.I in most cases obtain requested about “which crypto” is an correct one to make investments in. For sure, my answer is constantly bitcoin. Duration.

Listed here I’d want to lay out the reason from three angles:

- Financial

- Philosophic

- Moralistic

They all weave into and dangle on top of every different. If you happen to’re a Bitcoiner, I am hoping this reminds you of why we’re here. If you happen to’re a no- or multi-coiner, I am hoping this helps you along the path and additionally to impress why Bitcoiners are so adamant about it.

It’s now not shut-mindedness, but an arrival to a degree of fact. We indulge in one likelihood to grab down the Goliath. Wasting time on distractions doesn’t demonstrate you the contrivance to, me or any one else for that topic.

Let’s originate.

The Financial Rationale

On a long adequate time body, every single govt issued money, cryptocurrency, stock, bond, property or asset of any variety will vogue towards zero when priced in the toughest, most liquid, sound money that’s ever emerged.

And it won’t happen by the fiat decree of some group or establishment. This will maybe well possibly happen by pure economic natural different, or what I want to call “Financial Darwinism.”

Money is the cornerstone of all civilization.

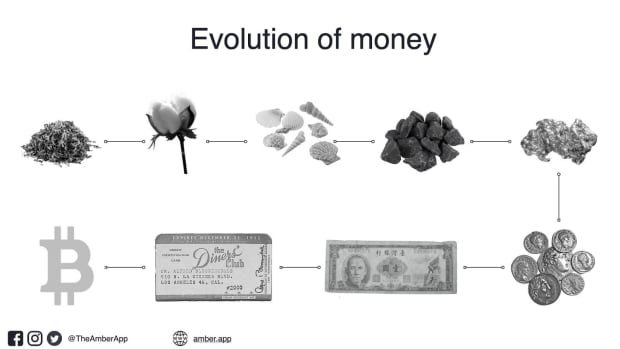

It’s how we store and exchange the fabricated from our labor, and subjectively measure our particular person inputs into society. It’s the material that binds us. It lets in us to cooperate all the device thru time and area, both at scale and in bigger levels of complexity. Money has and consistently will exist. The single factor that changes and developed over time is what we declare as money.

Money is the largest market.

There could be now not any bigger section of the area market. No longer vitality, now not meals, now not transport, now not govt, entertainment, healthcare or anything else else.

Money is bigger than all of them, as a consequence of it represents all of them, mixed.

On the present time, as a consequence of now we indulge in got broken money, many of us care for different property with different attributes in pronounce to store payment and defend our wealth. Nonetheless, with the emergence of a preferrred money, that is resistant to confiscation, inflation and corruption, that is also taken wherever, anytime and despatched or obtained by somebody for any cause, with out requiring permission, we are in a position to peep the monetary top charge being saved in these different items or property diminish.

As Bitcoin transforms staunch into a unit of account, staunch thru which all different items, companies and products and anything else of payment is measured, the shopping vitality of a fat bitcoin will vogue towards heights that few could well possibly also this day fathom.

My buddy Knut Svanholm dubbed it most accurately:

Every little thing there could be, divided by 21 million.

Financial Necessity

As more folks impress that the fabricated from their labor (i.e., their wealth, their savings and their money) is constantly being eroded, they’re going to see to store it in one thing that can now not be diluted. Bitcoin is the very ultimate possibility. It is miles available in the market all all the device thru the sphere, and is also saved as pure, unadulterated, unconfiscatable info.

Whether or now not you’re rich or unlucky, left or goal correct, employer or employee, storing your wealth somewhere safe is barely getting more crucial.

Within the identical contrivance it’s essential to well now not work all week only to accept salt from your employer as payment, as more time passes, less and less folks are going to accept depraved govt issued, or random-developer issued fiat money as payment for any of their items and companies and products.

Truly, future generations will study attend on us this day and sweetness how, in the title of all that is sane, did we imagine that measuring our wealth in a currency or money issued by some overlord, that devalued over time, ever made sense. It’s antithetical to the thought of growth and freedom.

Bitcoin is preferrred money.

Bitcoin is superior to all different forms of cash as a consequence of it perfectly embodies every attribute of the meta-conception that is money. It’s start source; consistently on; now not goal correct mounted, but identified in supply; verifiable by somebody; voluntary; permissionless; digital and without prolong rooted in the 2d legislation of thermodynamics. For this reason, it performs the capabilities of cash flawlessly.

-

- It’s the preferrred store of payment:

I know precisely how grand I with out a doubt indulge in in relationship to the entire, and I know that it could possibly possibly’t be diluted, altered or co opted. - It’s the preferrred medium of exchange:

I will ship what I prefer, to whom I prefer, whenever I prefer and there could be now not this form of thing as a vitality in the universe that can dwell me from doing so. - It’s the preferrred unit of account:

- It’s the preferrred store of payment:

I will measure all different items and companies and products in sats and because the shopping vitality grows, it’s pure digital nature contrivance we are in a position to continue to sub-divide the devices to measure smaller and more fractional items and companies and products, perpetually.

The finest money consistently wins.

There could be now not any where Bitcoin loses, as a consequence of the last word money consistently wins by the sheer force of natural different and survival.

Gold and silver emerged victorious over millennia of commercial battle. Gold-backed promissory notes then crushed silver. Gold became once then defeated by its leviathan: nation-sing fiat.

Now, bitcoin emerges, as the alpha-omega of cash, and this can strip all property of their monetary top charge.

It’s been occurring for 12 years straight already. Whisk forward and measure any asset on the earth against bitcoin, and you’ll rep that it’s down wherever between 90% to 99% since its inception, when priced in bitcoin.

And that’s barely the starting. Bitcoin hasn’t started sucking the air out of the larger asset classes yet.

Source:

The longer the chart, the worse it seems to be for the USD.

Right here’s a log chart, so the tumble doesn’t study as drastic, but it’s essential to well possibly also peep USD has devalued many pronounce of magnitude against bitcoin

Peek the fat chart and recordsdata here:

2,879 sats (this web dilemma is a dwell look of the value of the USD in satoshis).

Convergent Network Effects

Money, be pleased language, has a convergent network create, which contrivance that it’s most commended when on a general customary.

Truly, transport, transmission and verbal exchange media all converge around particular standards in pronounce to optimize for effectivity.

You peep it all over the place:

- The protocol stack that represents the catch, ie; TCP/IP, HTTP

- The gauge on put together tracks (which became once the identical gauge on Roman chariots)

- Birth container sizes

- Vowels and consonants in any particular language

Money is the grandest, oldest language and vitality transmission medium of all. It’s how we measure, store and transact human motion and it has been with us since the starting of time.

For this reason, money is a winner-hold-all sport.

Because it’s the largest language of all, and as a consequence of every particular person wishes to naturally hold that which performs every goal of cash simplest, the toughest, soundest, strongest money comes out on top.

On the present time, the USD reigns supreme now not thru merit, but as a consequence of it is enforced by a kabal. Bitcoin will be the area customary, now not as a consequence of some fiat decree or the force of the nation sing, but thru natural, market different.

That’s what makes it so unprecedented.

The Philosophical Rationale

The economic case for bitcoin stems from the philosophy of Bitcoin and the guidelines it embodies.Bitcoin is ready a lope away from “rulers” and towards “guidelines.”

It does this as a consequence of a series of market-selected attributes it has, and as a consequence of it has emerged organically in a direction-dependent pronounce. The three core enhancements of Bitcoin are:

- Digital scarcity

- Self reliant consensus

- Digital immutability

These are the outcomes of the zero-to-one 2d that occurred on January 3, 2009, with the Bitcoin genesis block.

The immaculate conception has occurred and the path that Bitcoin has adopted since can now not be repeated. It became once a once-in-history genesis and series of direction-dependent occasions.

We indulge in a preferrred money and a preferrred monetary network that somebody, wherever can declare and/or dangle on.

Right here’s the future, and what follows are aspects of the Bitcoin philosophy which create it outlandish.

Decentralization

The word “decentralized” will get thrown around a lot, but it doesn’t imply grand outside of the context of exact care for watch over or low-payment verifiability on the extent of the particular person.

In 2017, we had the block-dimension wars with a faction of Bitcoiners who believed that transactional throughput on the depraved layer became all all over again crucial than making sure the network became once as cheaply verifiable as capability.

Just a few forks of Bitcoin split from basically the most major chain, and there became once even an strive by miners and wide-scale exchanges to coerce the network into doubling the block dimension as piece of some “within your capacity heart ground.”

It too failed, exhibiting now not only the resilience of the network to assault (whether inside or external), however the decentralized nature inherent in Bitcoin. The voters of the network, the node operators, rejected the corporate and overlord versions of bitcoin, and the HODLers place their money where their mouths were and backed Bitcoin, now not some knock-off model.

On the present time, it is cheaper than ever to bustle your bear node, and as such, Bitcoin’s network topography is ever more decentralized. Truly, it’s the single network on which it’s essential to well possibly additionally be a top notch citizen that enforces the Bitcoin consensus guidelines for lower than $100!

Ethereum, to illustrate, is so bloated that YOU CANNOT rep the blockchain and bustle a node. Truly, it’s about to acquire many of worse as a consequence of once it strikes to proof of stake, the 32 ETH required to be a validator will label 99.9% of folks out. In different phrases, Ethereum could be bustle by those with all of the ETH. Sounds goal correct be pleased up-to-the-minute central banking to me.

The BCashers,BSVers are in the identical boat. They selected to scale their depraved layer linearly, by growing the block dimension. Empty blocks apart (i.e., no person is the usage of these things), this has resulted in a bloated blockchain with a single group of validators (only miners). There are now not any node operators on these networks and the larger their blockchain grows, and the more junk they throw on it, the more this can require recordsdata-heart-level operators to now not goal correct mine but really store their blockchains, leading towards total centralization.

They’re there already. BSV is really bustle by one company: CoinGeek. Bcash is bustle by Roger Ver. So grand for decentralization.

The alternate-offs made by Bitcoiners and the Bitcoin network were naturally selected to create sure maximum decentralization and, as such, maximum aversion to commerce of any variety. Therein lies its power as a customary.

Nic Carter wrote an even portion on Bitcoin’s alternate-offs here: “Bitcoin Bites The Bullet.”

Layers

Nature scales in layers. Engineering scales in layers. All human cooperation scales in layers. Verbal exchange networks, vitality transmission media and all different networks we’re attentive to scale in layers.

The Bitcoin network’s layered contrivance is in step with what works.

It’s now not only very unlikely to create a single layer enact all the things, but it’s an fully ridiculous pursuit.

Every little thing you add begins to have an effect on one other component. What some folks fail to impress (grand be pleased central planners and bureaucrats) is that every motion has a reaction and each resolution has a payment or a .

Within the prior example, I well-known that by making an strive to cram more transactions and recordsdata onto the depraved layer, you create it more costly for folk to bustle a node, thereby impacting the network’s decentralization.

The similar goes for making an strive to create the depraved layer deepest. The payment of doing that is the sacrifice of verifiability and auditability of the depraved chain. That’s now not a label we want to pay, namely when we are in a position to summary privacy to a better layer.

One of Bitcoin’s ultimate strengths is its native scripting language, which lets in the codification of easy contracts. This lets in the abstraction of things be pleased transaction throughput, multiparty authorization and privacy with out having an impact on the safety, decentralization and immutability of the depraved layer.

Truly, it lets in Bitcoin to scale all the device thru multiple dimensions exponentially. With Lightning, to illustrate, somebody is also a node for transactions, which contrivance throughput can scale geometrically.

Right here’s so incredibly crucial, but seems to be misplaced on linear thinkers.

In the end, the layered nature of Bitcoin contrivance that now not only enact the network effects obtain stronger and compound on themselves, however the network turns into an increasing number of decentralized. We introduce new layers to the network, every with their bear pores and skin in the sport, making it ever more refined for any participant, group or layer to indulge in have an effect on over one other.

It’s engineering perfection.

Censorship Resistance

When folks discuss about decentralization, they fail to impress that that is known as a contrivance to a more crucial end.

That end is the network’s resistance to commerce or censorship.

Right here’s categorically the largest attribute for a world digital money. Something whose supply can’t be altered, whose medium of exchange goal can’t be censored and whose guidelines can’t be directed by somebody.

And the device does Bitcoin obtain this?

COST.

Bitcoin transforms raw vitality, by computational work (one thing that can now not be solid or faked) into monetary vitality, giving us a thermodynamic guarantee of fact. Right here’s further enhanced by the spread of fat node operators, Bitcoin HODLers, 2d layer operators and infrastructure avid gamers all all the device thru the sphere.

There could be now not any sum of cash available in the market or coordination capability to grab a examine and co-decide the network. The cat is out of the obtain.

To study more about immutability and safety as capabilities of COST (i.e., proof of work), now not “blockchain,” peep the preliminary chapters of The Bitcoin Instances, “Model One” and “Breaking The Blockchain.”

Verifiability

As mentioned in the decentralization piece, indubitably one of Bitcoin’s core payment propositions is that any one, wherever can verify the foundations and build of the network, at any deadline.

Furthermore, any one who does so is mostly the one enforcing the foundations of the network on the local level.

Cheap, easy, rapid, easy verifiability is on the core of what makes Bitcoin now not only sturdy, but extraordinarily decentralized.

Right here’s goal correct, economic, exact decentralization. No longer some theoretic bullshit pushed by some academics who constructed a “model” on their laptop and are now claiming some “decentralization coefficient.”

The development is as follows:

Verifiability → Decentralization → Censorship Resistance

Individuality

Bitcoin is now not democratic. It’s purely anarchic.

It is miles enforced on the extent of the particular person. After I bustle my node, I put into effect the Bitcoin guidelines for me. I goal correct happen to be in alignment (or consensus) with thousands and thousands of others who are working the Bitcoin guidelines for themselves too.

We’re now not compelled to agree. We’re now not “told” by somebody. We’re now not organized by some central authority. We bustle it in the community, and we obtain consensus globally.

Right here’s free market perfection in motion. Truly, it’s the agorist, voluntarist, libertarian and anarcho-capitalist’s dream.

It’s a network with guidelines, which we put into effect as folks and is made up of others who agree and put into effect the identical guidelines

Unlike the low collectivist devices under which we dwell, where my conception has an impact on somebody else’s life, liberty or property and likewise theirs on mine, Bitcoin is pure voluntary individualism.

My choices achieve now not want any relating to you, nor yours on me. Truly, that is a key to Bitcoin’s immutability. Anybody is free to head and create up their bear Bitcoin guidelines or commerce them should aloof they want to. It has no impact on me and the leisure of the Bitcoiners who’ve adopted and are enforcing the Bitcoin consensus guidelines for ourselves. They who commerce the foundations will goal correct “fork off” onto their bear network, by themselves. The leisure of us continue on be pleased nothing ever occurred.

Bitcoin’s protection is in its total openness. There’s nothing somebody can enact to commerce Bitcoin for me. You could well also only commerce it for you.

Voluntary

Bitcoin is a force of nature that emerges in a vacuum of force and coercion. Bitcoin doesn’t “create” you enact anything else. It cares now not whether you settle on it, care for it, employ it, save it, ship it or receive it. Bitcoin goal correct is, and what you enact with it is as a lot as you.

Governments and central banks, on the a total lot of hand force you, at barrel of a gun and menace of imprisonment, to declare their money. If their money became once so appropriate, why your entire hostility? Why the last word tender laws? What are they nervous of? And what regarding the double standards?

Why is it perfectly correct for them to print and obtain it from thin air, but even as you happen to enact it, you’re either thrown in detention heart or you’re suffocated by a knee to the throat from some cop?

Anytime you’re compelled to declare and accept one thing, know that it’s depraved. Know that you’re the product.

Bitcoin is winning now not by coercion, but thru sheer natural different.

Despite the force, despite the threats, despite the so-known as “could well possibly and promise of the governments of the sphere,” bitcoin continues to acquire market portion. It continues to suck the air out of the room to your entire fake govt bathroom paper they are seeking to lope off as money.

All around the last 12 years, Bitcoin started from $0, and since then, every single nationwide currency that is compelled down our throats by govt bureaucrats is down 99% against it. And that’s barely the starting.

Peek usdsat.com and casebitcoin.com to acquire a clear, empirical look of Bitcoin’s statistics since the beginning.

No Head Of The Snake To Decrease Off

Something that occurred with Bitcoin, that can never be replicated as a consequence of it became once a one-time, direction-dependent occasion, is the disappearance of Satoshi. Let’s recap:

- Bitcoin emerged as a nil-to-one innovation

- At a time when one thing be pleased this became once thought very unlikely

- It became once planted right thru the 2008 world financial disaster, with a deep, optimistic message

- It became once picked up by the early cypherpunks and libertarians

- It became once pushed apart, left out, disparaged and ridiculed by each person else

- It persisted to spread under the radar

- It became once worn on Silk Avenue, which proved it could maybe maybe well possibly now not be stopped

- Its proof of work grew, as did the series of nodes, HODLers, believers and the infrastructure wished to lope folks out of fiat and into bitcoin

- The creator disappeared and left it to the sphere, to enact with as we want

There became once a time to wreck Bitcoin, and that became once somewhere in its first few years of its life. Nonetheless as an different, it became once laughed at. The cat is now smartly and with out a doubt out of the obtain.

Unlike Ethereum or any different shitcoin available in the market, which if the govt. wishes to co-decide or shutdown, it could possibly possibly goal correct call the highest office, Bitcoin is terribly unlikely to flip off. There could be now not any wreck switch. There could be now not any “off” button. Bitcoin will dwell on the catch, the electrical energy grid and this can dwell on all of us. Within the identical contrivance it’s essential to well now not wreck an conception, it’s essential to well now not flip off info. Recordsdata lives on in us, thru us and around us. Right here’s the gift Satoshi gave us when he disappeared.

For this, he will lope down in history as the last word hero of all time.

The Simply Rationale

The factual case stems from the philosophy of Bitcoin.

Principles, No longer Rulers

Bitcoin’s raison d’être is the elimination of rulers who can create arbitrary mandates that attend one group on the expense of 1 other.

It’s a general monetary customary, constructed on guidelines voluntarily enforced by every particular person that’s a part of the network. Bitcoin stands against fiat of any variety, whether issued by the govt., some deepest particular person or a bunch of crypto nerds who aspire to be our future overlords.

Right here’s why Bitcoin is broadly hated by statists, central bankers, bureaucrats, blockchainers, crapto enthusiasts, fintech folks, merchants, macro analysts and social justice warriors of all forms.

They all want you to be subservient to them.

Bitcoin lets in you to face up straight along with your shoulders attend, to handle yourself be pleased somebody you care about, and to be subservient to no person.

Bitcoin is a tool for optimum deepest sovereignty and freedom, and Bitcoiners are your brothers and sisters in palms, who want the last word for themselves and motivate you to want the last word for you.

Bitcoin is the most economically unprecedented tool, designed to bring down the low legacy financial machine that’s destroyed households, the atmosphere, education, morals, sources and time. Bitcoiners are the mute warriors who stand by this imaginative and prescient and is now not going to flinch.

Right here’s why I am a Bitcoiner. There is a large difference between us and the leisure of the “crapto” industry. The next screenshot sums it up properly:

Warriors, No longer Cheap Opportunists

You could well also consistently advise a crypto or legacy finance person by the irrational wretchedness they’ve of fine letting lope and allowing folks to make a resolution for themselves, or their incessant want to hope to care for watch over all the things and their desire to be the ruler.

It’s really reasonably pathetic and must stem some from a deep-seated insecurity in their bear psyche. Because they don’t indulge in any deepest discipline, they want to validate themselves by projecting care for watch over upon others.

You’ll additionally study the adaptation between Bitcoiners and the leisure of the folks in finance and crapto by why they’re here.

Bitcoiners will lock up their bitcoin in chilly storage and never touch it. They’ll work their asses off to generate more payment in society so that they might be able to store their new wealth in bitcoin, too. In doing so, they are now not only saving for the future and reducing their deepest consumption, but they are catch producers which can maybe well possibly be ripping their economic input out of the legacy financial machine. They are ravenous the beast.

Shitcoiners and merchants on the a total lot of hand will strive to gamble their contrivance to fiat riches. As an different of engaged on things which can maybe well possibly be meaningful, they’re hell bent on wasting time making an strive to acquire rich rapid, finding out the tea leaves on charts. They add zero payment to society. This gambling is indubitably one of many ailments of up-to-the-minute society, and one thing Bitcoin basically stands against.

One of basically the most goal correct articles on how Bitcoin will de-financialize the sphere became once written by Parker Lewis of Unchained Capital: “Bitcoin Is The Sizable Definancialization.”

Zero To One, No longer One To N

Bitcoin is a metamorphosis of cash and finance staunch thru which we change rulers with verifiable, clear guidelines that somebody can voluntarily decide into. Crypto, by its very nature, is candy a replication of the legacy financial machine, staunch thru which one goal of rulers is changed with one other.

As an different of Jerome Powell and Christine Laggarde, we’re getting Vitalik Buterin and Charles Hoskisson. Out with one group of megalomaniacs and in with one other.

Right here’s neither attention-grabbing nor trim.

Beautiful as a consequence of Ethereum and Cardano portion some digital similarities with Bitcoin does now not imply they’re anything else be pleased Bitcoin. They’ve an issuer, they’ve a foundation, they’ve a core group of operators who make a resolution what the foundations are. They’ve their bear descend safety groups, boards and “key personnel.” The philosophical foundations upon which their applied sciences are constructed are now not any different to well-liked nation sing govt and central banking.

All their discuss about “governance” and the hero adore of their respective creators makes this so evident that you’d want to be wilfully ignorant to now not peep it.

The area doesn’t want new rulers.

The area needs a money and fiscal network that no-one can attend from on the expense of 1 other. The area needs pores and skin in the sport, social mobility and an equality of commercial opportunity where the productive can ascend no topic who they are or where they come from.

Toxic Heroes

Bitcoiners are known as poisonous, assholes, bigots, intolerant, amoebas and each different title under the sun, by each person. We undertake every of those names and transform them into memes. We’re be pleased insult-recycling machines. The last in an antifragile neighborhood.

You won’t rep this wherever else. It’s with out a doubt a white-blood-cell-variety immune machine.

We enact this as a consequence of we know Bitcoin is the one shot that now we indulge in got. Bitcoiners are basically the most dauntless, selfless, courageous and forthright folks you will meet as a consequence of they’d maybe well also very with out problems promote their souls to some shitcoin organizations and shill you some rubbish as a consequence of they’ve been around long adequate and can achieve a charge on it, but they won’t.

It’s the only neighborhood that positive factors nothing at a person level when you settle on bitcoin. Except you’re in my conception shopping billions of greenbacks’ in bitcoin, you indulge in no relating to the bitcoin label and on my deepest wealth. Bitcoin has no marketing department that can pay me to permit you to know to settle on it.

Your entire different shitcoins are different. They literally pay folks to promote their wares, which contrivance you are the sucker shopping it.

We stand guard on the gates and obtain in touch with this behavior out. We’ve been doing it from day one, and despite the flack we obtain, we continue, as a consequence of we know why we’re here.

We are mission driven. And that mission is to basically save the sphere.

We’re here to avoid wasting the lifeblood of humanity, it’s time, vitality and sources now not by some decree, but by encouraging every and everybody of you to became a guilty, sovereign particular person that owns the fabricated from their labor.

We’re taking half in the long sport.

Time And Fracture

Bitcoiners perceive that the last word plague to humankind is kill. Fracture by contrivance of the natural sources and vitality we declare, and the time spent the usage of them.

At a classic level, money represents three things:

- Time

- Vitality

- Pure sources

Fiat money is basically the most wasteful advent on the earth as a consequence of it does now not accurately measure any of those. Truly, by willy-nilly constructing it out of thin air and squandering it, the value “the machine” will pay is a total devastation and irreversible lack of every.

When a govt creates a bunch of cash out of thin air, it filters thru the economy, is worn to transform scarce sources into some plastic junk we don’t want, so it is also blindly consumed by somebody whose deepest time preference has been deranged.

I wrote about this at length in this portion which I motivate you to study, “Fiat, Fascism And Communism.”

Crypto, fiat and the leisure of those legacy machinations exist now not to put off kill from the machine, but to acquire more kill and more confusion, while a couple of new overlords obtain rich at your expense.

It’s madness. And the problem is folks are so hell bent on making an strive to create it thru and “hold” the fiat zero-sum sport that they’re going to throw caution to the wind and burn thru any quantity of popularity, sources, time and vitality goal correct to “create a lickety-split buck.”

It’s a unhappy, nihilistic sing of affairs, and one which Bitcoin changes on the core — but will hold time.

Right here’s why it’s about time you stood up for what’s goal correct. It’s about time you joined us and with out a doubt made a difference, by placing your money, your blood, sweat and tears, where it counts.

There could be nothing on earth this day that’s going to indulge in a more particular, long-term impact as a consequence of nothing else changes the depraved incentives of the particular person (and as such, their behavior) as Bitcoin does.

The sooner you became a part of that commerce, the upper now not goal correct for you, but for the sphere. For more on why, study the Jordan Peterson series on Bitcoin here: “Bitcoin, Hierarchy And Territory.”

In Closing

Bitcoin is profound and outlandish, now not for any single cause listed above (seek I barely even touched on the technological causes), but as a consequence of it is all of them mixed.

It’s a advanced, emergent machine that has developed direction dependently, in an adversarial atmosphere from day 1.

This can’t be replicated no topic how keen any one tries. It’s as shut to immaculate conception as we are in a position to ever come.

Nonetheless….Despite all the things I’ve acknowledged, many of you will continue on with either your no-coining or shitcoining. You can converse, “It’s okay, I will beat Bitcoin,” or, “I don’t want it,” or, “It will’t be that crucial.”

And while those statements couldn’t be further from the very fact, I’ll leave you with any other harsh, but crucial fact:

Bitcoin doesn’t want you. It’s essential to Bitcoin.

I wrote a rapid, brutal portion about this last twelve months, which if you happen to’re in the shit- or no-coiner camp, I devoted to you: https://medium.datadriveninvestor.com/enact-now not-settle on-bitcoin-75da73226530

It issues now not if you happen to’re a person, a neighborhood, a company or a nation, you will only ignore Bitcoin at your bear misfortune. The decisions you create this day will create sure you’re either a footnote, or a maker of history. So hold properly.

The foundation that the sphere goes to bustle on a bunch of different monies, issued by a million different folks, is be pleased assuming we’re all going to discuss English to every different with a different series of vowels and consonants.

It’s now not only inefficient, but a categorically broken contrivance of vitality transmission that’s simply a remnant of a fiat money world. Will there be new forms of fiat that sprout up all over the place along the contrivance? Yes, in point of fact, but every of them will vogue towards their factual payment (zero) as a consequence of any sucker that supports a new overlord will only impoverish themselves in the contrivance, while their overlords and shitcoin heroes settle on bitcoin, radiant it could possibly possibly’t be overwhelmed.

Bitcoin is stronger than ever this day and its have an effect on, economic mass and gravitas will only continue to grow.

Bitcoin or shitcoin.

The different is yours to create.

Mediate deeply.

Employ properly.