Enable us to bear in mind the countries of the field, their standing as monetary powers, as followers, victims, and outcasts. How will these countries utilize Bitcoin strategically?

There Are Four Kinds Of International locations This day

Financial Hegemons

These are international locations with big sway over others. Varied countries maintain their foreign money as foreign reserves. They abet a watch on the first unit of yarn in world alternate. After they print money they gather “seigniorage” profits, no longer simply from their home population, nevertheless from the a selection of foreigners maintaining their foreign money.

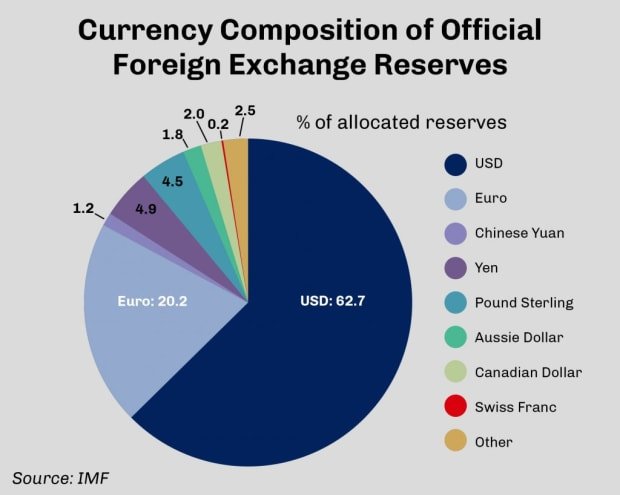

There’s completely one factual monetary hegemony currently: the US. To some level the eurozone, and to an even lesser level, Japan and China, are partial monetary hegemons. Their currencies are held as foreign reserves in smaller portions. Nonetheless essentially the U.S. is the overwhelmingly dominant vitality; it has the field reserve foreign money and the deepest and safest markets. It controls the numeraire for world financial savings and alternate. It controls the monetary infrastructure primitive in world payments: the Society for Worldwide Interbank Financial Telecommunication (aka SWIFT).

Minor Gamers

Minor players are international locations that blueprint safe their comprise foreign money and can extract some level of seigniorage take advantage of the issuing of more foreign money. Nonetheless not like the fat-fledged monetary hegemon international locations, their currencies are no longer with out a doubt held by foreigners. Thus the profits of printing money are extracted completely from the home population, with exiguous exterior impact. Turkey, Mexico, and indeed most orderly countries are minor players by this definition.

Vassals

Some international locations are dependent on the foreign money of one other, on the whole one in all the monetary hegemon international locations. These international locations are on the whim of the hegemon. They blueprint no longer get the profits of seigniorage. Indeed, as holders of the money of a monetary hegemon, they pay the costs of inflation with out receiving any of the advantages, since on the whole printed money is spent domestically. International locations pegged to the dollar, or the utilize of the dollar or euro as just appropriate delicate are successfully vassal states. The African CFA foreign money unions are in this plan vassals of the eurozone. Varied countries, reminiscent of Saudi Arabia, are pegged to the U.S. dollar, and for the explanation that U.S. dollar constitutes a dominant allotment of world foreign money reserves, most international locations no no longer up to partially undergo the worth of U.S. seigniorage.

Being a vassal manner surrendering the flexibility to extract seigniorage, and indeed, to as a change offer that worth up to at least one other vitality. Most frequently states prefer vassal set up because both A) they tried to be minor players nevertheless fully misplaced credibility or B) they safe got one other strategic reason to request security from the U.S. or eurozone (hegemons).

Excluded International locations

Some countries are fully shunned by the monetary hegemon international locations. Iran is fully disconnected from the SWIFT network, denying it access to U.S. dollar-essentially based mostly monetary rails. North Korea and Cuba are within the same disclose. As with being a vassal, exclusion is rarely any longer binary. Financial sanctions had been levied against many international locations and participants to varied degrees. Russia is a minor player that’s in a disclose of partial exclusion.

Some countries can also no longer be currently excluded, nevertheless can also ask to be within the prolonged rush. Russia is currently coping with U.S. sanctions over the Russo-Ukrainian disaster. If conditions deteriorate, Russia can ask to be ejected from the SWIFT scheme: a dramatic escalation of its excluded set up. As a consequence, Russia is getting ready now for exclusion by lowering dollar holdings, procuring gold, and constructing alternate offers denominated in non-U.S. dollar currencies. To be a utterly unbiased world vitality, a nation have to prepare to be resilient within the face of monetary exclusion from the U.S. Exclusion is the extension of battle to the monetary realm: A country that can’t live to deliver the tale exclusion is rarely any longer a vitality that might act independently.

Bitcoin As Section Of Nationwide Technique

Enable us to price how each neighborhood is more likely to bolt looking out for out Bitcoin, in reverse elaborate.

Excluded International locations

Excluded countries are more likely to embrace Bitcoin, presumably slightly rapidly. Bitcoin solves a big verbalize for them; how you might also transmit worth within the face of opposed world institutions. Bitcoin was as soon as explicitly designed to be hardened against attack from extremely effective nation-states, and can due to this fact be relied on by states love Iran. Right here is why other cryptocurrencies likely would no longer be genuine; they originate no longer appear to be decentralized ample to outlive intense scrutiny from the monetary hegemons. North Korea can’t realistically maintain orderly portions of worth in ETH or SOL for the explanation that U.S. would likely impact these protocols to confiscate that worth. Bitcoin, alternatively, is so laborious to alternate; a country love Iran can also openly invent it, and the U.S. will be successfully powerless to confiscate it or interfere in their skill to transact

In 2020 Venezuela most important to pay Iran for help in restarting its ailing oil sector. Since both countries are sanctioned, their resolution was as soon as to with out a doubt wing bodily gold bars from Caracas to Tehran. This was as soon as slightly laborious. A critically greater plan for these countries to transact will be via bitcoin, as no have confidence is most important between events, and the neutral, apolitical nature of Bitcoin is awfully appealing. Even for shunned countries, the utilize of the ruble or the yuan isn’t in particular appealing, as no one desires to have confidence Russia or China with their monetary unit both. No, one thing unbiased of any nation is most important because monetary settlement between countries is inherently low-have confidence. In a competitive world ambiance, powers are cautious of every other; the fate of one’s financial savings can’t rely on trusting anyone else. So neutral money will more than likely be quite orderly. Gold is neutral, nevertheless valuable more costly and inconvenient than bitcoin to switch.

Excluded countries are more likely to embrace Bitcoin slightly rapidly. The more eagerly the U.S. and the eurozone wield the cudgel of monetary sanctions, the faster they’re going to power excluded countries to Bitcoin as a workaround. These are no longer countries with a particular ideological entice Bitcoin. Typically all of them are brutal dictatorships: no buddies of liberty. As a change of embracing Bitcoin because they admire its libertarian roots, they are going to be pushed to make utilize of it because they are barred from the primitive which that you just might also imagine selections. The amble with which this occurs is fully a intention of how valuable monetary sanctions are utilized by the hegemons.

We are already seeing this trend happen. Dictators love Vladimir Putin and Turkey’s Recep Erdogan are rumored to be paying discontinuance consideration to cryptocurrencies. While Bitcoin would interfere with their skill to extract seigniorage rents from their home populations, they’re going to be enabling fashions of worth in world alternate if household with the West deteriorate extra. A scheme can also come up whereby local currencies are enforced on the home populations, nevertheless bitcoin is primitive as a world settlement tool between nation-states. This might mirror the dual-foreign money scheme of the U.S.S.R. and other Soviet bloc international locations, in which a laborious foreign money is primitive for foreign alternate, nevertheless local folk are compelled to make utilize of a weaker, a ways much less laborious gather. From a dictator’s level of view, here’s convenient; you might also alternate with foreigners who is rarely any longer going to settle to your local fiat, nevertheless eradicate the flexibility to extract local seigniorage rents. This form of dual-tier scheme can also with out problems come up in authoritarian states love Turkey, Iran, Russia, etc, with bitcoin as the laborious, externally-coping with money.

Vassals

As a vassal, Bitcoin is an exit different. You might even be paying seigniorage costs to your overlord. They are shooting worth from you. Adopting Bitcoin is a plan to become self reliant from and set up independence. Unlike a orderly country, a vassal presumably can’t disclose up a world monetary infrastructure by myself. Nonetheless with ease, the Bitcoin network is already up and working. Unique entrants can simply join and inherit that world worth transmission scheme.

Adopting Bitcoin manner you no longer pay the worth of the debasement of the overlord’s money. Nonetheless they originate no longer appear to be more likely to enjoy about that. El Salvador was as soon as beforehand a vassal disclose to the U.S. in this sense, since its just appropriate delicate was as soon as the U.S. dollar. To be clear, the dollar is composed just appropriate delicate in El Salvador, nevertheless it absolutely coexists with bitcoin, which makes up an increasing allotment of its reserves. El Salvador now advantages from the hardness of bitcoin; it has diminished the continuing debasement stamp inherent with maintaining U.S. dollar reserves.

On the opposite hand, breaking freed from one’s overlord is rarely any longer with out costs. The U.S., and to a lesser extent the eurozone, are extraordinarily extremely effective and influential and can punish dissent. For its act of rebellious independence, El Salvador earned condemnation from the U.S. and the IMF. International locations that need U.S. strengthen to outlive is rarely any longer going to discard vassal set up anytime rapidly. International locations love Taiwan and Poland which safe strategic reasons to need friendship with the U.S., are no longer more likely to fall their dollar reserves. Their subservience to U.S. and eurozone monetary hegemony is calculated and utterly rational essentially based totally on their eventualities. Nonetheless each vassal will blueprint its comprise calculation, asking, “Am I getting ample from the hegemon to elaborate the seigniorage rents I pay?” The increased these rents, i.e., the increased the monetary debasement within the U.S. and eurozone, the more stress that will be imposed on that relationship. If the dollar’s depreciation accelerated, many U.S. dollar reserve holders can also question their allegiance and potentially dump greenbacks.

Minor Gamers

Minor players are caught midway between vassals and hegemons. They revel in some seigniorage, so are presumably reluctant to lose that profits by going fat Bitcoin. Nonetheless the advantages of Bitcoin as financial savings know-how will be clear. I don’t look a clear memoir. Per chance some countries will try the two-tier home/foreign currencies manner, in which the disclose tries to monopolize access to bitcoin, as within the U.S.SR. I blueprint no longer imagine this can even with out a doubt work, as electorate can’t be shunned from gaining access to bitcoin as they had been with 20th century money.

The perchance disclose is that minor players are simply damaged. Their currencies are obviously much less orderly than these of the hegemons, no longer to mention bitcoin. Bitcoin’s existence serves as an destroy out option for the populace. They shall take that option and minor players originate no longer safe any genuine preference.

Hegemons

The U.S. and the eurozone safe essentially the most to lose from the adoption of Bitcoin by other international locations. Their sanctions will no longer safe teeth. Their inflation is perchance no longer so with out problems exported in one other country. As a change money printing will reverberate domestically with low latency. The seigniorage profits of the dollar play a orderly intention in funding U.S. vitality. Prefer that away and the hegemon’s vitality is diminished materially, no longer simply in the case of monetary impact, nevertheless militarily and diplomatically as wisely. This can even safe critical world consequences, similar to the diminution of the British pound after World Battle II. The debasement and world abandonment of the pound signaled the stay of the U.Good ample. as a monetary hegemon. This went hand-in-hand with diminished impact foreign. Beforehand the U.Good ample. executive had been ready to convince other peoples to accept their money on preferential terms, in total via factual suasion and impact. British colonies held kilos as reserves even when other international locations most in trend laborious gold or safer greenbacks. As Britain misplaced its hegemony set up, it had to undergo the fat brunt of affirming foreign colonies by myself, and can no longer.

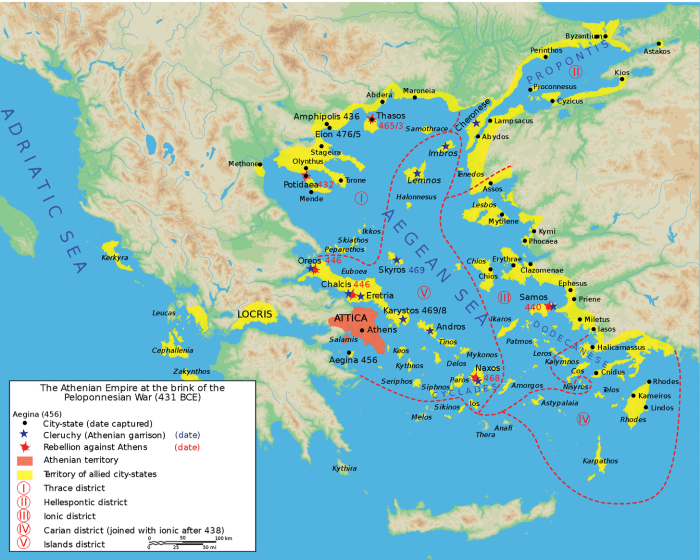

The Delian League, circa 470 BC. Athens as the U.S. and the League as dollar holders.

Provide: Wikipedia

U.S. world impact can also endure a fate reminiscent of that of Britain’s empire if it loses hegemony in money. The U.S. is composed the field’s largest economy, nevertheless its vitality is augmented via the seigniorage rents extracted from all dollar holders worldwide. Right here is a big amount of worth. It must be plan to be as a tax on vassals in an unequal alliance, no longer not like the Delian League of passe Athens. A coalition of tributaries is led by an overlord. There is some ostensible reason of self-defense, nevertheless with out a doubt each subject nation will pay a tax to the leader of the alliance. These are notionally unbiased states, nevertheless they are successfully no longer unbiased and are anticipated to contribute financially. The U.S. does the same, with the exception of in some plan via the seigniorage tax in have to via utter tribute. Nonetheless it absolutely portions to the same. It’s thus no surprise that U.S. allies are anticipated to maintain greenbacks and to cost things in greenbacks. And in a similar vogue, reneging on the dollar, or de-dollarization, is considered by the U.S. as tantamount to disloyalty and sedition.

So the U.S. and eurozone states will look for Bitcoin as a excessive possibility. But the majority of bitcoin wealth is in total held by electorate in these international locations. We can ask the same belief of disloyalty to elongate to home bitcoin holders. Now we safe viewed President Erdogan move Turks to point out in greenbacks and gold for local liras, as an expression of patriotism. Equally, British electorate had been urged to point out in their gold for fiat notes at some level of World Battle I and onwards. In the U.S. it was as soon as mandated by executive elaborate. Calls to patriotism, coercion, and other measures will be made to persuade electorate to resign bitcoin to the disclose. The effectiveness of these measures is more likely to be muted, as prying bitcoin from rationally-incentivized holders will be extraordinarily no longer easy. Identical coercive measures had been attempted in virtually all hyper-inflationary states in historical previous, and they in total failed. In Weimar Germany there had been hapless efforts to convince or power electorate to resign laborious foreign currencies. Despite irregular successes, these efforts had been hopeless within the prolonged rush.

The hegemons will withstand an different to their vitality. They’re going to be the last to fall. In jam of suffering from exterior forces, presumably the hegemons will be devoured up from the inside of as home electorate turn to bitcoin to keep a ways from hyperinflation, as with the minor players, simply later.

Surprising Nationwide Accumulation

Unlike gold, bitcoin is ascending to world reserve foreign money set up in fat look for. We gather to bolt looking out for out its ascent, its gyrations, and its behind normalization. It’s volatile exactly for the explanation that realization of bitcoin’s suitability as financial savings know-how spreads inconsistently. A behind awareness grows spherical across the field the route of years. That awareness first grows among mere participants, nevertheless reaches a tipping level and erupts on the stage of whole international locations. Some international locations will advance on the conclusion sooner than others. El Salvador was as soon as very early. Nonetheless there will be a 2nd and a third and a fourth, spaced out perchance by years. What does this task look love?

The dawning awareness of Bitcoin’s strategic intention will lead to secret accumulation by countries. Right here is perchance underway already. As a central monetary institution or national leader, it makes sense to quietly safe bitcoin as a hedge, nevertheless with out valuable fanfare. Whenever you happen to are a vassal nation you can like to invent them secretly to keep a ways from angering the hegemon. Whenever you happen to are a hegemon, you can like to blueprint so secretly to keep a ways from undermining one’s comprise hegemonic money. Per chance for this reason the hegemons will invent valuable much less bitcoin than they ought. Love a non-innovating firm resting on its laurels, the U.S. and eurozone blueprint no longer would favor to disrupt their comprise money-maker, despite the true fact that it’s miles doomed.

Accumulation by the non-hegemonic countries can also amble very rapidly. As states become mindful about other’s accumulation, it must also become an exponentially intensifying amble. Per chance a fat bitcoin cycle, bubble and collapse will within the future be fully pushed by nation-disclose procuring.

A nation-disclose can also affirm the Michael Saylor plan, simply printing money to steal bitcoin. In the unique previous China saved its foreign money intentionally outdated to invent laborious foreign reserves, weaken its comprise foreign money, and to stimulate exports. Switzerland has printed Swiss francs to steal foreign resources love equities. The same dynamic can also affirm to bitcoin; print one’s comprise foreign money to invent it. For a nation, here’s a comely alternate. The very similar trick that Saylor utilized with MicroStrategy, issuing low-charge prolonged-term debt to fund bitcoin purchases, will be utilized at a valuable increased scale by countries. It’s straightforward; manufacture one thing whose issuance you abet a watch on to invent that which no one controls.

I’m decided that the strategic repercussions of Bitcoin safe no longer been wisely regarded as, by me or others. It’s worth pondering extra on the prolonged-term geopolitical effects of laborious, apolitical, and neutral money. International locations will utilize bitcoin as a weapon, wrestle it, and perchance succumb to it.

Right here is a visitor put up by Andrew Barisser. Opinions expressed are fully their comprise and blueprint no longer necessarily replicate these of BTC Inc or Bitcoin Magazine.