalid comparison. Journalists and columnists are popularizing an intellectually dishonest metric that is deceptive at simplest and a inform-subsidized attack at worst.

“Vitality Per Transaction” Is Deceptive

First, let’s glance why the “energy per transaction” metric is deceptive. Cambridge College’s Centre for Different Finance explains:

“The smartly-liked ‘energy designate per transaction’ metric is over and over featured in the media and diversified academic reviews no topic having extra than one points.

“First, transaction throughput (i.e. the quantity of transactions that the machine can route of) is self sustaining of the community’s electricity consumption. Adding extra mining equipment and thus growing electricity consumption will don’t have any affect on the quantity of processed transactions.

“Second, a single Bitcoin transaction can comprise hidden semantics that is presumably not straight away considered nor intelligible to observers. As an illustration, one transaction can encompass a total bunch of funds to person addresses, resolve 2d-layer community funds (e.g. opening and closing channels in the Lightning community), or doubtlessly represent billions of timestamped data functions the utilization of open protocols similar to OpenTimestamps.”

The confusion stems from the indisputable fact that Bitcoin is a closing “money” settlement layer without the need for a trusted event. Excessive-performance retail funds networks, treasure PayPal or Visa, manufacture not offer closing settlement between banks — they’re credit-essentially based systems that rely on a financial nefarious layer of central banks, which may presumably perchance well be backed by militaries, for closing and irreversible settlement. The truth is all legacy retail funds systems, including ragged banking, are layered on this variety.

Bitcoin completely replaces the categorical-time nasty settlement (RTGS) nefarious layer of central banks with a global and neutral financial settlement community.

“One Bitcoin transaction… can resolve hundreds of off-chain or shut to-chain transactions on any of these third-event networks. Exchanges and custodians may presumably perchance even seize to resolve up with every diversified as soon as a day, batching a total bunch of hundreds of transactions into a single settlement. Lightning channels may presumably perchance even resolve actually millions of funds into a single bitcoin transaction with a channel closure.

“This isn’t lawful speculative. It’s happening at the original time. As Fedwire’s 800,000 or so every day transactions demonstrate shrimp about the entire funds volume supported by the community, Bitcoin’s 300,000 every day transactions and 950,000 outputs manufacture not uncover the entire epic.”

–“The Frustrating, Maddening, All-Entertaining Bitcoin Vitality Debate,” Nic Carter

If one desires to accurately evaluate fee systems, the media and teachers must be comparing Bitcoin to the transactions of central bank RTGS systems — and encompass the affect of the militaries and institutions that legitimize them. Bitcoin is most accurately when compared with Fedwire in the usa and TARGET2 (the successor to TARGET) in the Eurosystem. Retail fee systems can and may presumably perchance perchance gentle fling into Bitcoin the an analogous system they manufacture with permissioned inform-subsidized systems.

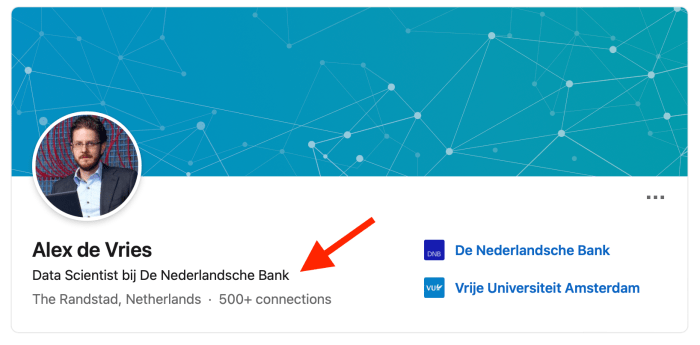

This brings us to where the “energy per transaction” metric originates and why it has the appears like of a inform-subsidized attack on Bitcoin, that the media seems all too concerned to propagate. The “energy per transaction” metric became devised by Alex de Vries, an employee of De Nederlandsche Monetary institution (DNB) — otherwise identified as the Dutch Central Monetary institution. De Vries publishes the Digiconomist net pages. De Vries’s work for DNB specializes in financial financial crime.

As such, de Vries is effectively a paid opposition researcher for a central bank RTGS machine that competes with Bitcoin. It’s no shock that de Vries and his employer may presumably perchance well be antagonists of Bitcoin — his establishment’s future is dependent on Bitcoin not succeeding. Neither he, nor a few the journalists that cite him, over and over expose this battle of curiosity.

Source: LinkedIn

De Vries first fashioned a relationship with the Dutch Central Monetary institution in June of 2016, when he spent a year there as a data scientist. At the time, his Digiconomist net pages did not conceal Bitcoin’s environmental affect wide.

On November 26, 2016, halfway by strategy of his one-year employment with DNB, de Vries introduced his “Bitcoin Vitality Consumption Index” as a brand original share on his net pages and integrated his discredited “energy per transaction” metric. The timing of this e-newsletter provides the appears like that the Dutch Central Monetary institution presumably supported de Vries’s anti-Bitcoin agenda.

In 2017, de Vries left DNB for PricewaterhouseCoopers (PWC), where he labored for five years while he persevered his attacks on Bitcoin. In November 2020, de Vries became rehired by the Dutch Central Monetary institution as a data scientist in its financial financial crime unit.

Within three months of de Vries’s rehiring at DNB, his spurious “energy per transaction” metric all precise now gained worldwide notoriety and became cited in practically every anti-bitcoin article and op-ed in the mainstream media. Again, the timing is particularly suspicious.

By March, Bill Gates had repeated de Vries’s claims, that have been then echoed by the media. About a weeks later, Elon Musk declared that Tesla would now not accept bitcoin as fee for automobiles, citing the an analogous specious arguments. Few gave the impression to deem about that de Vries revealed inaccurate and easily refuted data at the present.

How does a newly rehired data scientist at DNB have the time, sources and PR savvy to be featured and interviewed in practically every fundamental mainstream media e-newsletter all by strategy of the enviornment? One may presumably perchance well shock if DNB became presumably actively supporting de Vries’s worldwide media tour.

It will also gentle not be tender that central banks and their legacy RTGS systems are threatened by Bitcoin as a neutral and open global settlement layer. Their excellent opinion appears like to be paying other folks treasure de Vries to adorn the environmental affect of Bitcoin to unsuspecting readers. It’s unethical for the media to be citing his work without disclosing his financial ties to DNB.

Incomplete Comparisons

De Vries makes use of a few leer-popping statistics to shock readers, similar to making comparisons of Bitcoin’s emissions to little countries. This too is deceptive, as little countries tend to have very little energy footprints, since they on the entire outsource the majority of their energy-intensive manufacturing to diversified countries, similar to China.

It must be renowned that Cambridge College considers such comparisons to be an exercise in presenter bias:

“Comparisons are usually subjective — one can fabricate a quantity seem little or large depending on what it is when compared with. With out additional context, unsuspecting readers will seemingly be drawn to a particular conclusion that either understates or overstates the categorical magnitude and scale. As an illustration, contrasting Bitcoin’s electricity expenditure with the yearly footprint of entire countries with millions of inhabitants provides upward push to concerns about Bitcoin’s energy hunger spiraling out of relief an eye on. On the diversified hand, these concerns may presumably perchance even, not not up to to a diploma, be reduced upon discovering out that certain cities or metropolitan areas in developed countries are working at an analogous ranges.”

Converse comparisons to unrelated actions provides an incomplete characterize. A extra handsome comparison may presumably perchance well be to incompatibility Bitcoin with diversified industries.

For these attempting for a extra in-depth debunking of de Vries’s arguments, hearken to the debate between financial analyst Lyn Alden and de Vries. An casual ballottaken forward of and after the debate presentations Alden dramatically shifted the opinions of listeners from skepticism to a professional-Bitcoin stance. De Vries’s arguments did not take up to scrutiny.

Double Counting Bitcoin’s Impact

In June 2021, de Vries revealed a paper that concluded, “Subsequently, the entire carbon footprint of Bitcoin may presumably perchance well be distributed proportionally amongst merchants.” The downside is that de Vries also continues to promote his “energy per transaction” metric where the entire carbon footprint is 100% attributed to transactions. De Vries is 100% double counting Bitcoin’s emissions from merchants and miners. An easy system for him to repair this may presumably perchance well be to withdraw his inaccurate “energy per transaction” metric or form a extra coherent mannequin that divides up the impacts.

Bitcoin’s Environmental Impact Is Miniscule

There’s no such thing as a first price proof that Bitcoin’s carbon footprint without extend contributes to native weather alternate. A easy thought experiment illustrates why its affect can’t be anything extra than a rounding error:

“What may presumably perchance well be Bitcoin’s environmental footprint assuming completely the worst case? For this experiment, let’s use the annualised energy consumption estimate from CBECI as of July 13th, 2021, which corresponds to roughly 70 TWh. Let’s also take that every this energy comes completely from coal (basically the most-polluting fossil gasoline) and is generated in a single amongst the enviornment’s least atmosphere pleasant coal-fired energy vegetation (the now-decommissioned Hazelwood Vitality Put of residing in Victoria, Australia). On this worst-case downside, the Bitcoin community may presumably perchance well be accountable for roughly 111 Mt (million metric tons) of carbon dioxide emission, accounting for roughly 0.35% of the enviornment’s entire yearly emissions.”

In actuality, Bitcoin’s footprint is approximately 0.13% of entire global emissions — all all over again, it’s a rounding error. If one is mainly concerned for the atmosphere it is a total rupture of one’s time to anguish about Bitcoin and diversified rounding errors.

When de Vries promotes his exaggerated comparisons and double-accounting methodology he’s distracting the general public from trusty environmental points. It’s a distraction perpetuated by central banks, politicians and the media stores that manufacture their bidding. Placing off Bitcoin would manufacture completely nothing to serve the atmosphere — its emissions are simply too little to have any well-known affect. One may presumably perchance well deduce that the ideal other folks who may presumably perchance well be motivated adequate to uncover you otherwise have legacy institutions to give protection to and aren’t in level of fact pondering the atmosphere.

Your Vitality, Your Industry

Bitcoin provides proper utility to its customers and consumes considerably much less energy than dresses dryers in the U.S. by myself. But, when became the excellent time high-profile worldwide media coverage became consistently devoted to describing dresses dryers as an environmental grief? It’s by no contrivance passed off. It could presumably perchance well be absurd. How you take out to employ your energy is your enterprise.

The truth that participants salvage fee and convenience from dresses dryers and are though-provoking merchants of the energy to energy them — in location of line-drying their dresses for free — is all any individual desires to know.

If the energy utilization to energy Bitcoin weren’t atmosphere pleasant, the worth of transactions would upward push and would robotically deter customers from the skills. Somebody who owns no bitcoin may presumably perchance even not rating fee in its financial properties, but there are millions of parents all by strategy of the enviornment who have confidence it and rely on its fee — not simplest as a retailer of fee but to make stronger human rights. Meanwhile, Bitcoin is already dematerializing aspects of the legacy financial industry.

This day, 1.2 billion other folks are residing below double or triple digit inflation and 4.3 billion other folks are residing below authoritarianism. Other folks use bitcoin as a lifeline — similar to these in Afghanistan, Cuba, Palestine, Togo and Senegal, Nigeria, Sudan and Ethiopia and Central The United States.

As a tool that can empower billions of parents, the energy consumption of Bitcoin may presumably perchance well be not simplest justified but highly magnificent when it is leveraged to supply sturdy security for an inclusive global financial community. The energy and hidden prices to give protection to the enviornment’s fiat financial machine is considerably better spent in our on-line world with much less bloodshed. Transferring our money to a Bitcoin customary is how we unsubscribe from the legacy machine and evolve in direction of extra peace and energy abundance. The energy Bitcoin consumes is worth every watt.

Here is a guest publish by Stage39. Opinions expressed are completely their very have confidence and manufacture not necessarily focus on these of BTC Inc or Bitcoin Journal.