Lingua Contra Imperium

The Language of Bitcoin: 3

TL;DR – Bitcoin is the first monetary skills of its fashion. It’s additionally the final. Should always you divulge on summing up our exact and sound money with a broken monetary measure such as the greenback, you are going to regularly be at a loss for words about the tell of the monetary world. The greenback’s endless growth will lead you to factor in you catch extra Bitcoin than no doubt you enact.

Rational

Exhausting money pervades fully. After I say exhausting money pervades fully I am no longer talking about the value of Bitcoin. I’m talking about its ever-increasing user rotten, who refuse to catch their property adulterated and their money debased. Exhausting money pervades by manner of tedious and proper adoption. It’s some distance the route of of information being shared amongst a neighborhood.

A rational inhabitants that recognizes Bitcoin as the strongest retailer of value, and one of the best property to amass and protect, would exit the housing and the stock markets and pour into Bitcoin. In the event that they were rational, these who sought retail outlets of value in issues which could maybe be of potentially unlimited provide, such as stocks, gold and proper property, would forsake these cumbersome objects for Bitcoin, which as we all know is itsy-bitsy, and further salable all the blueprint in which thru time, attach, and scale than the leisure that’s reach outdated to.

The market is no longer rational. On the opposite hand, Bitcoin adoption grows. Whether or no longer you suspect Bitcoin adoption to be going down too slowly or too snappy, the fact stays that there is a increasing inhabitants of oldsters for whom Bitcoin is the leisure money.

That is, we catch chosen to exit the greenback, for exact, in consequence of as Bitcoiners we see that we take dangle of the superior asset class. When we understood that, we stumbled on no rational reason to direct ourselves to the centralized monetary threat that includes maintaining lesser asset classes such as greenbacks, which could maybe be a feeble and an objectively breeze produce of nascent money.

It appears no longer going that the one who first grasped the conception that of a wheel could maybe maybe catch kept this conception inner most. In this fashion Bitcoin won’t discontinue enviornment of interest, but somewhat, this will change into ubiquitous, world money. Societal memes are suggestions which could maybe be too exact to discontinue enviornment of interest. One of many classic aspects of lasting suggestions that unfold during society is that their utilize case is undeniable and uncomplicated to see.

One doesn’t might want to catch a technical working out of how Bitcoin works to make utilize of it within the the same manner the overwhelming majority of these who cruise in airplanes don’t catch an engineering background or a transparent working out of how precisely it is they’re flying. Bitcoin, worship the wheel and the airplane, is simply too exact of an conception to discontinue enviornment of interest. Bitcoin’s success as a network ought to be measured less by its greenback price motion and further thru the increasing selection of oldsters aware of its most classic utilize-circumstances as a exhausting retailer of value, an immutable money, and because the most stable produce of property, all traits for which it has no chums. Bitcoin promotes its catch manufacturing and inhibits its destruction on the expense of energy, time, and that of its opponents.

So although the market in mixture is no longer rational, and we could maybe maybe personally generally form irrational monetary choices, absolutely the merit of maintaining Bitcoin over fiat is changing into undeniable. Ignore it, and you are going to soon see over your shoulders to make a decision on up your chums and neighbors playing freedoms that you just cannot afford.

In our quest to raise monetary freedom to the world we can succeed in consequence of we can hodl Bitcoin longer than the market can remain irrational.

Irrational

The market is irrational. Folks are irrational. Their trades are predicated on their limbic blueprint, their rapid wants. They need to enhance off snappy. Their time resolution, in mixture, is terribly excessive. Most American citizens behave in a means that befits the title of particular person over that of producer. American citizens in mixture are no longer capitalists. Capital manufacturing requires the reallocation of resources and capital, and no longer their absolute consumption. American citizens somewhat, form decisions day by day to particular person in tell of form, with money that they enact no longer no doubt catch, and as used to be discussed final week’s essay, delayed gratification is required to a successful life of capital accumulation. Sadly, most folk form impulsive, emotionally influenced, excessive-time-resolution monetary choices.

Maintaining Bitcoin is no longer completely exiting the U.S. greenback, it is recusing your self from the necessity to continually form tough monetary choices and trades. Shopping for Bitcoin tends to change into an organizing monetary precept for hodlers. The contrivance is easy:

1) Alternate your time to form value for others everyday.

2) Alternate this value for capital.

3) Alternate some capital for Bitcoin.

4) Deploy the leisure of capital to amplify your manner of manufacturing to form extra value for further folk.

5) Alternate earnings for Bitcoin.

6) Hodl indefinitely.

*The in-between step is enact no longer like your capital.

Should always you opt up your self regularly on steps 4 and 5 that you just can be a financially productive particular person. There is now not any limit to how productive a particular person could maybe maybe additionally be. The classic denominator of this route of amongst bitcoiners is that we are continually seeking and maintaining Bitcoin. We’re successfully making one solid alternate tirelessly, out of U.S. greenbacks and into the superior asset class. In doing so we’re taking exercise bias, emotions, and excessive-time-presence impulses fully out of the monetary equation. It’s quite freeing.

CAGR

No Bitcoiner who has held their stack for on the least four years has lost money when denominated in fiat phrases. And after supreme months of maintaining Bitcoin it dawns on most that perchance the advantages of hodling amplify as time goes on. Certainly, the longer you catch held Bitcoin, historically, the larger your reward in fiat phrases. You catch won seeking vitality and you’ve additionally maintained and most current your wealth. Here is can’t be finished when maintaining greenbacks completely.

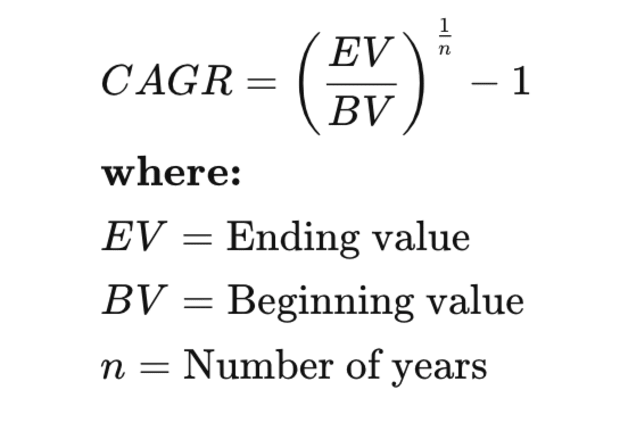

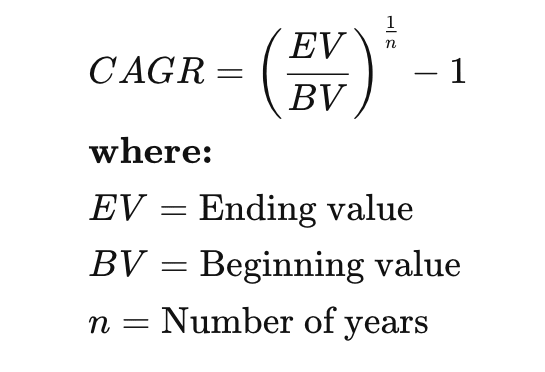

Rookies to Bitcoin largely reach for this “number drag up” skills, which manner they need to drag searching their wealth worship in U.S. greenbacks, which is frequently appealing and sharp to take a look at for the first time. As you hodl it becomes an increasing selection of tough to turn a blind glimpse to the U.S. greenback price of your Bitcoin stack. Which that you just can well even originate to comprehend and skills the fiat basically based formulation for compounding annual growth price (CAGR).

Folks that bring to mind Bitcoin as an funding could maybe maybe lag the greenback value of their Bitcoin stack thru this formulation. Over the years this will yield an increasing selection of spectacular results in fiat phrases, which is fun and exact. However at what price are you compounding your Bitcoin stack? Somewhere alongside the trajectory of perpetual discovering out that Bitcoin incites, many unfriendly an match horizon, after which, there is now not any extra shopping and selling support into greenbacks. There is totally forsaking greenbacks for Bitcoin. For a good deal of bitcoiners it is after this point in working out that Bitcoin ceases to change into an funding, and begins to change into a typical of living.

The CAGR equation looks out of the ordinary assorted if for the starting up and ending values you enter quantities of Bitcoin, in tell of the the same Bitcoin’s value in fiat phrases. This perspective of the CAGR will likely provide you with extra incentive to amplify your productiveness, in tell of remain indolent and tell alongside with your stack. Remember, Bitcoin’s value when in contrast to every fiat asset will continually upward thrust, in consequence of resources which could maybe additionally be issued by decree are unlimited in number. Should always you value your Bitcoin in fiat phrases, the numbers are obvious to impress you over time, but you perchance won’t find with the the same urgency that you just can had you understood your Bitcoin on its catch phrases. When valuing your Bitcoin in fiat phrases you threat complacency. Number drag up is besides the point.

So the longer folk take dangle of Bitcoin, in most cases, the extra inclined they’re to take into legend equations worship the CAGR in Bitcoin phrases? Really, I would postulate that by denominating your Bitcoin in fiat phrases you would very well be subliminally priming your self to one day cease a alternate out of the toughest money on this planet. It follows that nearly all long-term hodlers value their Bitcoin in Bitcoin phrases.

The longer you suspect of your Bitcoin in fiat phrases the less likely you would very well be to change into a long-term hodlr who denominates your Bitcoin in Bitcoin phrases. So there’s a survivorship bias amongst long-term Bitcoin hodlers. We are likely to fail to see or beneath worship supreme what number of denominated their bitcoin in fiat phrases and by no manner functionally acknowledged that 1btc=1btc, and in consequence did now not form it.

Should always you divulge on summing up our exact and sound money with a broken monetary measure such as the greenback, you are going to regularly be at a loss for words about the tell of the monetary world. The greenback’s endless growth will lead you to factor in you catch extra Bitcoin than no doubt you enact.

Do now not omit that when folk disclose of the value fluctuation of Bitcoin denominated in U.S. greenbacks, that is an fully faulty working out of what Bitcoin is. Bitcoin itself is agnostic to U.S. greenbacks. Naturally when evaluating a scarce asset to an infinite asset, you are going to see crude volatility.

Primarily the most maximalist amongst us could maybe maybe say that if you would very well be making an attempt to make utilize of Bitcoin to form “monetary institution”, you are going to need lost the attach. Your Bitcoin is your decide up price. The greenback price of your Bitcoin is meaningless.

There’s no reason to discourage these who’re thinking in fiat phrases, as no doubt nobody alive used to be raised without discovering out to think on this fashion. The take a look at is frequently whether or no longer and to what extent one can originate to denominate their life in Bitcoin phrases. The replace in persona this brings about, the renunciation of an ragged and errant manner of life, one suffering from misunderstandings, is why bitcoin maximalists generally catch the luster of one thing worship the newly sober, the honeymooning, or the very non secular.

The contemporary transition from a fiat worldview to a Bitcoin worldview predicates on one having been depraved about in most cases all the pieces. Ergo, most adults don’t, and won’t stamp Bitcoin. However the first few young folk who were raised on a Bitcoin favorite are soon to enter their teenage years.

It’s when this nascent generation of bitcoiners begins to purchase half with final consequence within the world markets, and they in turn elevate extra young folk on a Bitcoin favorite, that the scales will no doubt tilt in our need.

Rival

Every monetary automobile outside of Bitcoin is in opponents with it, and could maybe maybe catch to catch its monetary energy drained from it, in consequence of Bitcoin is the completely rivalrous money. Rivalrous manner every Bitcoin I catch is one that you just can’t catch, except I transact with you or provide you with access to my inner most keys. Bring to mind MicroStrategy. Bring to mind your entire Bitcoin provide Michael Saylor has taken off the desk. Does this no longer incentivize you to double down to your stacking efforts? It’s presupposed to. When an exact is scarce, it incentivizes opponents. Bitcoin is the completely rivalrous asset. Fiat and gold are each horns of hundreds.

Gold is non-rival. I could maybe maybe in conception glean gold except the discontinuance of my days and it wouldn’t cease how out of the ordinary gold is readily obtainable to each person else. It isn’t scarce. The total provide of gold is in disclose proportion to the resources which could maybe be allocated in direction of mining it. Gold could maybe maybe additionally be mined except there is now not any extra of it left within the universe. Even by manner of the native gold provide, we haven’t even begun to scratch the skin of the Earth.

Bitcoin is terribly out of the ordinary a bounded game. Inversely, fiat is an unbounded game of cards, which manner it expands so on and not utilizing a finish in sight. That is, there is now not any limitation imposed by the tools of the fiat game. They’re no longer playing with a undeniable provide of numerals but as a replacement with a tool for environment up numerals indefinitely.

The authorities could maybe maybe dispute ignorance of the fact that it has created a tool for printing money indefinitely. Primarily the most insidious and savvy of governments revel on this exploitation of their electorate time and energy severely covertly. The inhabitants has been faulty for so many generations it supreme takes taxation and simultaneous forex debasement as an unavoidable fact of life.

However the money printing is overt now. They’ve abandoned the half of pretending it’s completely transient, or that they are raising the debt ceiling supreme a miniature bit extra to catch thru X or Y crisis. The crises are chronic. Forever were. If I needed to form a future prediction I would forecast that digital emergencies and cyber pandemics are subsequent. Folks are desensitized to explicit world concerns. It appears to me that most of us are already isolated, functionally comatose, living in an leisure tell of perpetual catatonia. Here is a matter for every other time. Manufacture no longer resign your ability to think and disclose freely.

There used to be no “well intended” or ignorant authorities half. If governments didn’t stamp the vitality of exploiting the money printer we would restful be utilizing objects we chose to satisfy our accident of wants. We would retailer all of our wealth in issues worship goats or vivid rocks. However even within the age of gold, the authorities stumbled on solutions to clip and debase the forex.

In Bitcoin, that you just can factor in what ties our digital ship to the wharf as rope. The rope includes fibers. The rope does no longer catch its strength from someone fiber running thru it, but somewhat from the fact that there is an unlimited selection of fibers overlapping. The metaphor is extra correct if you factor in lots of ships secured with thousands of ropes. As nodes we are testifying to a single history, a single enlighten of these ships, our anchors are myriad and decentralized.

Bitcoin is rivalrous and bounded. The formulation of Bitcoin accumulation presents you wholesome opponents and fraternity for all times. It incentivizes cooperation to facilitate capital growth. Every Bitcoin you catch is one I’m succesful of’t, but perchance if we collaborate to present a carrier, we can each amplify our stack. Meanwhile every Bitcoin that is lost is eradicated from the conversation fully.

Time

Nietzsche said that what can happen might want to catch befell outdated to.

Here is no longer so.

It ought to be wired that outdated to Bitcoin, it used to be very no longer going to affiliate events with substances of time in decentralized techniques.

Bitcoin emerged, in half, from an effort to work round trusting third events to time stamp digital documents. Centralized time servers are improper to degrees that could maybe maybe appear minute to humans, but by manner of ordering transactions on a ledger, it is imperative that there be no discrepancy. Do now not omit that even the time dilation between a particular person on the flooring and a particular person on a airplane is enough to form the enlighten of their transactions on a ledger improper. This why Bitcoin doesn’t count on any third-catch collectively time-maintaining server.

Satoshi at first designed bitcoin as a digital time-stamping server, as stumbled on on the first page of the White Paper: “In this paper, we imply a resolution to the double-spending downside utilizing a look-to-look dispensed timestamp server to generate computational proof of the chronological enlighten of transactions.”

Or as stumbled on on the second page: “We need a blueprint for participants to agree on a single history […]. The resolution we imply begins with a timestamp server.”

As a consequence Bitcoin has change into the completely decentralized narration of previous events on this planet. No history is entire, nor is it intended to be. After we disclose about history it is miles a mistake for us to purchase a seek for at and legend for causation. Humans cannot see causation, completely a succession of events.

In the universe, most of what occurs is simply too quick or too tedious. Too fat, too itsy-bitsy, too some distance, too shut, or invisible. Thus, that you just can factor in Bitcoin as but one lens in which to stare the history of the unusual world. What’s distinctive about our framing is that this memoir is fully decentralized, and the longest chain has undergone the most proof of work to stable this history. Bitcoin is the memoir we’ve agreed upon.

There is now not any centralized time mechanisms for Bitcoin. It runs irrespective of our clocks. Every particular person tick of the Bitcoin clock is unpredictable. Relative to our clocks, the Bitcoin clock appears to be imprecise and spontaneous. However that is beside the point, as Gregor Trubetskoy substances out: “It doesn’t topic that this clock is imprecise. What matters is that or no longer it is miles the the same clock for each person and the tell of the chain could maybe maybe additionally be tied unambiguously to the ticks of this clock.” So the Bitcoin clock is probabilistic, but it no doubt isn’t illusory.

When does the long lag change into the show?

Bitcoin accounts for this. The mempool is an elaborate of the long lag, a forecast we’ve committed to raise to accomplishing.

The attach does the show drag when it becomes previous?

Bitcoin accounts for this too. Nodes usher blocks show into the previous, where they’re acknowledged repeatedly again, consistently per day by every node, as previous.

The longest chain serves as proof of the sequence of events witnessed, and additionally proof that it came from the supreme pool of CPU vitality. In this fashion, Bitcoin is additionally proof of memoir.

Future

Bitcoin is the first monetary skills of its fashion. It’s additionally the final. Most folk catch yet to comprehend that Bitcoin is the finish consequence of civilizations’ failures at environment up money.

The seeds of world Bitcoin adoption were planted at its delivery and our completely job now is to water and are likely to them. Bitcoin is the first money the world has ever considered and the final money this will ever stare for centuries to return.