Listed right here used to be previously published by Tax Notes, and has been republished right here with permission.

An not well-known provision within the Senate-favorite infrastructure bill1 would dramatically develop bigger the government’s surveillance of Individuals’ financial process and diminish The United States’s characteristic in increasing a in actuality important fresh technology. The amendment to part 6050I of the tax code must be struck when the bill is taken up within the Home. If it’s too uninteresting for that, it must be promptly repealed.

Beyond its impact on the liberty and dignity of U.S. voters, the provision targets a misunderstood place of fresh technologies — broadly, “digital resources” — and it will anxiety U.S. management in finance and technology.

In a huge vary of eventualities, the proposal would require Individuals to bag and document to the government the Social Security sequence of folks from whom they receive digital forms of monetary tag — alongside with that payer’s name, beginning date, take care of, career, and reason for the transaction. It does this by adopting wholesale the reporting regime that applies to the in-person receipt of orderly quantities of physical forex.

The applications and penalties of the proposed laws are hard to summarize, and even to confidently checklist, resulting from of the mismatch between the fresh technology being regulated and the old laws that is being repurposed to develop bigger govt surveillance. This old laws concerns the centuries-old technology of physical coin and paper forex, and it essentially governs face-to-face transactions fascinating more than $10,000 in cash.

The part 6050I proposal would impose hard surveillance and reporting responsibilities on all Individuals, with fines or detention center for those that fail (or perchance are unable) to conform.2 Nominally, the field of the laws is “cash,” nonetheless it’s not in actuality cash that’s being regulated; it’s folks.

Merely place, the fresh provision has no state in a free society. But despite everything, those that may perchance perchance perchance perchance relief the fresh laws must be required to argue for it within the cool gentle of day. A momentous imposition on Individuals’ monetary affairs — one that will perchance even impact the evolution of a vital and quiet-nascent technology in which the usa may perchance perchance perchance perchance already be losing its management characteristic — may perchance perchance perchance perchance quiet not be quietly tucked correct into a must-scamper spending bill underneath the guise of offsetting a cramped a part of its trillion-buck ticket.

A Modest Proposal for Authorities Surveillance

To cherish the proposed revision to part 6050I, it helps to gain a bird’s-explore explore of the government’s initiatives to display screen the drift of cash among voters. The surveillance and reporting of Individuals’ monetary process is defended largely as a purposeful necessity to sever the underreporting of taxable profits and to back battle crime. The dwelling quo has expanded piecemeal over the a protracted time and is unfold by procedure of assorted laws and regulations. Severely, most of this surveillance and reporting takes state within the back of the scenes, past the day-to-day journey of most Individuals. It has been outsourced to intermediaries corresponding to banks, employers, and the reasonably a pair of “brokers” that are defined in phrases of their duty to document third parties’ tax-linked monetary knowledge to the government.3

To know the procedure the government does, and may perchance perchance perchance perchance, preserve tabs on taxpayers in uncover to maximise its tax receipts, it’s functional to launch up with an crude nonetheless hypothetical reporting regime, after which back away to catch closer to doubtlessly the most contemporary actuality. Take into consideration a in actuality easy system designed to back the government develop sure all people pays their taxes:

Every time somebody receives money, the recipient must document the incident to the government.

On this hypothetical system of total monetary surveillance, “somebody” ability what it says (and comprises companies or other entities). “Receive” ability, gain possession for any reason. “File it” ability, first, to test the payer’s name, beginning date, take care of, career, and Social Security or tax ID number. Then, to promptly send that knowledge — alongside with the quantity got and the reason for the transaction — to the government on a make signed underneath penalty of perjury.

I am hoping this proposal strikes you as imperfect, not merely as absurd and not doable to put into effect as a purposeful topic. But from right here on out, I will focal point on the purposeful implications of the government’s methods of surveillance. The implications for Individuals’ rights and interests in dwelling free and private lives are left to the reader.

One reason it will certainly be absurd for the government to count on a document of every monetary transaction is that the government already has beautiful upright entry to much of the records that the hypothetical regime would create. As we debate how much paperwork and surveillance Individuals may perchance perchance perchance perchance quiet tolerate within the name of elevated tax income, it’s important to be upfront concerning the dwelling quo. Proponents of fresh surveillance measures to place up with technology will argue that the die has already been cast. But when fresh technologies lengthen the collateral penalties of more surveillance and reporting, it’s time to ask when ample is ample. No longer all measures may perchance perchance perchance perchance additionally be justified by a promise of elevated tax receipts, and surely it is miles scandalous to proceed without urged public debate.

Assist to our hypothetical surveillance regime. In gentle of how things work underneath the system already in state, it’s not laborious to seek why reporting every monetary transaction is overkill. The govtdoesn’t need voters to document every receipt of cash resulting from at the moment most money moves by procedure of monetary intermediaries corresponding to banks. Banks preserve upright records. They’re required to. They’ve your name, beginning date, take care of, and tax ID number on file, and your records is linked to every bank transaction you’re engaging with. Banks (and other monetary intermediaries corresponding to “brokers,” the field of the separate, much-discussed digital asset reporting provision within the infrastructure bill) are already required to expose the government when one thing principal happens with money you’re sending or receiving. And even though nothing triggers a reporting requirement, banks are ready to fragment even your silly records with the government when requested. They’re also free to document one thing else they deem suspicious, even though they’re not required to.4

So requiring all transactions to be filed with the government is already needless, resulting from much of that is already taken care of by banks. What’s left that will perchance perchance perchance require monitoring?

Piece 6050I And Conventional-Long-established Cash

Most money moves by procedure of banks, nonetheless not all of it. Physical cash quiet exists. I will hand you $100 — and even $1 million — without fascinating a bank. The govtdoes not love this, in any case, resulting from it could perchance perchance perchance not learn who got what from whom. So there are principles governing the employ of cash. Many Individuals don’t learn about these principles resulting from, the vogue the world now works, the foundations don’t in actuality appear to impact their daily lives. Plus, the foundations themselves delight in helped push cash to the perimeter of the financial system. Individuals quiet employ shrimp quantities of cash, and in any case the unhappy and unbanked employ cash loads, nonetheless that’s tolerated irrespective of occasional calls to extra sever the employ of physical forex to lengthen surveillance.5

Arguably, and more charitably, the reason many Individuals don’t know concerning the laws regulating their employ of physical cash is that those principles were certainly drafted, debated, and enacted following Congress’s respectful glance and recognition of how Individuals in actuality are dwelling and scamper about their financial lives as voters whose prosperity, autonomy, and liberty are the very targets of upright govt. On this argument, the wisely-conception to be cash principles sever the laws’s intrusion on frequent taxpayers’ private affairs in a wisely-struck steadiness with fighting crime and tax equity. But no identical argument may perchance perchance perchance perchance additionally be made concerning the proposed tax provision’s impact on Individuals who may perchance perchance perchance perchance employ digital resources. There used to be no exploration of how this would impact Individuals who love to employ digital resources, and there has been no debate.

Cash quiet exists, nonetheless now there may perchance be a fresh manner for me at hand you monetary tag without fascinating a bank or other intermediary. For simplicity, and following the proposed tax provisions, we’ll call this technology “digital resources.” The principle points of this technology are certainly important, and lawmakers especially would quit wisely to larger understand them. Sadly, what governments understand exclusively about digital resources is the actual fact that, love a paper $100 bill, I will give you a digital asset without the employ of a bank or other monetary establishment. And that ability that the government may perchance perchance perchance perchance not hear about it.

As we’ll soon glance, old principles limiting the employ of cash are the muse for the fresh proposal to develop bigger financial surveillance and reporting. If all you care about is monitoring every taxpayer’s receipt of cash, physical cash and digital resources certainly seek loads alike: All you may perchance perchance perchance perchance leer is that, with every forms of monetary tag, the government may perchance perchance perchance perchance not compare it will you receive some.

So governments are inclined to imagine the employ of digital resources, love the employ of cash, must be regulated and even downhearted. And certainly, the proposal to amend part 6050I does upright that, purporting to kind out physical cash and digital resources precisely the identical. These quick amendments to the tax code literally redefine the “cash” that must be reported to incorporate “any digital illustration of tag which is recorded on a cryptographically-secured disbursed ledger or any identical technology as specified” by the Treasury secretary.6

But physical cash and digital resources aren’t old within the identical ways, so the proposal to lump them together underneath the statute does not kind out them (or the humans that employ them) the identical. One amongst them is fat and the employ of it without the back of a regulated monetary intermediary on the final requires the payer and the recipient to meet face to face. The other is weightless and can zip anyplace on this planet within the blink of an explore. Painting them every with the identical brush underneath part 6050I fails to plan shut or respect how digital resources are (or can also very wisely be) old and what makes them an innovation to launch up with.

In 1970 Congress began to crack down on the employ of cash to battle money laundering. The Financial institution Secrecy Act required banks to document orderly cash transactions to the Treasury.7 The edge for reporting used to be place at $10,000, which may perchance perchance perchance perchance perchance translate to about $65,000 in at the moment’s dollars.

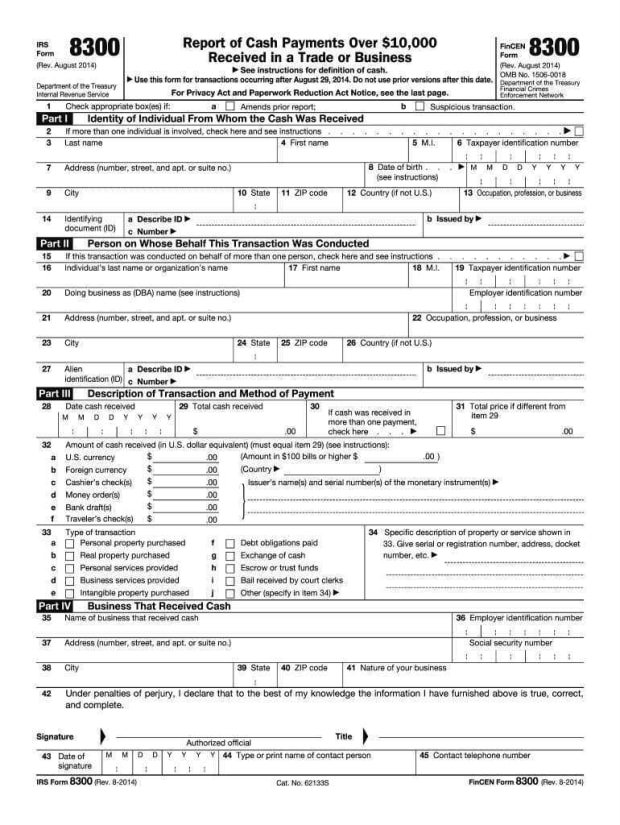

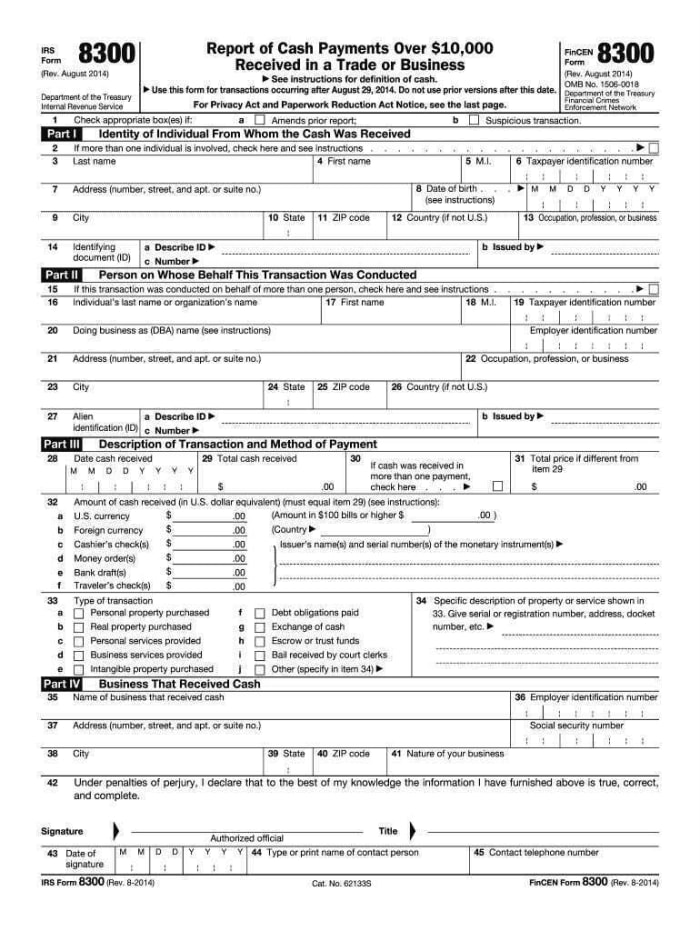

In 1984, this time with the acknowledged goal of accelerating tax compliance, Congress added a identical provision to the tax code. Area to a pair of barriers, part 6050I requires “somebody” who “receives” more than $10,000 in income any transaction to document the match to the IRS. This entails filling out Produce 8300, signing it, and mailing it to the IRS inner 15 days. (On the present time, there’s an technique to file the document online with FinCEN’s Financial institution Secrecy Act E-Filing system.) The govtestimates it takes 21 minutes to absorb out a Produce 8300.8 Penalties for unreported or misreported Forms 8300 may perchance perchance perchance perchance additionally be as diminutive as $50, for missing the 15-day reporting closing date nonetheless curing the error inner 30 days.9 “Intentional brush apart” for the laws may perchance perchance perchance perchance raze up in fines of as much as $100,000; willful violations may perchance perchance perchance perchance raze up in detention center time.10 Other penalties be aware for failing to send an annual commentary by January 31 to every person you reported throughout the old one year.11

To total a Produce 8300, the recipient of the cash is required to test the payer’s identification,12 and must also document the payer’s change or career and the nature of the transaction. The well-known knowledge comprises the payer’s Social Security or tax ID number. It appears, requiring the disclosure of 1’s Social Security number to one’s counterparty as a situation of transacting more than $10,000 used to be not one thing that raised concerns among lawmakers in 1984 when they enacted part 6050I. But at the least the requirement used to be virtually most likely, because the replace of cash and private knowledge used to be seemingly face to face. This also made most likely the Treasury’s requirement that, if the payer claims to be an alien, the recipient must “watch such person’s passport, alien identification card, or other legitimate file.”13

The exclusively “folks” exempted from the requirement to file Produce 8300 are — are waiting for it — banks and other monetary establishments.14 That does develop sense resulting from those establishments already delight in a identical requirement to document orderly cash transactions underneath the Financial institution Secrecy Act. But this asymmetry ends in an absurdity that highlights the indefensible trail to operate this substantive laws as a segment of a spending bill.

In uninteresting 2020 the Treasury proposed to amend, on an expedited timeline, the Financial institution Secrecy Act regulations for reporting orderly cash transactions to incorporate transactions in digital resources.15 Following thousands of public feedback on this and other proposed regulations, the proposal used to be slowed to permit extra consideration.

That Treasury provision would be aware exclusively to monetary establishments, now to not the “somebody” addressed within the fresh tax proposal. It’s upright that the quick Treasury proposal used to be slowed. However the consequence is that monetary establishments would be exempt from part 6050I’s fresh reporting requirement underneath existing laws, at the same time as you and I are not. If the Treasury’s proposal deserved extra evaluate earlier than being imposed, then this far broader proposal surely does.

To require reporting, the receipt of cash must be one day of the recipient’s change or change, nonetheless this limitation does not present the safe harbor some may perchance perchance perchance perchance demand. In most cases, a “receipt” of cash does occur one day of change or change. The tax code does not in actuality outline “change or change,” requiring us to seek to case laws to search out out what raze-attempting for activities are adequately in actuality intensive, unprecedented, and continuous16 to trigger the statute.

Importantly, the requirement of a “receipt” has nothing to quit with taxable profits, and even income, and even the recipient’s comely to place the money: It’s simply the receipt of cash that triggers the statute. Receiving cash on behalf of any individual else requires the recipient to document it.17

The regulations develop clear that the which implies of “transaction,” that is, “the underlying match precipitating the payer’s transfer of cash to the recipient,” is amazingly gigantic. Right here’s the partial checklist from the laws18:

“Transactions consist of (nonetheless are not miniature to):

- a sale of items or products and services;

- a sale of proper property;

- a sale of intangible property;

- a rental of proper or personal property;

- an replace of cash for other cash;

- the establishment or repairs of or contribution to a custodial, trust, or escrow association;

- a price of a preexisting debt;

- a conversion of cash to a negotiable instrument;

- a repayment for charges paid;

- or the making or repayment of a mortgage.”

$10,000 appears love a transparent threshold, nonetheless what counts as a “transaction” exceeding that figure is more complex. Related transactions count as a single transaction, as may perchance perchance perchance perchance “linked” transactions if the recipient “is aware of or has reason to know” that they are linked.19

Payments resulting from a single transaction catch added up over time, triggering the reporting requirement when they exceed $10,000. And once those funds all over again attain $10,000, a fresh Produce 8300 must be filed. “Structuring” transactions in an strive to handbook far from the $10,000 threshold can itself be against the law.20

Piece 6050I And Digital Sources

As this overview of part 6050I shows, the employ of orderly quantities of physical cash invites excessive-stakes questions over precisely what transactions require reporting. Those questions are multiplied when “cash” is prolonged to “digital resources.” And when filing a Produce 8300 is clearly required, the nature of digital asset transactions raises one other host of questions over the procedure it could perchance even be most likely to conform with the knowing sequence and verification requirements.

It’s not most likely, in this place, to checklist the vary of transactions that will perchance perchance perchance trigger Produce 8300 reporting — much much less to explore the much less-clear circumstances that will count upon the interpretation of the statute’s phrases in opposition to a technology that used to be impossible when the statute used to be written. A few notes must suffice. Confidently the laws’s significance is obvious ample to elaborate the time and learn important to list its rotund costs and penalties.

Merely buying $10,000 charge of digital resources (in one or more “linked transactions”) may perchance perchance perchance perchance trigger the requirement to absorb out a Produce 8300. Grab that “an replace of cash for other cash” counts as a transaction. This implies that “an replace of digital resources for other digital resources” will be reportable, raising extra questions concerning the which implies of the term “digital asset” and the uses of them that will perchance perchance perchance trigger the statute.

Receiving digital resources as repayment of a “mortgage” would require reporting. Already, digital asset technology permits its house owners to lend, lock up, post to the partial or total custody of others, and otherwise deploy digital resources in ways in which are hard to analogize to physical cash and even to computerized nonetheless bank-centric monetary technologies. Grab also that “receipt” has nothing to quit with profits or income, and it is miles explicitly defined to incorporate “custodial” eventualities. Assuming there may perchance be a “receipt,” the statute extra assumes that there may perchance be an identifiable celebration able to offering — certainly, verifying — a tax ID number and other personal knowledge.

In sum, digital resources are not merely, and even essentially, another option to physical cash. They’re a most likely different to the bank-mediated financial process that the government now leans on so heavily to position in force its surveillance requirements. Intermediaries love banks didn’t evolve simply to back governments’ hobby in collecting taxes and fighting crime; they evolved to back humans’ targets in commerce, monetary security, and whatever else may perchance perchance perchance perchance make contributions to human flourishing. A proposal to thwart technology that will perchance perchance perchance sever Individuals’ — and yes, also the government’s — reliance on such intermediaries to quit their targets may perchance perchance perchance perchance quiet not be rushed. It requires a rotund and comely debate — and within the raze a resolution that does not unnecessarily sacrifice Individuals’ privacy and autonomy within the name of tax sequence.

Footnotes

1 Infrastructure Investment and Jobs Act, H.R. 3684 (2021).

2 In comparability, a separate and far-discussed tax provision within the infrastructure bill would require exchanges and other “brokers” engaging with digital resources to document their customers’ tax knowledge to the government, a revision of part 6045.

4 Uniting and Strengthening The United States by Offering Acceptable Tools Required to Intercept and Obstruct Terrorism (USA PATRIOT Act) Act of 2001, P.L. 107-56, part 314.

5 Judge about, e.g., John Carney and Joshua Zumbrun, “The Location to Execute the $100 Invoice,” The Wall Aspect street Journal, Feb. 16, 2016.

6 Infrastructure Investment and Jobs Act, part 80603(b)(1)(B) and (b)(3).

7 31 U.S.C. part 5313.

8 Instructions to IRS Produce 8300.

9 Megan L. Brackney, “When Money Costs Too Necessary,” CPA Journal, July 2020.

10 Identification.

11 Identification.

12 Reg. part 1.6050I-1(e)(3)(ii).

13 Identification.

15 FinCEN, “Requirements for Obvious Transactions Intelligent Convertible Digital Foreign money or Digital Sources,” leer of proposed rulemaking, 85 F.R. 83840 (Dec. 23, 2020).

16 Commissioner v. Groetzinger, 480 U.S. 23 (1987).

17 Reg. part 1.6050I-1(a)(3).

18 Reg. part 1.6050I-1(c)(7).

19 Identification.