The 51% assault on Bitcoin SV this week is an opportunity to concentrate on the significance of decentralized blockchain safety.

The below is from a contemporary edition of the Deep Dive, Bitcoin Magazine‘s top class markets newsletter. To be amongst the fundamental to receive these insights and other on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The altcoin Bitcoin SV become 51% attacked earlier this week, and thus arose an opportunity to concentrate on the significance of the protection mannequin for “decentralized” blockchains. This tweet thread from Lucas Nuzzi does a gargantuan job of explaining what came about.

The notions that bitcoin is “too slack” or that it doesn’t have “ample transactions per second” to be world money that many proponents of altcoins have championed over the years are in response to unsuitable assumptions and belief of how blockchains work and what they fundamentally solve.

First, what is a 51% assault?

A 51% assault is when an entity acquires a majority portion of a community’s hash rate, they’ll maliciously double use coins. As a result of the Bitcoin community defaulting the longest chain of blocks, a 51% assault is easiest conceivable if the attacker can proceed to plan blocks at a sooner rate than ultimate miners.

“The design is actual as long as ultimate nodes collectively alter extra CPU vitality than any cooperating crew of attacker nodes…. If a majority of CPU vitality is controlled by ultimate nodes, the incredible chain will develop the quickest and outpace any competing chains. To change a past block, an attacker would must redo the proof-of-work of the block and all blocks after it after which remove up with and surpass the work of the incredible nodes.” – Satoshi Nakamoto, “Bitcoin: A Peep-to-Peep Digital Cash Machine”

Within the case of Bitcoin SV, the protection mannequin is significantly compromised for 2 obvious causes in particular:

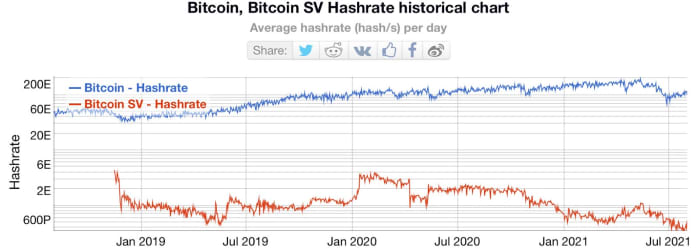

- As a result of the monopolistic nature of proof-of-work networks, it is commonly uneconomical to sell hash vitality for forks. Less safety, less liquidity, less customers, etc. Community effects topic.

- Due to Bitcoin SV (a fork of Bitcoin Cash) extra expanded the blocksize to that of 100 times the scale of BTC, there are diminutive to no transaction costs on the community, extra reducing the incentive to sell hash vitality to the community. As the provide issuance of bitcoin (or any of its forks) traits to zero in asymptotic vogue, transaction costs pays for all of the protection mannequin of the community. Right here is unsustainable for networks admire BSV.

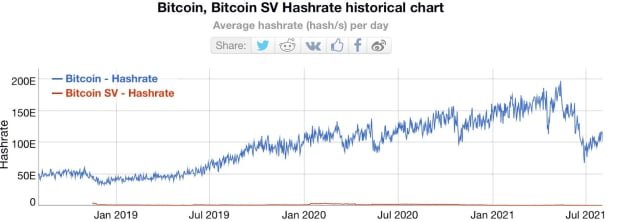

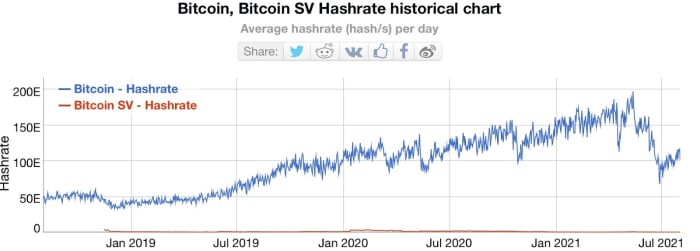

Below is the hash rate of BTC and BSV charted collectively (in each and each logarithmic and linear peep for standpoint):

Those that mumble a blockchain can scale by simply multiplying a theory all the scheme through the community have a classic misunderstanding of how a decentralized blockchain can scale. Bitcoin SV is a classic instance of that. Proponents of BSV would express how “fleet” and “cheap” transactions were on the community, however the reality is there are constantly tradeoffs. Users of BSV in a roundabout scheme were picking noxious safety and settlement assurances.