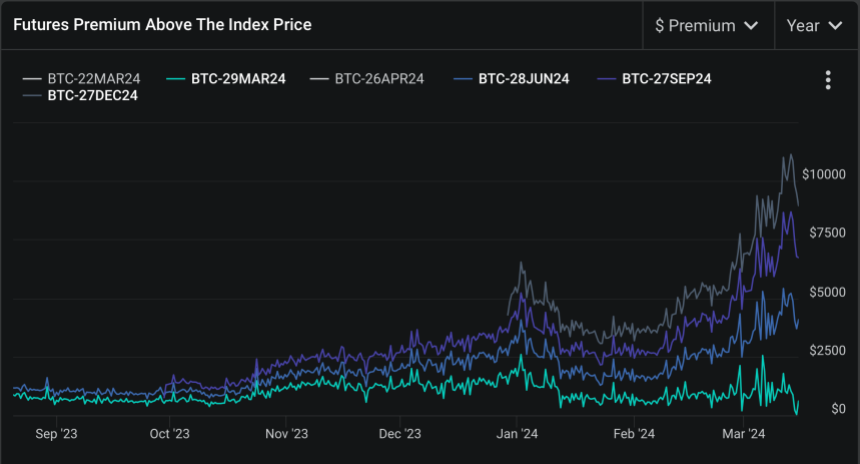

Bitcoin’s futures market is showcasing indicators that obtain historically signalled bullish sentiment. Analysts are turning their attention to the Bitcoin futures basis—a metric representing the differential between the futures tag of Bitcoin and its build aside tag.

Most up-to-date records has printed that this basis has escalated to unprecedented levels since Bitcoin’s all-time excessive of $69,000 in November 2021.

Bullish Indications From Bitcoin Futures

Deribit’s Chief Industrial Officer, Luuk Strijers, has highlighted the present declare of the Bitcoin futures basis, which ranges between 18% to 25% every 300 and sixty five days, a rate paying homage to the market stipulations in 2021.

According to Strijers’s insist, this elevated basis will not be any longer gorgeous a bunch but a lucrative different for derivatives traders.

By though-provoking in trades that involve buying Bitcoin in the build aside market and concurrently promoting futures contracts at a top rate, traders can real a “greenback originate” that will materialize on the contract’s expiry, no topic Bitcoin’s tag volatility.

Strijers extra renowned that this arrangement is highly attention-grabbing in the present climate, fueled by the influx of modern investments following the approval of Bitcoin ETFs and anticipation surrounding the Bitcoin halving event.

The significance of the heightened futures basis extends beyond the mechanics of derivatives buying and selling. It extra shows broader market optimism, “bolstered” by contemporary regulatory approvals and macroeconomic components influencing cryptocurrency.

The disparity between Bitcoin’s build aside and futures costs suggests a assured market outlook, propelled by the anticipation of continued funding inflows and the affect of the upcoming Bitcoin halving.

Such stipulations originate a fertile ground for Bitcoin’s fee to surge, as historical precedents obtain generally linked bullish futures basis rates with periods of grand tag appreciation.

Market Sentiment And Halving Cycles

Whereas Bitcoin’s present market efficiency reveals a bearish trajectory, with a 3.9% dip bringing its tag to $68,203, market analysts expose in opposition to interpreting this as a destructive signal. Rekt Capital, a revered resolve in crypto analysis, views the contemporary tag correction as a “sure adjustment” earlier the worthy-anticipated Bitcoin halving in April.

Halving events, which minimize the block reward for miners, thus slowing the rate of modern Bitcoin entering circulation, obtain historically catalyzed essential tag rallies due to the the resulting provide constraints.

Rekt Capital’s analysis parallels present market actions and historical patterns noticed in old halving cycles.

According to the analyst, no topic the swift journey of these cycles, they expose a constant sequence of a pre-halving rally adopted by a retracement phase—every of which align with Bitcoin’s present trajectory. This cyclical standpoint suggests that the contemporary dip is merely a brief setback, atmosphere the stage for the next bullish phase put up-halving.

Despite the indisputable reality that there are indicators of BTC experiencing an Accelerated Cycle…

Historical past aloof continues to repeat, nonetheless$BTC broke out into a “Pre-Halving Rally” unbiased on agenda

And now, #Bitcoin is transitioning into its “Pre-Halving Retrace” unbiased on agenda#Crypto https://t.co/Egqxs9ritl pic.twitter.com/lj0IdQtBEE

— Rekt Capital (@rektcapital) March 15, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is equipped for tutorial purposes entirely. It does no longer signify the opinions of NewsBTC on whether to amass, promote or set any investments and naturally investing carries risks. You are urged to conduct your bear analysis old to making any funding choices. Utilize data equipped on this internet page entirely at your bear threat.