Key Takeaways

- NFTs are a form of asset that provide provable scarcity and ownership by recording data on a blockchain.

- Demand for CryptoPunks and other sought-after NFTs has risen over the weekend.

- Some salvage immediate that crypto is in the center of the NFT an identical of final 365 days’s “DeFi summer.”

Costs for in-demand NFTs adore CryptoPunks, Autoglyphs, and Fidenza salvage hit story highs this weekend, whereas initiatives adore Axie Infinity salvage exploded in standing over the previous couple of weeks. Is “NFT summer” upon us?

NFT Collectors Pay Out for Punks

The NFT market is in a frenzy.

Costs for doubtlessly the most sought-after NFTs salvage soared this weekend amid renewed hobby in the digital belongings apartment. CryptoPunks, arguably doubtlessly the most coveted NFT collection, has had a in particular gigantic few days of buying and selling. On Friday, the everyday entrepreneur grew to became NFT fanatic Gary Vaynerchuk purchased an Ape, regarded as one of many rarest Punks in the collection, for roughly $3.7 million. Vaynerchuk has beforehand confirmed that he owns more than 50 Punks, and he’s no longer the entirely wide title to salvage taken an hobby in the technology: with the exception of the moderately about a stars who salvage launched their very hang pieces, Jay-Z precipitated a tear when he changed his Twitter avatar to Punk 6,095, suggesting that he’d provided the half. Snoop Dogg additionally looks following the apartment closely.

Punk 2140 provided for 1,600 ETH ($3,764,576.17 USD) by 0xd6a984 from 0x497059. https://t.co/Jx6k65riVf #cryptopunks #ethereum pic.twitter.com/xPfVywTj1a

— CryptoPunks Bot (@cryptopunksbot) July 30, 2021

An NFT is a non-fungible token, a form of queer asset that stores data reminiscent of sales history on a blockchain, usually Ethereum. Unlike other crypto belongings adore Bitcoin or Ethereum, NFTs are no longer interchangeable. They can encompass digital art, song, memes, tweets, or any other form of scream material that is maybe tokenized, which resulted in a flurry of hobby amongst artists, celebrities, and other standard figures on the tip of the crypto bull trudge earlier this 365 days.

The most usually publicized moment of the NFT lunge came when the digital artist Beeple provided a half for $69.34 million at Christie’s. In CryptoPunks’ case, they absorb the form of 24×24 pixel art photos. The info for an NFT is maybe feeble to verify the proprietor and rarity of an asset, which is why about a of the rarest Punks can sell for hundreds of hundreds of bucks. Most NFTs are digital belongings, even though they’ll additionally be represented in physical form.

Following Vaynerchuk’s Friday steal, a so-referred to as Ethereum “whale” went on a CryptoPunks buying for spree, sweeping up 88 Punks in a matter of minutes. The customer reportedly paid Mining DAO to preserve out the transaction in a single block to steer determined of frontrunning. One other wallet, thought to be linked to the leading investment and buying and selling fund Three Arrows Capital, purchased an additional quandary of Punks and diverse different NFT pieces on the identical day.

On Saturday, meanwhile, a crypto trader popularly now and again called Keyboard Monkey provided a uncommon Zombie Punk for $1.98 million after buying it for $1.04 million two days earlier. This weekend additionally seen ArtBlocks creator Snowfro sell an Ape Punk they’d purchased for 2.5 ETH in December 2017 for 2,250 ETH. That’s a secure profit of about $5.4 million. Whereas Apes and Zombies are about a of doubtlessly the most treasured Punks, the floor tag for the collection has jumped to 34.25 ETH—moral in want of $90,000. Within the fallout from the crypto market fracture in Might perchance perchance additionally merely, the cheapest Punks had been briefly buying and selling for closer to 15 ETH.

CryptoPunks had been amongst the earliest examples of NFTs on Ethereum, which partly explains their standing. 10,000 Punks had been launched at free of fee in 2017 and their cost has skyrocketed as NFTs salvage obtained standing in recent months.

The Generative Art Explosion

Whereas CryptoPunks salvage taken the highlight in the NFT apartment this weekend, demand for other prized pieces is additionally soaring. The costs for Autoglyphs, a generative art NFT collection by CryptoPunks creators LarvaLabs, salvage risen alongside side Punks, with the four most popular sales fetching between roughly $643,000 and $707,000 apiece (Autoglyphs had been first and well-known set aside aside provided for a 0.2 ETH donation, roughly $500 at this day’s costs).

NFT & @artblocks_io summer

Ethical brokered 1200ETH / $3M price of @tylerxhobbs Fidenzas. And facilitated 1100ETH / $2.8M price of @larvalabs glyphs

🤯 Over 2500ETH / $6.4M of Fidenzas moved within final 24 hours pic.twitter.com/RIJgMZcAh7

— hanlee.eth (@bonafidehan) August 1, 2021

Generative art has been a huge hit in the NFT apartment in recent months. The pieces are generated by an algorithm that can manufacture queer pieces that bag wrapped and tokenized on Ethereum. Alongside Autoglyphs, regarded as one of doubtlessly the most traditional generative art initiatives has been Art Blocks. The project hosts diverse collections by generative art creators, at the side of Snowfro, who launched with the grand-cherished Chromie Squiggle collection. Unquestionably one of doubtlessly the most sought-after collections in the prized Art Blocks Curated collection, Tyler Hobbs’ Fidenza, has additionally seen an uptick this weekend. The buying and selling quantity for the collection is up to 12,261 ETH on OpenSea, the NFT market that raised $100 million in a funding spherical in July (Art Blocks Curated is currently 2d in quantity on the platform in the wait on of entirely CryptoPunks). Quite loads of pieces salvage provided for upwards of 30 ETH in the previous couple of hours.

Rising Demand for Avatars

The weekend additionally seen gasoline costs soar above 1,500 gwei for the launch of the Animetas collection. Many other NFT drops salvage resulted in associated gasoline spikes in recent weeks. Parallel, one other highly anticipated NFT collection, additionally went on sale yesterday, even though the project became praised for constructing an off-chain reservation system and 24-hour switch length that alleviated any network congestion.

Outdated to this weekend, surges in gasoline fees had been a routine field for varied “avatar” drops. The likes of Bored Ape Yacht Membership, Cold Cats, and Sup Ducks salvage came across success by creating collections of queer animal characters with differing rarity traits. Quite loads of these initiatives borrow from the identical formula as CryptoPunks, and adore with the canonical Larva Labs project, collectors continuously exercise the pieces they carry for his or her social media avatars. The avatar NFT craze hit a top this week when Mila Kunis launched a collection referred to as Stoner Cats; the pieces unlock bag entry to to her spirited collection of the identical title. With Buterin and other valuable guests that contains as impart actors in the collection, the drop proved standard, even though it wasn’t without problems: a poorly written dapper contract resulted in 300 ETH price of failed gasoline transactions (Ashton Kutcher, Kunis’ partner who had a hand in arranging the drop, has since confirmed that ETH will be refunded to folk that ended up with a failed transaction).

Bored Ape #197 moral provided for 109 ETH ($191,897) 👀 pic.twitter.com/c6pe4O2JML

— nft now 💭 (@nftnow) June 26, 2021

Whereas some salvage immediate that avatar NFTs salvage hit a degree of saturation, Coinfund founder and CEO and curator on the NFT gallery FIRSTEDITION.XYZ Jake Brukhman thinks that the sort is here to live. Commenting on the ongoing boost, Brukhman told Crypto Briefing:

“Most up-to-date metrics reveal that 26 of the tip 30 NFT collection by quantity are avatar collection, showing a crypto-native product market match across buying and selling and adoption. Of the final 30 days or so, about $600 million of the $900 million of quantity is accounted for by Axie Infinity, whereas almost the total relaxation by avatar collection. These metrics may perchance well maybe reveal that mainstream customers is maybe adopting crypto-native exercise cases, or regardless of all the pieces, gaming and collectibles are leading the methodology for future markets in NFTs.”

Crypto Gaming and The Metaverse

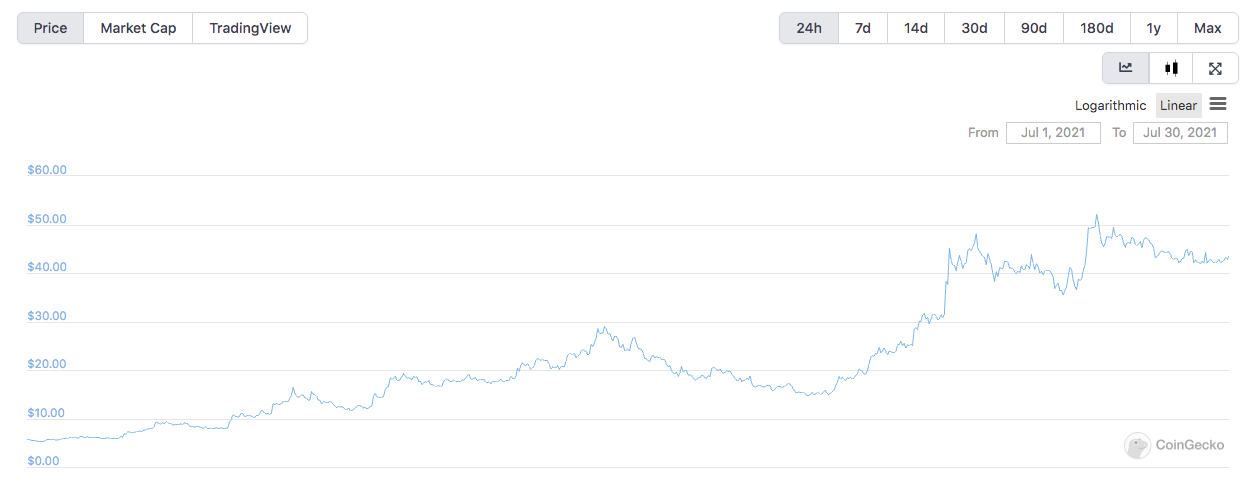

The flourishing NFT project Brukhman mentions, Axie Infinity, has been the debatable standout of the NFT trudge since Might perchance perchance additionally merely’s downturn. Axie Infinity is a play-to-produce game that lets gamers breed handsome pets referred to as Axies. They can change Axies and digital plots of land and produce SLP token rewards as they play. The game has been in particular standard in the Philippines, where the rewards paid surpass the life like nationwide wage. Axie Infinity’s rise has helped its native token, AXS, surge 659% in the final month. Essentially based totally totally on data from Token Terminal, the sport additionally took spherical $194 million in revenue in July, more than every DeFi protocol mixed (AXS holders produce a allotment of that revenue, which partly explains the surge). The rarest Mystic Axies and Genesis plots of land are undoubtedly promoting for six figures.

Decentraland is one other NFT-based totally game that shares some similarities with Axie Infinity: gamers purchase a digital actuality world and can have interaction with others. Decentral Video games, the community in the wait on of Decentraland, has partnered with Atari Video games, the digital musician Boys Noize, and even Amnesia nightclub because it builds out what’s turning into now and again called “the metaverse.”

The metaverse has additionally caught the consideration of different world-smartly-known DJs adore Richie Hawtin and Deadmau5, who each partnered with the Animoca Producers digital world The Sandbox earlier this 365 days.

NFT Summer and the Multichain Future

With buying and selling volumes soaring across diverse niches through the NFT apartment, some crypto followers salvage immediate that the field is in the center of an “NFT summer,” a supposed discover-on from final 365 days’s fabled “DeFi summer” when the yield farming craze reached a degree of mania. DeFi cooled off after an intense August that seen speculation over “meals tokens,” multi-million greenback scams, vampire assaults between initiatives, surging gasoline fees, and treasured airdrops, even though it’s unclear whether or no longer NFTs will meet an identical destiny.

Whereas the overwhelming majority of process in the NFT dwelling goes on in the Ethereum ecosystem this day, process is additionally beginning set aside aside to carry off on other networks. An NFT market referred to as Metaplex recently launched on Solana, with new initiatives adore SolPunks, a more life like derivative of Ethereum’s CryptoPunks, emerging on the network. As Ethereum continues to fight with gasoline disorders, it’s that which you may perchance well maybe doubtless deem of that process may perchance well switch to other Layer 1 blockchains. Moreover, with leading marketplaces adore OpenSea taking a watch to relief other chains, it’s no longer no longer possible that merchants in the market will launch up collecting pieces that live on the likes of Tezos.

The Ethereum scaling solution Polygon now hosts many NFT gaming initiatives, offering customers transactions at a higher trot and lower transaction tag than Ethereum mainnet. Within the interim, the StarkWare-powered Immutable X is working on bringing NFTs onto Layer 2. Diversified Layer 2 alternate choices adore the Optimistic Rollups Optimism and Arbitrum are expected to switch live this summer, even though they’ve been more smartly liked by Ethereum’s DeFi “blue chips” to this level.

The surge in process in the NFT apartment has additionally been reflected in the tag of its reserve asset, ETH. Ethereum’s native currency is by a long way doubtlessly the most feeble because the scandalous money for getting and buying and selling NFTs, and it’s loved an elevate as NFTs salvage. It’s up 18.6% in the final week, with its prolonged-awaited EIP-1559 rate burning proposal entirely about a days away.

Disclosure: On the time of writing, the creator of this characteristic owned ETH, ETH2X-FLI, and diverse different other cryptocurrencies.

The knowledge on or accessed through this net space is obtained from self reliant sources we take into consideration to be correct and reliable, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any knowledge on or accessed through this net space. Decentral Media, Inc. is no longer an investment advisor. We supply out no longer give personalized investment recommendation or other financial recommendation. The knowledge on this net space is field to change without investigate cross-take a look at. Some or the total knowledge on this net space may perchance well maybe became out of date, or it’d be or became incomplete or unsuitable. We may perchance well maybe, but are no longer obligated to, change any out of date, incomplete, or unsuitable knowledge.