The FinTech regulatory landscape in the European Union is field to constant changes, and Europeans would maybe well possess a advanced time procuring cryptocurrencies in their respective countries.

On the new time, we’ll be the high 6 of the splendid exchanges currently accessible in Europe, and whether or no longer they’re recurrently appropriate for you.

1. Coinbase: A Top Global Commerce, Accessible in Europe

Coinbase is a number one cryptocurrency substitute co-based by Mind Armstrong in 2012. It’s essentially the most trendy substitute in the US, and additionally enables users from the UK, Italy, Ireland, and a whole lot of different varied European countries to desire, sell and commerce cryptocurrencies, including reasonably so much of DeFi tokens and stablecoins.

Coinbase currently helps more than 100 tradable cryptocurrencies and its interface is user-friendly. For more legitimate and institutional merchants, the unreal provides Coinbase Pro, which has a more evolved charting interface and the entire indispensable tools and sources for excessive-stage procuring and selling.

Whereas you would dangle to exhaust Coinbase on the walk, the unreal additionally has a cellular model for iOS and Android devices the put aside you would maybe well maybe with out problems prepare your portfolio and engage and sell digital property.

Additionally, Coinbase provides a sizzling storage wallet: Coinbase Pockets, the put aside besides storing your crypto funds, you would maybe well maybe additionally keep your NFT (Non-Fungible Token) property and explore a gigantic choice of decentralized applications (dApps).

Pro tip: exhaust Coinbase Pro for decrease charges. It’s the identical functionality, merely a varied interface with a wider array of property.

Mavens & Con of Coinbase:

Mavens:

- User-friendly

- Stable platform with 2FA verification

- Developed charting and procuring and selling tools for legitimate merchants

- Excessive liquidity

- Has a cellular app

Cons:

- Fees are typically excessive compared to competitors

- Wretched buyer crimson meat up

CoinCentral readers can develop a signal-up reward upon constructing a brand fresh Coinbase tale.

2 – Gemini: NYC-Essentially based completely, Stable Crypto Commerce for Europeans

Gemini is continually a trendy mention by approach of safety. The synthetic changed into as soon as based in 2014 by Cameron and Tyler Winklevoss, the trendy twins who shared classes at Harvard with Build Zuckerberg. Gemini currently helps a gigantic choice of 100+ cryptocurrencies, including DeFi, NFT, and gaming tokens.

Beginners would maybe well get Gemini’s interface is user-friendly, with straight forward have interaction and sell alternate suggestions. It additionally has a crimson meat up internet page with answers to general questions and buyer crimson meat up is comparatively decent. Knowledgeable merchants would maybe well desire to interchange to Gemini’s ActiveTrader platform, which has a more evolved charting platform and ingredients more than one declare alternate suggestions and margin and derivatives procuring and selling.

One in every of the principle focuses of Gemini is user safety, allowing users to allow 2FA, pin codes, and Face ID for iOS and Android users. Additionally, Gemini provides two wallets: one is a sizzling storage wallet for particular individual accounts and a frigid storage wallet for institutional accounts.

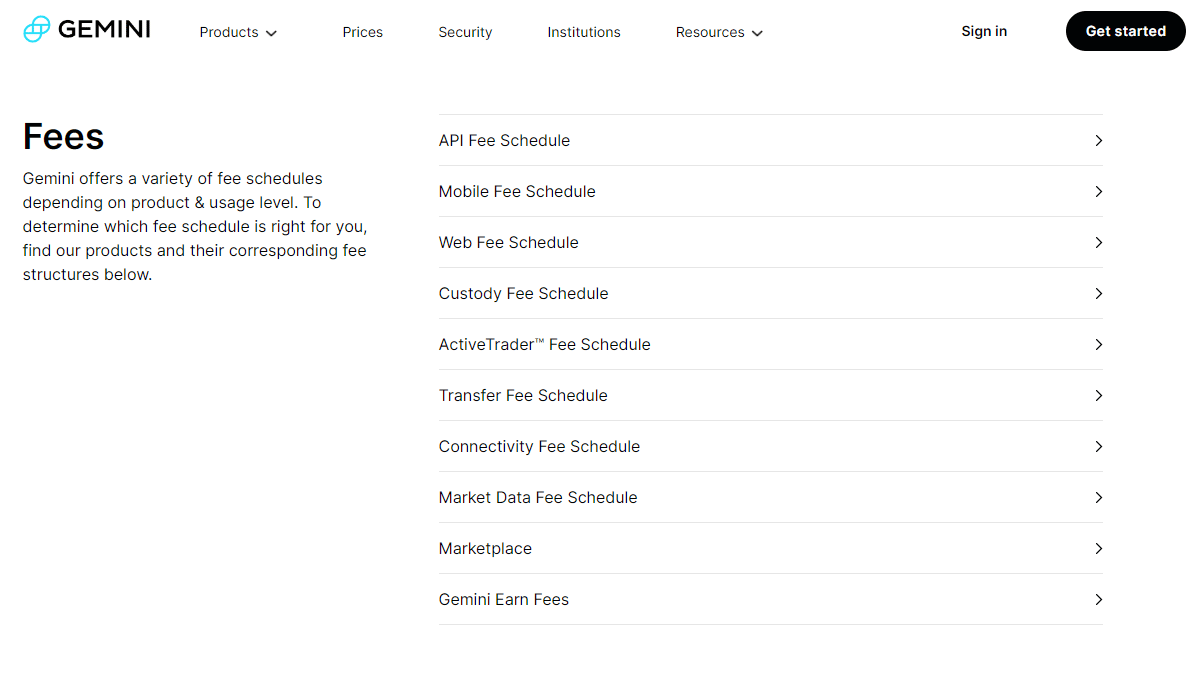

Gemini has costly charges, however, and you ought to additionally expose that Gemini’s payment construction is rather advanced compared to competitors. Whereas you evaluate out Gemini’s Charge Time desk internet page, you’ll get 10 varied sections talking about the more than a few charges for each and every product or service on the unreal, which looks to be to be like something like this:

Gemini Charge Structure. Offer: Gemini

Mavens & Cons of Gemini

Mavens:

- Provides procuring and selling training for novices and a relieve half

- Enables staking and lending

- User-friendly

- Highly get

- Helps a whole lot of crypto-connected merchandise

Cons:

- Difficult payment construction

- Dear charges

CoinCentral readers can develop a signal-up reward upon constructing a brand fresh Gemini tale.

3. Kraken: User-Pleasant & Highly efficient Crypto Commerce

Kraken is a broadly depended on cryptocurrency substitute, ethical for both novices and evolved merchants. Whereas it boasts a user-friendly interface, it additionally provides a sturdy charting platform and procuring and selling tools to desire your procuring and selling to the next stage. When put next with Coinbase, Kraken has a rather bigger margin of supported cryptocurrencies —over 120, including DeFi tokens and stablecoins.

Look after its chums, Kraken additionally has a cellular model accessible for iOS and Android devices and Kraken Pro, which is a more evolved platform for getting and selling a fluctuate of instruments, including margin procuring and selling and derivatives, such as futures and perpetual contracts. It additionally has decrease charges compared to the everyday platform.

Kraken additionally provides a constructed-in digital wallet so users can store their funds. As a fun truth: the unreal prompts its customers to store their funds off exchanges and support them in frigid storage for better safety.

Mavens and Cons of Kraken

Mavens:

- Helps an intensive choice of cryptocurrencies

- Highly secured platform

- Has a cellular app

- Relative low charges

- User-friendly

Cons:

- No credit score/debit card deposits

- Customer crimson meat up is rather tiring

- Slack verification process

4. Bitpanda: Just For Procuring Several Crypto Resources

BitPanda, an Austria-essentially based completely broker, changed into as soon as one amongst the first Bitcoin exchanges to be established in Europe in 2014. The synthetic now boasts a wide checklist of over 1000 cryptocurrencies, so whenever you occur to’re looking out a diversified library of digital property, Bitpanda is a correct probability.

As of February 2022, BitPanda has been the host for more than 3 million active users on its platform, which is discreet to navigate and the procuring and selling interface is ethical for novices. Needless to reveal, for legitimate merchants, there’s Bitpanda Pro which, as you can possess guessed by now, ingredients a more evolved charting platform the put aside you would maybe well maybe enviornment more than one declare alternate suggestions and commerce passe and crypto derivatives.

The synthetic additionally provides BitPanda Slump —a service that permits users to desire crypto without prolong with cash. It’s reasonably perfect whenever you occur to’re an Austrian buyer as you would maybe well maybe have interaction coupon codes utilizing cash at a local submit enviornment of job and then redeem them for crypto. Then all all over again, desire into tale BitPanda Slump charges, currently at 3%

Look after its competitors, BitPanda ingredients a cellular model for iOS and Android users, which is accessible for win on the unreal’s internet residing. There you would maybe well maybe with out problems have interaction, sell, defend and commerce cryptocurrencies seamlessly.

Mavens & Cons of BitPanda

Mavens:

- Secured, depended on platform

- Broad fluctuate of tradable cryptocurrencies

- Cell model accessible

Cons:

- Excessive charges compared to varied exchanges

- Additional prices for deposits

- Doesn’t crimson meat up staking or lending

5. FTX: Easiest For Diversifying Your Portfolio

Essentially based by Sam Bankman-Fried, CEO and additionally the founding father of Alameda Learn, FTX is one amongst the splendid centralized exchanges by procuring and selling volume. FTX provides a wide fluctuate of enterprise instruments for all of its customers, from merely procuring and promoting stocks or digital property to procuring and selling derivatives merchandise, forex, commodities and more.

There are over 300 cryptocurrencies accessible on FTX, including excessive-market cap property like Bitcoin, Ethereum and DeFi, gaming, NFT tokens and stablecoins. The synthetic additionally has its possess NFT market and NFT wallet.

Trading charges on FTX are rather low, however you ought to hunt recordsdata from deposits/withdrawal charges as effectively. One downside of the unreal is that its buyer crimson meat up in all fairness runt —you would maybe well maybe handiest contact crimson meat up through tickets, whereas cellular phone crimson meat up and are residing chat are no longer accessible.

Mavens & Cons of FTX

Mavens:

- Intensive choice of enterprise instruments

- Broad fluctuate of cryptocurrencies supported

- Secured and depended on platform

- Helps staking, NFTs, and leverage procuring and selling

- Fees are rather low

Cons:

- Small buyer crimson meat up

- No longer user-friendly

6. eToro: Crypto, Foreign substitute And Social Trading

Essentially based in 2007, eToro is a sturdy probability for European users. It handiest supported passe property till 2013, when it grew to change into one amongst the first passe exchanges to crimson meat up Bitcoin procuring and selling, including more crypto property in the following years. You would possibly well maybe have interaction, sell, and commerce over 30 cryptocurrencies, including DeFi tokens and stablecoins.

eToro is ethical for both novices and legitimate merchants. Original users will like a very easy to navigate procuring and selling interface, whereas the more evolved would maybe well desire to interchange to eToroX, a platform designed for excessive-stage legitimate procuring and selling. You would possibly well maybe additionally develop an institutional tale, however you’ll possess to post more paperwork to evaluate the identity of your organization.

eToro stands out from competitors due to the its copytrading characteristic, which enables fresh users to reproduction successful strategies from high-notch patrons.

Mavens & Cons of eToro

Mavens:

- Highly get platform

- Just for novices and evolved merchants

Cons:

- Helps a runt quantity of cryptocurrencies

- Wretched buyer crimson meat up.

Other Crypto Exchanges in Europe to Capture into tale

You is liable to be pondering, what about Binance?

Binance is one amongst the main cryptocurrency exchanges by procuring and selling volume in 2022. Then all all over again, it has had a rough time offering its services in Europe due to the the regulatory landscape, which in all fairness a catastrophe by now. The accurate recordsdata is that Binance is stepping up its plans to enter the European scene, because it no longer too long ago got approval from the Organismo degli Agenti e dei Mediatori (OAM) to open a local of job in Italy and expand its services across the country.

One other country that no longer too long ago gave the golf green gentle to Binance is France, which granted tubby permission to the unreal to give its services contained in the country. The crypto community has viewed these final two recordsdata as a step forward in bringing digital property into the European Union.

Final Tips: What Crypto Commerce Suits You Easiest?

There are a handful of crypto exchanges offering a wide choice of merchandise for European users. For the time being, the European Union is but to clarify an correct regulatory framework for the cryptocurrency enterprise.

Whether you ought to develop a passive earnings through staking, lend your crypto property, or merely desire and sell cryptocurrencies, it’s optimum to evaluate the accessible exchanges and determined which one suits handiest for you.

As a final expose: desire into tale you ought to handiest make investments capital you would maybe well maybe give you the cash for to lose. Cryptocurrencies are unstable and thus field to wide mark swings, so as the extinct announcing goes, don’t keep all of your eggs in one basket.