Bitcoin’s stamp has come down from all-time highs hit on November 10, 2021, and just a few the publicly-traded bitcoin mining stocks saw their costs tumble alongside with it. Marathon Digital Holdings (MARA) became as soon as no exception to this rule.

Corporate Mumble

Its final two earnings experiences weren’t its strongest exhibiting, but Marathon did have a solid year in 2021 overall. On January 3, 2022, Marathon launched its 2021 plump year and December updates, at the side of these critical highlights:

- Amassed 3,197 self-mined bitcoin in fiscal year 2021 (846% amplify year-over-year)

- Elevated total bitcoin holdings to approximately 8,133 BTC

- Reached total cash available of approximately $268.5 million

- Added 72,495 ASIC miners in 2021 (most modern mining rapid includes 32,350 energetic miners producing approximately 3.5 exahashes per 2d [EH/s])

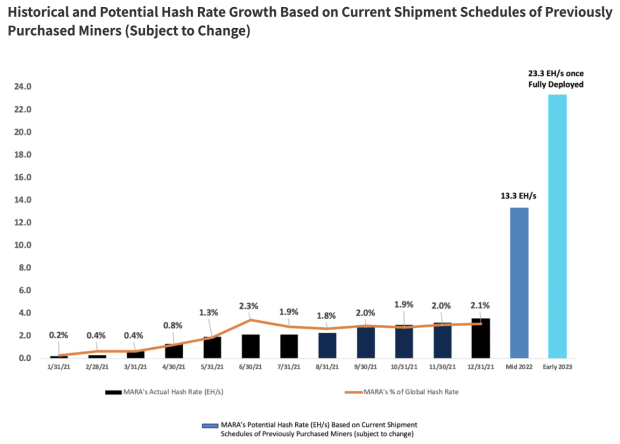

Above is a bar chart of Marthon’s hash price, its p.c of the global hash price and its forecasts for 2022 and 2023. The decline in Marathon’s percentage of the global hash price while increasing its possess hash price means that its opponents had been more aggressively increasing than it became as soon as at some level of this time. While Marathon continues to salvage miners from its Bitmain deal, it might per chance well well well need to be more aggressive in its expansion efforts.

Marathon successfully constructed a brand fresh mining facility in Hardin, Montana, which led to an amplify in its hash price from 0.2 EH/s in January 2021 to three.5 EH/s in December 2021. Its next mining facility, field for West Texas, might per chance be ready to aim in Q1 2022. Ought to restful all development apply agenda, Marathon will deploy all of its bought miners by early 2023; the operation would encompass 199,000 bitcoin miners, producing approximately 23.3 EH/s, making Marathon surely one of many biggest publicly-traded bitcoin miners on this planet.

Inspecting The MARA Stock Mark

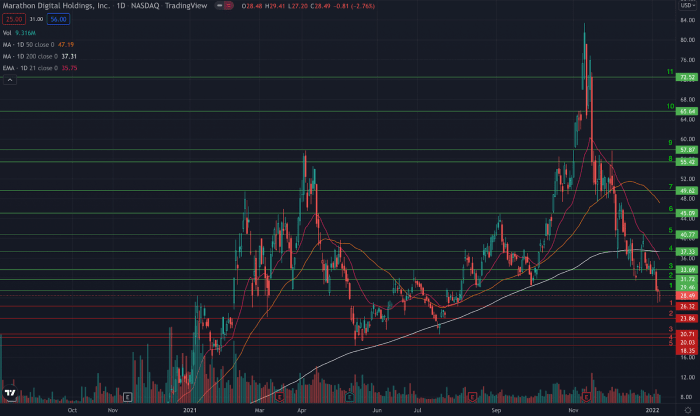

Esteem just a few its peers, Marathon’s stock stamp has been carefully tied to bitcoin costs. In March and April, MARA and bitcoin surged to fresh highs and when the fee of bitcoin came down in April, so did MARA stock.

In Would possibly perchance per chance fair and June, MARA stock persevered to pass with bitcoin’s trek: At some level of the China mining crackdown, the fee of bitcoin fell below $33,000 and MARA stock crashed almost 40% at some level of this timeframe.

These stamp movements did no longer extinguish within the summertime — with the launching of two Bitcoin alternate-traded funds (ETFs), bitcoin made a brand fresh all-time excessive and MARA followed. MARA is surely one of many fitting bitcoin-adjoining equities to have made a brand fresh all-time excessive when bitcoin did the the same. This is in a position to indicate that MARA’s stamp is more straight away correlated to the fee of bitcoin than diversified bitcoin-adjoining equities. It is price noting that while bitcoin has come down about 40% as of the writing of this, MARA has fallen almost 70% from its most modern all-time excessive.

The foremost culprit for MARA’s decline in Q4 became as soon as a subpoena from the U.S. Securities And Exchange Price (SEC), asking Marathon to manufacture paperwork touching on constructing and financing the Hardin facility. On the day of this subpoena, MARA stock fell 27%. While nothing has come from this subpoena, the markets have solid their verdict. That is the biggest candlestick on MARA’s on a usual basis chart and can elevate a heavy amount of overhead resistance, but more on that later.

Marathon will fraction Q4 earnings records in March. But a ogle motivate over the final three years helps paint a image of how some distance Marathon has come and the intention mighty further is left to pass.

Marathon’s Q3 earnings uncared for projections by 0.65 attributable to its expansion efforts: constructing fresh companies and products, shopping miners from Bitmain and issuing fresh shares. These efforts coupled with the firm’s HODL device (which has been in extinguish since October 2020) drove running charges greater than the old year. While revenue is confirmed to be gradually increasing, there are positive signs suggesting as soon as these expansion efforts come off the books, and revenue continues to develop as expansions proceed, earnings per fraction (EPS) might per chance well well well restful suitable and abet power the stock greater.

Inspecting MARA’s on a usual basis chart, the stock has been in a exhausting downtrend (blue line) since the all-time highs had been reached on November 10. While this downtrend has been occurring for over two months now, with some areas of enhance constructing, shall we restful detect a crash in this downtrend soon.

The importance of rapid-term highs/lows, gaps, candlesticks and resistance are clues which had been left on a chart by the mountainous cash on Wall Avenue. Inspecting charts and their clues lets in us to better make a call how a stock will react particularly areas.

The chart below has confirmed areas of enhance (crimson traces) and resistance (green traces). These areas of enhance and resistance is at possibility of be frail as markers for when to capture and sell stocks. An example of a device might per chance well well well be if volume is lowering because the stock approaches a crimson line of enhance, taking a converse (shopping shares) as shut to the enhance converse as that it is seemingly you’ll well well well mediate of provides the dealer more space to let the stock rebound to an converse of resistance. Ought to restful volume amplify as we methodology resistance and it breaks above, a brand fresh converse of enhance is created and this might per chance change into the minimum exit stamp as soon as the stocks begins to drop.

The colors signify where our expectations might per chance well well well restful be if these traces are broken — if the stock breaks below the crimson line of enhance, then we are in a position to most likely proceed decrease, till the next converse of enhance (and vice versa for areas of resistance). I’ve listed the areas of enhance and resistance with numbers such as the line number on the chart.

Increase

- This converse is our first defensive line within the sand. These are the lows from final week which have not been broken but, the upside hole and confirmed enhance from August and the intention back hole from Would possibly perchance per chance fair, which became as soon as old resistance into mid-June

- That is an converse of confirmed enhance that has no longer been examined since late July, resistance and bottom of upside hole in January, and bottom of intention back hole and resistance in Would possibly perchance per chance fair

- The low from late July (this has no longer been examined and is at possibility of be nothing, given its proximity to converse four). Now not much less than surely this kind of might per chance be enhance (potentially quite of greater, above 21m and shut to where the shut became as soon as in desire to the low of the day)

- $20 stamp stage is a psychological number that would restful repeat some stage of enhance. Furthermore it is internal proximity of the bottom of an upside hole from January 2021.

- Low of Would possibly perchance per chance fair, which has no longer been examined

Resistance

The foremost transferring realistic traces that I preserve to listen to all take a seat above essentially the most modern stamp stage. These transferring averages are the 21-day exponential transferring realistic (EMA, purple line), 50-day easy transferring realistic (SMA, orange line), and 200-day easy transferring realistic (white line) and can all be areas of resistance at some point.

- Low from final Wednesday’s colossal crimson candlestick. Attributable to its dimension in contrast to diversified candlesticks nearby and the upper volume on the day, there might per chance be resistance someplace internal this candlestick, and given the stock’s incapacity to shut internal of the candlestick’s body, the bottom of this candlestick has snappily change into resistance

- The heart of this candlestick corresponds with the rapid-term low from December. This became as soon as also resistance at the start of July that triggered a exhausting, inspiring dump for 13 straight shopping and selling days.

- The highest of the candlestick corresponds with the excessive from that July day that triggered the 13 day dump. This might per chance be one other example of supreme surely this kind of areas being the true resistance.

- Bottom of a intention back hole from December 27 to 28. That is the the same converse that the 200-day SMA at this time sits at.

- The rapid-term excessive reached on December 27 became as soon as a failed are trying at getting above the 21-day EMA; the tip of an upside hole from October 8 to 11, which became as soon as straight away examined as enhance. Ought to restful MARA be breaking on the upside, the momentum from retaking the $40 stamp stage might per chance well well well restful power the stock greater. Expectations of a further breakout might per chance well well well be shut to 80% as soon as MARA breaks above $40.

- The next converse of anticipated resistance is spherical $45: the rapid-term excessive reached on September

- The $50 stamp stage is no longer some distance off from the old all-time excessive reached on February 17; the converse of enhance for the splendid two weeks of November

- The final splendid resistance areas are connected to the biggest candlestick seen on November 15 (the date of the SEC subpoena). This candlestick is approximately 25% in total. This provides a mountainous selection for the stock to alternate internal without breaking out of doors of its bounds. That is top staunch estate for choices shopping and selling while you are more targeted on that kind of shopping and selling.

According to where the chart is now, there is no longer any dilapidated chart pattern that has formed, suggesting we are in a length of spoiled constructing. The tremendous dump from highs is greater than most sell offs when constructing a spoiled. The dump length at some level of this spoiled constructing length is elevated than a healthy spoiled, on the other hand given how unstable MARA has been over the final two years, that is no longer unreasonable.

While there is no longer any factual spoiled and MARA is below an tremendous downtrend, it is no longer a capture at this 2d. However, more aggressive investors can are trying and exercise the crash within the downtrend line coupled with the areas of enhance and resistance to abet field expectations with the alternate.