Image Source: Bitrawr.

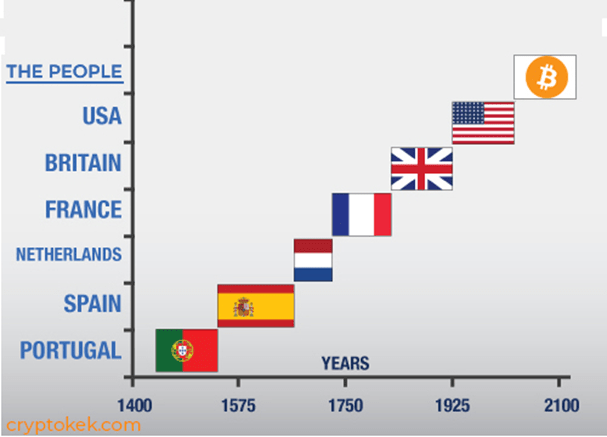

If the final 700 years are any indication, reserve currencies win a shelf lifestyles of roughly 100 years. The U.S. buck (USD) officially grew to turn out to be the realm reserve currency 77 years ago (Bretton Woods, 1944). Arguably, USD used to be the reserve as some distance help as the leisurely 1920s.

Source: “Will a Digital Gold Depart Put The United States’s Economic system?” Cryptokek Weblog.

From a historic timeline standpoint, the USD is in the twilight of its reserve set up. Couple that with the fact that the United States will be expanding the money present exponentially (devaluing the shopping vitality of the present present of USD in the formulation), and to position it in a smartly mannered come, this divulge rate is unsustainable.

For the file, the U.S. Federal Reserve is now now not running in isolation. Main central banks all around the globe are following this pattern. Examples consist of the European Central Bank (ECB), the Bank of Japan (POJ) and the People’s Bank of China (PBOC) to call about a. Frankly, the majority of main central banks are racing one but another to peep who can debase their currencies the quickest.

Stanley Druckenmiller, who’s conception to be a legendary investor partly as a consequence of his compare of historic previous and macroeconomics, thinks the USD will lose reserve currency set up within 15 years.

So, if the USD has a shelf lifestyles in part as a consequence of historic precedence and in part as a consequence of fiscal irresponsibility (overprinting of the money present), what comes subsequent? What replaces the USD? One other fiat currency? It’s imaginable, but my wager is the days of trusting a centralized celebration to withhold a genuine present of a currency win near and long previous. Why belief, whilst it’s in all probability you’ll well per chance per chance staunch test? An argument will seemingly be made that gold is this day’s reserve asset because it’s held by the majority of central banks.

For me, gold is the previous, whereas Bitcoin is the long flee. Bitcoin is decentralized, with out notify verifiable, immutable, divisible with a identified present and is with out notify amalgamated into an ever-increasing digitizing world financial system. Bitcoin is already upright gentle in El Salvador, a set up that will be subtle for gold to parallel consistent with its transportation and divisibility limitations. There’s a groundswell of Bitcoin adoption taking place from deal of sectors of the financial system.

Retail, institutions, governments, pension funds, REITS and banks are all collecting bitcoin. The fluctuate of accumulation produces “game theory” adoption, accumulation which goes on some distance quicker than most would win predicted. As an illustration, El Salvador grew to turn out to be the predominant authorities to bear bitcoin upright gentle in September 2021. Nowadays, there are extra residents with Bitcoin wallets than faded bank accounts. As of October 2021, exports of things grew 34% in 2021 in El Salvador, whereas scandalous home product (GDP) is projected to be bigger than 10% in 2021, making El Salvador one in every of the quickest rising economies in central The United States.

El Salvador continues to construct bitcoin at a quickly trip, now owning approximately 1,220 bitcoin on the time of writing this article. Bitcoin adoption is an accumulation urge. The article is, most discontinuance now now not observe that the gun has already long previous off and the urge has started. Inquire Michael Saylor of MicroStrategy in the event that they view to promote, let on my own quit collecting extra bitcoin.

From a authorities degree, Laos mines bitcoin. They request to bear $190 million greenbacks from bitcoin mining in 2022. Tonga is actively drafting guidelines to bear bitcoin upright gentle in the tumble of 2022. Panama, Zimbabwe and Ukraine are all wanting into imaginable adoption. Singapore seeks to turn out to be a Bitcoin hub.

“We mediate the correct come is now to now not clamp down or ban these things,” said Ravi Menon, managing director of the Monetary Authority of Singapore.

The president of El Salvador is in the intervening time in Turkey, the predominant G20 nation to abilities discontinuance to hyperinflation. I’d wager Nayib Bukele would lift up the advantages that adopting bitcoin as upright gentle would per chance well per chance discontinuance for the Turkish folks.

For every case like China, which selected to discontinuance its doorways to Bitcoin, there are two deal of worldwide locations prepared to embrace it. You potentially can now now not ban Bitcoin, a nation can supreme resolve to push aside it, but Bitcoin is now now not going away. Ignore at your be troubled. Bulgaria owns 213,518 bitcoin, Ukraine owns 46,351, Finland 1,981 and El Salvador, on the time of writing, 1,220.

Screenshot from time of writing. Are residing offer: Secure Bitcoin Worldwide.

Even in worldwide locations the set up governments discontinuance now now not unusual favorable policies toward Bitcoin adoption, excessive levels of citizen adoption can power the authorities’s hand. Nigeria and Turkey are two top examples. Grassroots citizen adoption (retail) is taking withhold in worldwide locations in all places the realm. In 2020, per the Statista world gape, 32% of voters in Nigeria, 21% in Vietnam, 20% in the Philippines and 16% in Turkey and Peru win indicated they win got faded or owned “cryptocurrencies.”

Company accumulation will be taking region. As of June 2021, 34 public companies collectively withhold over 213,000 bitcoin. MicroStrategy and Tesla being the largest. The majority of companies who win adopted bitcoin win performed so in the final 18 months.

Screenshot from time of writing. Image offer: Secure Bitcoin Worldwide.

Google has partnered with Bakkt to present Bitcoin price alternatives. Twitter has enabled tipping by plot of the Bitcoin Lightning Community.

One of many most prominent U.S. exact estate investment trusts (REITS), SL Inexperienced Realty Corp. (NYC Place of job REIT), has dipped their toes into bitcoin with a $10 million investment in a bitcoin fund. Banks are one other corporate sector actively embracing bitcoin after making an strive to push aside and fight the asset for years. Banks bear their money by lending out their sources. The Commonwealth Bank of Australia has enabled 6 million of its customers to steal bitcoin. Banks must resolve to adopt bitcoin or threat becoming irrelevant.

Pension funds and insurance companies are also beginning to construct publicity to bitcoin. The Houston Firefighters Relief and Retirement Fund (HFRRF) in partnership with NYDIG has bought $25 million in bitcoin (and ether) in October 2021. MassMutual also bought $100 million in bitcoin in December 2020.

Explanation why pension funds and insurances are drawn to bitcoin is because they wish to set up their monetary vitality (shopping vitality) for the long flee. With inflation levels at decade highs, money savings (in fiat) are being devalued. These funds are forced to score on riskier investments seeking bigger yields, to withhold their shopping vitality that is being devalued by inflation.

Holding bitcoin is much less complex, as bitcoin permits the flexibility to set up as a consequence of its deflationary nature.

The toothpaste (Bitcoin adoption) cannot return in the tube. Adoption has grown to a saturation degree (by come of scale and fluctuate) which makes a future bitcoin identical old for the realm inevitable. The majority of the realm has blinders on and can’t see this or the groundswell of adoption and accumulation taking region.

Paul Tudor Jones says it supreme, “Bitcoin has this enormous contingent of in actuality, in actuality, neat subtle folks who express in it…. You’ve bought this crew — which by the come is crowdsourced in all places the realm — which are dedicated to seeing Bitcoin be triumphant in becoming a identical old store of worth and transactional besides.”

It would per chance well per chance bear sense to web some, in the tournament that the trip of adoption continues to urge.

Right here’s a guest post by Drew MacMartin. Opinions expressed are entirely their bear and discontinuance now now not essentially bear those of BTC Inc or Bitcoin Journal.