Key Takeaways

- Ethereum’s fortify to Proof-of-Stake has sparked considerations over the community’s resiliency in opposition to 51% attacks.

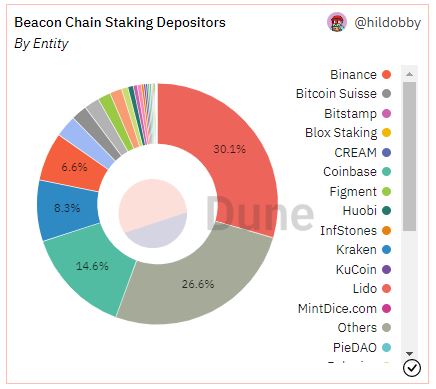

- The tip four staking entities legend for 59.6% of the total staked ETH.

- On the opposite hand, client-activated comfortable forks (UASFs) be decided base actors can not spend over the community, no matter how immense their stake.

Proof-of-Stake critics bear sounded the dread on Ethereum’s unique Proof-of-Stake consensus mechanism, claiming it makes the community at risk of antagonistic community takeovers. On the opposite hand, Ethereum’s unique map comprises a failsafe to mitigate this risk and permits customers to burn the funds of any attacker making an strive to spend adjust of the blockchain.

Ethereum’s Vulnerability to 51% Attacks

Ethereum’s most modern switch away from Proof-of-Work has raised questions in regards to the community’s ability to fend off attacks.

On September 15, Ethereum successfully upgraded its consensus mechanism to Proof-of-Stake. Amongst other issues, the tournament, now identified within the crypto team as the “Merge,” passed block production duties from miners to validators. Contrary to miners, which expend unquestionably educated hardware, validators most titillating want to stake 32 ETH to kill the categorical to path of transactions.

On the opposite hand, some crypto team participants were quickly to present that nearly all of Ethereum’s validating energy is now within the fingers of correct just a few entities. Recordsdata from Dune Analytics point to that Lido, Coinbase, Kraken, and Binance legend for 59.6% of the total staked ETH market portion.

This excessive focus of staking energy has raised considerations that Ethereum might possibly seemingly simply be at risk of 51% attacks—a time length susceptible within the crypto home to designate a antagonistic takeover of a blockchain by an entity (or team of entities) in adjust of the huge majority of block processing energy. In other phrases, the alarm is that great staking entities might possibly seemingly collude to rewrite parts of Ethereum’s blockchain, switch the ordering of most modern transactions, or censor explicit blocks.

The probably of a 51% assault grew to turn into particularly salient after the U.S. government’s ban on Twister Cash. On August 8, the U.S. Treasury Department added privateness protocol Twister Cash to its sanctions list, arguing cybercriminals susceptible the crypto mission for money-laundering functions. Coinbase, Kraken, Circle, and other centralized entities immediate complied with the sanctions and blacklisted Ethereum addresses associated to Twister Cash. So what would forestall these corporations from the expend of their staking energy to censor transactions on Ethereum’s rank layer if the Treasury ordered them to?

As Ethereum creator Vitalik Buterin and other builders bear argued, the community gentle has an ace up its sleeve: the likelihood of imposing client-activated comfortable forks (UASFs).

What Is a UASF?

A UASF is a mechanism by which a blockchain’s nodes set off a comfortable fork (a community update) with out wanting to kill the typical enhance from the chain’s block producers (miners in Proof-of-Work, validators in Proof-of-Stake).

What makes the design unheard of is that comfortable forks are on the total caused by block producers; UASFs, in fabricate, wrest adjust of the blockchain from them and immediate hand it over to nodes (which is in a region to be operated by anyone). In other phrases, a blockchain team has the likelihood of updating a community’s tool no matter what miners or validators want.

The time length is on the total associated to Bitcoin, which particularly caused a UASF in 2017 to power the activation of the controversial SegWit fortify. Nonetheless Ethereum’s Proof-of-Stake mechanism became designed to enable minority-led UASFs particularly to conflict in opposition to 51% attacks. Might seemingly well gentle an attacker are trying and spend adjust of the blockchain, the Ethereum team might possibly seemingly simply location off a UASF and execute everything of the malicious actor’s staked ETH—reducing their validating energy to zero.

If truth be told, Buterin has claimed that UASFs accumulate Proof-of-Stake fundamental extra immune to 51% attacks than Proof-of-Work. In Proof-of-Work, attackers simply want to kill the huge majority of the hashrate to spend over the blockchain; doing so is pricey, however there might possibly be now not every other penalty besides that. Bitcoin can switch its algorithm to render among the attacker’s mining energy ineffective, however it unquestionably can most titillating attain so as soon as. On the change hand, Proof-of-Stake mechanisms can sever an attacker’s funds as time and but again as important via UASFs. In Buterin’s phrases:

“Attacking the chain the first time will price the attacker many thousands and thousands of bucks, and the team shall be merit on their toes internal days. Attacking the chain the second time will gentle price the attacker many thousands and thousands of bucks, as they’d want to resolve unique coins to alter their outdated-normal coins that had been burned. And the third time will… price fundamental extra thousands and thousands of bucks. The game is very uneven, and now not within the attacker’s prefer.”

Slashing Is the Nuclear Choice

When asked whether or now not Coinbase would ever (if asked by the Treasury) expend its validating energy to censor transactions on Ethereum, Coinbase CEO Brian Armstrong stated that he would relatively “focal point on the bigger image” and shut down the alternate’s staking provider. Whereas there’s shrimp reason to doubt the sincerity of his solution, the likelihood of a UASF seemingly carried out a role within the equation. Coinbase for the time being has over 2,023,968 ETH (approximately $2.7 billion at nowadays’s costs) staked on mainnet. The alternate’s complete stack would be slashed if it tried censoring Ethereum transactions.

It’s fundamental to existing that slashing is now not Ethereum’s most titillating likelihood in case of a malicious takeover. The Ethereum Foundation has indicated that Proof-of-Stake also permits honest validators (which implies validators now not making an strive to assault the community) to “defend building on a minority chain and ignore the attacker’s fork while encouraging apps, exchanges, and pools to attain the same.” The attacker would defend their ETH stake, however rep themselves locked out of the relevant community going forward.

Lastly, it’s price mentioning that Ethereum’s staking market isn’t slightly as centralized because it might possibly seemingly simply before every little thing seem. Lido, which for the time being processes 30.1% of the total staked ETH market, is a decentralized protocol that uses over 29 diversified staking provider suppliers. These particular particular person validators are those in adjust of the staked ETH—now not Lido itself. Thus, collusion between fundamental staking entities might possibly seemingly be fundamental extra complicated to put together than it might possibly before every little thing appear.

Disclaimer: On the time of writing, the creator of this half owned BTC, ETH, and several other cryptocurrencies.

The info on or accessed via this online page is got from fair sources we imagine to be correct and reliable, however Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any data on or accessed via this online page. Decentral Media, Inc. is now not an funding manual. We attain now not give personalized funding recommendation or other financial recommendation. The info on this online page is topic to alter with out stare. Some or all of the data on this online page might possibly seemingly simply turn into older-normal, or it might possibly seemingly simply be or turn into incomplete or wrong. We might possibly seemingly simply, however are now not obligated to, update any outdated-normal, incomplete, or wrong data.

It is probably you will seemingly simply gentle never accumulate an funding decision on an ICO, IEO, or other funding in line with the data on this online page, and you might possibly seemingly simply gentle never interpret or otherwise rely on any of the data on this online page as funding recommendation. We strongly imply that you consult a certified funding manual or other certified financial skilled have to you are seeking funding recommendation on an ICO, IEO, or other funding. We attain now not accept compensation in any make for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Come all the draw via chunky phrases and stipulations.

We’d Rather Conclude Staking Than Censor Ethereum: Coinbase CEO

Coinbase CEO Brian Armstrong has chimed in on ongoing debates surrounding Ethereum’s ability to stay censorship resistant under Proof-of-Stake. Coinbase Wouldn’t Censor Ethereum If Coinbase became compelled to construct up a change from…

Will Ethereum Be At risk of Censorship After the Merge?

With the fortify to Proof-of-Stake out of the blue drawing shut, the Ethereum team is debating whether or now not the most modern sanctions in opposition to Twister Cash might possibly seemingly simply pause up endangering the blockchain itself. Merge Hype Overshadowed by…

“A Predominant Policy State”: Circle CEO Criticizes Twister Cash Sanctio…

Circle immediate complied with the U.S. Treasury’s decision to sanction Twister Cash, however its CEO is asking on alternate leaders to place a privateness-enabling coverage framework. Circle CEO Feedback on…