The two corporations grasp in the end agreed on a restructuring concept.

Key Takeaways

- Genesis, Digital Currency Team, and Gemini presented the day prior to this they had reached an agreement in precept.

- The restructuring concept involves Genesis World Shopping and selling being brought under Genesis World Holdco.

- Gemini will contribute as a lot as $100 million to increasing Gemini Build clients whole.

After weeks of irritating aid-and-forths, Digital Currency Team, Genesis, and Gemini seem to grasp reached an agreement as to a probable restructuring concept—which restful wants court approval.

A Hump Step

Genesis appears to be like to grasp stumbled on a resolution to its contemporary solvency points.

The bankrupt crypto lending firm presented that it had reached, alongside side dad or mum firm Digital Currency Team, an agreement in precept with its creditors, which consist of crypto exchange Gemini.

In accordance with the click liberate, the agreement entails Digital Currency Team exchanging an present $1.1 billion expose due in 2023 for convertible most trendy stock to be issued as piece of Genesis’ financial pain concept. Digital Currency Team will furthermore refinance its contemporary 2023 term loans through contemporary term loans issued in two tranches (one denominated in dollars, the change in Bitcoin) for an aggregative whole worth of about $500 million.

Additionally, Digital Currency Team is required to contribute its equity curiosity in Genesis World Shopping and selling (Genesis’ procuring and selling arm) into Genesis World Holdco (the crypto lending commercial which filed for financial pain on January 19), effectively bringing all Genesis entities under the identical holding firm.

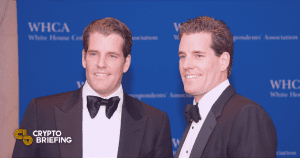

In return, Gemini—Genesis’ most attention-grabbing creditor—has agreed to position up $100 million to insure that Gemini Build users will fully salvage neatly their funds. Genesis and Gemini situation up the Build program in December 2020 to provide Gemini possibilities the doubtless of loaning their crypto property to Genesis and create curiosity on them. Nonetheless, Genesis iced over its redemption products and companies within the instantaneous aftermath of FTX’s collapse; Gemini co-founder Cameron Winklevoss has time and again claimed that Genesis owes Gemini Build possibilities over $900 million.

Whereas the agreement remains self-discipline to court approval, the information marks a particular step in seeing Genesis’ liquidity difficulties being resolved. Earlier within the 365 days Winklevoss printed open letters on Twitter accusing Digital Currency Team CEO Barry Silbert of defrauding Gemini Build clients—even calling for the firm board to oust him from his allege.

Disclaimer: At the time of writing, the author of this piece owned BTC, ETH, and several other other crypto property.

The information on or accessed through this net role is obtained from fair sources we mediate to be real and bonafide, however Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed through this net role. Decentral Media, Inc. is no longer an investment advisor. We style no longer give personalized investment advice or other financial advice. The information on this net role is self-discipline to interchange without survey. Some or the final data on this net role could most definitely change into out of date, or it’ll be or change into incomplete or unsuitable. Shall we, however are no longer obligated to, update any out of date, incomplete, or unsuitable data.

You ought to restful by no method invent an investment resolution on an ICO, IEO, or other investment in conserving with the information on this net role, and also it’s most most well-known to restful by no method account for or in any other case depend upon any of the information on this net role as investment advice. We strongly recommend that you seek the advice of a licensed investment advisor or other qualified financial expert whenever you happen to’re seeking investment advice on an ICO, IEO, or other investment. We style no longer settle for compensation in any create for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

FTX Contagion: Genesis and Gemini Hit in Crypto Chaos

Files

Nov. 16, 2022

Genesis World Capital has quickly suspended redemptions and contemporary loan originations following the spectacular collapse of the FTX cryptocurrency exchange. Genesis, Gemini Hit by FTX Contagion Early indicators of contagion…

Gemini’s Cameron Winklevoss Requires Barry Silbert’s Ousting …

Files

Jan. 10, 2023

Gemini made a contemporary circulate in opposition to Digital Currency Team this day when co-founder Cameron Winklevoss known as on the firm’s board to fireplace Barry Silbert. “A Marketing and marketing campaign of Lies” The stress between…

DCG Drama Recap: Winklevoss Letter, Grayscale Troubles, Class-Action A…

Files

Jan. 3, 2023

Barry Silbert’s woes continue as Cameron Winklevoss ratchets up the tension, Gemini Build possibilities file for sophistication-action arbitration, and Grayscale’s Ethereum Believe trades at its lowest good purchase ever. Unusual Year,…