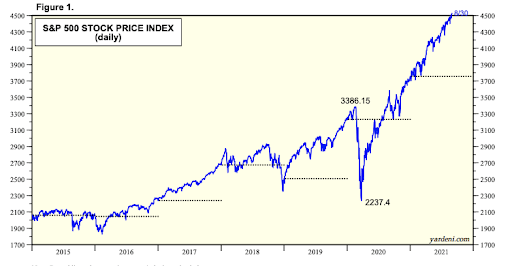

An appreciating inventory market is now a matter of nationwide security in the United States. This may possibly be a the truth is tiny acknowledged truth of the present financial plot, but it absolutely is the truth.

Since the Bretton Woods Settlement that established the U.S. greenback as the field reserve currency abet in 1944, apart from the Nixon Shock in 1971 which presented the global financial system to free-scuttle with the waft fiat currencies, the United States is in reasonably the precarious plight.

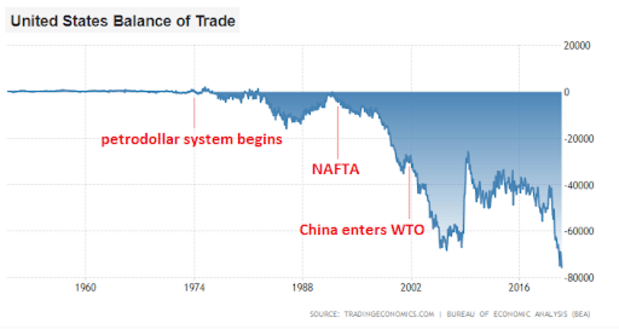

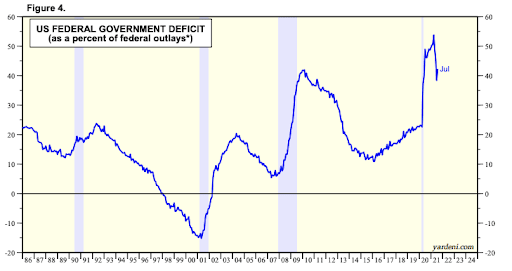

Due to the Triffin Dilemma (covered temporarily in The Each day Dive #041), the United States has served as the rare case gaze of a twin deficit nation (both a balance of alternate deficit and a fiscal deficit).

Economist Robert Triffin outlined the explanations for this abet in 1960,

“If the United States stopped running balance of payments deficits, the global neighborhood would lose its ideal supply of additions to reserves. The resulting scarcity of liquidity may possibly pull the field financial system into a contractionary spiral, main to instability.

“If U.S. deficits persevered, an everyday circulation of bucks would continue to gasoline world financial growth. Alternatively, impolite U.S. deficits (greenback glut) would erode self assurance in the fee of the U.S. greenback. With out self assurance in the greenback, it may possibly now no longer be celebrated as the field’s reserve currency. The mounted alternate price plot may possibly ruin down, main to instability.” – The World Monetary Fund

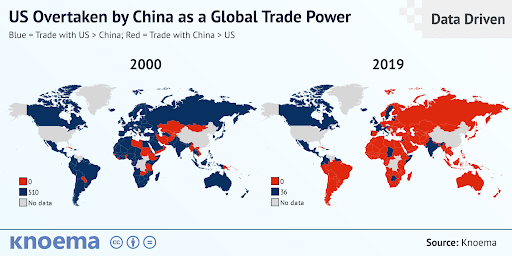

America in precisely twenty years has long previous from a world leader in alternate to being totally overtaken by rising nation-sigh superpower China. Because it turns out, Triffin’s worries enjoy modified into out to be warranted, and the U.S. finds itself with two clear paths:

Choice 1: Reverse direction and “protect the greenback” by having the Federal Reserve elevate interest rates and curtail asset purchases, thus spiraling the global financial system into an unheard of depression in the technique, while riding an already-polarized society extra apart as unemployment skyrockets, asset values plummet, and the actual prices of debt explode.

Or

Choice 2: Proceed the devaluation of the greenback while equities, actual estate, and varied asset classes continue to melt up in nominal terms, as the U.S. makes an are attempting to onshore the manufacturing that left its borders over the closing twenty years, all while preserving the social unrest at a minimal.

It’s no mistake that the market continues to melt upwards with minimal volatility, but reasonably, right here’s totally by compose. Market participants know that the talking heads on the Federal Reserve and in political vitality produce no longer enjoy any desire but to devalue the currency.

As used credit market vendor Greg Foss likes to recount:

“In a debt/GDP spiral, the fiat currency is the error length of time. That’s pure arithmetic. It’s a spiral to which there just will not be any mathematical procure away.”

This is no longer a novel phenomenon, and the truth is debt cycles such as what’s unfolding this day — no longer handiest in the U.S. but across the globe — enjoy came about time and again earlier than (apt no longer at this scale in a technologically-interconnected world).

All debt crises examined at some stage in ancient previous enjoy resulted in a identical style:

“Printing cash/debt monetization and govt ensures are inevitable in depressions wherein interest price cuts gained’t work, even supposing these instruments are of tiny fee in nations which may possibly per chance be constrained from printing or don’t enjoy resources to abet printing up and may possibly per chance’t with out disaster negotiate the redistributions of the debt burdens. All the deleveragings that now we enjoy studied (which is most of those who happened over the previous hundred years) in the raze ended in mammoth waves of money creation, fiscal deficits, and currency devaluations (against gold, commodities, and stocks).” – Ray Dalio, “Suggestions For Navigating Gigantic Debt Crises“

Our proposed resolution to this undertaking is evident: bitcoin. The explanations that we pressured long-established supply and query dynamics of the bitcoin financial network at the birth of this file is the reason that it serves to be the resolution for the colossal financial inflation.

“Investing at some stage in a hyperinflation has just a few long-established principles: procure short the currency, produce whatever you may possibly possibly be in a location to to procure you cash out of the nation, preserve commodities, and make investments in commodity industries (like gold, coal, and metals). Shopping for equities is a blended catch: investing in the inventory market turns into a shedding proposition as inflation transitions to hyperinflation.

“In its attach apart of there being a high correlation between the alternate price and the fee of shares, there is an rising divergence between share prices and the alternate price. So, at some stage in this time gold turns into the most smartly most current asset to retain, shares are a anguish even supposing they upward thrust in native currency, and bonds are worn out.” – Ray Dalio, “Suggestions For Navigating Gigantic Debt Crises“

The resolution is easy:

- Uncover you cash out of the nation, and retailer it in the immutable Bitcoin financial network.

- Short the currency (i.e. borrow greenbacks looking out on length, collateral, and interest price), and compose arduous resources with a producing fee.

The reason gold used to be consistently the most smartly most current asset to retain at some stage in debt crises is no longer due to brilliant steel nature of the steel, or due to its industrial employ cases, but reasonably the unforgeable costliness of the asset. A marginal unit of gold used to be/is more provocative to produce relative to the prominent supply than any varied fungible commodity.

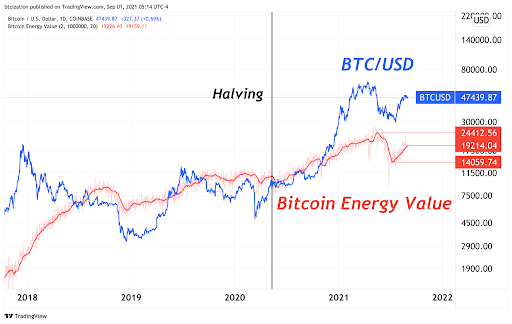

With bitcoin, now we enjoy a financial asset with 24/7/365 liquidity in every jurisdiction and market on the planet, with a arduous-capped supply, with a train financial incentive to sell any/all excess vitality to the network, strengthening it in the technique while raising the marginal unit manufacturing fee (due to drawl adjustment, as covered above).

Bitcoin is no longer apt an asset one must retain at some stage in cases of unheard of financial turmoil.

Bitcoin is unequivocally the most determined asset on the planet, and not like gold at some stage in debt crises of the previous, bitcoin is in the strategy of monetizing this day, main us to mediate that 10,000% upside is no longer handiest seemingly, but seemingly over the coming decade.