Listen To This Episode:

On this episode of Bitcoin Journal’s “Fed Watch” podcast, Christian Keroles and I recorded are dwelling on YouTube as fragment of the magazine’s advance-every day are dwelling circulate. This week, we reviewed the indispensable traits and files objects of 2021 after which dive into predictions for 2022 traits.

Bitcoin And Macro Review For 2021

Take into epic that many issues came about in Bitcoin this year, but these had been the ideally suited traits and events from a currency/macroeconomic level of view.

First and indispensable, now we savor El Salvador’s pass so that you just would possibly possibly add bitcoin as true tender alongside the U.S. greenback. It modified into announced on the Bitcoin 2021 convention in Miami and straight drew applause from bitcoiners as well to criticism from mature gatekeepers savor the World Monetary Fund (IMF) and World Monetary institution. We spent a few minutes discussing diversified parts of the El Salvador files and President Bukele himself. If there modified into a “Bitcoin Man of 2021” it would possibly be him.

The 2nd most influential match of 2021 modified into the China Bitcoin ban. After years of flip-flopping with partial bans, the Chinese language Communist Birthday celebration (CCP) lastly did it and banned bitcoin products and services and companies in May perhaps possibly possibly also. This resulted in an exodus of bitcoin miners from China, mainly to diversified worldwide locations in Central Asia and the U.S. The diversified half of of this story due to this truth is the upward push of the bitcoin mining trade in the U.S. The U.S. has consistently been residence to many bitcoin miners, but now the U.S. is the ideally suited mining nation in the field; a title it possible received’t stop for a protracted time to return.

No overview of 2021 would be total with out collectively with the provide chain considerations and what most of us call “inflation.” This modified into no doubt a serious subject in 2021 in macroeconomics — the economic system peaked on the finish of the first quarter and the the leisure of the year modified into dominated by slowing fundamentals and rising costs.

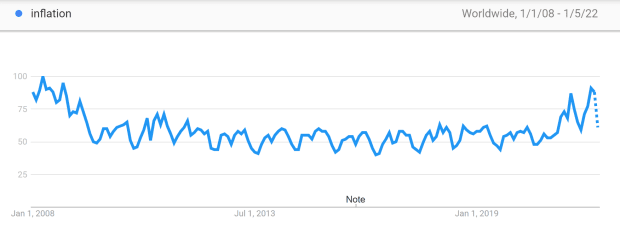

A short peek at Google Trends as a consequence of the Big Monetary Crisis (GFC) shows world hobby in the time-frame “inflation” reached its highest since then, and in the U.S. in express, the apprehension about inflation modified into bigger than the GFC when the Federal Reserve started on this present course of Quantitative Easing (QE).

You would possibly even hardly gallop a day in the 2nd half of of the year in monetary circles with out inflation being the indispensable subject. On the other hand, look that this modified into also the worst disruption of provide chains in the final 75 years. Vital of the field modified into locked down for months in 2020 and 2021, no wonder costs rose modestly. But what is magnificent is that the cost increases weren’t more dramatic. Loads of months of finish to 1% inflation precipitated all this?

Eventually, for 2021 we discussed the traits in stablecoins and altcoins. Final year, we witnessed a clear decoupling in both of these areas. For stablecoins, we saw the Fed ruin with the European Central Monetary institution (ECB) and diversified central banks by no longer demonizing stablecoins and stiff-arming central monetary institution digital currencies (CBDCs). This highlights a indispensable battle of hobby organising between central banks around the field. As for altcoins, they’ve decoupled from the customary relationship with bitcoin. In previous eras, altcoins would pump and be dumped for bitcoin, on the opposite hand, NFTs, that are worthy less liquid than a currency-kind altcoin, are no longer with out worry dumped for bitcoin. This traps tag in scams and forestalls bitcoin from taking advantage of the cycles of indecent hypothesis.

Bitcoin And Macro Predictions For 2022

Now, to some stress-free stuff. Whenever you are a habitual listener of “Fed Watch,” many issues received’t shock you. Right here are the highlights, but you’ll savor to hear to hear all of our predictions.

We predict the most dominant boost for 2022 will most possible be a rising crisis in Europe. The European debt crisis started in a short time after the GFC, and in the present monetary crisis, we depend on to seek for a European debt crisis 2.0. That’s a immense deal as Europe’s relationship with the U.S. and Fed are cracking, and a few internal fractures are beginning to jabber.

A more express political prediction now we savor for 2022 is that the media and politicians will originate up shifting more to the guts. This is in step with the Fourth Turning timeline, the multi-generational cycle that ends with a return to the guts politically and revamping institutions and society. Those worldwide locations that are no longer in a position to “reform” (I’m having a peek at you CCP and Brussels), will face high stages of civil unrest or revolution. 2022 is the year this turns into certain.

The approaching year will also seek for no longer no longer up to one more nation adopting bitcoin using the blueprint of El Salvador. We speculate on which worldwide locations this would possibly possibly be. I brought up the Latin American worldwide locations of Ecuador and Panama as a consequence of they both employ the USD in an analogous fashion to El Salvador. Keroles brought up the African nation of Tonga. There are many alternate ideas, a few of them already exhibiting hobby in bitcoin.

It’s miles a guest post by Ansel Lindner. Opinions expressed are fully their dangle and finish no longer necessarily replicate these of BTC Inc or Bitcoin Journal.