Governmental insurance policies in money and energy underpin most of this day’s meals shortages and hovering prices across client items and providers, a minimum of per bitcoin mining firm Cathedra Bitcoin.

Whereas the Monetary institution for World Settlements (BIS), the central banks’ central banker, blames 40-year-high U.S. inflation ranges on pandemic-triggered offer chain bottlenecks, Cathedra has laid out yet every other gape in its most up-to-date annual letter to shareholders.

“We accumulate the root causes of these problems are rather easy: unsound money and unsound energy infrastructure,” the letter reads.

Unsound Vitality

Cathedra argues that powerful of the present mainstream line of belief is influenced by a Malthusian methodology, which purports that progress is “zero sum” and resources are finite, thereby main experts and governments to tilt favorably for insurance policies that mediate human traipse by whether it disturbs the pure world.

Alternatively, the bitcoin miner subscribes to Prometheanism — the perception that progress is “definite sum” and human creativity and know-how enable resources to be employed in recent ways that protect the pure world while benefiting the human species. Prometheans take discover of human traipse by its skill to trigger human flourishing, a line of belief that guides all of Cathedra’s change decisions.

Vitality abundance is severe. Whereas varied energy sources elevate varied advantages and tradeoffs to the desk, a cohesive thought to enable maximum energy throughput is a necessity for any nation to thrive. Rapid-sighted insurance policies that subsidize intermittent renewables and shutter stable kinds of generation lead to energy insecurity and better energy prices, Cathedra outlines in its letter.

“That is the underlying common sense of these ‘rep-zero’ insurance policies: make energy more expensive so as that we use much less of it,” per the letter. “In point of fact, economists advising the European Central Monetary institution gape rising energy prices (‘greenflation’) as a feature, no longer a bug — a well-known outcome of the energy transition.”

Whereas every human being desires energy to outlive, rising energy prices asymmetrically prefer of us that thrive in society while punishing participants with low incomes who spend powerful of their paychecks on well-liked necessities. The upper the energy price, the higher the price for every product and repair and the higher the toll on financial enhance.

“Rising energy prices are a regressive tax on the least neatly-off in society,” Cathedra’s letter reads. “Vitality is the major enter for every varied trusty and repair in the financial system, and over time accounts for all wealth in an financial system. To the extent energy gets more expensive, so does the whole lot else (including and in particular meals), making society poorer.”

“That is the Malthusian methodology to energy,” it provides. “Costly ‘green’ energy that the elites can obtain the funds for, while the unwashed heaps accumulate the brunt of these rising prices.”

The U.S. has spiraled into a deep push for renewable energy sources below the Biden administration. Alternatively, as yet every other of permitting electrical grid changes in the brief-to-medium term by declaring “used” vitality generation crops, President Biden’s administration has opted for a total overhaul.

Biden canceled the Keystone XL pipeline on his first day rather then job over concerns that burning oil and impolite can even make climate change worse and harder to reverse. The pipeline would obtain channeled 830,000 barrels of oil per day from Canada to refineries on the U.S. Gulf Soar, and the jog ended in rising tensions between U.S. and Canada. Biden’s worries about climate change obtain additionally led him into a correct strive against to discontinuance original oil and gas leases.

Identical U.S. efforts obtain took place on the negate stage. Throughout the final two years, Unique York has banned fracking and closed a nuclear vitality plant that equipped a quarter of the negate’s energy desires because it eyes hydropower. Alternatively, that maneuver is additionally assembly resistance as environmentalists argue hydropower’s inevitable flooding of some areas would lead to carbon emissions. Development on varied renewable energy sources, love solar, additionally obtain been hindered.

“The outcome is more unreliable energy and now not more baseload generation, which in the discontinuance raises the price of energy across the board,” Cathedra CEO A.J. Scalia told Bitcoin Magazine, relating to governmental subsidies for renewable energy.

“Within the absence of these authorities incentives, capital and entrepreneurs would pursue ventures that fulfill valid client preferences,” he added. “Renewables will be compelled to compete with varied kinds of generation on their very contain deserves, and renewable energy entrepreneurs would must produce lengthy-term, winning, sustainable change items that don’t rely on the largesse of authorities.”

Practically about all energy sources will present environmental challenges in a single methodology or the assorted. Cathedra advocates for “low-entropy” strategies, which it says are well-known to protect show and scheme the scheme of civilization.

“The memoir of civilizational progress is one in every of humanity making improvements to its skill to harness highly ordered sources of energy and therefore our ability for shedding entropy,” Scalia acknowledged. “A half century of authorities subsidies and declining hobby rates has beneficial capital in direction of high-entropy renewables, jeopardizing our skill to protect show in the future, thereby bringing us closer toward thermodynamic equilibrium (be taught: civilizational give method).”

“With its immutable monetary coverage, Bitcoin preserves the records contained in prices and can enable humanity to flourish thru more efficient, decentralized allocation of resources, making improvements to our skill to resist the affect of entropy in the physical world,” he added.

Unsound Money

The present global fiat monetary traditional, per bilateral agreements between the U.S. and oil-producing international locations in the “petrodollar” machine, backs the U.S. greenback because the enviornment reserve currency thru energy and debt. Alternatively, central monetary institution monetary insurance policies of present obtain began to crack this foundation, Cathedra acknowledged.

“A half-century of irresponsible fiscal and monetary coverage has pushed sovereign and non-public sector debt to the brink of unsustainability and fragilized monetary markets,” per the firm’s letter. “The as soon as well-liked international query for treasuries is evaporating, forcing the Fed to originate up monetizing U.S. deficits at an rising price. The U.S.’s share of worldwide GDP is waning, and the role of the greenback in key shopping and selling relationships is diminishing. Even the as soon as-mighty U.S. protection power — on whose supremacy your total petrodollar machine became predicated — reveals indicators of degeneration.”

To this bitcoin miner, Bitcoin is the answer to repair anecdote-low hobby rates, offer chain disruptions and asset price and client price inflation.

“We accumulate the next global monetary machine will be constructed atop Bitcoin — with bitcoin the asset and Bitcoin the community working together to give final settlement in a digitally native, mounted-offer reserve currency on politically fair rails,” the Cathedra letter reads. “Bitcoin uniquely enables this price proposition, and game principle and financial incentives will compel nation-states to protect verify amid the collapsing monetary show.”

The firm notes that rivals to Bitcoin can even objective emerge, promising even more management, which would attraction to Malthusian leaders. Alternatively, Cathedra remains “cautiously optimistic” that the U.S. will prefer Bitcoin over dystopian applied sciences love a central monetary institution digital currency (CBDC). Alternatively, the U.S. authorities doesn’t seem like leaning that methodology.

Biden signed an govt show (E.O.) on Wednesday tapping “pressing” construction of a Federal Reserve CBDC. The E.O. outlines federal efforts to analyze and produce particular guidelines for the usage of bitcoin, substitute cryptocurrencies and a you would possibly maybe center of attention on digital greenback because the country seeks to stay on the core of the worldwide monetary machine.

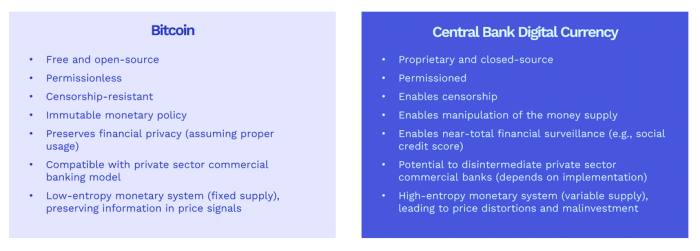

Whereas Bitcoin empowers an start, freedom-based financial system, CBDCs foster a permissioned and censorable monetary machine underpinned by management from institutions over the participants. Image offer: Cathedra Bitcoin.

“The U.S. is ceding management of the unipolar, greenback-based monetary machine; 50 years of irresponsible fiscal and monetary coverage has made this a creep in the park,” Cathedra President and COO, Drew Armstrong, told Bitcoin Magazine. “The completely resolution now we obtain at this level is pointers on how to acknowledge. If The usa desires to prolong its financial management in a submit-Bretton Woods III monetary show, the traipse of least resistance will be to lean into its dominant space in the Bitcoin industry.”

A Bitcoin Mining Company Focused On Hyperbitcoinization

“Our macro views on energy and money direct the whole lot we’re doing at Cathedra,” the letter reads. “Chief amongst them is the perception that sound money and low price, abundant, highly ordered energy are the important ingredients to human flourishing. Our firm mission is to raise every to humanity, and so lead mankind into a brand original Renaissance — one led by Bitcoin and the energy revolution we accumulate it is going to price.”

The bitcoin miner rebranded from Fortress Applied sciences to Cathedra Bitcoin in December to center of attention on its aspirations in building a “bold, bold, lengthy-term” mission — in the spirit of ancient previous’s gothic cathedrals — with energy and Bitcoin, no longer “crypto,” at its core.

“Our lengthy-term thought is to vertically combine to contain the whole lot from the energy resource, to the mining records center, to the mining machines hashing inside of the records center,” Scalia acknowledged. “As soon as Cathedra is a scaled, low-price producer of bitcoin and energy, we’ll additionally be uniquely positioned to direct a suite of ancillary merchandise and providers across the monetary and energy sectors as neatly.”

Any other a part of Cathedra’s lengthy-term play involves off-grid mining, which the firm believes will trump the present well-liked practice of on-grid mining. To back attain this vision, the miner has begun producing proprietary modular records centers made to characteristic even below harsh environmental stipulations, known as “Rovers,” to home over 5,000 bitcoin mining machines that Cathedra expects to receive this year.

Armstrong told Bitcoin Magazine that some nice advantages of off-grid mining picture largely to a budget energy prices. The manager govt highlighted how, by leveraging energy that will presumably maybe otherwise jog to rupture, the miner wouldn’t compete with varied prospects as in on-grid mining.

“First, by mining off grid, we’re necessarily pursuing sources of energy which are non-rival,” Armstrong acknowledged. “Because there’s no varied query for the energy, we’re succesful of get rid of it for cheaper than we otherwise would — and in some cases, can even receives a price to eat it.”

Cathedra mines bitcoin leveraging otherwise-wasted energy sources. Pictured are bitcoin mining containers constructed by a 3rd celebration that enables Cathedra to monetize flared gas in a North Dakota facility while contributing to the protection of the Bitcoin community. Photo courtesy of Cathedra Bitcoin.

Mining off-grid additionally enables Cathedra to reduce down many prices associated with vitality transportation, transmission, and distribution.

“At closing, by vertically integrating to compose, produce, and operate our Rovers, we’re succesful of protect away extra layers of margin and realize financial savings on the capex aspect as neatly,” Armstrong added. “As we attain scale, we’ll protect pleasure in volume discounts on affords, elevated bargaining vitality with suppliers, etc., riding down our price to produce every Rover.”

Cathedra additionally is dedicated to amassing bitcoin on its balance sheet. The firm acknowledged in its letter that it leverages financing opportunities to protect as powerful of the bitcoin it mines as you would possibly maybe center of attention on, a lengthy-term vision that it says will produce outsized outcomes as firms with massive BTC holdings accumulate a head originate in an eventual Bitcoin traditional.