There’s been a total bunch talks about the U.S. buck losing its dwelling because the realm’s reserve forex. While most folk silent shock when right here’s going to happen, I’m right here to order you the magnificent truth: It’s already happening good in entrance of us. But most folk fail to imprint this because of they don’t imprint the signs. So, let me fracture it down for you so exactly how right here’s unfolding and, most importantly, how to guard yourself.

Since the 1700s, we’ve viewed 750 varied currencies in the realm and most productive 20% of these remain. All were devalued. This means they retract less nowadays than they did initially, and the U.S. buck is no longer any exception.

Why Construct Currencies Die?

In step with Ray Dalio, founding father of the realm’s supreme hedge fund, Bridgewater Mates, currencies die when a country racks up too powerful debt. The country ends up with four varied alternate choices:

- Austerity (spending less)

- Debt defaults and restructurings (e.g., financial catastrophe)

- Wealth redistribution (e.g. lift taxes)

- Printing money and devaluing it

Of all these alternate choices, governments constantly preserve to print money because of that’s the “easy” route. They don’t must lower down on spending, piss off collectors or harm the smartly off. But that’s how things commence to head south for a forex. Let me give an explanation for this for you with historical examples.

How The U.S. Dollar Grew to turn into The World’s Reserve Forex

In 1914, when WWI broke out, many European countries abandoned the gold traditional in state that they’d well possibly also pay for navy expenses with paper money as a replace of gold. The usa became the lender of different for several countries and, as a end result, the USD unofficially replaced the British pound because the realm’s new main forex by 1919.

For the interval of WWII, the USA came upon itself in a privileged plight to make the many of the war. Before becoming a member of the battle, we supplied ammo, weapons and other affords to the Allies in alternate for gold. As a end result, we ended up amassing two-thirds of the total world’s gold.

When countries got right here collectively at the Bretton Woods Settlement, they realized it used to be time to gain a global forex machine that used to be linked to gold. Since the USA owned plenty of the realm’s reserves, and the U.S. buck used to be additionally backed by it, USD officially claimed its world’s reserve forex plight.

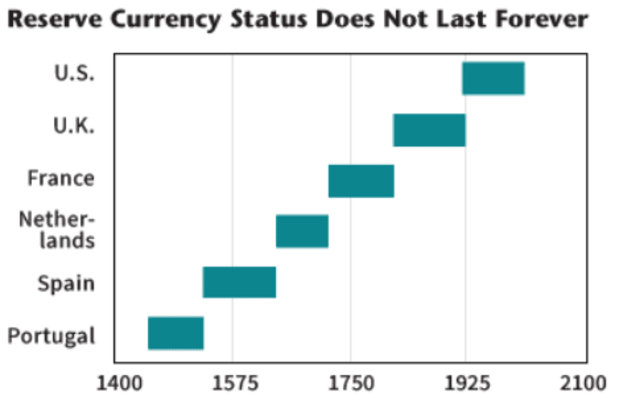

While most folk mediate that the transition from British pound to U.S. buck came about when the agreement used to be signed, it used to be undoubtedly a 30-year transition that started manner wait on in 1914 when countries began to borrow bucks from the USA.

So when folk request from me when the following transition is going to happen, I enlighten, “We’re in the center of it.” The arena is already de-dollarizing and the signs are obvious; you good must know which ones to witness at.

The Downfall Of The Dollar

In step with the World Financial Fund (IMF), USD dominance is already declining. In 2017, the buck silent 64% of the realm’s reserves. This present day, it’s down to about 59%.

One other glaring signal is in the U.S. Dollar Index (DXY), which is down 10% this year by myself.

Clearly, the pandemic plays a purpose in all this and the mainstream media is taking leer.

But right here’s the sizable field: The metrics above most productive enlighten you a part of the memoir because of you’re evaluating USD with a basket of other currencies. In other phrases, you’re most productive taking a witness at fiat currencies.

In its assign apart, we ought to be taking a witness at what money is dilapidated for: purchasing items and products and services. That manner we must witness at the buck’s purchasing vitality. Here’s what I mean: When you compare gold to the buck over time, that it is probably you’ll well possibly compare it tag $20 to retract an ounce. of gold in the early 1900s. It jumped to $35/ozin 1933, then it went haywire after 1971.

This present day, an ounce. of gold prices over $1,800. Does this sound address the USD is conserving its purchasing vitality? I don’t mediate so.

What about precise estate? How has the USD held its purchasing vitality when when when put next with precise estate? That you just can well possibly possibly mediate home prices are going up, hitting all-time highs. But is precise estate undoubtedly going up or is the buck simply losing its worth?

The index below highlights the loss of USD’s purchasing vitality when when put next with precise estate. The fact is home prices aren’t good going up; it good takes more bucks to retract them.

We can additionally bewitch a witness at oil. It’s been going up equally to gold, so is it increasing in worth or is it good one more signal of the buck losing its purchasing vitality?

Clearly, I couldn’t depart out one of essentially the most up to this point sources nowadays — bitcoin. Here is the worth of BTC when when put next with USD. Construct you compare any resemblance with the opposite sources I good showed you?

Is Historical past Doomed To Repeat Itself?

Now, let’s order all of it collectively and compare our most recent enlighten with a historic instance. Before we proceed, let me warn you: This affords you a “zoomed out” viewpoint and possibly flip your mindset fully.

Here is the case of the Weimar Republic (Germany) in the early 1900s.

In 1922, Germany defaulted on debt to repay WWI reparations. In disclose to recoup their funds, France and Belgium invaded the Ruhr Valley — the German industrial epicenter.

As a response to the invasion, the German authorities ordered all workers to prevent at home and now no longer work — right here’s known as “passive resistance.” Here’s the assign apart the Weimar Republic’s demise spiral starts.

The country used to be already crippled by debt, nevertheless they silent needed to gain a technique to realize wait on up with money to pay its workers. So what did they devise out? They began to print money (the fourth probability we talked about earlier).

Now, bewitch a witness at what came about to their User Model Index (CPI). The CPI measures the frequent alternate in prices that customers pay for items and products and services (aka inflation).

How did this affect the population? An even instance is a loaf of bread, which tag $0.13 in 1914. That identical loaf of bread tag $0.19 two years later in 1916. By 1919, the worth had doubled to $0.26, then $1.20 in 1920 and $3.50 in 1922.

After they began to print money in 1922, that identical loaf of bread went from $3.50 to $100,000,000,000 ($100 billion!) by December 1923. That’s when the German mark collapsed.

For the interval of that interval, you actually wished wheelbarrows to switch your money round. In some design, the forex used to be worth now no longer up to wooden, so they burned money to warmth their homes.

It’s well-known to mask that, firstly, the loaf of bread went up very slowly. At that time, most folk didn’t imprint what used to be happening except it used to be too gradual. Take care of the boiling frog fantasy.

The Parallels Between The U.S. And The Weimar Republic

We’re going to no longer return in time and alternate the past. But we will witness at historical examples and compare them to our most recent actuality, so we don’t repeat the equivalent mistakes.

The first parallel between the USA and the Weimar Republic is money printing. Select a witness at the USA’ M1 and M2, which may possibly well well possibly be measurements of the amount of bucks in circulation: M2 is additionally a key economic indicator dilapidated to forecast inflation.

It goes without pronouncing, the resemblance between these indicators and the German CPI is amazing.

The third parallel we will plan from the Weimar Republic is our crippling debt. Defaulting on debt used to be the most well-known “domino piece” that ended in other events unfolding. In 2021, the USA grew to a report budget deficit of $1.7 trillion in the most well-known half of of the fiscal year. It manner we’re spending more than we’re bringing in — exponentially more than in outdated years.

It’s All A Subject Of Perspective

The motive I order you all these files is so that that it is probably you’ll well possibly zoom out and compare things from a bigger viewpoint. In the ebook, “When Money Dies” by Adam Fergusson, he says most Germans couldn’t compare what used to be undoubtedly happening. Numerous them actually belief they were getting smartly off because of they belief their sources were going up in worth.

But now that used to be now no longer the case, it used to be undoubtedly the German mark losing purchasing vitality. So they started banking their money, promoting their sources and shopping and selling them for forex. At the discontinue of the day, they ended up with a literal pile of worthless paper.

Now, while you were in the Weimar Republic for the time being, what would that it is probably you’ll well possibly also unbiased gain completed?

The chart above presentations the worth of gold from 1915 to 1935. When you’d supplied gold round 1920 and held on to it except 1935 that may possibly well well possibly’ve been the alternate of the decade for you. But right here’s the supreme takeaway: It’s easy to take a look at the upward pattern from this viewpoint, nevertheless it wasn’t a clear, straight line for folk living for the time being. It used to be a truly unstable interval.

So let me query you: What are you doing with your money now? Some folk are cashing out, shopping and selling their sources address precise estate, gold, bitcoin and even shares for bucks because of they’re at all-time highs. The identical manner the Germans did.

If we proceed to expand debt and print money, the USD will proceed to lose its worth and its plight because the realm’s reserve forex. The loaf of bread is going up and likewise you don’t are attempting to total up with a pile of worthless money.

My advice to you is to gain inflation hedges, sources that are going up with the flee of inflation. Most considerably, commence now earlier than it’s too gradual. Don’t live up for the “next Bretton Woods Settlement,” the transition is already happening — and it’s happening good in entrance of you.