Welcome to the Thunderdome (Cryptocurrency Buying and selling)

Whether you’re a crypto expert or correct getting your ft moist with investing, there’s a lot to be responsive to when procuring and selling your system by the cryptocurrency industry. Unlike in frail markets, cryptocurrency procuring and selling is chock beefy of volatility, infamous gamers, and irrational tag movements.

Listed right here, we’ll converse you about some of the favored errors in cryptocurrency procuring and selling and the system to steer clear of them.

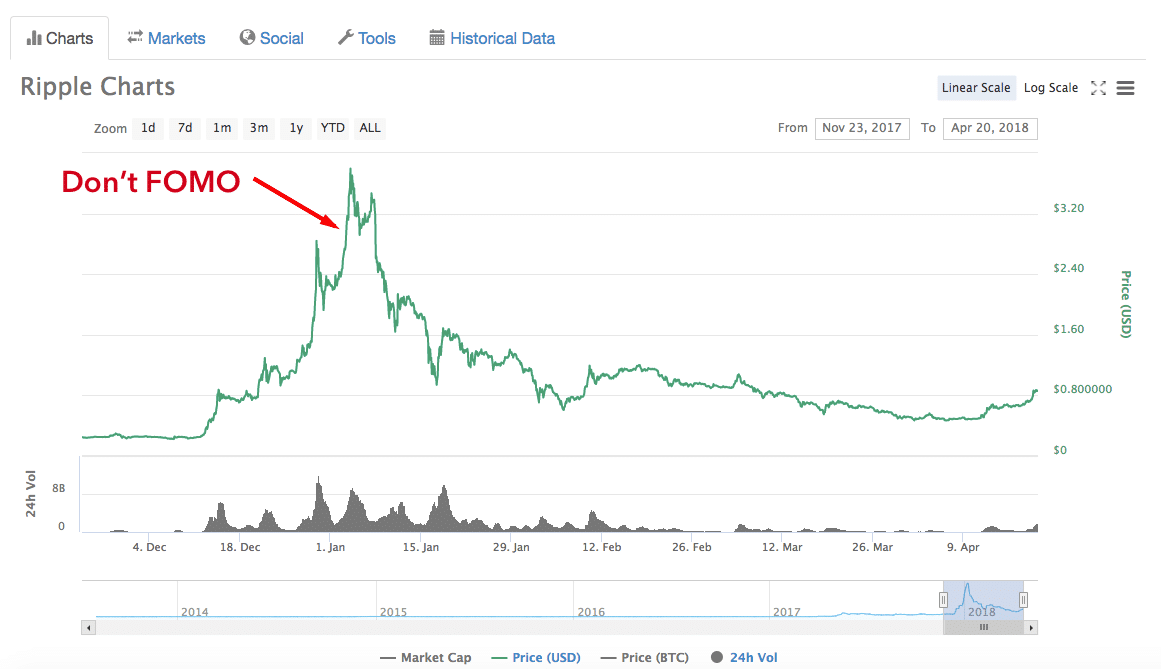

Mistake #1: Chasing Pumps aka FOMO

The most typical (and most sensible) mistake to manufacture in cryptocurrency procuring and selling is procuring correct into a coin after it’s already risen a well-known quantity. Traders that supplied into Ripple (XRP) and Tron (TRX) at the tip of their runs in 2017 positively felt the ache correct about a weeks later in 2018. It’ll also very smartly be your intuition to throw some money in the ring might want to you peer a coin shoot up 30-40% on memoir of it’s “sizzling.” Don’t.

Vulgar increases in tag are virtually always accompanied by some form of pullback. By the time you hear about a “sizzling” coin, it’s in general too late. Unless you’ve performed your research, think in the fundamentals of the coin, and wish to clutch it for the prolonged-term (>1 year), wait until the pullback to invest.

Pump and Dumps

Pump and dumps (PnDs) are a diversified breed of pumps which would be assured to head away you burned. While you happen to peer an unknown coin skyrocket at this time, be wary. It’s in all chance segment of a PnD draw. We poke into more ingredient about PnDs in this article, but they’ve infrequently coordinated efforts to artificially drive up the cost of a coin (the pump) earlier than selling it to these who FOMO’d in (the dump).

In case you bump into a coin admire this, the principle thing to test is the procuring and selling quantity. CoinMarketCap is a mammoth resource for this. Any 24-hour procuring and selling quantity below $1 million might want to raise a crimson flag.

Mistake #2: No longer Gleaming Your Investments

Don’t correct blindly educate the advice of some Twitter or YouTube “guru” for investment picks. Recurrently, these excessive-profile participants are paid to advertise definite money. Even John McAfee, one of many most smartly-identified figures in the region admitted that he gets paid to advertise projects. Inquire of the money that you just’re instructed to invest in.

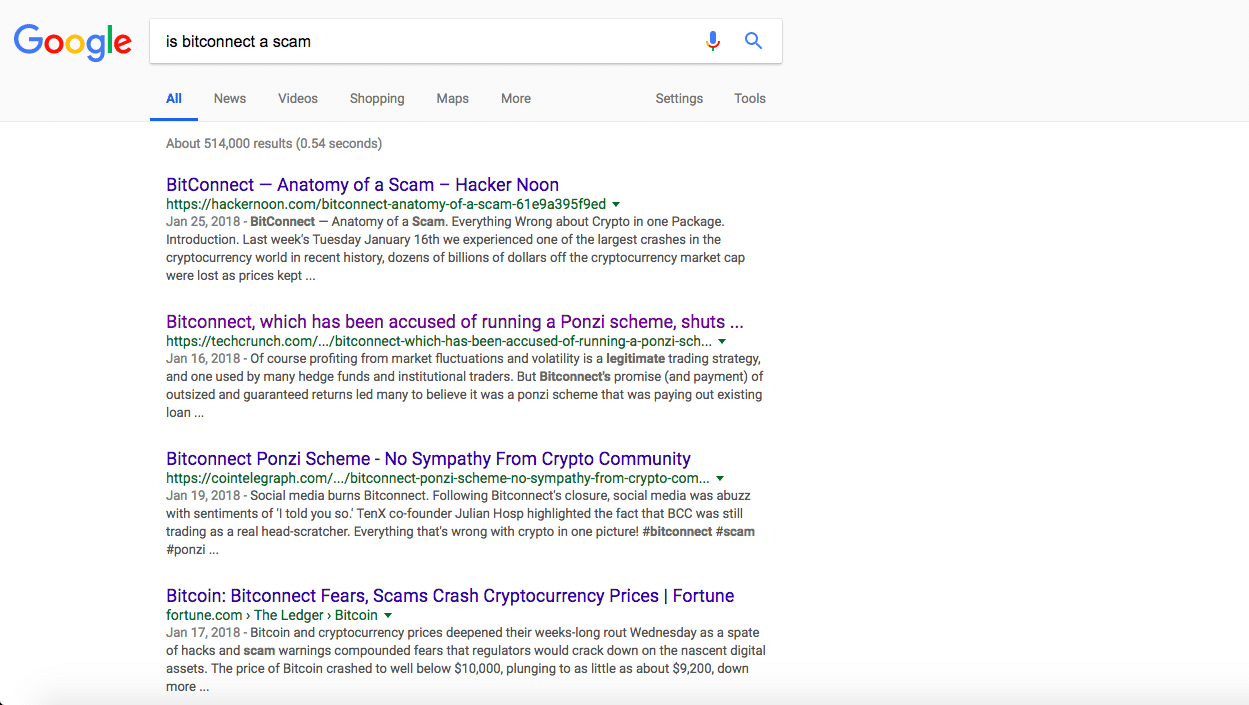

At the bare minimum, you are going to need to devote an hour to researching any mission wherein you intend to invest in. Compare out what converse it’s making an strive to resolve, the staff building it, and the economics of the coin. Has the mission partnered with someone well-known? Any essential names as advisors? These are all stuff you are going to need to know.

Even a transient Google search can even unveil some data that turns what can even seem admire gold into the trash. Taking it a step extra, you are going to need to ideally be taught the whitepaper of every and each mission you invest in.

Becoming a member of or forming an investment community can manufacture wonders to encourage with this. It forces you to manufacture research so that you just might possibly additionally utter your investment reasoning to your chums. It furthermore locations you an ambiance wherein it be well-known to converse your assumptions as others query your reasoning.

Mistake #3: Promoting at Detrimental Times

The reverse of chasing pumps, emotion-pushed selling is calm prick from the same cloth. It’s no longer easy, but you could to quit collected when procuring and selling – retain emotions out of it. Time and time all all over again, money have dipped down double-digit percentages earlier than rocketing to 200-300% gains.

When a coin you maintain begins to fall in cost, earlier than you sell, re-evaluation your enviornment. While you happen to invested on memoir of you’re thinking that in the coin’s fundamentals, there are about a questions that you just might possibly additionally quiz your self:

- Have faith any of the fundamentals modified?

- Had been there any bulletins that might possibly possibly per chance have affected the cost?

- Have faith you stopped believing in the prolonged-term vision of the coin?

In case your reply to all of these questions is “No”, then have in solutions holding on. This system turns into worthy more uncomplicated might want to you educate the golden rule of cryptocurrency procuring and selling: Don’t invest extra money than you’re pleased shedding.

On the change side of this equation, seeing some genuine gains might possibly possibly per chance also tempt you to sell. Despite the indisputable truth that taking earnings is wise, that you just might possibly additionally wish to steer clear of selling your total stack. Reckoning on the problem, the coin can even upward push extra. A favorite procuring and selling system is to steal out your preliminary investment whereas keeping your earnings invested in the coin after gaining a definite percentage. This decreases your blueprint back threat whereas calm exposing you to the upside doubtless.

Mistake #4: Being Uninformed

In a market that strikes as swiftly as cryptocurrency does, you could to no longer sleep-to-date with industry news. Without tuning in weekly, or even day-to-day, the investment tides can even shift without you even vivid.

The accurate news is that there’s a lot of sources that manufacture this straight forward. *Shameless slump alert* Right here at CoinCentral, we provide the most contemporary news and tutorial sources to will let you out. Our weekly e-newsletter *cough signal up below cough* sends the week’s most sensible doubtless news tales and articles on to your inbox.

Twitter, Reddit, and projects’ Telegram channels are furthermore mammoth sources that you just might possibly additionally use to quit informed. Oftentimes, groups fragment mission updates and tense bulletins on these platforms earlier than they hit mainstream media. Becoming a member of these communities furthermore gives you the change to be more bright with the projects whereas usually even impacting future model.

Appropriate Good fortune Out There

Even with the following tips, there are sure to be errors that you just manufacture. Don’t let that discourage you – it occurs to everybody. Section of the investing process is to be taught from these errors and no longer manufacture them all all over again.

Continuous improvement is the name of the game. And, as prolonged as you’ve got that going for you, you’ll be a procuring and selling whiz very hasty.