Bitcoin’s perpetual futures market funding rate can play a key role in non permanent label bolt. So the build rupture issues stand now?

Bitcoin’s perpetual futures market funding rate can play a key role in non permanent label bolt. So the build rupture issues stand now?

The below is an excerpt from a newest model of Bitcoin Magazine Authentic, Bitcoin Magazine’s top rate markets newsletter. To be among the main to salvage these insights and diversified on-chain bitcoin market prognosis straight to your inbox, subscribe now.

Alternate suggestions And Derivatives Update

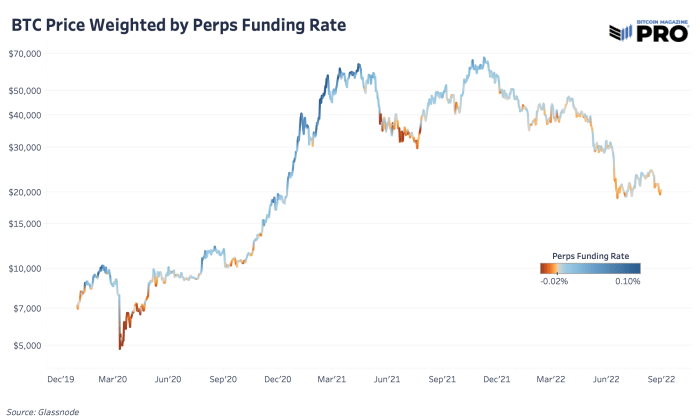

One dynamic and chart we’ve lined extensively before is bitcoin’s perpetual futures market funding rate in contrast to label. Within the outdated 2021 bull stride, the perpetual (perps) futures market played a key role in transferring non permanent prices to both the upside and scheme back with coarse leverage. It’s price reviewing the direct of the derivatives market and the system’s recent leverage as bitcoin label has broken down from its newest rally, following U.S. equities on a attainable course in opposition to sleek lows.

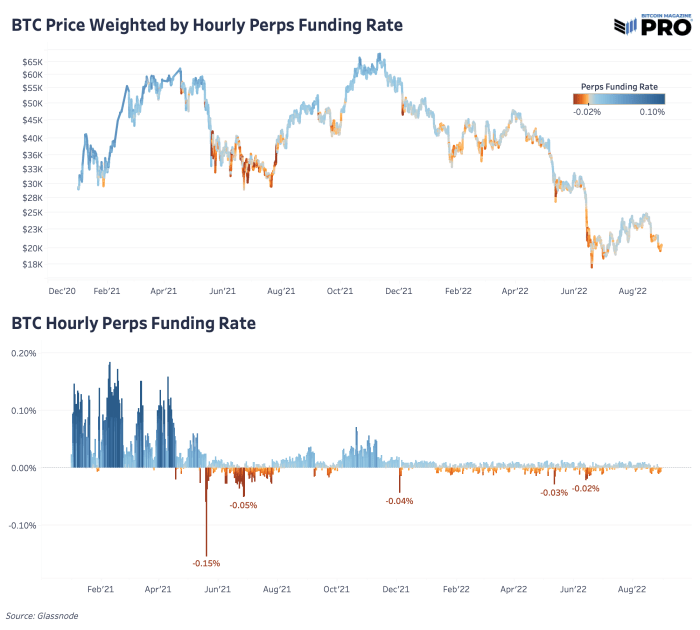

For the reason that high in November 2021, the perpetual futures market has been repeatedly biased in opposition to the scheme back (neutral funding rate is 0.10%). Merely establish, extra of the market people had been and restful are biased short over the remaining eight months. Even for the length of the latest endure market rally trot, that hasn’t changed. We didn’t sight the funding rate trot above neutral territory showing a favorable label that lengthy speculators and wretchedness appetite enjoy no longer returned to the market.

With the worthwhile open of a bitcoin futures ETF in U.S. markets remaining tumble, alongside with a general unwind in speculative exercise across the bitcoin/cryptocurrency market, perp funding charges had been teetering from a neutral to short bias with mighty much less explosive strikes in funding charges. Though derivatives market dynamics enjoy changed, it’s restful price expecting an actionable signal from the perps market the build the shorting bias will get heavily offside as it’s proven to rupture in the future of history marking vital bottoms. It’s price noting that in outdated endure market cycles (the build sleek incoming space demand changed into diminished by prepared sellers) funding could take care of unfavorable for lengthy intervals of times, attributable to lack of demand to invest/leverage the asset from the bulls.

In outdated bitcoin endure markets, funding could take care of unfavorable for lengthy intervals of times attributable to lack of demand to invest/leverage BTC.

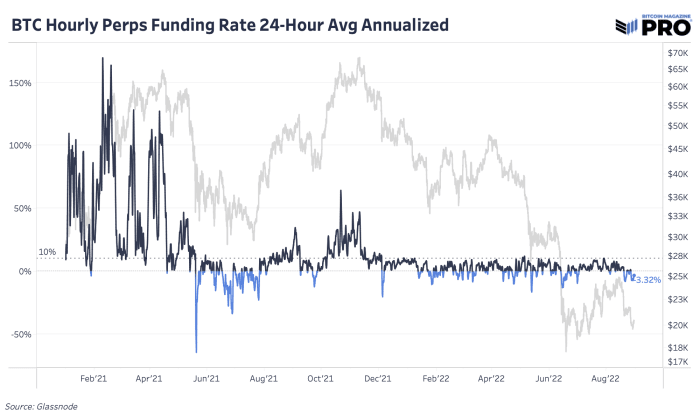

One other technique to visualize the funding rate is to stare at an annualized price with the sizzling unfavorable funding charges yielding an estimated 3.32% for taking a lengthy in opposition to the majority of shorts. For the reason that breakdown in November 2021, the market has yet to catch aid over the annualized neutral funding rate.

Trace has moved with the form of declining futures market originate interest in USD since the market high. That’s more straightforward to gaze in the 2nd and third charts below which merely reveals the perps futures market fragment of all futures originate interest. The perps market accounts for the lion’s fragment of originate interest of over 75% and has grown severely from approximately 65% at the foundation of 2021.

With the quantity of leverage accessible in the perps market, it makes sense why perps market exercise has the form of gigantic impression on label. The utilization of a tough calculation of the total perps market quantity from Glassnode of $26.5 billion per day (7-day transferring common) versus Messari’s real space quantity (7-day transferring common adjusting for inflated change volumes) of $5.7 billion, the perps market trades virtually 5 times the quantity to space markets. On high of that, day to day space quantity is down virtually 40% from remaining year, a statistic to aid perceive merely how mighty liquidity has left the market.

Given the quantity of the bitcoin by-product contracts relative to space markets, one could come at the conclusion that derivatives is seemingly to be outmoded to suppress bitcoin. We indubitably disagree, given the dynamically priced rate of interest connected to bitcoin futures products, we deem that on a lengthy sufficient timeframe the rupture of derivatives is catch neutral on label. Whereas bitcoin seemingly exploded mighty better than it otherwise would enjoy attributable to the reflexive results of leverage, these positions at remaining had been forced to shut, thus an equal unfavorable reaction changed into absorbed by the market.