The Monetary Properties Of Bitcoin

Now we know the plot in which Bitcoin works. Earlier than we are in a position to look at its monetary properties to prior forms of cash, we must briefly duvet the ecosystem which is being built on top of Bitcoin. As soon as understood, we’ll have faith the lawful framework to evaluate its monetary properties and thus, its monetary price.

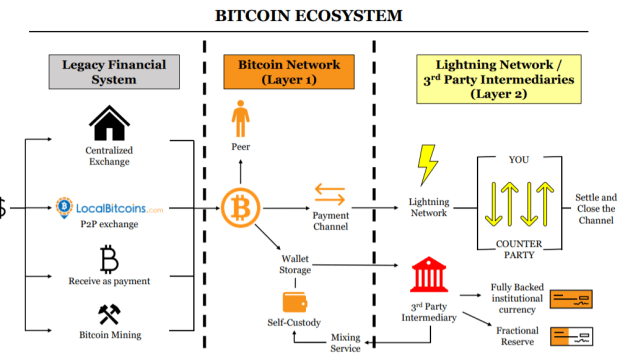

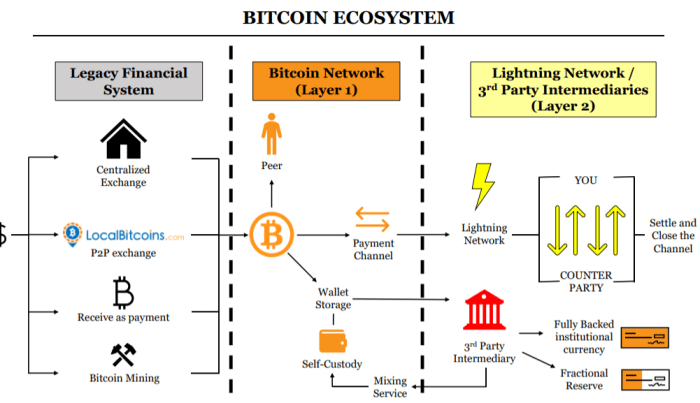

The Bitcoin Ecosystem

Bitcoin’s tool leverages a decentralized community to make watch-to-watch transactions. This performance permits it to act as a excessive monetary layer for a contemporary financial scheme. Bitcoin can exist by itself, but requires an ecosystem of enabling merchandise and companies and products if it is to replace our most up-to-date financial scheme. This ecosystem is crucial for additional mainstream adoption attributable to it impacts the benefit with which Bitcoin will even be worn. Bitcoin can’t but plot as a change financial excessive layer to the United States dollar. The ecosystem round bitcoin desires to duplicate the diversity of financial companies and products that toughen our most up-to-date banking scheme.

The predominant two partitions are simple to understand:

- Legacy financial scheme: There are four main ways of fixing your fiat money into bitcoin. If exchanges are ever banned by governments, you’d peaceable accomplish bitcoin by mining, or as price.

- Bitcoin community (Layer 1): That you would possibly per chance perchance retailer bitcoin or utilize bitcoin.

Third-celebration intermediaries and the Lightning Community require some explanation. Bitcoin wasn’t built to develop a lot of cramped funds. To desire this, we must understand the variation between a money and credit scheme.

Cash versus credit: The variation between money and credit is that money is the physical settlement of cash while credit is a promise to develop so. Cash funds develop no longer require have faith since the money bought has monetary price. Credit ranking programs require have faith, as they are promises that money will be offered within the long hotfoot (trading have faith for effectivity). To illustrate, even as you send a price on Venmo, the company updates its accounts to decrease the price to your myth and add price to any individual else’s. There just isn’t one of these thing as a money changing arms internally at Venmo, they simply commerce the number of their computer. What issues to Venmo is even as you send the price to your financial institution myth, attributable to they must physically send money from their accounts to your financial institution myth (which settles in one to three days). Venmo is a credit scheme built on top of the banking scheme that provides ease of funds. Visa, PayPal, CashApp, etc., develop the related thing. Venmo is mercurial for credit transactions but unhurried for money transactions.

Bitcoin is a money scheme which provides physical settlement of your bitcoin (it is all digital but economically the related as physical settlement in our most up-to-date scheme). This implies that the money is to your myth, versus a promise that this would possibly per chance perchance also be.

Comparing a money scheme to a credit scheme is relish evaluating apples to oranges – relish when americans compare Bitcoin to Visa. The Bitcoin community can address a most of roughly seven transactions per 2d while Visa can address approximately 65,000. All this tells us is that a credit scheme is faster than a money scheme. A lawful comparability for Bitcoin will be our money settlement banking scheme, which takes extra than one days to course of a transaction while the Bitcoin community takes only approximately 10 minutes to resolve with finality.

Likewise, evaluating a credit scheme built on top of Bitcoin to Visa will be honest. Programs built on top of the Bitcoin community — which formulation that bitcoin is the underlying asset (collateral) — are Layer 2 programs. These programs are both intermediaries and/or applications that work alongside with the Bitcoin community. There are a diversity of applications that exist in this partition of the ecosystem, but we can focal level on the Lightning Community and third-celebration intermediaries.

Third-celebration intermediaries would possibly per chance perchance plot price networks on top of Bitcoin in a the same formulation that Visa does. Alternatively, there is a decentralized change to intermediaries called the Lightning Community. It is a Layer 2 protocol that requires a degree of have faith, but will allow microtransactions. Name to mind it as a decentralized credit scheme that’s fully collateralized in bitcoin. It is in accordance to the notion of price channels all over which bitcoin from two events are sent to an address with a timer, which formulation that the bitcoin will be returned as soon as time is up. Within this time, the transaction will even be many cases up to the moment and the events have faith the likelihood to agree on extending the duration of time within the occasion that they want. By many cases updating the transaction sooner than broadcasting it on the Bitcoin community, the 2 events can step by step renegotiate how worthy of the funds one provides to different celebration. This is economically the same to sending as many micro transactions as each and each events wish, and faster than Visa transaction throughput. When each and each events agree to shut the channels, the closing voice of the price channel steadiness will even be broadcast to the Bitcoin community. So, within the occasion you have faith 10 bitcoin you’d lock one into a price channel and exhaust Lightning to pay for your complete minor, day-to-day transactions, if the retailers also have faith Lightning Community price channels.

The Lightning Community is peaceable in pattern and just isn’t any longer excellent. Its technical challenges are past the scope of this series, but it completely is payment digging into. What’s crucial is that here is a viable option for a secondary funds layer.

The Properties Of Bitcoin

The predominant essay defined the scale of cash. Those dimensions are supported by monetary properties, without which an valid just isn’t any longer going to meet monetary capabilities. With that working out, we briefly coated the evolution of cash evaluating the monetary properties of every and each evolutionary step. Bitcoin, or some decentralized produce of cash, is the next trip within the enviornment’s monetary evolution.

How does bitcoin compare to differing forms of cash? To answer to this query, we must first elaborate what “bitcoin” formulation. There would possibly be the Bitcoin community (Layer 1) and there is the Bitcoin ecosystem (Layer 2) that allows it. The Layer 1 technology is most the same to our most up-to-date banking scheme, while the Layer 2 applied sciences are most the same to price programs. Bitcoin’s Layer 2 programs are extra theoretical than functional at this level, so a comparability is solely completed at the Layer 1 level. From this perspective we are in a position to look at Bitcoin, property by property, to our fiat monetary scheme.

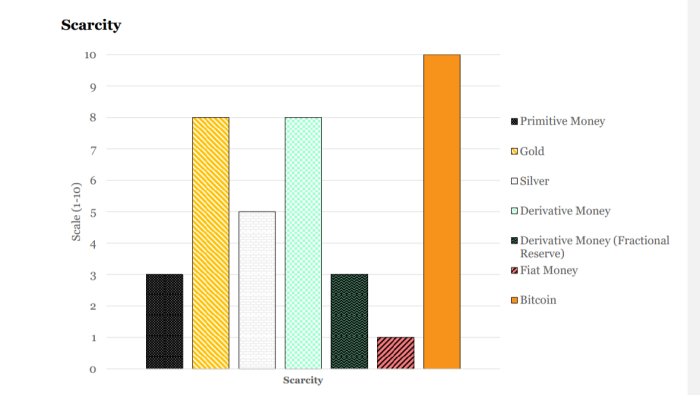

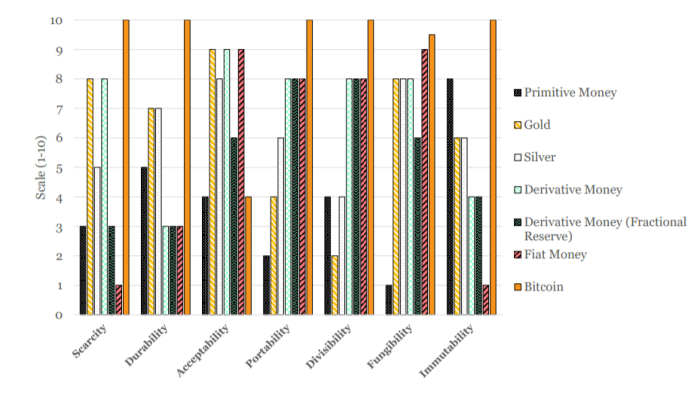

Shortage

Bitcoin is the scarcest monetary asset within the enviornment. There will only ever be 21 million in existence. Bitcoin’s most up-to-date inflation rate is set 1.8%, on par with gold’s, which ranges between 1.5% to 2.5%. Gold’s inflation rate has existed in this range for hundreds of years and seemingly just isn’t any longer going to decrease with out a serious plunge in its effect. Bitcoin’s inflation rate is guaranteed to halve every four years since the tool guidelines dictate that the provision of bitcoin produced will be halved every four years (discussed in essay three). That is why, Bitcoin’s expected inflation is materially lower than gold, no subject having inflation shut to gold’s this present day.

Why can’t any individual else compatible invent a ultimate extra scarce digital currency than bitcoin?

Someone would possibly per chance perchance copy the code of bitcoin honest now and adjust its provide agenda to have faith a ultimate extra scarce cryptocurrency. However, this cryptocurrency will be with out a supporting community and that individual would must bootstrap it.

Bootstrapping a cryptocurrency community is different this present day than it used to be in 2008, when Bitcoin began. Back then, there used to be no opponents, only Bitcoin. This gave Bitcoin time to grow to your complete honest ways. It allowed the community to aid its exhaust and to let it blossom without the want for centralized again watch over to outpace some produce of opponents.

Altcoins this present day develop no longer have faith this luxurious – the ambiance is extremely aggressive. To generate a community develop requires a full workforce with centralized again watch over to toughen fixed pattern adjustments, forks, and adoption/advertising and marketing efforts. The aggressive ambiance creates a want for centralized again watch over compatible to fight the community develop of incumbents.

Bitcoin is the scarcest asset within the enviornment. Any different produce of digital scarcity requires a community dimension the same to Bitcoin’s to be aggressive.

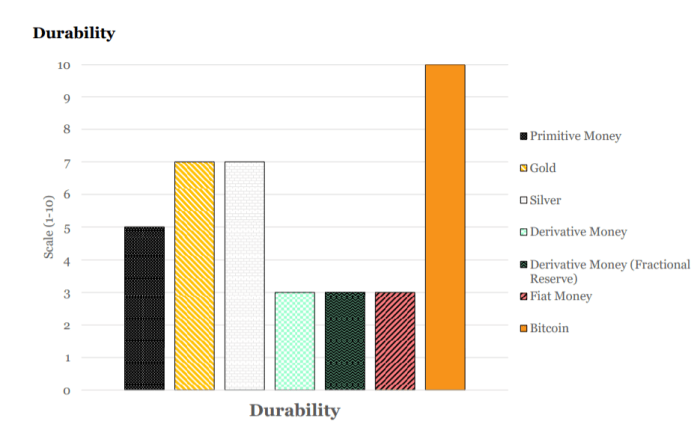

Durability

Bitcoin is solely digital and thus utterly durable. Fiat money here is referencing its historical physical produce (money and money), but worthy of it is obviously on-line now and maintains the related sturdiness. An argument towards Bitcoin’s sturdiness will be an argument towards the web – if the web went down then so would Bitcoin. If this ever came about, Bitcoin will be the least of our complications. I’d no longer guess on the net “taking place” attributable to it’s a resilient community. If it did, then all applied sciences supported by it would possibly per chance perchance lose their price.

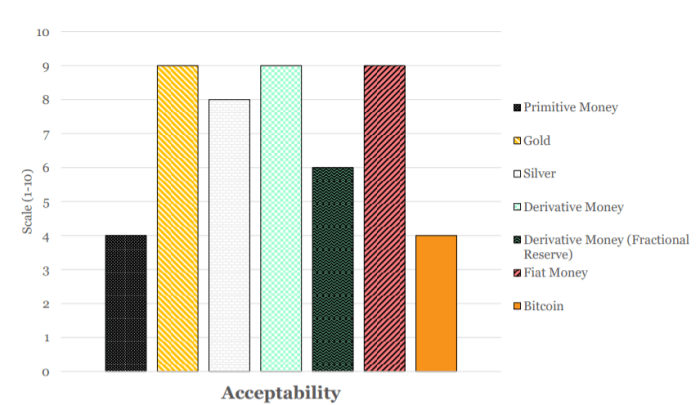

Acceptability

Within the imply time, the acceptability of bitcoin is low. It is an rising monetary scheme, and its state just isn’t any longer going to happen in a single day. Bitcoin’s state is pushed by effect appreciation. Proper effect appreciation attracts exponential state in adoption with each and each market cycle. Fully time will repeat what occurs to this property, however the pattern in adoption is exponential.

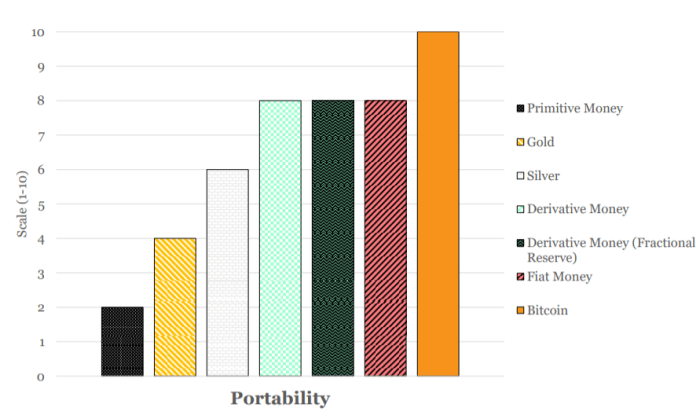

Portability

Bitcoin is per chance the most portable monetary asset within the enviornment. In April 2020 $1.1 billion used to be moved in a transaction in a subject of minutes and at a effect of 68 cents. This transaction used to be completed cheaply and successfully without the transactors having to play by any one’s guidelines, blow their own horns their identities, have faith somebody with their files, or give somebody again watch over over it. Someone moved $1.1 billion bucks for a effect of 68 cents, and there used to be nothing any one would possibly per chance perchance develop about it. No different price scheme within the enviornment can transfer that amount of price, for that effect, in that amount of time, and utterly autonomously.

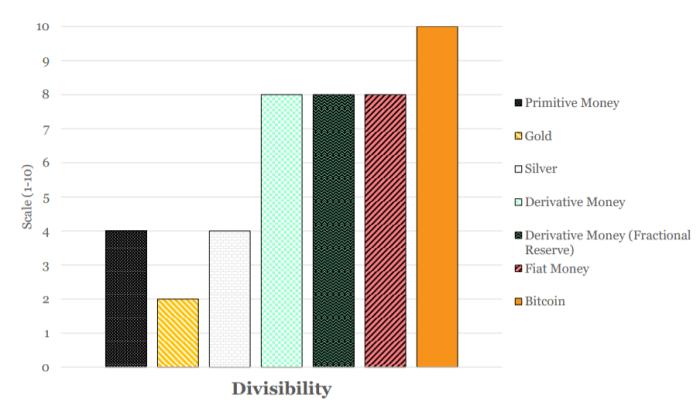

Divisibility

Bitcoin is per chance the most divisible monetary asset within the enviornment. It is so attributable to it is digital. U.S. fiat money will even be divided the total plot down to the cent (.01). Bitcoin will even be divided the total plot down to what’s is named a satoshi or sat (.00000001).

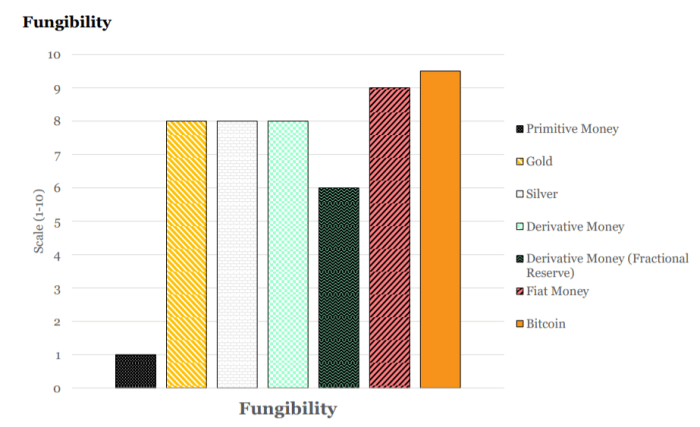

Fungibility

Fungibility formulation an valid’s particular individual unit is homogeneous and interchangeable, no longer lower than to a point (i.e., any dollar bill just isn’t any different from one other dollar bill). The U.S. dollar is fungible, but no longer completely fungible. To illustrate, a two-dollar bill has some extra desirability attributable to it’s no longer generally seen – americans would quit two one-dollar bills sooner than giving up a single two-dollar bill. Bitcoins are also fungible, but they are no longer completely fungible. Since you’d tag possession on the blockchain, every bitcoin has a historical past that somebody can survey, tracing your complete formulation again to its fashioned coinbase transaction. Differing histories would possibly per chance perchance impact the cost of cash, the same to the formulation all over which historical paintings is trim.

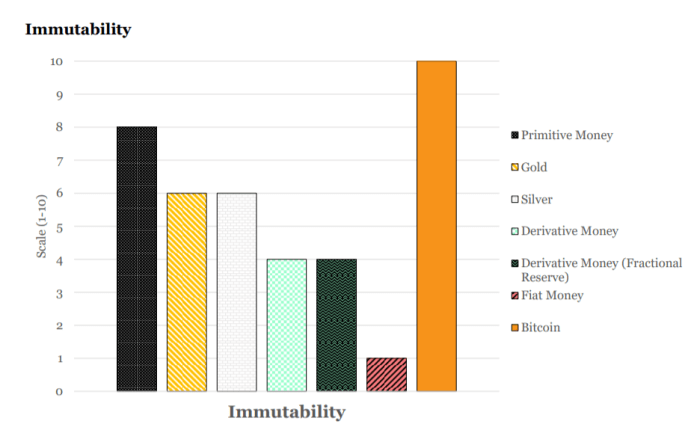

Immutability

In my guide I append a seventh monetary property – immutability – to per chance the most up-to-date six authorized properties, the dialogue of which requires enormously extra explanation past the scope of this series. However, to mediate the cost of an additional monetary property, I aid you to commence with asking your self questions relish, “Right how has our money been coerced and modified over time?” “Does unbiased hazard ensue when the brokers of cash have faith a warfare of curiosity with society?” “Why is bitcoin stable from the coercion of brokers who strive and manipulate money?” “How will decentralized money fundamentally impact our contemporary banking programs?”

Conclusion

Bitcoin differentiates itself from our most up-to-date monetary scheme attributable to:

- Bitcoin requires accountability. You are liable for your financial smartly-being. And bitcoin comes with advantages as smartly as responsibilities. In Bitcoin, within the occasion you lose your individual key you have faith misplaced your bitcoin. No person can reverse the transaction for you; here is is named finality of settlement. Right here’s a effect of Bitcoin, as being fragment of a centralized scheme does allow you to reverse transactions.

- Bitcoin is trustless. It doesn’t require have faith in a third celebration to again your funds or to transfer them. Banks, PayPal, Venmo, CashApp, etc., are managed by centralized third events.

- Bitcoin is pseudonymous. You develop no longer must quit all your most non-public files to steal part within the Bitcoin community. Whereas linkability (linking one’s identification to their bitcoin address) is a serious possibility to privacy on the community, taking steps to live non-public will even be completed to your have faith or with the again of third-celebration intermediaries.

- Bitcoin is without boundary lines. It will even be moved across the globe in a subject of minutes. To develop the related within the fiat banking scheme takes days, if no longer weeks. Additional, it requires you to quit a extensive amount of your privacy, and requires permission out of your financial institution and regulators.

- Bitcoin is a money scheme. Transacting in bitcoin formulation you have faith moved, in digital produce, a monetary asset. It is never credit such as PayPal, Venmo, or CashApp; to fetch you money from these programs requires multi-day settlement cases by our banking scheme, which Bitcoin can develop in minutes.

- Bitcoin is permissionless. That you would possibly per chance perchance transact on the Bitcoin community with none third-celebration constraints, attributable to it is watch-to-watch. As a participant within the Bitcoin community, you are going to even very smartly be utterly sovereign. I mediate that even within the occasion you relish to must make exhaust of third-celebration intermediaries to retailer and send bitcoin – the mere existence of a watch-to-watch scheme will deter intermediaries from unbiased hazard attributable to members will step by step have faith the flexibility to again their very have faith funds and performance outside of a scheme of intermediaries (watch deterrence theory).

Bitcoin is a watch-to-watch money scheme. Its technological characteristics were designed to invent superior monetary properties for the digital world. Thru time, its community has grown substantial ample that it is now the scarcest, most durable, most portable, most divisible, monetary asset within the enviornment. Additional, it is per chance the most decentralized.

All Bitcoin wants now is adoption. A thriving ecosystem and additional adoption would eventually invent a digital change to our most up-to-date financial scheme. This contemporary decentralized scheme would establish away with the unbiased hazard that ensues from centralized brokers who’re assumed to be acting in accurate faith.

This essay touched on some main criticisms of Bitcoin, but there are extra. Bitcoin Journal is a ultimate resource, but I also aid you to be taught about for sources outside of the Bitcoin community. On my web situation I have faith a listing of property I’ve came upon precious in my be taught – whisk to them and stare upon their sources as smartly for additional reading.

Lastly, my guide is the resource that I wish I had been given when I first came upon Bitcoin. It covers the train material of this series and much extra, including how our contemporary banking programs work and their historical past, a detailed explanation of Bitcoin, and responses to your complete main criticisms of Bitcoin. In level of reality feel free to attain out to me by my contact files beneath with any questions. I desire to act as a resource to all americans that are severely trying to understand Bitcoin.