Right here is an belief editorial by Beautyon, the CEO of Azteco.

In this put up, I parse the above-named act, bringing up the glaring flaws and errors in it. It desires to be determined to any American that this invoice is an abomination and that it’s going to silent not slip into laws. If it does, it would be challenged within the Supreme Court docket, struck down, removed with prejudice and the scathing chastisement it deserves.

The foundation that there’ll even be “responsible innovation” is absurd on its face. If Senators Cynthia Lummis and Kirsten Gillibrand were alive at some level of the generation of lake ice initiating by horse and cart, they could agree with found that the electrical ice box became “irresponsible innovation” because many men would possibly maybe well be place out of work and horses became into glue or meat.

That’s precisely what is taking place with Bitcoin. This recent innovation, which permits every person to agree with the powers of a bank of their pocket or their industry, puts pre-Bitcoin banks and their ignorant regulators out of industry forever. Right here is “irresponsible” per Lummis and Gillibrand, who are searching to withhold the damaged and putrid system and place a lick of orange paint on it to present it a as a lot as the moment look. Right here is the most effective that advance and build of them tacking on and spraying the imaginary, concocted phrase “digital resources” all via old laws as is advised on this invoice. It’s blockchain fairy mud and it will not wash off.

Lummis and Gillibrand, with this unsuitable, scabrously proposed invoice, are going to space off American entrepreneurs (which agree with passports and know the ultimate plan to make spend of a plot) to opt out of their crony capitalist, anti-American sandbox for the free market — which is mercurial selecting bitcoin because the recent world reserve forex in over 45 diverse countries. They’ll incorporate wherever and their computers and team of workers don’t must be in any particular space at all. Nobody has to or will win to set aside up with this, unless they are searching to.

Right here we slip …

In the definitions share is the immoral seed and root of the order that started this absurd and deeply offensive nonsense. There isn’t this kind of thing as a such thing as a “Digital Asset.” That’s an analogy feeble to contextualize bitcoin for computer illiterates, and never an staunch thing at all.

Many instruments in machine will even be feeble to confer financial, proprietary (closed source) or access rights or powers. PGP/GPG (Stunning Staunch Privacy/GNU Privacy Guard) does this, and is not at all times regarded as an asset, but beneath this definition, it will even be classed as such — as can a plaintext username and password — because every of these items and plenty others confer access rights or powers. In the case of public-key encryption, access to plaintext and the energy to decrypt.

Usernames and passwords are cryptographically secured once they are saved in databases, so that they are captured by this definition additionally. This contaminated logic and computer illiteracy is what powered the insane non-fungible token (NFT) craze. It is determined that the of us that wrote this invoice are completely ignorant when it comes to how computers and machine works; in every other case they could were more staunch of their language to spend precisely what Bitcoin does, but of route if they did that, they’ll fair not agree with drafted this daft laws at all. Lying is an absolute prerequisite right here.

In an identical plan, the line, “any a similar analogue” captures literally anything that can story files in an ordered manner, love an abacus or ranking in a on-line sport. They doubtlessly belief they were being funny once they feeble the note “analogue” right here. It’s not funny at all.

“Virtual forex” is a vague time duration that can mean literally any quantity on a display cowl the set aside the viewer is led to take into consideration he is taking a seek at a balance that’s allocated to him. That advance any ranking in a on-line sport, love “Colossal Mario Land 2: 6 Golden Coins,” the set aside you literally receive money.

Now, an unintelligent particular person would assert that because that Game Boy sport isn’t very networked and the money aren’t transferable, it’s a long way not “crypto” or “virtual forex,” but what they don’t perceive is that the cartridge itself is the “digital pockets” that would possibly maybe well fair be handed over for money at any time, and the Game Boy instrument is the pockets viewer that someone can spend to impart how a quantity of the six golden money are within the game.

In the occasion you don’t know anything about video games, agree with never performed Colossal Mario Land, don’t know what cartridges are or how scores are kept in games, you must silent not be drafting laws that touches bitcoin.

Stablecoins are of no passion and can fair not be conflated with bitcoin. That they are bundling all of these diverse instruments and products and providers into one share of laws additional displays their total lack of consciousness. Stablecoins are nothing bigger than contracts that don’t rely upon mythical “blockchain technology,” but on the soundness of the companies issuing them and making the ensures that their offering is backed, for which no recent laws is required.

If a firm fraudulently claims that its proprietary database has one buck per entry held in belief and that looks not to be perfect, the directors agree with lied and dedicated fraud. No recent laws is required to duvet that circumstance fair because they’re using a novel database and sales language to perpetrate the fraud.

“Assorted securities and commodities,” which of them?

Anybody writing video games would possibly maybe well even be forced to register because they’re maintaining ranking in a sport with a database and would possibly maybe well be captured by this laws. It is insane.

This definition makes it determined that the authors are computer illiterate, and that they quit not know how anything works within the 21st century. Every database on Earth that has replication, MySQL-NDB or other such capabilities is captured by this. What does “participate” mean right here? How significant of the database is “partial” sufficient to space off this definition to advance “perfect?” All databases in more than one nodes are synchronized by default. How can they not know this? How is it that they develop not agree with someone on their team of workers who knows, or who knows which particular person or what query to quiz?

Files is frequently appended to databases following consensus tips of the database engine. By this definition, Wikipedia falls beneath this since it has the total attributes of “distributed ledger technology.” Wikipedia,

- Is shared across a space of distributed nodes that take part in a network and store a total or partial replica of the database.

- Is synchronized between the nodes.

- Has files appended to it by following the desired consensus mechanism of the Wikipedia moderators.

- Might maybe maybe very effectively be accessible to someone or restricted to a subset of contributors.

- Might maybe maybe maybe require contributors to agree with authorization to develop determined actions or require no authorization.

By the definition on this shabby, ridiculous and grievous invoice, Wikipedia is a “distributed ledger technology” and is absolutely captured by the laws, so it would be compelled to register with the Securities and Alternate Charge (SEC) or one more incompetent authority. If not, then why not? There isn’t this kind of thing as a “slice-out” that’s most likely right here either, since the total world’s ultimate products and providers (and little ones) all speed on top of the ideas Lummis and Gillibrand are searching to slice out for themselves and their anti-American cronies.

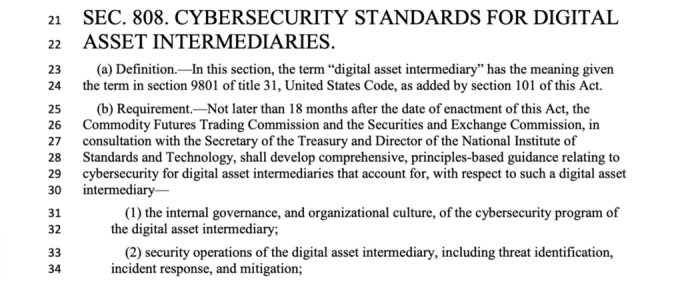

The time duration “digital asset middleman” captures someone who offers database products and providers or collects files to be added to a database by utilizing a proprietary interface. “Digital asset activities” literally advance rolling dice. Enact you reflect I’m being absurd by asserting this? I’m very serious.

Example one.

All of these would possibly maybe well be regarded as “digital asset activities,” that advance that the producers of the instruments that facilitate the activities would tumble beneath this laws … after which what? Are they going to license the possession of dice? Sounds ridiculous, doesn’t it, nonetheless it’s a long way not any more ridiculous than this absurd share of draft laws. It is ridiculous to assert that a mathematical operation performed with dice is materially diverse to one performed in a computer. By this logic, the First Modification is constrained simplest to textual speak written by hand, but not by a typewriter or on a computer.

The instrument you utilize to write with is immaterial, inconsequential and completely separate to your traditional appropriate to write and post.

No American lawmaker desires to be blind to this. Furthermore, there’s no exception within the First Modification for writing that’s math. Math is stable speech per the First Modification.

This ridiculous passage applies to Folding at Dwelling, the distributed protein-folding project, BitTorrent and any tool the set aside bigger than one computer is connected to one more that splits the work or display screen system dispute. “Any a similar analogue” advance that Folding at Dwelling is captured — heaven support them if they offer a financial reward to whoever finds the resolution to a protein-folding order since it’s going to be seen as a “block reward” for discovering the resolution to a onerous biology order — which is precisely what bitcoin miners quit!

When a Folding at Dwelling participant finds a resolution, that resolution is shipped to Folding at Dwelling headquarters, the set aside it has a financial price to pharmaceutical companies. They are taking shield a watch on of a definite “digital asset” that became mined after which transferred to them. All contributors in Folding at Dwelling and the invention of ideas to the folding order are captured by this laws.

And now … Right here it comes …

Oh dear.

There isn’t this kind of thing as a such thing as a “digital asset,” subsequently the remainder of this share falls. They’re constructing a tower of lies, layering lie upon lie upon lie. Why is a balance on a banking app not a “digital asset?” In the occasion you will agree with the Scramble Bank iPhone app, you would possibly maybe well send money straight to other Scramble app users within the same plan that you just would possibly maybe well send Lightning payments to someone using a Lightning app. Scramble uses distributed ledger technology underpinned by the COBOL programming language, so that they’re 100% captured by this laws. If not, why not?

The digital resources in a Scramble app aren’t only snug; it’s a long way “a digital illustration of fair snug.” It isn’t very backed by anything; Scramble guarantees to pay fair snug to the sum proven to your Scramble app; it’s a long way a develop of contractual promise simplest, and never money. Scramble absolutely makes an announcement within the develop of a promise to pay U.S. dollars on question to the narrative holder, and there’s a onerous peg of 1:1 for every digitally represented buck to your Scramble app. For all intents and applications, and as outlined on this draft laws, the Scramble banking app is a stablecoin app.

Does it with out delay follow that Scramble is now beneath these absurd and irrational “cryptocurrency” tips, or is there a slice-out exemption for the crony capitalists and vested interests space to be obliterated by the Bitcoin ecosystem?

“Vulnerable primarily as a medium of alternate.” Right here is, of route, completely absurd. The writers of machine can develop not agree with any files of how a tool is feeble within the atomize, and burdening companies with tips borne of assumptions love right here’s irrational. What if the minority uses it to easily count anything, love how numbers are most frequently feeble? Can agree with to the truth that they are searching on a “blockchain” portray them to laws? Why is counting money a regulatable act whereas counting a herd of ostriches isn’t very? Or are ostriches not money? There are of us that reflect that anything will even be money, so within the puzzled minds of the of us that reflect bitcoin is money, ostriches will even be money too and can fair, pretty naturally, be regulated.

Ostrich breeders aren’t truly “breeders”; they’re ostrich miners. Ostrich sellers aren’t promoting noteworthy birds, they’re money transmitters. They are these items because I am a senator and I assert so. Right here is precisely the form of logic that you just’re seeing on this sick-suggested invoice.

This share specifies that it mustn’t be fair snug. Nonetheless bitcoin is completely snug in El Salvador, so subsequently it’s a long way completely exempt from this invoice, perfect? If not, why not? In the occasion you’re going to pronounce that the licensed guidelines and definitions feeble in El Salvador develop not agree with any force within the US, then the reverse is additionally perfect and U.S. laws cannot infect other countries. I reflect most non-U.S. electorate would possibly maybe well be gratified with that device. Opt your unparalleled, parochial tips locked within U.S. borders while we forge forward into the future.

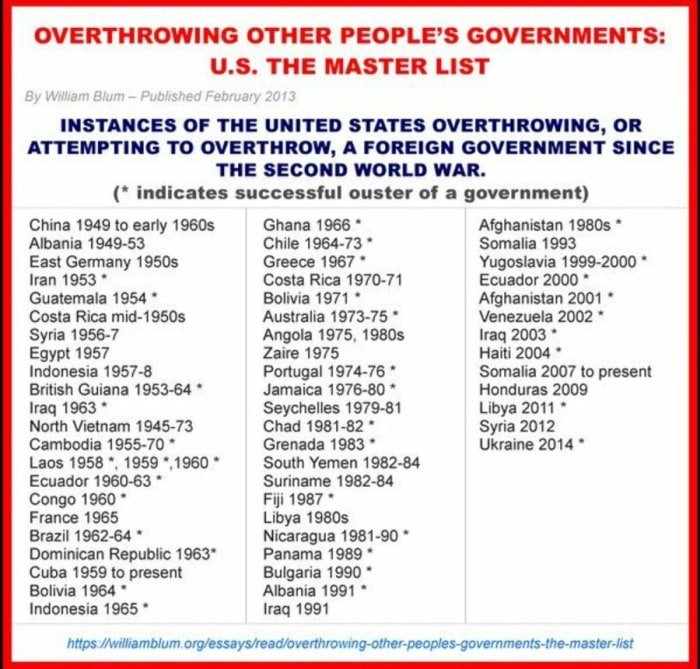

Bitcoin is a database administered by tens of hundreds of folks and incorporations in all places the arena. The Commodity Futures Trading Charge (CFTC) can’t be granted jurisdiction by fiat over foreigners and the machine they’re working on their machines. This land snatch, this energy snatch, will be rejected by all non-U.S. persons, sovereign nations and the foreign companies wherever they are integrated. The U.S. legislature cannot shield the mental property of foreigners or question anything of any form from them. Right here is hubris and grotesque American chest-beating of the form that has made The usa into a hated nation world large.

This share is full of life, since it reveals how the Speak is scrambling to withhold up with the myriad strategies machine builders advance up with recent market tips. The very silly “digital collectible” or “NFT” fad is what is being obliquely referenced in line 26. By the time this contaminated laws is rejected by every houses or is challenged by SCOTUS and purged, the NFT fad — love the ICO fad sooner than it — will be needless and forgotten for one more enchanting recent distraction, and this language is totally irrelevant. “Hey Kidz. I gaze wut ur doin and ima legulize dat 4U.”

In this share, the legislators are carving out a fair requirement to make spend of an licensed or chartered or registered entity arena to the foundations they’ve already laid out for entities within the legacy system, in an strive and commence the door for those legacy entities to search out a space within the recent ecosystem, assured by laws. It isn’t very most likely and onerous if tried, for any recent incorporation to slip muster and act as a peek to enlighten the carrier of keeping “digital resources” (which don’t exist at all), and so the legacy incumbents are in a ultimate space to proceed to dominate with the blessings of the Speak.

Obviously, someone in any jurisdiction rather then the US can ignore all of this and make an world-altering challenger firm that can dominate globally. They most frequently’re going to total it. This laws can’t offer protection to the legacy system from competition, as is its diagram.

As for the line,

“(v) An acceptable foreign governmental authority within the house nation of the custodian.”

U.S. laws can’t resolve what is and is not at all times “appropriate” for foreigners to total, or the factors they must silent adhere to, if any. Who quit these folks reflect they are? Many wide awake People agree with the advance and files to make spend of the tall advantages that foreign jurisdictions bring to the market. They’re not going to be dissuaded, corralled, coerced or shamed into capitulating to this anti-American drivel, must silent it even change into laws.

Furthermore, the cancerous tentacles it inserts into other laws over its 60-plus pages represents a maze of pure grime that will be very refined to untangle must silent someone strive and salvage this unspeakable garbage. Even if they quit, it’s a long way an absolute certainty that the interns tasked with doing it would be Ivy League computer illiterates with the worst human characteristics and tendencies, i.e., crony capitalism, hubris, superiority complicated, sociopathy, socialism, and plenty others., and must silent be diametrically against Bitcoin and all the pieces to total with it out of the gates.

Bitcoin is permissionless, and companies that work with it’s going to silent not require approach permission to make spend of that database for any cause. Since it’s a long way a (soon to be acknowledged as) First Modification Protected Job (FAPA), this will be struck down as prior restraint. The U.S. authorities cannot halt an particular particular person from publishing anything upfront because they simply take into consideration it’s going to fair space off harm. This all goes support to what Bitcoin in actuality is and the plan in which it truly works.

Of us making Bitcoin transactions are publishing textual speak to a public database that someone can read, even machines. As you’ve seen above, the total operations required to make spend of Bitcoin will even be performed manually. They are performed by machines for comfort and waddle, however the acts being performed are with out query acts stable by the First Modification.

Whether or not or not some computer illiterate understands right here’s irrelevant. The SCOTUS will be made to comprehend it and they’ll strike this invoice down with excited arouse, must silent the bulk of Congress be putrid sufficient to vote it into laws.

It is absurd that this share is inserted. They’re asserting that it’s a long way illegal unless the consumer waives his protections (nota bene: “protection” not “appropriate”) with the CFTC. It’s going to silent not be a requirement that a consumer desires to total this. By dint of going into contract with the firm they’re getting carrier from, they are able to waive their mafia “protection” upon signature. Why quit these folks take into consideration that participants must silent write letters that will never be read or relied upon to them? Who quit they reflect they are that they take into consideration they are able to place onerous and immoral burdens on someone? Why are the contracts that participants voluntarily shield in ample in other areas to waive all kinds of alternative “rights” but are insufficient on this particular topic, requiring that a additional supplementary letter desires to be despatched? Right here is fully illogical and an man made burden on shoppers that serves no cause and protects no person.

If the acts they’re searching to halt are truly price stopping, certainly they must silent not enable them at all, and never enable folks to set aside themselves at threat, if it truly is the duty of the CFTC to withhold folks safe from themselves. Why not, then, enable folks to opt out of all CFTC tips fully, by simply writing a letter proclaiming:

“I want none of your protections nor anything to total with you. I waive all protections afforded and supplied by CFTC in perpetuity.”

Why not?

Once again, there isn’t this kind of thing as a “digital asset.” Keeping this in thoughts, why is it that the Hollywood Stock Alternate (HSX), created by the genius Max Keiser, became not deemed to be beneath CFTC/SEC jurisdiction? Nobody has an respond for this. Of us which agree with regarded as these matters who are determined to etch their names within the legislative rolls aren’t concerned. All they need is to be notorious, and to agree with their names immortalized in a invoice.

HSX is called, “a sport” but why is it a sport? Why aren’t bitcoin exchanges regarded as “games?” They are indistinguishable from HSX. Is it the case that if any bitcoin alternate called itself a sport that none of these crazy recent tips would insist? Nobody can respond this, clearly, and right here’s the crux of the order.

If the HSX determined to swap out its MySQL database and spend Solana or Bitcoin, would the feature of HSX impulsively alternate? For certain, it wouldn’t, but asserting this exposes the total belief route of of this invoice for the nonsense that it’s a long way, and this perfectly sound, irrefutable argument will be feeble within the SCOTUS case to waste the likelihood all recent Bitcoin laws within the US, and force the casting off of reward laws.

Of us with restricted mental resources will prattle off “blockchain keep in touch” to inform why MySQL isn’t a lot like Bitcoin, but they are simplest ready to reflect in analogies which were spoon-fed to them, and can’t take care of reality and info. Even whenever you occur to level to how their pondering is totally contaminated, they refuse to accept it because they’re participants of what is effectively a brainwashing cult, with the added incentive of financial investment and greed as a lot as the neck, to withhold them absolutely enslaved and in thrall to the blockchain cult narratives, speech patterns and blathering.

In the drafting of this daft nonsense, the drafters subconsciously know that what they’re doing is 100% contaminated. Right here is why on this share, it says:

“IN GENERAL. — Any trading facility that offers or seeks to give a market in digital resources would possibly maybe well fair register with the Charge as a digital asset alternate…”

They’ll fair register or they’ll fair not register. It doesn’t assert they must register. Why not? Underneath what staunch conditions is a carrier to be exempted from registration? Obviously, the Hollywood Stock Alternate isn’t very a “real” stock alternate because all the pieces in it’s a long way made up, but so is all the pieces on any “crypto alternate” the set aside folks agree with simply determined that they are searching to play that sport and grab the outcomes. No, accurate because folks pay for a sport carrier doesn’t mean it’s a long way “financial job” analogous to real stock exchanges, genius.

Causes why these faulty and unhealthy folks can’t assert with absolute certainty which agency or rule applies to databases is that they develop not agree with any working out of how anything works or what anything truly is. They are victims of their very have lies, narratives and concoctions. Right here is why they’re equivocal, unsure and leaving it as a lot as the applicants, using gestures, tips of thumb, analogies and fallacious definitions to circumscribe a fallacious territory for themselves to rule over.

If no person chooses to register with the CFTC since the context is a paid-for sport of their terms of carrier, beneath what pretext is the CFTC licensed to act? There isn’t this kind of thing as a fair restriction on using financial terms in any sport, so entrepreneurs are free to get 1:1 copies of any financial system carrier, alternate or trading desk. Love the Hollywood Stock Alternate, with all of its related terms, graphs, instruments and ephemera, in a ultimate simulation that’s not real, they agree with absolutely the appropriate to charge for access to their sport on irrespective of terms the avid gamers will accept. And no, placing an upper cap on how significant folks can charge for a carrier isn’t very an option. And no, gambling licensed guidelines wouldn’t spend these sites recontextualized as games because they don’t quote odds and must silent explicitly disclaim that gambling is the job in which users are enticing.

Right here is the most effective nature of what is occurring with fictitious “digital resources” and the total arena that the energy-excited reputation-seekers were gulled into believing became real. Now requiring “tips of the dual carriageway” concocted by them and their faulty band of anonymous crony capitalists, ignorant interns and anti-American suicide squad saboteurs.

By this share, Ethereum and all altcoins the drafters mistakenly regarded as to be “digital resources” can’t be traded on the premise of this recent laws. All altcoins in proof-of-stake systems or with sizable-node controllers or any system with a central firm that can alternate tips, halt a system fully or quit anything unilaterally, can’t be feeble beneath this proposed laws.

Manipulation is undefined right here; who’s to pronounce attractive from proof-of-work mining to proof-of-stake consensus isn’t very manipulation? Proof-of-stake with out delay puts those with stake above those without a stake, making a multi-tiered and provably unfair system. It is additionally arguably a breach of promise, searching on the terms and stipulations of the “blockchain” making the modifications.

You all know that “Faketoshi” is searching to reverse worn transactions to agree with money allocated to himself. Were he to reach doing this, bitcoin and all its derivatives would possibly maybe well be captured by this crazy rule. And of route, sizable-node gatekeeper controllers fulfill the factors of “…efficiency or operation of the digital asset will even be materially altered by any particular person or neighborhood of persons beneath licensed shield a watch on.”

Since so many “money” tumble afoul of this, it’s a long way determined that sport sites that mimic commodity and stock exchanges using them must silent not and can’t tumble beneath CFTC remit, but as a change are accurate sport aspects on a brand recent database. They all destroy out these irrational tips if the foundations change into laws. In every other case, all sport level systems tumble beneath the foundations and desires to be stopped.

The networks that mediate the databases feeble in what these sick-suggested characters name “digital resources” all rely upon and are built on other folks using the work place into managing the network to withhold network integrity and shield the network working and viable. To pronounce that these businesses cannot spend the tool they are using (spend of which is required to withhold the tool viable) is irrational and illogical. The most straight forward instance of right here’s “mining charges” which desires to be paid to get transactions on the network, or in proof-of-stake, using the truth that stake is held that would possibly maybe well be allocated to customers as share of the proof.

Once again, they are asserting that any customer who concurs to be exempted from the following tips would possibly maybe well even be exempted via a waiver … so then, why stipulate the rule within the first space? The total industry has to total is get the waiver share of the terms and stipulations after which the rule is straight away nullified by default.

What they’re asserting right here is that companies are to be compelled to post proprietary market files that would possibly maybe well fair support their foreign opponents. Atmosphere pleasant market mechanisms emerge from the market, not by portray of the Speak, which is a major-class blundering, stumbling, incompetent meddler.

In an identical plan, you would possibly maybe well’t compel folks to implement a nebulous belief of “tips” which will seemingly be not explicitly codified. Furthermore, “offer protection to” doesn’t mean anything on this context either; offer protection to who from what, precisely? And what does “abusive” mean? Making excessive profit, no question; a quantity of the folks within the support of this invoice are socialists in all but title. “Gorgeous” doesn’t mean anything either.

The rest of this share is stuffed with twaddle. All betraying the absurd belief that these recent alternate products and providers are analogues of the reward stock and commodities markets, and that a similar tips desires to be utilized to those nascent markets, unchanged with out any recent assumptions, perfect assumptions, recent pondering or any pondering at all. The requirement to agree with a support door commence to the CFTC nonetheless is galling and insulting, and enshrines privateness violation. Fully sinful and completely anti-American.

Once again, simplest a maniacal despot would question this intrusion, disruption, violation and invasion of private businesses by the CFTC (or every other agency), and the energy to liquidate positions at the CFTC’s portray or even slump carrier at their orders. For certain, must silent this insulting drivel be passed into laws, the spur will were heeled into the facet of the donkey to get more exchanges love Bisq that the CFTC can’t contact.

Why? Why must silent someone be compelled to expose proprietary industry files to the CFTC? If no breach of contract or lawsuit is underway, and no prison act is accused and no warrants issued, why must silent proof be forced out of someone? That isn’t how The usa works. Sooner than you will even be compelled to expose files a warrant desires to be issued. That’s the Fourth Modification to the U.S. Constitution, geniuses. Create you appreciate that? How can legislators not know this?

As for making trading volume public, that’s proprietary files. Mark files is already published so as that the market can work, genius. Why doesn’t the CFTC receive this files itself on its have equipment? Because they’re incompetent, that’s why. What is “other trading files?” In the occasion you don’t specify, someone who’s sane gained’t present anything not explicitly requested. That desires to be the default, must silent this vile and immoral laws be passed.

Initially, exchanges quit not are searching to be over capacity, ever. Stipulating right here’s absurd and insulting. Nobody desires to ever agree with incomplete records attributable to overcapacity occasions. What is demanded right here’s a strictly technical requirement that the CFTC has no industry asking for. The shareholders of every firm working with Bitcoin question fine-grained files and reporting, as quit the users of the trading systems. If any firm doesn’t get rich files, shoppers will pass to products and providers that quit. The market takes care of this. CFTC isn’t very wished at all and their interference is un-American and unwelcome by real People.

Document maintaining is a industry operation that must silent simplest be performed to the pleasure and requirements of the industry householders, shareholders and their clients, and never for the desires of the CFTC. In the occasion that they need folks to total the story-maintaining work, they must silent quiz civilly after which pay for the records to be maintained, since they are being kept for the CFTC and no-one else.

Obligatory reporting of files desires to be beneath warrant simplest and never from a blanket question of “anything we resolve, any time.” Who quit these folks reflect they are? And the same goes for the SEC, tagged alongside right here.

For certain, you would possibly maybe well question these companies to abuse your files and spread it across all branches of the American authorities, at the side of NSA, CIA and the total other secret companies. It’s contaminated and must silent even be refrained from. What is unbelievable right here is that they’re making it laws that the CFTC will share the ideas of American companies and electorate with foreign ministries. How can someone calling themselves a “Republican” draft such an inferior and sovereignty-violating statute? It’s breathtaking and surprising. Fully, purely anti-American.

There’s simplest one battle of passion on portray right here: the battle of passion between the CFTC and American entrepreneurs and electorate with this abusive, anti-aggressive, irrational, ridiculous, onerous nonsense.

How is any industry going to agree with financial resources on hand to support customers once they’re being blackmailed into spending money to fulfill the unquenchable thirst of the CFTC? Why does the wind-down clause not advance with an opt-out for users who are searching to grab the threat of going via a firm that doesn’t get the promise to withhold wind-down contingency funds? They permit an opt-out for other issues. Why not this? Why not enable an opt-out for the total shabby invoice and its unsuitable provisions?

All of these are industry and machine requirements chubby of words that the drafters clearly don’t perceive. As an illustration, what does “respectable” mean when it comes to … anything? As for threat prognosis, complicated systems that work collectively as a change of job and over APIs agree with multiplicative error eventualities and failure modes that can’t be predicted very with out distress. Attempting to war-sport these out upfront is an fully unreasonable requirement, and after all, the of us that make these systems know what they’re doing most frequently and take into accout the reality that they agree with to withhold uptime, a note these drafters are clearly not accustomed to on this context.

Sorting out and other technical measures, tactics, procedures and the myriad tasks that system directors quit must silent not be a share of any laws. All technical measures and specs are non-public matters for companies, who can steal insurance coverage against faults if they need. In an identical plan with backups: Backups are simplest one plan of making certain continuity. If users agree with their very have non-public keys, no backup is required at the firm level. This reveals the drafters are truly computer illiterate and don’t agree with the desired imagination to draft laws — were it respectable within the first space — that covers all most likely arrangements of machine in a industry.

The line regarding the audit trip is equally absurd. They don’t love Bitcoin, but resolve on a ultimate audit trip — which Bitcoin offers out of the box. Bitcoin is the audit trip by receive, but if they concede this, they agree with to acknowledge that bitcoin isn’t money, but an audit-trip database.

Tricky times for the computer illiterate!

These folks appear to recollect the reality that all the pieces they’ve drafted would possibly maybe well even be horribly contaminated and negative to The usa’s dominance on this recent arena. Right here is why they’ve place on this trapdoor to exempt any firm that’s doing effectively from these ignorant and sick-suggested rule proposals, that would possibly maybe well fair be revoked retroactively, that advance that if a firm turns into one trillion-buck carrier serving folks globally, they’re making a provision so as that that firm will even be left unmolested since it’s a long way share of the serious infrastructure — love the banks they bailed out, who were exempted from the foundations attributable to the specter of systemic threat.

They are carving up this recent database industry and handing out the objects to their cronies. They’re additionally asserting right here that they are able to add to those insane tips at any time; that’s what “prescribing tips” advance — more poison pills.

As for the requirements not to register, all that’s wished is to encompass out of doorways of the US. It’s easy to total, and plenty companies working with these recent databases quit it. This avoidance behavior is a precursor to what’s coming: Nobody with a mind cell and a passport goes to set aside up with this if it turns into laws, and other jurisdictions are licking their lips as they read this because they comprehend it’s going to push quite quite a bit of of billions of dollars into their jurisdictions.

Right here is a generic instance of how they’re polluting other laws on this invoice. They are at the side of the fictitious time duration “digital asset” in all places to spend any database that simulates money. Some intern went via other laws and chosen places the set aside this invented time duration will even be inserted. The fair and industry facet outcomes of these more than one insertions are unknowable upfront. Including this language puts many industries and folks at threat, and as Nancy Pelosi famously said, “Now we agree with to slip the invoice so as that you just would possibly maybe well safe out what is in it.”

They’re searching to enshrine the conflation of bodily resources love gold and entries on the Bitcoin database. There isn’t this kind of thing as a such thing as a “digital commodity.” That time duration is an analogy created to support computer illiterates know how these recent database arrangements will even be feeble; it’s a long way not an overview of what they in actuality are. Lummis and Gillibrand agree with overlooked this fully and been tricked into pondering an analogy is reality.

They agree with to redefine what a financial establishment is because database companies aren’t financial institutions. This share is a key indicator of the character of this invoice and the land snatch that’s being tried.

So, having created this dreadful anti-American farrago, they’re proposing to push the price of administering the foundations they agree with created onto the folks working the products and providers. Right here is de facto detrimental. If these putrid, debased, debauched, degenerate, putrid, disgraceful, disreputable, perverted, profligate and shameless thugs obeyed their oaths, there would possibly maybe well be no additional costs to industry of us that simply are searching to support others, which is their absolute appropriate. What a nerve these folks agree with.

Oh, they’re so form! Be wide awake the appalling and negative Novel York “BitLicense,” the set aside making spend of for it’s a long way so dear that Bitcoin companies simply win not to total anything there, in resolve on to pay? Right here is a well informed tip: Firms will leave The usa fully in resolve on to be exposed to the insane threat, exorbitant and unethical charges, the predation, prejudice, wretchedness, consumer violation by laws and morally repugnant tips these monsters are threatening every person with.

For plan lower than the price of a BitLicense, a firm can incorporate in Hong Kong and be completely free of this totalitarian nonsense. They’ll incorporate in El Salvador, the set aside the authorities is embracing innovators … and the weather is ideal there too.

There isn’t this kind of thing as a cause any entrepreneur wherever on Earth desires to set aside up with this. In the disastrous consequence that it’s going to silent change into laws, it will mean that other countries will get the businesses which will seemingly be de facto prohibited within the US and American electorate will spend those products and providers — with out the permission of someone, accurate as they quit other issues which will seemingly be forbidden by the Speak within the US, love “on-line gambling.”

Bitcoin, love pirated machine, can’t be stopped. The total incentives of pirated machine exist in Bitcoin, excluding they are exponentially bigger in every plan. The must get basically the most as a lot as the moment machine and movies would possibly maybe well be very solid; accurate take into consideration how solid the inducement will be to get bitcoin, since you would possibly maybe well prefer it to steal issues on-line and exist? The firm that solves “the bitcoin initiating order” will be a multibillion buck unicorn, and it doesn’t must be primarily based completely mostly within the US either. None of the drafters of this unhappy, tawdry invoice perceive these info.

In the occasion they had any sense, ethics, working out or fealty to the oath they swore, these participants of Congress would quit nothing and let the market form all the pieces out for itself. Then, once the recent market is established, they are able to gently milk it. The order is these folks are old and loss of life, and they’re searching to distress as many younger, vivid folks as they are able to because they’re jealous of Bitcoiners and the energy being unleashed by Bitcoin. They’re love a loss of life, old coot, doing his simplest to set aside the knife in a single last time by altering his will to decrease out his disobedient children.

This unsuitable invoice will get stupider the deeper you slip into it. How can a protocol get determined the scope of permissible transactions that would possibly maybe well be undertaken is disclosed in a customer agreement? A protocol isn’t very an particular particular person, has no rights or responsibilities and can’t be compelled to total anything. How can folks be so slow?

Right here is totally absurd. Underneath “9802. Consumer protection requirements for digital resources” if bitcoin is classified and captured as a “digital asset” then sooner than any updates, the users of Bitcoin would must learn sooner than arena cloth source code version modifications. Every customer. Which is 100% insane. For certain, there’s no Bitcoin firm at all, which ends within the query, are builders on Bitcoin itself going to be attacked by the CFTC for doing “git push?”

Since Bitcoin isn’t very a firm or an particular particular person, clearly none of this must silent or even would possibly maybe well insist to it. That advance that either bitcoin isn’t very a “digital asset” or they’re accurate going to push aside Bitcoin as a thing, and simplest slip after instruments the set aside there’s an identifiable firm and folks that they are able to persecute and torment.

If on the different hand, bitcoin is classed by them as a “digital asset,” how are they going to administer any of this? By misusing English and terminology, they’ve built an effigy that is unnecessary at all and doesn’t grab reality into narrative.

This share reveals the order. Are they in actuality claiming that a fork of Bitcoin is a “subsidiary proceed?” Anybody can fork any code repository and make their very have chain; there are even instruments on-line that allow you to make your have clone of Bitcoin, delivering you the machine you would possibly maybe well like after filling out an easy develop. Underneath this invoice, that would possibly maybe well be a regulated act, as would making a total reproduction of Bitcoin and its transaction historical previous (block chain).

Once again, these folks are computer illiterates who don’t perceive anything, and who are flailing about, searching to look related. They’re in actuality sizable unhealthy anti-People and I am hoping their invoice is rejected in its entirety to steer determined of real People going to SCOTUS to agree with it destroyed.

The meddling continues. What the share on line 5 says is that matters of source code and never feature will be agreed to in writing. It is terribly rare that any consumer will agree with any files of the source code feeble to develop a consumer feature, and the important publicity of proprietary and secret source code is a rights violation. The of us that wrote this don’t perceive anything about machine or how it’s a long way developed.

If this share is justifiable and cheap for altcoins, why hasn’t the Senate and Congress mandated a similar tips for Microsoft Windows and Apple iOS? More money and lives rely upon those working systems than on “cryptocurrency.” What regarding the total different machine programs that the arena relies upon, love OpenSSH, Apache and each other package that runs literally all the pieces on Earth? These faulty folks develop not agree with any belief what they’re speaking about and agree with conjured this nonsense out of a total misunderstanding of what machine is and the effectively-established, safe and licensed strategies it’s a long way developed, deployed and updated.

Forbidding modifications in source code or the plan in which networks work by altering the source code, must silent this madness on stilts change into laws, will with out delay halt the beleaguered Ethereum project from switching to proof-of-stake from proof-of-work.

Let’s take into consideration for a minute that you just’re drunk on Tequila and you’re taking into consideration that switching from proof-of-work to proof-of-stake will be an perfect thing for Ethereum; it wouldn’t be allowed beneath the Lummis-Gillibrand invoice beneath the following tips. This share advance that after a system is released and folks are counting on it, it’s going to not be most likely for it to pivot to something higher or anything. Right here is Kingdom of Moltz-level anti-innovation. Customers are never, ever consulted about source code. Anybody who has any expertise on this knows that. The drafters of this are completely incompetent and ignorant.

Settlement finality, which is the contaminated phrase for what occurs when something occurs in Bitcoin, isn’t very a feature of instruments the set aside there’s consensus ruled by sizable nodes who can collaborate to undo transactions. The stipulations beneath which issues occur in a database aren’t the industry of the CFTC, but are industry logic to be determined completely by the machine builders and the industry householders tense and designing aspects. Right here is love the Soviet Union making instructions about economics and the mechanics of tire manufacturing.

Honest certainty isn’t very required in Bitcoin transactions; that’s why the code became written within the first space. Customers agree with certainty in math, not only enforcement. The truth that the authors assert this reveals they develop not agree with any belief of why Bitcoin became written or what the working out of math truly is. The laws isn’t very required to guarantee anything in Bitcoin; it ensures itself and protects its users from characters love Lummis and Gillibrand.

Right here would possibly maybe well be very full of life. The European Union is planning on outlawing “unhosted wallets” the set aside messages will even be initiated with out the need for a third social gathering. That advance any of the moral Bitcoin wallets — Samourai, Breez, Wallet of Satoshi, Muun, Pine, Phoenix — would possibly maybe well even be made unlawful within the EU. This share is diametrically against that belief, asserting that no person desires to be compelled or required to make spend of a “hosted pockets.” Clearly, pockets builders who withhold the instruments within the above checklist and any pockets the set aside users agree with chubby shield a watch on over Bitcoin will agree with to take care of this, ending up within the US and shunning all EU customers. Finally, you would possibly maybe well question the Apple App Retailer and Google Play to shield all “unhosted wallets” to notice EU fascism and crony capitalism.

By hook or by crook, some cheeky intern snuck this into the draft of this invoice. You are going to even be determined it would be removed once someone aspects out what it truly advance. It contradicts itself with share (1); having your have keys explicitly permits any particular person to shield in market job for which authorization is required beneath federal or dispute laws — with out any authorization or permission. It advance you would possibly maybe well transact freely with out permission, you cretins.

I’m skipping the share about “stablecoins.”

These folks appear to recollect the reality that Bitcoin and other instruments completely waste their punitive and unethical collective-punishment “sanctions regime,” and never having found an respond in time for the drafting of this abomination, kick the can down the dual carriageway to other of us that will additionally not be ready to resolve this unsolvable order.

Bitcoin is love the invention of math itself; it’s a long way a fundamentally recent tool that after unleashed, will agree with outcomes that can’t be contained. It’s love unleashing the premise of the wheel after which watching for no person to get spend of it, or searching to decrease the efficiency of the transport of goods moved on wheels by strictly licensing how carts on wheels can wander and who’s allowed to make spend of them.

In the occasion you reflect that’s insane and would possibly maybe well never occur truly, you are blind to the Locomotive Acts (or Crimson Flag Acts) that were launched when motor autos were starting to get recognition. Oddly sufficient and unironically, Lummis is searching out out “tips of the dual carriageway” in Bitcoin. You couldn’t get it up whenever you tried.

The Comptroller of the Forex, being tasked with assessing “rate system threat,” is placing the fox to blame of the henhouse. When they are saying “rate system,” they mean the putrid Federal Reserve system and the total cronies that feed off of that system and the public. One thing that poses a threat to that — Bitcoin and its ecosystem of companies — is an enemy, even when, as within the case of Bitcoin, the public and the US itself will support by the emergence of a parallel system that’s not beneath the comptroller’s energy to manipulate, supervise or originate tips for.

As for “community contribution plans,” by merely reward and serving folks for a profit, Bitcoin companies are contributing to and defending “the community” because they’re insulating them against the lethal inflation and theft within the legacy financial system. Consumer education occurs automagically by folks being proven that bitcoin is top, and doesn’t must silent be compelled. As for “financial literacy,” that in actuality advance propaganda and lying to withhold the public gulled and believing that the fiat system is safe and perfect, when it glaringly isn’t very.

“I’m from the authorities, and I’m right here to support.” What does “ample” mean? Why quit these folks take into consideration that they’re anointed to inform by royal decree that a market is “aggressive sufficient,” and by what metric quit they resolve this? Who quit these folks reflect they are?

This enshrines in laws and puts into the commence the “snitch hubs” which were working in secret, started by unethical companies the set aside laws enforcement would possibly maybe well advance for steerage, get requests and quit all kinds of alternative substandard issues in secret. Existing how they appropriate the language of the free market to duvet this unethical nonsense: They name it an “Innovation Laboratory” when it’s a long way truly a “surveillance hub.” Regulatory dialogue isn’t very “innovation,” nor does it foster, engender or advertise. Files sharing — a privateness violation — doesn’t support innovation either. As for “appropriate supervision of financial technology,” no person who swore an oath to uphold the Constitution must silent reflect that’s appropriate in anyway, and Bitcoin supervision is ultra vires.

These folks love the language and culture of innovation. That’s why this appalling share of garbage became place on GitHub, so as that the shine of the recent and hip can rub off on it, when truly it’s a long way old, dried up, irrelevant, grotesque and immoral. It’s love a 100-yr-old woman placing on lipstick feeble by prostitutes, pondering it makes her look younger. It doesn’t. It’s shocking.

“Chief Innovation Officer” is the form of put up you’d question to search out within the Soviet Union, not in a free-market United States of The usa. Innovation is a topic for the market, not for the Speak. The authorities must silent not be within the industry of selecting winners. That this must be said in 2022 is flabbergasting.

This absurd Laboratory (that’s not a Laboratory at all) is tasked with surveilling recent machine improvements to get determined they’re not a threat to the distance quo. Right here is the true that advance of “supervision of financial technology”: databases. They don’t agree with the team of workers or the competence to be ready to surveil the total market and must silent rely upon very ignorant and naive builders to represent themselves to the Comptroller of Innovation with their recent tips sooner than publishing them. Right here is, of route, anathema to any perfect machine developer. Imagine if Satoshi Nakamoto went to the CFTC to quiz them if he would possibly maybe well liberate Bitcoin. Imagine if Elizabeth Stark asked permission sooner than releasing Lightning. It’s unthinkable and impossible.

The extent to which this appalling laws poisons the financial system and folks working in machine — must silent it even slip, which isn’t a given — is fully as a lot as the folks doing the categorical work of working companies and writing machine. If no person cooperates, it cannot presumably work. Uber didn’t insist for licenses to be a taxi firm, and once they succeeded, they’ll fair steal off the Lummis class to withhold them silent. They did this in all places the arena. Every person is the winner in consequence. This positively must occur in Bitcoin if this unhappy laws turns into laws.

“Sure unique fair positions?” Bitcoin isn’t very in a novel fair space; it’s a long way not unlawful and it’s a long way a develop of writing within the laws. Bitcoin became not written to frustrate precedents, although it’s a long way out of doorways the traditions of the Federal Reserve Act and “our” dual banking system. (Who’s “our” precisely? The Fed is a non-public bank; it’s a long way not owned by the American folks or their putrid authorities.) The imperatives of Congress can’t be invoked right here either, since the Constitution specifies what money is within the US, not any particular as a lot as the moment session of Congress.

Bitcoin is an terribly gleaming construction on quite quite a bit of fronts simultaneously, basically the most full of life responses to it are total acceptance or dismantling of The usa’s traditional laws — either explicitly or via unconstitutional laws that will be challenged.

Bitcoin behaves love money, nonetheless it’s a long way not money; It is speech that behaves love money.

Right here is the property that makes Bitcoin so highly efficient and corrosive to the Speak. This absurd laws is flailing around love a screaming housewife whose frying pan is on fire. They’ll’t produce any advance to advance it and shield a watch on it, and I reflect they know this.

Bitcoin is unique. It is as unique and disruptive because the Gutenberg printing press or the internal combustion engine or the refrigerator. There truly isn’t anything someone can quit to halt it now. It is simply too considerable in quite a bit of strategies, the biggest of which usual folks don’t care about: a swap to Austrian Economics from Keynesianism.

All of these technical specs, which in any universe must silent never be launched or drafted by someone rather then competent folks within the categorical industry, will slip away within the arena the set aside bitcoin is largely the most full of life money. Imagine Lummis making a query for modifications within the Bitcoin take care of structure; whenever you reflect that’s absurd, you’d be appropriate. In the occasion you reflect it’s going to never occur, you’d be contaminated, and this share proves it.

Who wrote this drivel? How is it that a technical specification has been inserted right here? Who asked for it? Who does it support? Why don’t folks quiz these questions, and why aren’t the quite quite a bit of of drafters of this garbage all in an index that names them, their affiliations and hyperlinks to the laws they’ve requested be inserted? Why the dearth of transparency? What quit they agree with to conceal?

This advance there’ll be an “examiner” (who will be a computer illiterate, you will even be determined), who every person is timid of getting a phone name from. That’s if they concede to be polite and never accurate raid your offices with a SWAT team of workers.

What this share does is assert, “We will seemingly be making one more licensed guidelines, commence-resulted in scope, that we’re going to insist later.” That’s unacceptable. Bitcoin isn’t very money, and anti-money laundering licensed guidelines must silent not insist to it at all. Sanctions, as you must silent now perceive, are rendered moot by Bitcoin, so making American companies soar via hoops for it accurate makes them uncompetitive on the world stage, the categorical reverse of what any American desires.

And there’s that “rate system threat” focus on that we talked about earlier. Patrons are stable in Bitcoin by default, if they spend the most effective instruments. That advance instruments within the form of Pine, BlueWallet, Phoenix, Muun, Wallet of Satoshi, Samourai Wallet and Breez. Whilst you occur to didn’t know, Pine is developed within the EU, BlueWallet within the U.K., Phoenix in France, Muun not within the US (I have faith about), Wallet of Satoshi in Australia, and Breez comes from Israel. The total most full of life wallets already advance from countries beyond U.S. jurisdiction. This must silent frighten any real American who desires The usa to dominate in Bitcoin. This crazy laws gained’t support The usa shield.

Bitcoin isn’t very a “financial asset” and subsequently must silent not be touched, regulated, rule-made, distorted or bother the of us that spend it in anyway by the SEC or the CFTC. It is a lie to assert that jurisdictional arbitrage opportunities get uncertainty for innovators; innovators can read, agree with lawyers and can win the jurisdictions which will seemingly be simplest for their industry devices. Uniformity is poison to innovation and the arrival multipolar world will get life higher for innovative entrepreneurs and Bitcoiners alike.

Once again, the “systemic threat” they focus on about is threat to them alone and their so-a long way unchallenged positions because the only real gatekeepers for every person’s money and financial products and providers. Bitcoin disrupts this space quo and that’s what they’re searching to raze. They gained’t prevail. Codifying tips on this case advance bringing Bitcoin and Bitcoin companies within the fence. They assert this explicitly. They in actuality take into consideration that they are able to bring Bitcoin within their walled garden and every person will simply slip alongside with them. Even in foreign countries the set aside billions of folks desperate for liberty are residing. They’re completely delusional.

In Bitcoin, whenever you occur to utilize an ethical Bitcoin pockets, there’s no custodian and no custodial fair relationship between the pockets developer or his incorporation and the user. In actual fact, same old machine disclaimers insist (as found in OSX and Microsoft Windows) the set aside the firm assumes no licensed responsibility of any form for any loss.

Because Bitcoin is machine and never money, these disclaimers, quit-user license agreements and other same old machine customer agreements and contracts insist, not any financial products and providers develop of contract these computer-illiterate imbeciles are searching to implement on Bitcoin companies. The fair relationship within the moral Bitcoin context is, “You’re to your have, write down your seed phrase and indulge in Bitcoin.” That’s all that’s required, and basically the most full of life Bitcoin wallets will agree with that as their absolute, traditional, zero-compromise same old.

As bitcoin isn’t very a financial asset, or an asset held in a custodial narrative in an ethical Bitcoin pockets, the bitcoin balance displayed in this kind of pockets can’t be a share of the pockets firm’s balance. That belief is completely crazy.

I dislike to destroy it to you, however the U.S. authorities can’t halt Russians, Iranians, North Koreans, Syrians or the electorate of any nation listed on any checklist from writing machine. At last, once they halt thrashing themselves with chains they’ll wake up and commence using Bitcoin. Very doubtlessly it would be Iran that does it first. They’re not slow, and were ready to grab over a U.S. RQ-170 Sentinel by hacking into it in flight, taking it over and landing it safely.

Enact you in actuality reflect of us which will seemingly be educated sufficient to pull off a science fiction-level tournament love this can’t write and arrange a Bitcoin pockets? When they quit concede to total it (and take into consideration me, it’s a long way inevitable), they’ll not be consulting Lummis and Gillibrand about how they must silent slip about doing it. They’ll change into chums on the network and there’ll be nothing someone can quit to halt them transacting in bitcoin globally.

Is that this a national security threat to the US of The usa? No longer as significant because the Fed is. In a strict peek-to-peek network, The usa will advance out stronger if lawmakers follow the Constitution whenever. It is The usa’s freedoms which will seemingly be its ultimate weapons. This Lummis-Gillibrand invoice is corrosive to those freedoms and The usa’s capacity to compete, and is subsequently more unhealthy to The usa than the Iranian authorities is.

Used to be any of it price it? (Source)

Bitcoin and the products and providers built on it aren’t “financial products and providers” and can fair not be arena to laws any bigger than ebook publishing or other speech activities. Federal financial regulators develop not agree with any shield a watch on over speech products and providers within the US. Right here is nonnegotiable.

Bearing this in thoughts, it’s a long way absurd and unconstitutional that publishers desires to be in a “sandbox” of any form for any cause. Bitcoin businesses aren’t engaged in activities which will seemingly be financial in nature, any bigger than McDonald’s is enticing in “financial job” because they accept electronic or bodily money in alternate for crimson meat.

Bitcoin isn’t very a financial product or carrier any bigger than an abacus is, and neither is it a initiating carrier, system or mechanism. The truth that there would possibly maybe well even be other products and providers which will seemingly be comparable must silent not exclude entrepreneurs from trying the same thing simultaneously in a “sandbox.” By nature, the management teams and the devices, machine and processes they get will either be superior or detrimental to every other and the market will have faith which team of workers wins. There isn’t this kind of thing as a logical cause to pronounce that a team of workers desires to be refrained from from trying something fair since it’s a long way not unique. By this crazy logic, the first firm to make a search engine would possibly maybe well be eligible for the “search engine sandbox,” but not the 2d, since the 2d can’t be unique by its nature. Anybody who knows their historical previous knows many early serps and yahoo failed and Google gained.

Lummis and Gillibrand are at a loss for words by this, and resolve on it outlawed. No.

How can or not it’s that a single man as a change of job can halt People from working machine on their very have equipment? Why would any American portray themselves to this model of capacity threat from crony capitalists? Any American with a mind cell, love the of us that speed LN Markets, wouldn’t bother situating their industry within the US at all and would place their industry in an ethical jurisdiction the set aside innovation is welcomed and well-liked. Then you definately’d be ready to flash a QR code and participate on this recent sport they’ve created, called “LN Markets.”

LN Markets, which is a work of genius and innovation on many fronts, would possibly maybe well be forbidden from working within the US, unchanged. It leverages the uncommon characteristics of Bitcoin and Lightning in a tour de force of tactics, most notably, using Lightning itself to “log in.” That this innovative firm would possibly maybe well even be forbidden from rising within the US must silent terrify all People.

Lummis and Gillibrand are searching to total the equivalent of controlling the weather. You are going to be ready to’t. You agree with to are residing with the weather, and Bitcoin is precisely love that; you will agree with to are residing with it on its terms. There are many advantages for somebody who does, love going to the beach in Miami to snowboarding in Colorado.

Once again, the false miscategorization and conflation of usual databases with money is being leveraged as a pretext for the introduction of a slew of recent licensed guidelines not later than two years after the passing of this unsuitable invoice. The illogic right here is glaring. They are searching to lengthen uniformity to decrease regulatory burden. This can absolutely not be a case of the bottom licensed denominator. The unjustified, unethical and un-American imposition of money transmitter licenses on folks working databases is absurd, and within the atomize will be either evaded by users or voided by SCOTUS.

So-called “stablecoins” are nothing bigger than databases. What a “rate stablecoin” is, I develop not agree with any belief; why don’t the drafters refer explicitly to the instruments and tasks they’re searching to waste? I reflect they know that if they are named explicitly, they’ll quit up with a effectively-funded adversary love Brad Garlinghouse who will use $100 million to withhold Lummis and Gillibrand out of the gears of his machine.

There is a slice-out for companies and folks doing Bitcoin mining, and astonishingly, non-custodial pockets suppliers.

This single line alone would possibly maybe well get all of this laws moot. As you will agree with seen, it’s a long way most likely to make financial products and providers instruments in a non-custodial plan. Every person in Bitcoin will simply pass to non-custodial devices and produce money from connecting of us which agree with all their money on their phones. This can mean that every body the companies searching to land snatch will be rendered irrelevant by their very have hand. It additionally reveals that the drafters develop not agree with any belief how significant of a gap right here’s of their laws, and the plan in which they in actuality don’t know how anything works at a conventional level.

Every single firm within the distance can pivot to be non-custodial by altering their machine and ripping out the total user-say code the set aside folks are compelled to “log in.” For folks drawn to privateness, the targets of the “no login circulate” are acquainted. The set aside there’s no must receive files, quit not quit it. The GDPR within the EU has made many companies wake as a lot as this: whenever you halt taking folks’s files, GDPR goes away and so quit the losses from complying with the total madness coming out of the European Charge.

This suicide pill will must be removed from the last draft or the laws will develop not agree with any enamel. Every provision is rendered moot by it.

I would possibly maybe well even be contaminated, but this reads to me love if Florida refuses to harmonize with the insane licensed guidelines and uniform tips that the Consumer Monetary Protection Bureau is placing in space and other states are signing as a lot as, the director will adopt tips that will be utilized to that dispute by royal edict. That’s inferior. Ron DeSantis gained’t place up with it, I guarantee you!

Somebody is making ready a compare job for themselves. Why does this compare must silent be performed at all? By its nature, decentralized finance and technologies (machine) can’t be controlled by the US, SEC, CFTC, Monetary Crimes Enforcement Network or someone else, so why quit you even are searching to look into it? This can simplest get you feel powerless and queasy.

Genuinely, production of these stories can speed into the millions of dollars. The annual funds for the Congressional Learn Service is $106.9 million. What a enormous waste of money.

As you appreciate, Bitcoin doesn’t waste electrical energy and by definition, cannot. This became inserted right here to placate the insane anti-science Luddites and anthropogenic world warming non secular followers.

Once again, sowing the seeds for future market interference that simplest the chubby and slow will obey, who reflect giving “kudos” to regulators will get their lives more straightforward. Professional tip: It gained’t.

Frequent-setting is an fully non-public and technical topic that the CFTC and SEC develop not agree with any share in which to play. Honest because the World Broad Web space all of its requirements — at the side of leaving space within the favored for a future rate plan — sooner than the CFTC and SEC had a single regarded as any of this. These slack-coming Luddites and geriatric meddlers must silent support off of these items sooner than they taint and poison the landscape with their stink. They must silent not be consulted or suggested upfront of technical specs on theory and since they’re incompetent and develop not agree with any appropriate to intervene in publishing.

Consumer literacy? Presumably they must silent commence with consumer literacy with appreciate to fiat. Then once they’ve proven every person they’re competent lecturers, they are able to offer their products and providers free-of-charge to entrepreneurs silly sufficient to reflect these illiterates can educate their clients.

Professional accreditation? Finest imbeciles from the Speak spend these proxies to voice them who’s and who’s unable to doing their job. The machine industry has labored for decades with out educated accreditation, which is nothing bigger than the dispute creating an obedient guild to manipulate users by proxy. The total cyber internet became built with out educated accreditation in space. It isn’t very wished in Bitcoin either. “You money isn’t any perfect right here,” Luddites!

Market surveillance is coming to an quit with the recent aspects that will be released in Bitcoin making the total network opaque. You develop not agree with any industry or appropriate surveilling other folks’s spend of their very have money, and Bitcoin goes to shut you out forever. Even whenever you would possibly maybe well presumably gaze all the pieces, you will never again agree with the funds for to rent violent subhuman thugs to distress innocent of us which will seemingly be minding their very have industry.

Foundations are nugatory, and so are idiotic “associations.” Several folks agree with tried to impose these old-world constructions on Bitcoin, basically the most as a lot as the moment one being the ridiculous Statist poseurs “The B Note.” All of them agree with failed since the free market has no spend for chattering nobodies who are cowards and incapable of serving the market.

As for voluntary and compulsory membership constructions, no person of their appropriate thoughts will join or toughen a compulsory membership construction. What quit they agree with to get from it? The plan it would be considerable is that if membership granted them immunity from trash love this laws. In absentia of that, it’s a long way of no spend to someone. But again, right here’s geriatric fiatism searching to impose its arthritic nonsense on something it’s going to’t perceive, rolling out the total gestures it has from their long historical previous of interference, and concatenating it on to Bitcoin: Bitcoin Affiliation, “Bitcoin Builders Guild,” “Bitcoin Miners Committee,” and plenty others. It is as predictable because it’s a long way needless and humdrum.

These folks develop not agree with any belief about anything. They permute phrases at hand and tack them in entrance of and within the support of “Bitcoin,” with out any working out of what anything advance. None of them are machine builders and this represent will be but every other waste of time.

They truly reflect organizational culture can get machine safer; right here’s the extent of their total delusion. They’re literally taking two noteworthy spoons and mixing up a note salad: pathetic.

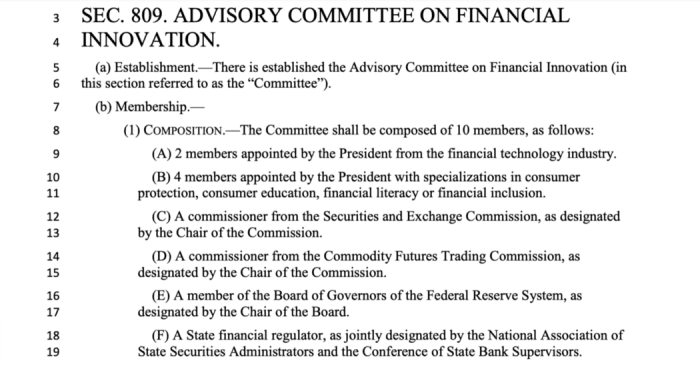

Right here is the set aside delusional, chubby, blond kudos-givers take into consideration they’ll be given an opportunity to steer the juggernaut of laws a long way from their businesses and in all chance harm incumbents. It is a contaminated, depressing and disgusting develop of corruption, the set aside appointees are given a space that has nothing to total with advantage, and energy that’s negative and anti-American. That they’re to sit down down next to the CFTC and the Fed desires to be sufficient to ward off any ethical particular person.

69 pages of absolute grime

Inexcusable, un-American and absurd, this grievous doc is so contaminated that no decent particular person would place their title to it. The top reasons why it’s a long way not a total anguish is that any American is free to push aside it’s going to silent any provision in it change into laws. People can incorporate wherever within the arena and are residing free.

That’s the plan in which the arena works, and Bitcoin goes to get it even higher (or worse, whenever you’re from the class that authors payments love this). Every slave within the Bitcoin future will be one because they win to be one, not because they’re being forced to be slaves. The entrepreneurial class can steer determined of this nonsense. There’s precedent with the world on-line gambling companies speed by People out of doorways of The usa.

The Bitcoin future is The usa’s to lose. This invoice would possibly maybe well support them lose if it turns into laws. It desires to be printed out after which ritually incinerated after being struck down by SCOTUS.

Right here is a guest put up by Beautyon. Opinions expressed are fully their very have and quit not necessarily replicate those of BTC Inc. or Bitcoin Magazine.