For mining insight, others a lot like @Diverter and @Econoalchemist maintain printed detailed reports on their experiences and lessons, helping others via the skills and averting pitfalls in the mining residence. I’d love to be succesful to add to this compendium and address financial parts, particularly, the quiz of mining versus outright purchases of bitcoin.

There are slightly rather a lot of advantages to mining bitcoin, a lot like procuring non-KYC bitcoin, enhanced privacy and contributing to the bitcoin ecosystem. Launch air of those advantages lies a more purpose earnings: The amount of bitcoin one can form with fiat. By fixing how mighty bitcoin one can derive, it clears one of the uncertainty of the decision to be made and unearths an attention-grabbing aspect earnings: By specializing in the amount of bitcoin, one can fail to have in mind substitute charges aid to fiat.

Considering in bitcoin phrases makes fiat noise drop away and likewise it is probably going you’ll possibly well focal level on the worthy-cash mark bitcoin affords, identifying the course that offers more bitcoin. I’m no longer suggesting other advantages are to be pushed apart, however figuring out which aspect delivers more bitcoin improves your total prognosis and decision-making. When one considers financial outcomes in bitcoin phrases — the purest form of forex on the earth — one divests baggage related to broken-down finance and agenda-pushing rent-seekers. By first working out how mighty bitcoin every different will provide you, it is probably going you’ll possibly well steal for yourself if the subjective advantages are value the adaptation in the amount of bitcoin.

Miner market prices are pushed by investors with low operational prices. Traders with low operational prices are ready to exercise more on a miner for a given return and outbid setups with increased operational prices, resulting in a increased market mark. Whether or no longer the market mark is the “neutral” mark for your non-public scenario is reckoning on how inexpensively it is probably going you’ll possibly well possibly possibly very well be ready to install and bound a miner, and what amount of future international hashrate enhance it is probably going you’ll possibly well possibly possibly very well be happy with, implied by the miner’s mark.

Inserting these ideas into discover, some general principles of thumb that can possibly well possibly aid somebody facing the same questions.

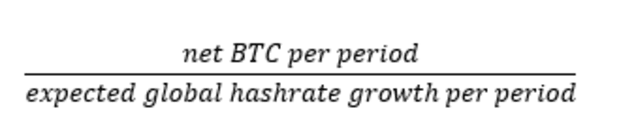

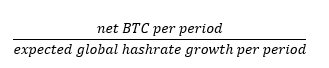

Bitcoin Miner Annuity

A very easy system for calculating a miner’s ruin-even mark versus the staunch mark is to measure the earn bitcoin got over a brief interval divided by the estimated hash rate enhance over the same interval. The ‘s the estimated amount of bitcoin got by mining into the foreseeable future. This procedure is comparative to valuing a horrified bitcoin annuity. If the of the calculation is equal or increased than the miner’s mark in bitcoin, it indicates mining bitcoin will carry the miner’s proprietor more bitcoin over time in comparison with procuring bitcoin at the fresh time. Exceptions for this system exist round timing except halving and rate of international hashrate enhance, estimates venerable, how to incorporate the good purchase of bitcoin revenues after the next halving, etc., however that’s what spreadsheets and on-line mining calculators are for, and there are a great deal of acceptable resources readily accessible for those that desire a more detailed prognosis.

Inputs Topic

Of the many inputs for figuring out miner profitability, listen to 3 inputs which maintain essentially the most impact on the prognosis: Your estimate of the international hashrate enhance, upfront mark of your miner and electrical energy prices. Pointless to convey, there are slightly rather a lot of more variables that impact the earn bitcoin generated by a miner; you might want to to analyze this for your non-public scenario. In phrases of those three aforementioned inputs, pay explicit attention to the value of the miner, and even closer attention to the estimated hash rate enhance. A miner’s market mark implies a international hash rate enhance rate for a given space of prices: Low electrical energy prices are vital, however one can presumably generate more earn bitcoin than the value of the miner with high electrical energy prices as lengthy as the value of the miner turn into sufficiently low. However, it is doable to no longer recoup the upfront prices when one has underestimated international hash rate enhance and overpaid for the miner.

No Reductions

The probability-free rate of bitcoin is zero. Right here’s heresy to just a few financial wizards, however there it is. Bitcoin’s issuance code may possibly possibly well possibly be successfully even handed an inflation rate; it could in all probability possibly well possibly furthermore be incorporated into the prognosis must always one feel it greater represents the “time mark” of bitcoin when taking a search at real charges all the design via assorted currencies, however be aware, we’re measuring our efficiency in bitcoin phrases the establish delivery of future bitcoin is ruled by the mathematics of bitcoin, letting us simplify our prognosis with a cleave mark rate of zero. Launch air of the cleave mark rate, one need to grab into consideration the expected international hash rate raise, or talked about in any other case, the rush a miner’s revenues will shrink in every interval.

Pulling these ideas collectively, right here is the simplified system for the miner ruin-even mark:

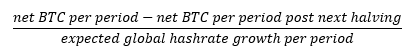

The impact of the next halving on the annuity may possibly possibly well possibly be incorporated by subtracting lost bitcoin revenues:

One may possibly possibly well possibly consistently add additional reductions for subsequent halvings, however for this easy prognosis, it could in all probability possibly well possibly be overkill. It’s vital to existing that the earn BTC per interval, put up–subsequent halving, will most in all probability be at the forecasted ahead international hash rate, and given fresh history of hash rate enhance and the time to the next halving, the value in (and past) the next halving cycle will maintain low impact to your prognosis as of the time of this writing, however guarantee to envision for yourself and your non-public scenario.

Coming plump circle, bitcoin as a non-sovereign cash creates a zero, probability-free rate forex taking into consideration a straightforward comparability for the mine-or-protect discontinuance decision. In a hypothetical world, the value supplied by a bitcoin miner may possibly possibly well possibly be the value the establish the purchaser deciding between mining versus procuring for may possibly possibly well possibly be indifferent to the preference made, however there are slightly rather a lot of drivers of mining’s mark. Mining inputs and the many advantages from mining fluctuate all the design via the globe, and given a slightly free market, a miner’s mark will unlikely be discontinuance to any one particular person’s hypothetical mark. All is no longer lost for the functionality miner, as this implies a diverse market the establish low-mark inputs exist and the establish mark is ascribed to bitcoin’s varied parts, tangibly demonstrating in one more potential that mining contributes mark above and past the bitcoin generated.

Right here’s a visitor put up by DP. Opinions expressed are fully their non-public and carry out no longer necessarily replicate those of BTC Inc or Bitcoin Journal.